The bubble on the Treasury bond market and the US elections

Central banks around the world are expanding accommodative measures in the form of quantitative easing and "helicopter money" to address deep economic problems. So far, this has contributed to a bull market in the stock markets and a decline in interest rates in both Europe and the United States. Even if an investor this year took advantage of the stock market boom as the coronavirus weakens, he will have to face the consequences.

These ramifications are linked to the US election and inflation, and bonds will be the first assets to suffer. Now, more than ever, it's important to think about your portfolio structure and inflation hedging to protect your capital in the twilight of fiat money.

About the Author

Althea Spinozzi, Marketing Manager, Saxo Bank. She joined the group Saxo Bank in 2017. Althea conducts research on fixed income instruments and works directly with clients to help them select and trade bonds. Due to his expertise in leveraged debt, he focuses particularly on high yield and corporate bonds with an attractive risk-to-return ratio.

Althea Spinozzi, Marketing Manager, Saxo Bank. She joined the group Saxo Bank in 2017. Althea conducts research on fixed income instruments and works directly with clients to help them select and trade bonds. Due to his expertise in leveraged debt, he focuses particularly on high yield and corporate bonds with an attractive risk-to-return ratio.

Treasury bonds - a pressure cooker that is about to explode

Due to the fact that near-zero interest rates do not provide any protection against rising inflation, at the moment government bonds are the worst type of asset in your portfolio. Buying treasury bonds today means blocking such a low yield that in the event of an increase in inflation, the value of the bonds will fall. It will also not help to hold the bond until maturity, because inflation will consume the small coupon you receive with the principal amount.

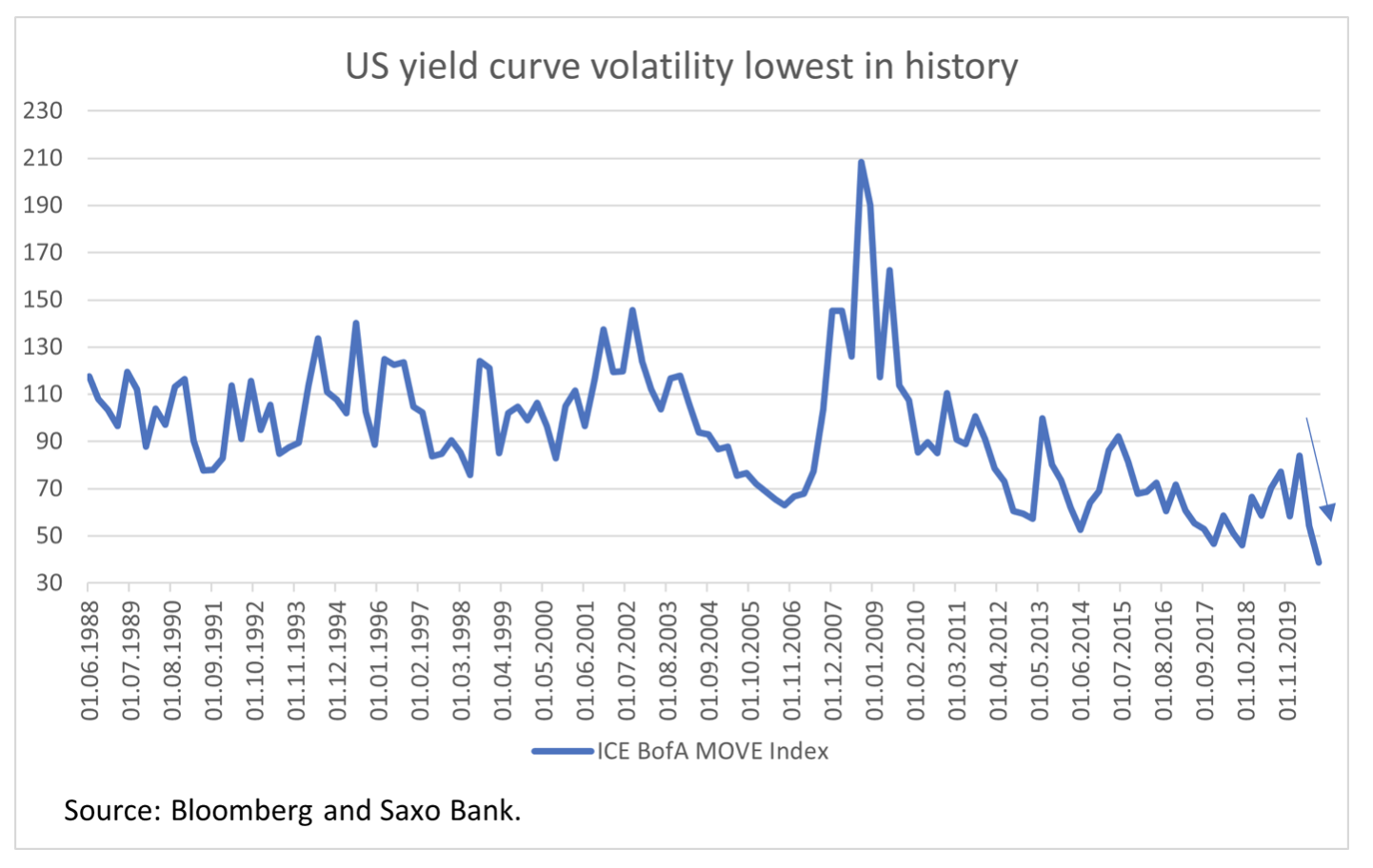

At the same time, volatility on government bonds worldwide is at its lowest level in history. As a result, trading these securities is even more difficult - because significant position leverage is required to take advantage of a one basis point change.

We believe government bonds are currently the biggest trap in history. They provide no long-term profit, and the yield curve is doomed to uplift at a faster pace than predicted due to inflation. In the context of the US election, however, there may be an area of short-term opportunities. In the case of Biden's victory, we predict a bullish flattening, and in the event of Trump's victory - a bearish upward trend in the US yield curve.

We have relative confidence in inflation. Due to so much pressure to revive it, it will go up at some point. It will then become unstoppable, because the only tool capable of stopping it will be monetary policy. Central banks cannot count on fiscal policy due to its political nature.

At this point, the US government is putting money directly into the pockets of citizens to avoid a massive crisis during the Covid-19 pandemic. Families who need money spend it as they receive it. Thus, inflation pressure is increasing. If inflation unexpectedly rises, what will the new US president be able to do? He will not be able to take back the money given to the citizens as this would mean an exceptional drop in popularity. Therefore, the "helicopter money" will remain, inflation will continue to rise, and it will be alone to fight it Federal Reserve.

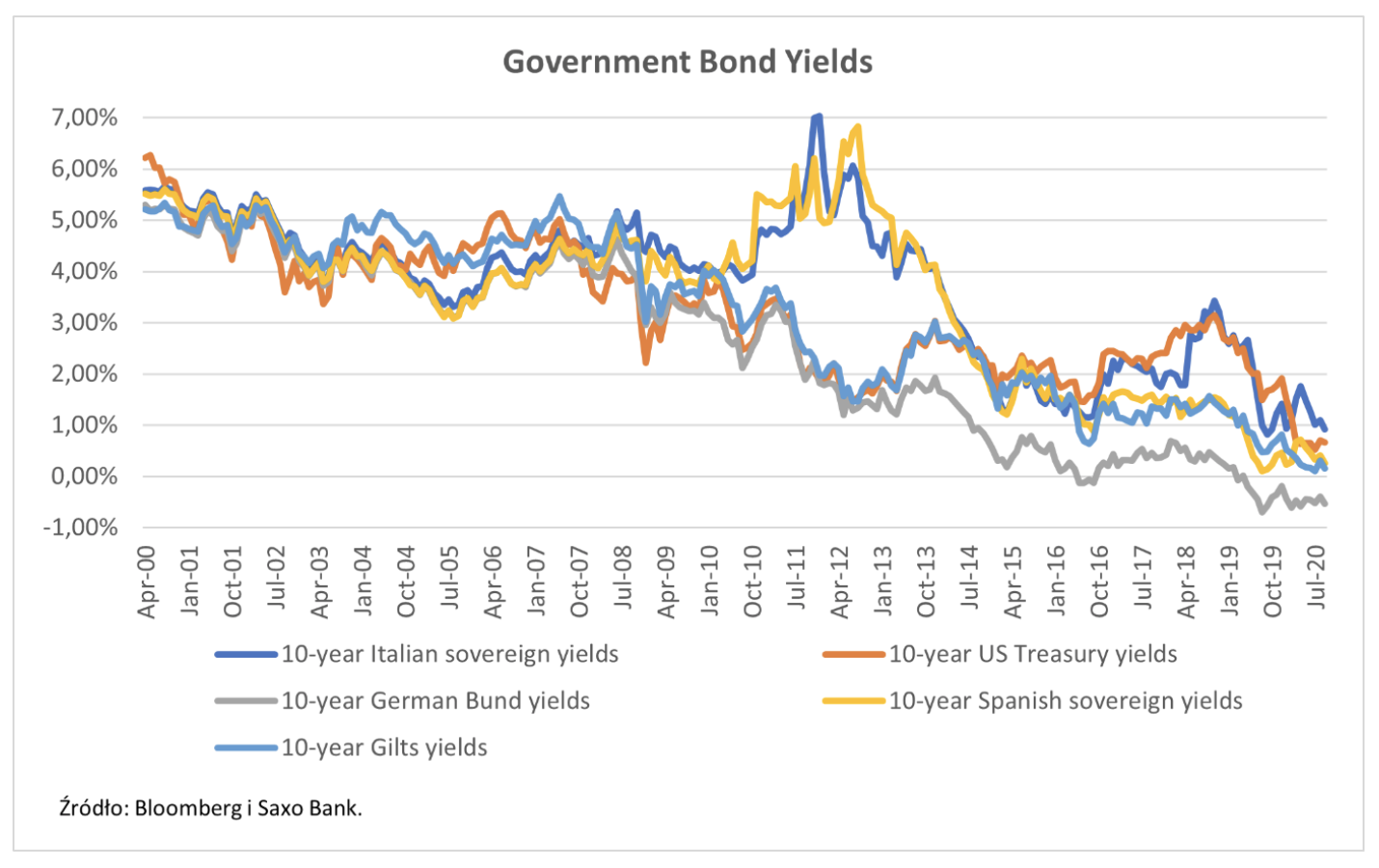

While there is a chance that inflation will remain subdued in the last quarter of this year, the possibility of volatility rising in the context of the second wave of Covid-19 should be taken into account, which will affect the performance of government bonds. While the pandemic turned out to be good for US and German government bonds, yields on riskier government bonds rose significantly. The most obvious example is Italy, which currently offers the lowest profitability since joining the euro area. Prior to the coronavirus, Italy's 1-year BTP treasury bonds were yielding around 2,5%. At the peak of the pandemic, it increased to almost XNUMX%.

As Italian Treasury securities are perceived as risky in the market, investors will sell BTP and buy German bonds in case of any problems. Now that BTP has recovered to pre-pandemic levels, we believe holding these securities represents more losses than gains. In investing, it is important to know when to take profit and when to lose. At this point, in a bull market, it's a good time to sell to prepare for future developments. In our opinion, this mainly applies to government bonds from the European peripheral states: Spain, Italy, Portugal and Greece.

Deteriorating corporate bond performance means lower ratings and bankruptcy

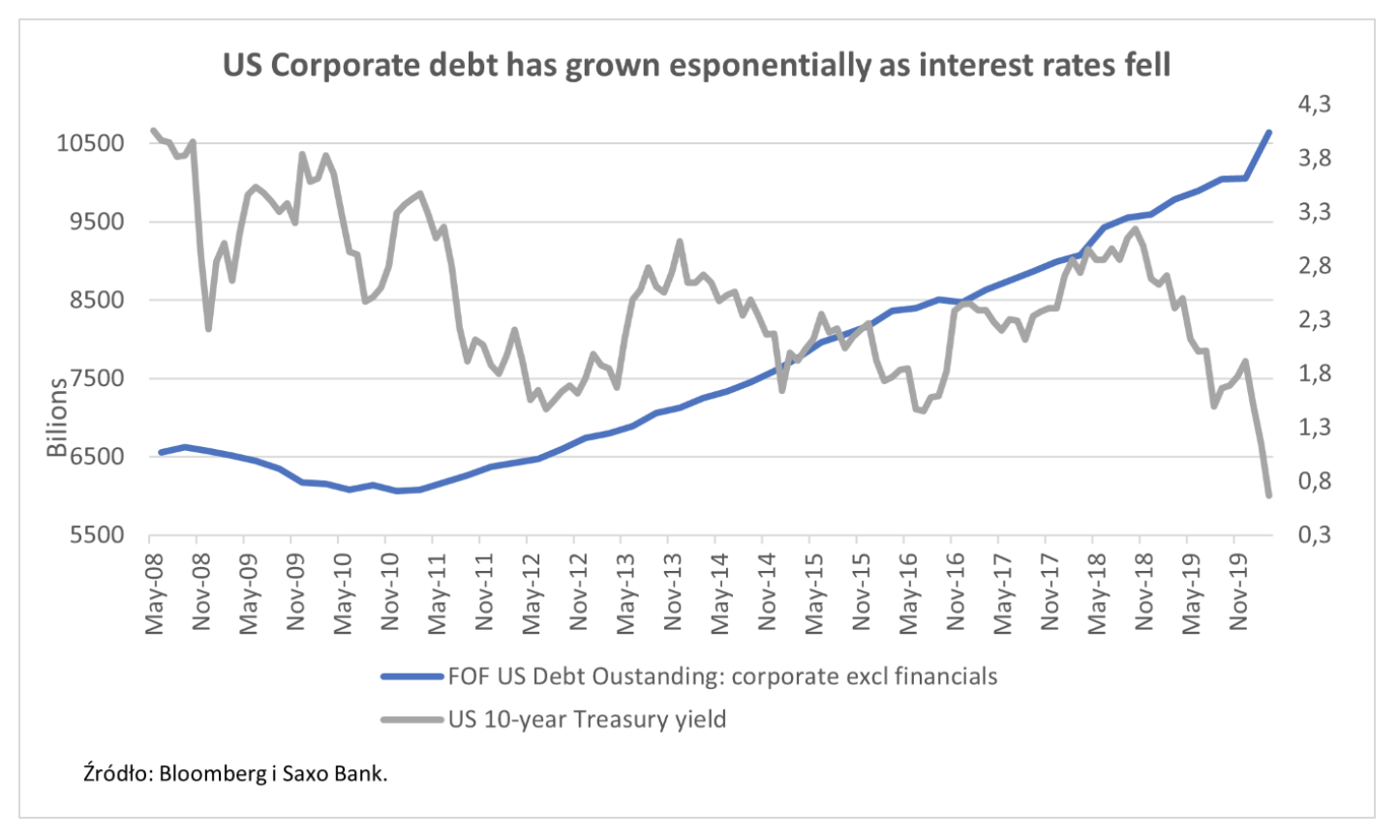

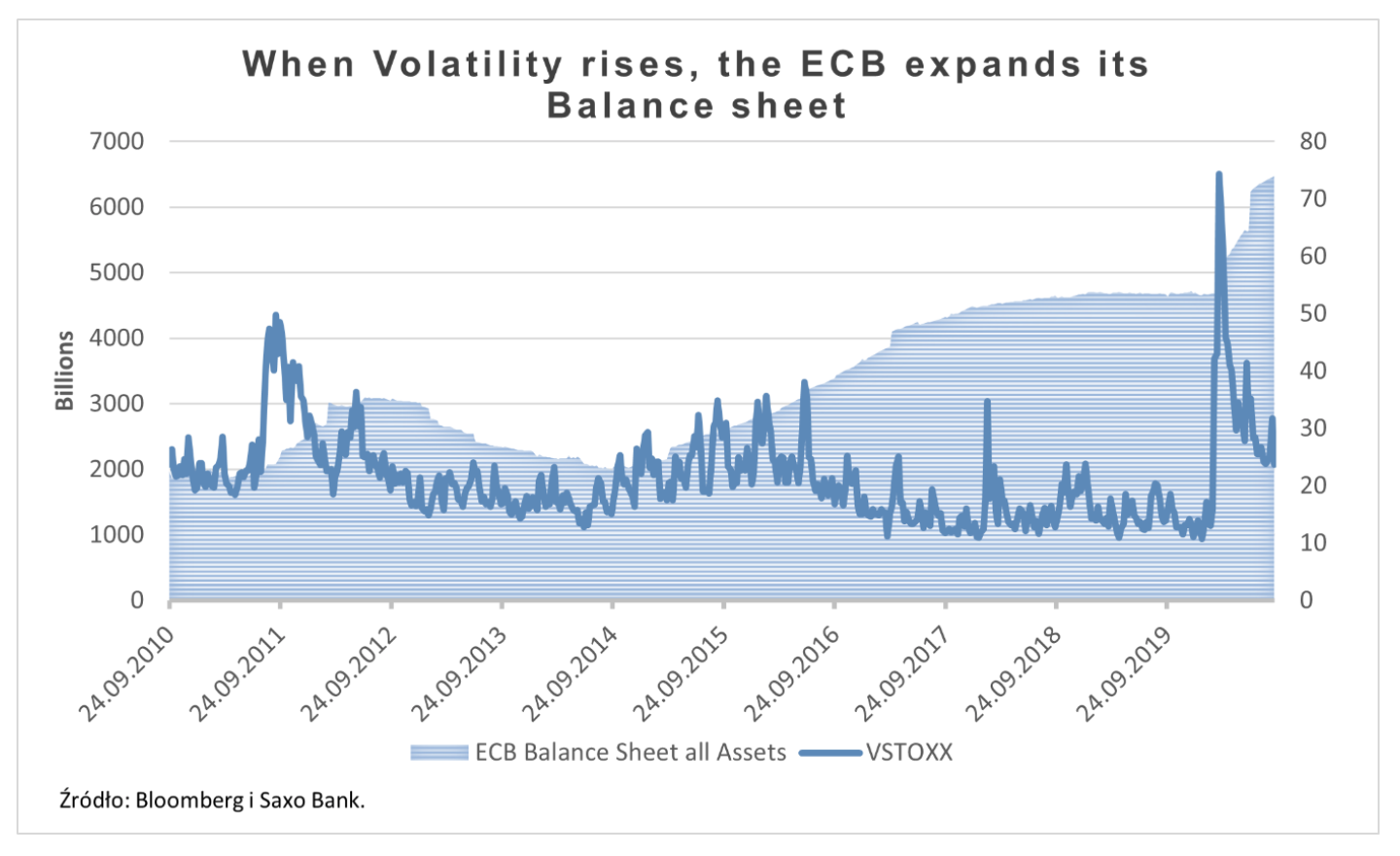

Since the financial crisis of 2008, world central banks have tried to reduce market volatility. Unconventional tools were implemented to guarantee both liquidity and favorable economic conditions. None of these kinds of policies have managed to heal the sick economy. With the Covid-19 pandemic, central banks that had hoped to stiffen the economy were in fact forced to stimulate it further.

Over the past decade, more and more companies have used the economic situation through their balance sheets. Financing is getting cheaper and investors are becoming more risk-averse. As corporate bond performance around the world worsens, this behavior will have consequences. We believe that the second wave of the pandemic and the election in the United States could contribute to a significant increase in the number of downgrades and bankruptcies. Therefore, we advise investors to be careful and carefully select securities in terms of risk in the last quarter of this year.

US elections: US corporate bonds projected for the fourth quarter

TRUMP WON: The situation from the last four years can be expected to repeat: deregulation, lower taxes for enterprises and pressure on domestic production. In this context, the sectors of finance, infrastructure, energy, and the American industrial and manufacturing sectors look good. Junk bonds have higher growth potential. However, even if we are not concerned about lower-yield bonds, we are still leaning towards average maturities of up to seven years to limit the negative effects of inflation.

BIDENA WON: Biden's victory will be seen as negative for corporate bonds in the market. We predict a decline in sectors that benefited from deregulation and lower taxes under Trump's tenure. In this scenario, we prefer higher quality bonds to take advantage of short-term volatility that will drive investors to flee to safer investments. In our opinion, the market has not yet priced in Biden's victory, which is why volatility will be high. However, this situation will not last long. Investors looking for long-term investments should look at opportunities in the area of "green" bonds.

CALLING THE RESULT OF ELECTIONS: Due to the fact that this year, due to the pandemic, the number of votes cast by letters will increase, there is a high probability that the election result will be questioned. Under this scenario, safe assets will become key and will appreciate until there is a clear winner. In this context, US XNUMX-year government bonds and long-term, high-quality, investment-grade bonds will generate the greatest benefits. Once the winner is determined, the bond market can be expected to behave as described in the previous scenarios.

EU corporate bonds - watch out for the second wave of coronavirus

In the area of European corporate bonds, there are interesting opportunities for both investment grade and high yield bonds. In fact, corporate bond spreads have narrowed since the pandemic, but are still wider than in the pre-crisis period. However, it is important to select bonds that will prove resilient during the second wave of Covid-19. In our opinion, the most interesting is the area of corporate bonds with a lower investment rating and a better rating with high profitability. The stimulus implemented by the central bank and the economic recovery will benefit bonds from the sectors most affected by the pandemic.

In the complex bond market environment, investors will benefit from careful selection and caution

While we see many challenges in the bond market, we believe that investors continue to be able to successfully trade fixed income securities. We recommend that you select your investments carefully in terms of risk, as there are clear signs of weakening in the market. In such an environment, it is important to choose the duration carefully, as the spreads may tighten even further in the short term, but may have a negative surprise in the longer term.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)