Alpari wants to offer its customers a leverage of ... 1: 3000

Undoubtedly, the amount of leverage in forex brokers is what ignites the most imagination, especially for beginner investors. Who has not read about people who, thanks to it, did not have to have enormous capital to earn millions? Now everyone will be able to try it, because the broker from Russia has just made its offer more attractive - registration in the Karabian Islands allowed to provide its clients with a leverage of ... 1: 3000.

Alpari is a broker from Russia, which unfortunately has a not very glorious past. A few years ago as a result of "Black Thursday" the British branch went bankrupt, and customers have not yet recovered some of the money. The debt collector took care of the company, but ultimately it was not possible to regain the equivalent of approximately USD 100 million (FCA regulations at that time offered a 100% guarantee of funds only up to GBP 50, currently the limit is GBP 85). Then, there was a surprise for customers, because it turned out that their data was sold to another company.

Be sure to read: Alpari UK customers receive a refund after the bankruptcy of 2015.

As if that was not enough, At the end of December 2018, the Russian central bank decided to withdraw the license of several Forex brokers operating on the local market - including Alpari Forex.

The effect is easy to imagine - Alpari, although previously extremely well-liked by retail traders, suddenly had trouble in other markets because mistrust was common. So it started to propose more than other brokers to not only stay on the market, but also to attract new customers.

Forex leverage 3000: 1

The latest idea is by far the most ambitious and igniting investors' imagination. Until now, the value of 500: 1 was treated as large, and 1000: 1 was a sensation. On 9.03.2020/3000/1, it will be a thing of the past, because Alpari offers much more. From this day on major currency pairs the leverage in Alpari will be astronomical XNUMX: XNUMX. How does the broker explain this move?

"Thanks to this, our clients will be able to invest more capital, which will lead to an increase in the profitability of their transactions" - we read in the announcement.

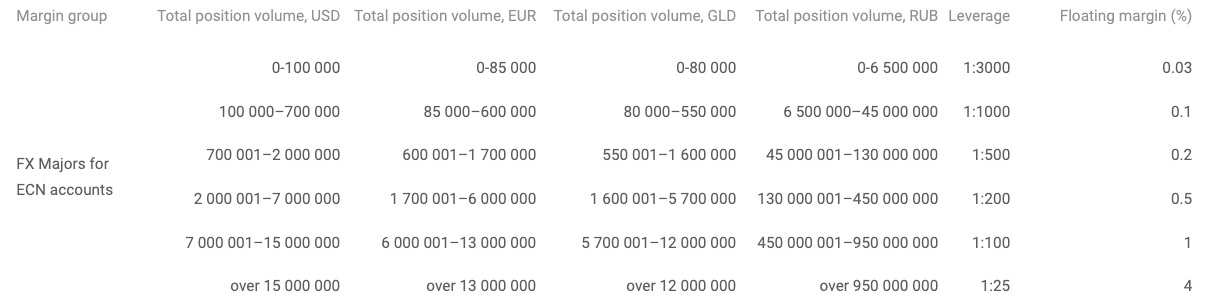

The deposit will need to be secured, of course, but the requirements are not strict. The broker placed their details in a transparent table.

Where does such a big lever come from?

A leverage of 3000: 1 is a huge profit opportunity, but - which of course the broker does not mention - a much greater risk, at least in the hands of inexperienced traders who may not necessarily be aware of the consequences of using it in full. Even small price movements will cause an overly large position to close quickly and the account to zero. So it will be safer to trade a small part of the deposit, which of course will bring proportionally smaller profits. Unless someone decides to take a risk against common sense, but it will no longer be an investment, or even speculation, but simply a gamble.

Alpari can afford a high leverage, which definitely distinguishes it from the European competition, because the company moved its headquarters to the country of Saint Vincent. It is a country that brings together several islands in the Caribbean Sea. Considered one of the largest tax havens and thus quite a "loose" regulatory policy. So you can offer such financial products there, but in the event of the broker going bankrupt (which, as we wrote, has happened in the past), recovering capital from a company located in the Lesser Antilles archipelago may be - to put it mildly - not easy.

ESMA is still adamant

Let us remind you that European restrictions began in mid-2018. It was then that ESMA (European Securities and Markets Authority) introduced regulations that not only limited access to the most risky instruments, such as binary options, but also reduced the maximum financial leverage to 1:30 on the most important currency pairs. It's easy to calculate that we currently have 100 times more leverage in the Caribbean ...

It is for this reason that some clients leave to companies operating outside the European Union, accepting not only the greater risk of transactions, but also possible problems that may arise in the event of a broker's financial problems. In Europe, however, you can also get more leverage, but it is only available to people who will gain the status of an experienced customer. Each broker has separate regulations, but most often you need to prove knowledge of financial markets, as well as provide a transaction history of above average amounts.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)