Shares: Higher cost of capital becomes painful - Saxo Bank forecasts for QXNUMX

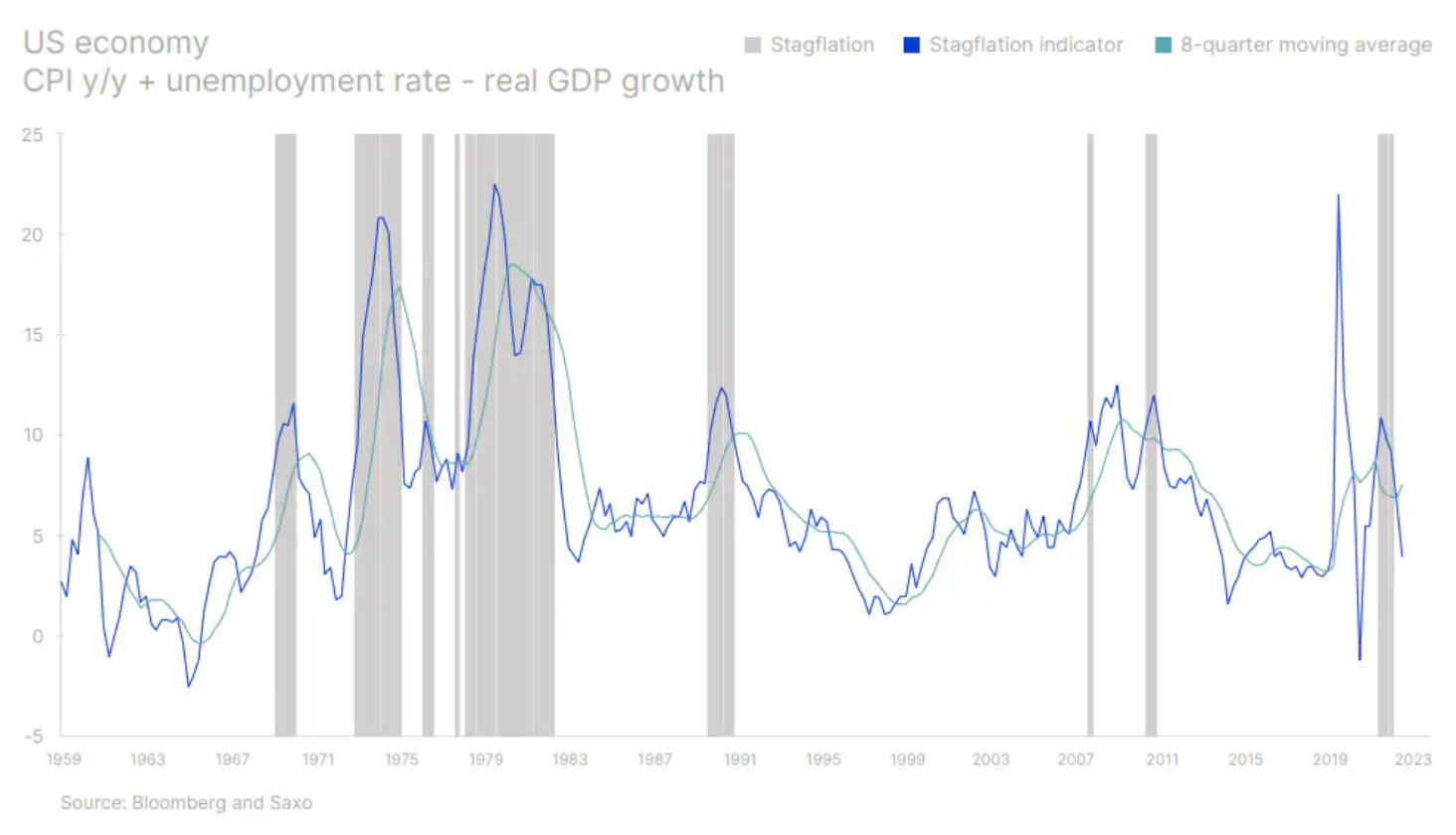

The fight against inflation has pushed the cost of capital to levels that have fractured the global economy. At the same time, there is a turnaround in the US fiscal cycle, which, combined with high interest rates, may push the economy into slight stagflation. This will be unfavorable for cyclical stocks, and the greatest risk under such a scenario is associated with shares of companies in the field of artificial intelligence. The higher cost of capital has also highlighted the fragility of the green transition, and this is potentially the most important factor in lowering interest rates, apart from the weakening economy, because a rapid transition away from coal can only occur in an environment of lower rates.

Shift to defensive sectors in preparation for stagflation

Since July 2022, the U.S. fiscal stimulus (growing fiscal deficit) has provided an additional 5 percentage points to GDP, or financing, approximately $1 trillion in additional government spending through various fiscal spending programs developed by the Biden administration, such as CHIPS Act or the Act on Reducing Inflation. This growth momentum offset the negative momentum from higher interest rates and essentially prevented a potential recession this year. At the time of implementation of this significant fiscal stimulus, it was estimated that the U.S. economy would have a small output gap and the dynamics of tight labor market supply would increase structural inflation pressures, forcing the Fed to tighten rather than loosen policy.

As the US fiscal cycle is likely to shift from positive to negative, the US economy will begin to slow while both Europe and China remain stuck in an environment of weak economic growth. This prepares the world for a potential mild stagflation, in which real economic growth begins to slow while inflation remains well above historical averages. The last time the world feared stagflation was in the summer of 2022, but these fears could quickly return and cast a shadow over the action landscape.

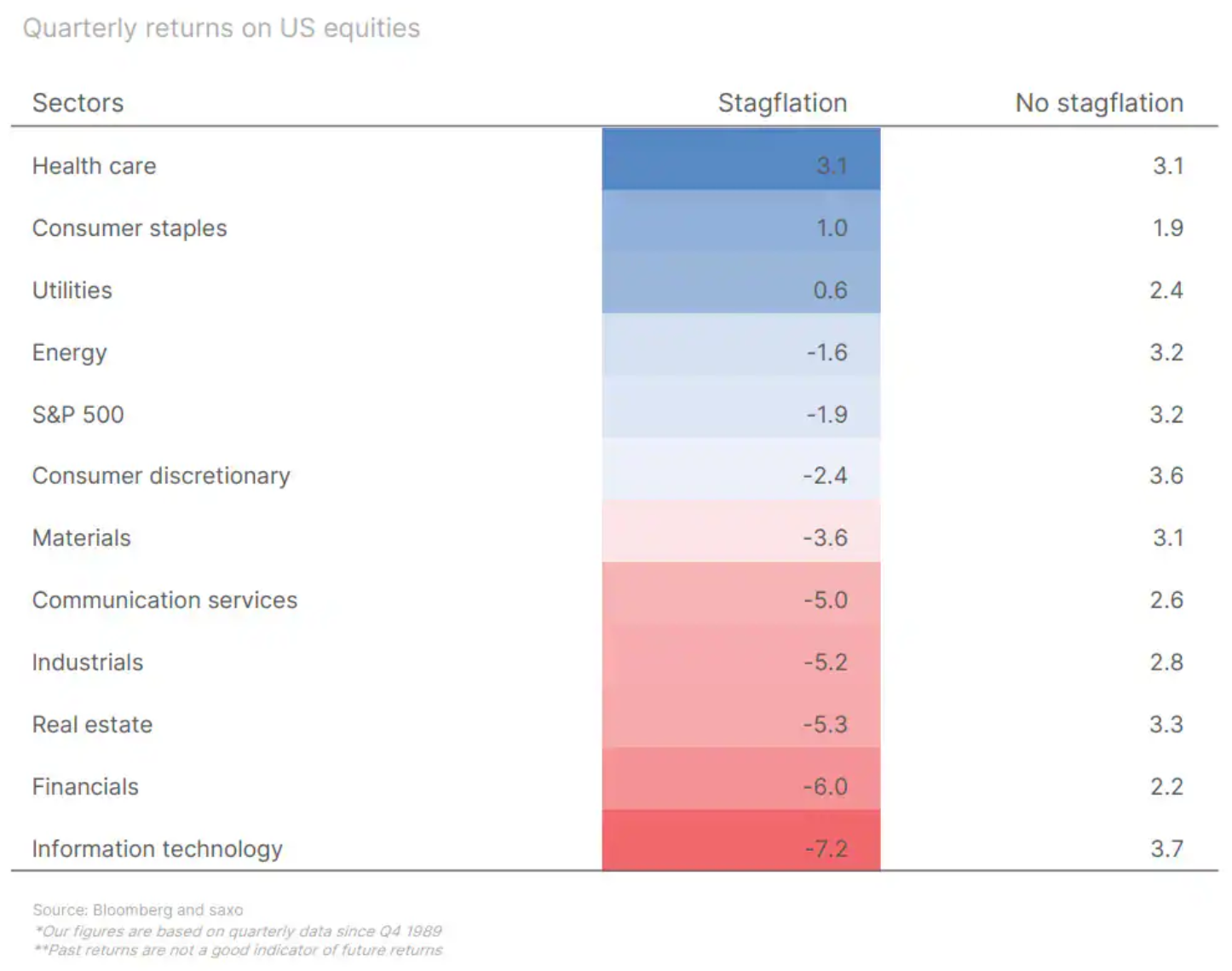

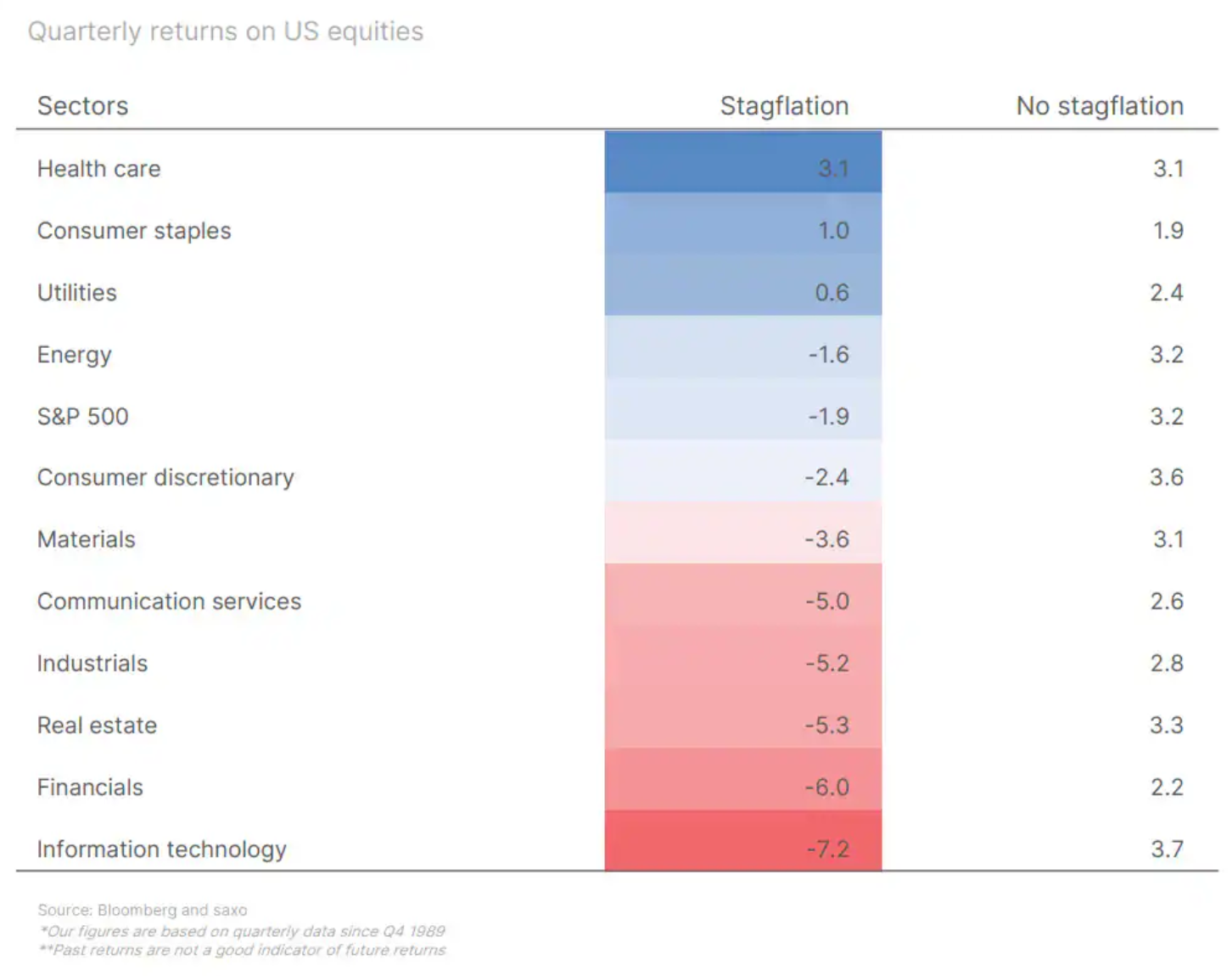

If the economy enters slight stagflation, the key issue for investors is to assess how this will affect stock markets. Based on historical data, it can be concluded that this will have a negative impact on stock returns, and given the limited set of sector data since 1989, the best sectors during stagflation would be defensive sectors such as healthcare, consumer staples, utilities and energy. Sectors that often start to underperform when economic growth slows and inflation or unemployment rises are real estate, finance and information technology. The latter of these sectors is particularly interesting given this year's rally in technology stocks and the overexposure to these stocks among many investors.

Our cautious outlook is further supported by the fact that, despite clear signs of the impact of higher interest rates on the global economy, equities have returned to valuation levels that are approximately one standard deviation above the long-term average since 1995. This naturally lowers the long-term risk-reward ratio for equities.

Green transformation limited by higher bond yields and geopolitics

As we stated in the introduction to this quarterly forecast, real interest rates are too high to support the green transition, acceptable living costs for new homebuyers and consumers with little savings using consumer loans. Higher interest rates and higher commodity prices have drastically transformed the assumptions made in the context of offshore wind energy, which was previously seen as one of the key energy sources for the green transition. Many of the world's offshore wind developments have been negotiated on the assumption that interest rates will remain low and industrial metals will be cheap.

After the pandemic and Russia's invasion of Ukraine turned the world upside down, these ventures are no longer profitable, forcing Orsted, the world's leading developer of offshore wind farms, to take significant write-downs. Siemens Energy is struggling with flawed designs of its wind turbines, incurring significant costs, and the business of Vestas, the world's largest wind turbine manufacturer, has stagnated. However, changing circumstances have strongly impacted not only wind energy, but also all aspects of the green transition. The three worst-performing thematic buckets over the past year are renewable energy, green transition and energy storage.

Research on the role of capital costs in the decarbonization of the electricity sector shows that solar and wind energy are most sensitive to increases in capital costs, because these energy sources have a larger share of initial investments in overall costs. The next two most sensitive energy sources are nuclear and coal with carbon capture. The source of electricity least sensitive to higher capital costs is natural gas, so if the goal is the lowest marginal cost of energy, higher capital costs generally encourage the use of fossil fuels. In the context of renewable energy, higher capital costs benefit nuclear power, which has seen a complete change of course as policymakers slowly realize that nuclear power will be the key to decarbonizing the global economy in the short term. As time passes, the pressure to reduce interest rates for the green transformation will increase.

Not only has the green transition suffered from higher capital costs, but worse still, the flood of cheap Chinese electric cars has dragged the entire electric industry into the fragmentation game we wrote about in our QXNUMX forecast. Semiconductors are already an element of geopolitical friction between the United States and China, and it now looks like electric vehicles will cause a geopolitical conflict between Europe and the Middle Kingdom. The world is fragmenting and this process will continue to prevent the green transition unless real bond yields decline.

When will the AI gold rush turn into a real gold mine?

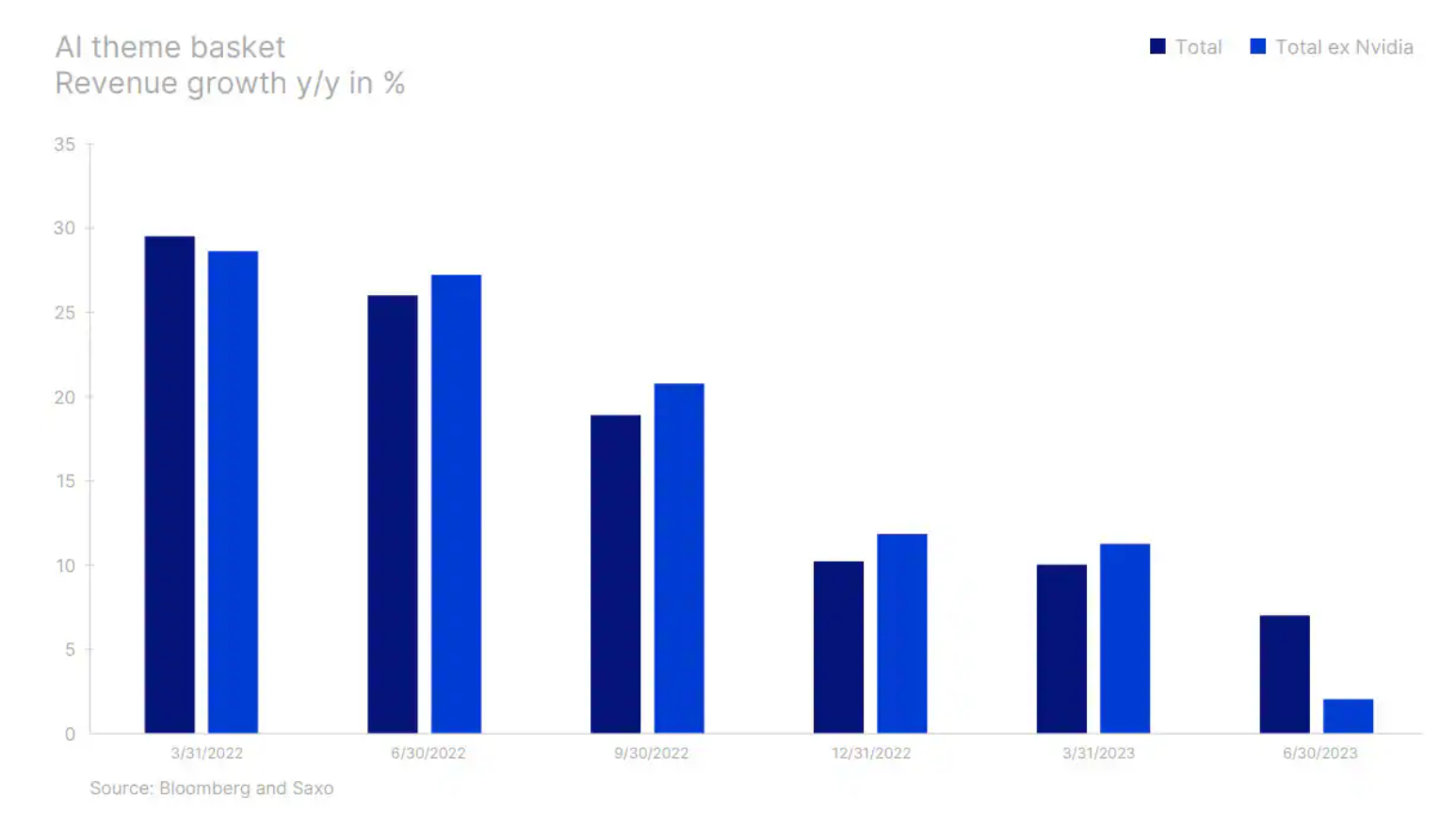

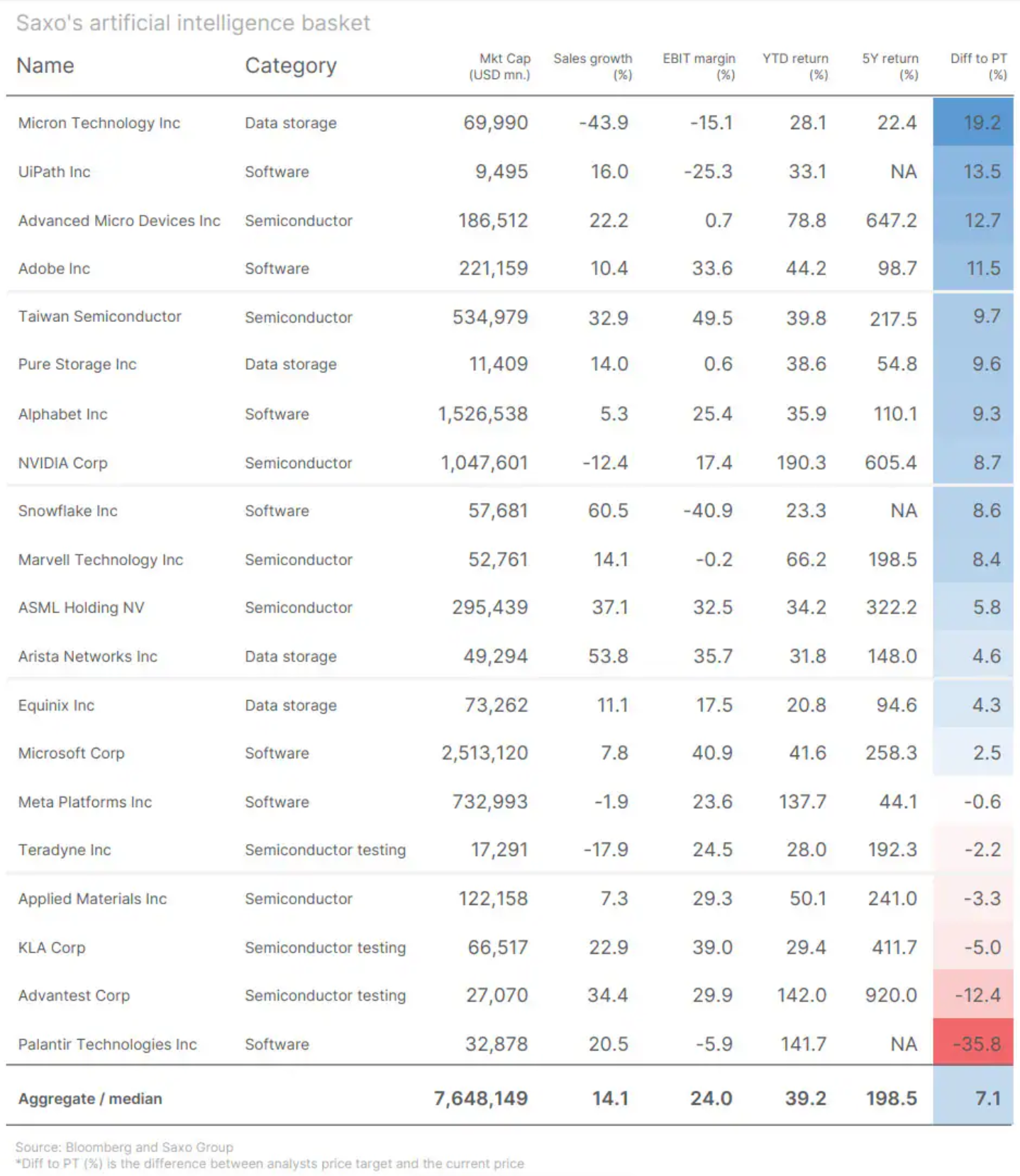

In our last quarterly forecast, we discussed the enthusiasm for AI driven by rising stock prices, particularly among AI-related stocks, which we believed were in a bubble due to dangerously high stock valuations and a decline in search interest for keywords such as “ AI" or "ChatGPT". Another quarter has passed, and the data following the publication of QXNUMX results do not suggest that the artificial intelligence gold rush and mass purchases of Nvidia graphics processors are turning into real gold mines. Microsoft and Adobe, two large-scale companies that are part of the content production ecosystem, have failed to sustain enthusiasm around AI. During the conference call, Microsoft announced that AI sales would be gradual; Adobe's forecasts also do not reflect the eruption of growth in the field of artificial intelligence.

Although Nvidia continues to sell significant volumes of GPUs as enterprises look to capitalize on large new language models as quickly as possible, overall revenue growth for AI companies excluding Nvidia is lower, and average y/y revenue growth in Q2 was 27% vs. 20% a year ago. Our AI thematic basket of 33 AI stocks is valued at a forward-looking valuation that is 100% higher than the Nasdaq XNUMX Index and almost twice as high as the MSCI World Index. If bond yields fall due to slowing economic growth, it is unclear whether a lower discount will help AI stocks as they are much more sensitive to growth forecasts and therefore AI stocks have one of the highest risks in QXNUMX.

About the Author

Peter potter - director of equity markets strategy in Saxo Bank. Develops investment strategies and analyzes of the stock market as well as individual companies, using statistical methods and models. Garnry creates Alpha Picks for Saxo Bank, a monthly magazine in which the most attractive companies in the US, Europe and Asia are selected. It also contributes to Saxo Bank's quarterly and annual forecasts "Shocking forecasts". He regularly gives comments on television, including CNBC and Bloomberg TV.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![CRB index – one of the popular commodity market benchmarks [Guide] crb index](https://forexclub.pl/wp-content/uploads/2024/05/indeks-crb-184x120.jpg?v=1715055656)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response