AMC Entertainment - unexpected benefits of being a meme company [Guide]

Not always a stunning rate of return is achieved by a company operating in the digital industry and increasing its revenues at the rate of 30% per year. Sometimes a company forgotten by the market gains popularity, which suddenly becomes one of the most popular companies on the stock exchange in an interesting combination of circumstances. company AMC Entertainment this is another January hero short squeeze on shares "Companies - mem".

AMC was with GameStop one of the most popular companies among the WSB community (wallstreetbets). Despite the poor financial results, the company's share price has risen by over 1400% since the beginning of the year. The article presents the history and activities of this company.

The beginnings of AMC Entertainment

The history of the company dates back to 1920 when Maurice, Edward and Barney Dubinsky bought it Regent Theater on 12th Street in downtown Kansas City, Missouri. The company later changed its name to Durwood Theaters and expanded its operations to the state of Kansas. In 1945, Edward's son, Stanley, persuaded his father to create Drive-in theaters in St. Joseph (Missouri), Jefferson City (Missouri), and Leavenwort (Kansas). In 1947 a cinema in downtown Kansas City was acquired and in the following years it was taken over more cinemas from this city: The Empire Theater, the Capri Theater, the Midland Theater and the Paramount Theater. At the time of Edward's death (1961), Durwood Theaters was a small chain of 10 cinemas.

Changing of the guard in the company

The initiator of introducing car cinemas to the offer - Stanley - took control of the company. One of the breakthroughs for the company was 1963 when the first multiplex (Parkway Twin) was created in a shopping mall in Kansas City.

It was an innovation, because in the multiplex it was possible to broadcast more films (more cinemas), which increased profits, but it was not necessary to employ twice as many people. As a result, the profitability of this concept was higher than in the case of "one-screen" cinema. In the following years, the multiplex offer expanded to include other cinemas. In 1966, a 4-screen cinema appeared in Kansas City. And in 1969, a 6-screen multiplex was established in Omaha. It is worth adding that in 1968 the company name was changed to American Multi-Cinema (AMC).

Stock exchange debut, foreign expansion

The company tried to make its customers more comfortable. An example is the armrests with cupholders. AMC introduced them in 1981 - as the first cinema chain in the US. AMC also planned to expand its offer with additional locations in the United States and start expansion abroad. She needed additional capital for this. For this reason, in 1981 it made its debut on the stock exchange. In 1983, the company's revenues already amounted to $ 200 million and the company reported a net profit of $ 10 million.

Profitable business allowed for its scaling. The more cinemas the company had, the higher its revenues and profits. This, in turn, allowed more money to be invested in new cinemas. At the end of 1986, AMC had 200 cinemas with over 1100 screens. The first cinema outside the United States was established in 1985 in Great Britain, in the following years AMC expanded its operations to other countries of Western Europe or Asia and Oceania (including Singapore).

The 90's

These are some of the best years for the company. New cinema concepts are emerging. In 1996, a megaplex was established in Ontario (California), which housed 30 screenswhich made it the largest cinema in the world. However, three years later, AMC was dethroned by the cinema in Brazilwhich could boast 31 screens. The company created megaplexes in Japan (Fukuoka), Portugal (Porto) and Great Britain (Manachester, Birmingham).

The period of 1990 - 1999 in the history of cinema is the time of gigantomania. It was believed then that the greater the number of screens, the greater the monetization potential of the center. However, in the following years the fashion for the largest cinemas passed - the economic calculation won.

The post-Stanley era

In 1999, Stanley Durwood died and Peter Brown became his successor. This was the first CEO not to be a member of the Dubinsky / Durwood family. 5 years later, the company was taken over by subsidiaries JP Morgan and Apollo Management. The transaction was worth $ 2 billion. At the time of the acquisition, AMC had 382 theaters with 5340 screens operating in the United States, Canada, Mexico, Argentina, Brazil, Chile, Uruguay, Hong Kong, France and Great Britain. In 2006 (2 years after being taken off the stock exchange), the company announced plans to debut on the American stock exchange (valuation of $ 2,7 billion). However, unfavorable market conditions caused the company to postpone its debut. The company made two more debuts (2007 and 2010).

Ultimately, in 2012, the Chinese company Wanda spent $ 2,6 billion on the acquisition of AMC Entertainment. At the time of the acquisition, Wanda became the largest cinema chain in the world. Wang Jianlin, CEO of Wanda Group, announced that he intends to spend $ 500 million on AMC network renovations. A year after the acquisition, the company made its debut on the US stock exchange. AMC sold the shares for $ 18, raising $ 332 million. Wanda still became the main shareholder with an 80% stake in the company. The new owner wanted AMC to continue its expansion. As a result, in 2016 the company acquired one of its competitors - Carmike Cinemas. AMC paid $ 1,1 billion. Following the transaction, the company became the largest cinema operator in the United States (900 cinemas and 10 screens). However, due to too much concentration in some markets, AMC was forced by the Justice Department to sell theaters in 000 markets in 15 states.

After 6 years, Wanda began to reduce her involvement in AMC actions. 32% of the shares in the company were acquired by the Silver Lake fund. The transaction was valued at $ 600 million. However, due to her preference shares, Wanda still had majority control over the company. After the acquisition of Carmike Cinemas, AMC generated approximately $ 5 billion in revenues annually and generated an operating profit of $ 200-300 million. Of course, there were concerns that streaming platforms could take part of the market, but overall the company was a stable company with wealthy owners.

Covid-19

The coronavirus pandemic has caused the company's business model to collapse. On March 18, 2020, AMC announced the closure of all theaters. The closing of theaters resulted in revenues plunging to almost zero in the second quarter of 2020. At the same time, the company began to have a problem with film producers. Jeff Shell, CEO of NBCUniversal, announced in The Wall Street Journal that the studio intends to introduce films simultaneously on streaming platforms and in cinemas. The news was a "blow" to AMC, as always big productions attract more traffic to the cinema. As a result, AMC announced on April 28, 2020 that it would no longer air Universal Pictures films. The dispute ended in July with the signing of an agreement in which the films will debut in cinemas 17 days earlier than on streaming platforms. This was significantly less than AMC's initial request of 90 days. At the end of 2020, the company found itself in a difficult liquidity situation. The year 2021 was not brightly applauded.

People, salaries

Adam M. Aron (CEO)

He has been the CEO since 2016. Between February 2015 and December 2015, he was the CEO of Starwood Hotels and Resorts. From 2006 he worked as a Senior Partner in an investment fund in Apollo Management. Adam M. Aron was also on the supervisory board of Norwegian Cruise Line Holdings (2007-2014). From 1996 to 2006, he was the CEO of Vail Resorts. Between 1993 and 1996, Mr. Aron was also the CEO of the Norwegian Cruise Line operator. In 1987 - 1993 he was the Chief Marketing Officer in two companies: United Airlines (1990 - 1993) and Hyatt Hotels & Resorts (1987 - 1990).

Sean D. Goodman (CFO)

He has been CFO at AMC since 2019. Previously, he worked in companies such as Asbury Automotive Group (CFO), Unifi Inc. (CFO), Americas for Landis + Gyr Group AG (CFO). He also worked at a lower level in companies such as Home Depot, Morgan Stanley and Deloitte.

John D. McDonald

John D. McDonald

Since 2009, he has been the EVP (Executive Vice President) at AMC. McDonald served as Senior Vice President (SVP) of Corporate Operations from November 1995 to October 1998.

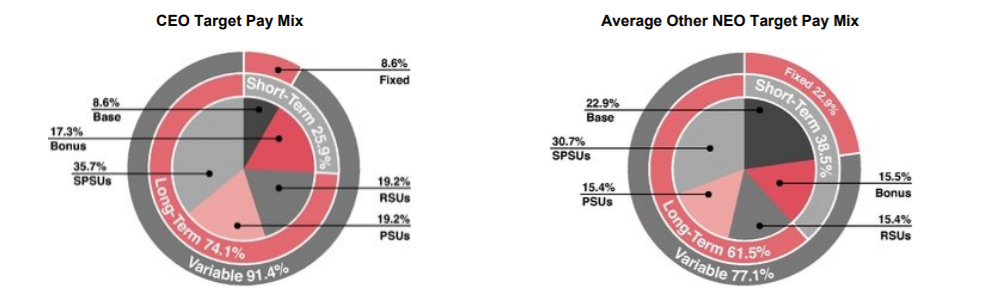

The remuneration of the company's CEO is mainly variable, as the fixed salary is only 8,6% of Adam Aron's salary. Additionally, the achievement of long-term goals set by the company is remunerated. In the case of others of senior managers, approximately 38,5% of remuneration depends on the achievement of the company's short-term goals.

The short-term goals that are required of the CEO and other senior managers depend mainly on achieving the level of cleaned EBITDA (80% bonuses). The remaining 20% depends on individual goals for each manager.

Long-term goals are paid over the next 3 years. The payout depends on the fulfillment of long-term goals, which include, inter alia, adjusted EBITDA, profit per share and free cash flow (FCF).

Shareholding

At the end of 2020, Dalian Wanda Group Co. He owned 23,08% of the shares in the company, which gave 47,37% of the votes. This resulted from the preference in the votes of series B shares. On February 1, 2021, Wanda exercised the right to exchange all series B shares for series A shares. As a result of the issue of new shares and the reduction of some shares by Wanda, the share of this shareholder decreased to the level of 9,8 %.

Operational activity and the market

AMC is the largest cinema operator in the world. At the end of 2020, the company had 590 theaters in the United States with less than one room 7700 screens. AMC also operates in foreign markets, where it operates 360 cinemas (2875 screens) in 13 countries around the world. The largest foreign market is Great Britain with 112 cinemas. It is worth adding that in 2020 AMC sold its business in Latvia and sold 49% of its shares in the Lithuanian business.

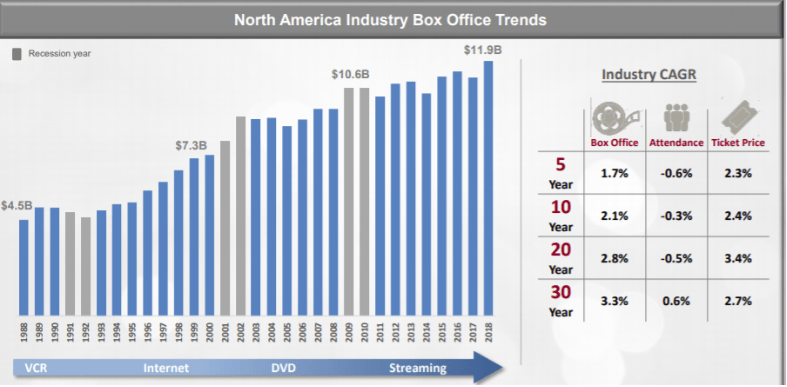

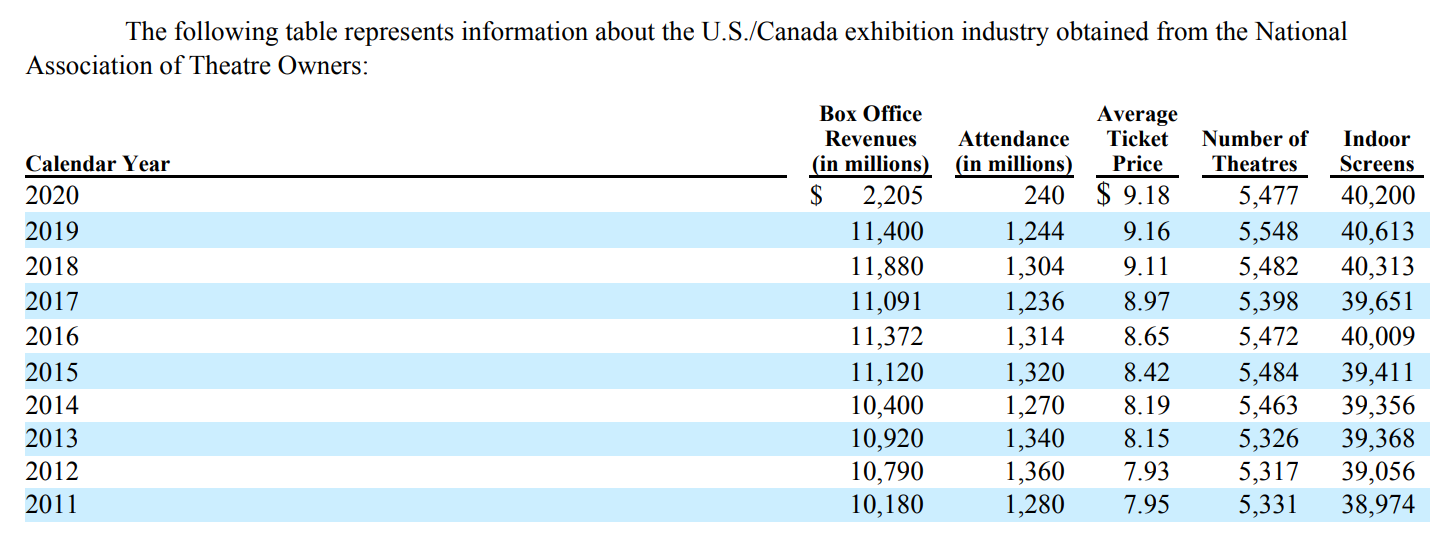

The North American cinema market is also worth a look. As you can see, the cinema audience has been steadily declining over the past 20 years. These are not drastic drops as the audience dropped by around 10% (0,5% annually) in two decades. At the same time, cinemas manage to raise prices, which more than covers the decline in attendance.

2020 was a difficult year for the entire industry. Revenues decreased by 80,7%, while the turnout decreased to only 240 million (-80,7% y / y). Interestingly, at the end of 2020, the number of cinemas decreased by 1,3% y / y.

It is also worth mentioning the European market. In the markets where AMC operates, the UK is key (an average of 2020 million people visited theaters before 176). The next largest markets are Germany (120 million) and Spain (106).

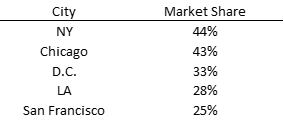

AMC is a market leader in cinema operators in countries such as the United States, Sweden, Norway, Finland and Spain. The company is also the second largest cinema operator in Great Britain, Ireland and Portugal. In the United States, 49% of the population lives within 10 miles of the nearest AMC-owned cinema. The company is also a leader in key American markets such as New York, Los Angeles, Chicago, Atalanta and Washington DC. It is worth remembering that three cities: New York, Los Angeles and Chicago represent 17% of the American cinema market. In these three cities, AMC has a 39% market share. Additionally, the company has a 1st or 2nd position in 21 out of 25 key American markets.

The company generates revenues from two main sources. The first are tickets sold for screenings. 80% of US film revenues come from six distributors (Sony, Disney, Universal, Warner Bros., Paramount and Lionsgate. In Europe, 75% of film revenues come from three distributors, including Warner Bros., Disney.

The second source is the sale of food and drink. In addition, the company earns money by selling loyalty programs (subscriptions), pre-screening advertising and space rental.

The loyalty program is called AMC Stubs. This is a monthly subscription that costs from $ 19,95 to $ 23,95. The price difference depends on the region where the cinema is located. At the end of December 2020, the program was used by 23,3 million households (approximately 50 million customers). Subscribers account for approximately 45% of cinema attendance.

Financial results

AMC in 2017-2019 did not significantly increase the scale of its operations. Margin business is not too great, which is due to the large fees paid to distributors and the cost of products sold (food and beverages). At the same time, the company has to contend with high net interest expenses, which increased from $ 2017 million to $ 2020 million from 251 to 317. With the exception of 2019, interest debt was "eating up" all operating profits. It is therefore not surprising that the company was on the radar of short-sellers who assumed that the company was in need of restructuring.

| AMC (million $) | 2017 | 2018 | 2019 | 2020 |

| revenues | 4 777,9 | 5 056,5 | 5 020,9 | 1 074,5 |

| Operational profit | 208,4 | 309,3 | 234,6 | -1 |

| Operating margin | 4,36% | 6,12% | 4,67% | -145,68% |

| Net profit | -487,2 | 110,1 | -149,1 | -4 |

Source: own study

In terms of liquidity it wasn't looking good. Although the company in "normal times" was able to generate over $ 500 million in cash from operating activities, it was "eaten" by capital expenditure (CAPEX). This made free cash flow negative. It is also worth mentioning that in the first two quarters of 2021, cash flow from operating activities was negative and amounted to $ 546,7 million. Due to the difficult financial situation in the first half of 2021, capital expenditures were reduced to less than $ 30 million.

| AMC (million $) | 2017 | 2018 | 2019 | 2020 |

| OCF * | 537 | 523 | 579,0 | -1 |

| CAPEX ** | -627 | -576 | -530 | -174 |

| *** | -90 | -53 | 49 | -1 304 |

Source: own study; * operating cash flows from operating activities; ** investment expenses; *** free cash flow (OCF-CAPEX).

The company's interest debt increased over the years 2017-2020 from $ 4 million to $ 235 million. Leasing was not included in the debt. At the same time, after the issues in the first and second quarter of 5, the cash level increased from $ 715 million to $ 2021 million. This gives a "cushion" of safety for the next few quarters.

Where to buy AMC Entertainment shares (#AMC)

Below is a list of selected offers Forex brokers offering an extensive stock offer, including AMC Entertainment (#AMC).

| Broker |  |

|

|

| End | Poland | Denmark | Poland |

| Shares on offer | approx. 3500 - shares approx. 2000 - CFDs on stocks 16 exchanges |

19 - shares 8 - CFDs on stocks 37 exchanges |

approx. 1 - stocks + CFDs on stocks 5 exchanges |

| Min. Deposit | PLN 0 (recommended min. PLN 2000 or USD 500, EUR) |

0 PLN / 0 EUR / 0 USD | PLN 0 |

| Platform | xStation | SaxoTrader Pro Saxo Trader Go |

MetaTrader 5 |

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. From 72% to 89% of retail investor accounts record monetary losses as a result of trading CFDs. Think about whether you understand how CFDs work and whether you can afford the high risk of losing your money.

Summation

AMC is the largest cinema operator in many countries. In recent years, the company has been under pressure from digital platforms, which are becoming an increasingly attractive place to host movie premieres. The pandemic period accelerated this process even more. For this reason, AMC had to reach an agreement with Universal Pictures and allow the films to debut on digital platforms 17 days after their premiere in theaters. At the same time, at the end of 2020, the company had huge debt (less than $ 6 billion) and financial costs consumed most of its operating profits. At the same time, the company was unable to generate free cash flow.

During the pandemic, it seemed that the company's fate was sealed and that restructuring would be needed. However, after the astronomical increase in the price, the company managed to raise funding of $ 1,5 billion. As a result, the company gained some time to restructure its operations. Still, the company has to cope with the competition of digital platforms, which are becoming an increasingly attractive place for film distributors. As a result, AMC's negotiating position is getting weaker. This could result in AMC not being able to raise fares to cover the "natural" decline in attendance that has been visible for over 30 years. The current capitalization of the company is $ 17 billion. This means that the market is already assuming that the restructuring of the business will be successful. However, the company is still heavily indebted, operating in a difficult market, and struggling to achieve solid free cash flow.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![AMC Entertainment - unexpected benefits of being a meme company [Guide] amc entertainment actions](https://forexclub.pl/wp-content/uploads/2021/08/akcje-amc-entertainment.jpg?v=1629184347)

![GameStop shares - investment in a "mem company" [Guide] gamestop shares gme how to buy](https://forexclub.pl/wp-content/uploads/2021/07/gamestop-akcje-gme-jak-kupic-300x200.jpg?v=1625060223)

![AMC Entertainment - unexpected benefits of being a meme company [Guide] avax avalanche crypto](https://forexclub.pl/wp-content/uploads/2021/08/avax-avalanche-crypto-102x65.jpg?v=1629183367)

![AMC Entertainment - unexpected benefits of being a meme company [Guide] cryptocurrency hacker protocol](https://forexclub.pl/wp-content/uploads/2021/08/protokol-kryptowalutowy-haker-102x65.jpg?v=1629287736)