Benjamin Graham - Father of Value Investing

A hundred years ago, investing in the stock market was not as professional as it is today. The average investor had little knowledge of listed companies. In addition, access to financial information of companies was very limited, both due to technological reasons and the reluctance of companies to share complete data about their financial situation. As a result, there were conditions for earning from inefficiencies in the market. This was because some companies were valued well below their intrinsic value. Just not all investors were aware of the actual financial situation of the company. Many investors were not able to estimate how much the company actually generates cash and what is the real value of the assets held. He noticed it Benjamin Grahamwhose investment strategy was to buy discounted companies at a fraction of their true value. In today's text, we will present the history "Father of investing in value".

Youth, education

Benjamin Graham's real name was Grossbaum. He was born on May 9, 1894 in London. His family was of Jewish origin. Benjamin was the great-grandson of Jacob Gesundheit, who was the rabbi of Warsaw from 1870 to 1874. In 1895, the family moved to the United States in search of a chance for a better life. After some time, the family changed their name to Graham in order to better assimilate into American society. Some give the reason to avoid anti-Semitism and anti-German sentiments (the name was German-sounding). The father of the future investor established a furniture store that allowed him to support the family. However, after the death of his father, the family ran into financial problems. To make matters worse, Benjamin's family was also one of the victims The panics of 1907. During this time, they lost a significant portion of their savings. This forced family members to tighten their belts. Years later, Benjamin Graham said that Experience in searching for discounts in stores had a big impact on his investment strategy.

Despite the difficult financial situation, Benjamin's education has not been neglected. Young Graham was a good student. One of his passions during the years of study was ancient literature. So the stories described in Homer, Virgil, were no mysteries to him. He also liked to read the philosophical treatises of such figures as Aristotle, Plato and Marcus Aurelius. In addition, he was linguistically gifted - he knew 7 languages.

Career on Wall Street

Good results in school led him to be offered a job as a lecturer in Greek, Latin, English and mathematics at Columbia University. However, Benjamin did not take advantage of this offer and went to work on Wall Street in Newburger, Henderson and Loeb. By the age of 25, he was earning about $ 500 a year, which was an astronomical amount. The "Crazy Twenties" lulled the young investor's vigilance even more. He risked a lot, but the bull market on the stock market forgave mistakes. During crash in 1929 he lost almost all his fortune. It was these experiences that paid off in the future. The experiences of the XNUMXs and early XNUMXs inspired him to write the book "Security Analysis", which became one of the most famous books on investing.

In the 20s, Benjamin Graham decided to start his own business. Graham-Newman Partnership was established to invest in the American stock market. It is worth mentioning that Graham-Newman's results have been fantastic. Graham's average annual rate of return was approximately 1936% from 1956 to 12,2. At the same time, the US stock market achieved a CAGR of XNUMX%. This meant that Graham's good results were not a coincidence, but a deliberate strategy that allowed him to gain an advantage over the market.

Benjamin Graham and his investment strategy

This advantage was due to the consequences. Graham and his partners did not focus on predicting market behavior, but estimating the intrinsic value of the company and comparing it with the market valuation. Benjaminn Graham believed that the stock market was behaving similarly to a man with a manic-depressive disorder. In times of euphoria, the market overestimates the value of companies, while in times of depression it values companies well below their intrinsic value. The role of the investor is to use these situations to his advantage. The stock market compared to a neighbor who comes to your house every day and offers a different price for the house each time. Sometimes, when he is in a good mood, he offers much more than the real value of the land and building, to one day get into a gloomy mood and announce that the house is only worth a fraction of the value of a few days ago. The role of the investor is not to follow the momentary moods and focus on long-term investing.

Graham rejected the idea of using technical analysis for this purpose. Fundamental analysis would be much better for predicting long-term trends, he thought. He believed that it does not matter whether the company is the best on the market or stands out from the competition. The most important thing is that you can make money on it. The favorite type of companies purchased by Graham were the so-called "Butts" (cigar butt). These were companies that investors did not particularly like. The lack of demand meant that the shares of such a company were valued very cheaply. The main reason for the low valuation was the exaggeration of the risks faced by companies (loss of market shares, economic recession, etc.). Graham carefully examined the company's documents each time, trying to estimate how much the company has liquid assets, how many liabilities it has and how much the company's fixed assets may actually be worth. In addition, he also investigated the company's ability to generate profits in the following years. After examining the company's financial situation, Graham carried out a conservative valuation of the company. However, to buy the company's shares, its valuation had to be much lower than Graham's. The greater the difference, the theoretically greater was the chance of generating a profit on a given transaction. This difference was named by Benjamin Graham "Safety margin". He adopted the concept of a safety margin at home Warren Buffett.

What was the simplified formula for estimating the intrinsic value of the enterprise? So-called Benjamin Graham's formula (Benjamin Graham Formula) was the following formula:

V = EPS * (8,5 + 2g) where;

- V - intrinsic value of the enterprise

- EPS - earnings per share

- 8,5 - this is the value of the P / E ratio for non-growing companies

- g - long-term rate of return

In 1974, the formula was modified. A multiplier of 4,4 was introduced, corresponding to the average interest rate on corporate bonds in 1962. The result was divided by the value of the Y-factor, which represented the current interest rate on AAA-rated (highest) corporate bonds.

V = (EPS × (8.5 + 2g) × 4.4) / Y

GECO's summer advertising 60th source: vintage-adventures.com

The best investment that Graham-Newman Partnership made was purchase of a 50% stake in the GEICO insurer. In 1948, half of the company was paid for $ 712. In 000, shares in the company were valued at $ 1972 million. It was an absolutely masterful investment decision that generated more profits than the other investments combined. GEICO itself was acquired in 400 by Warren Buffett's investment vehicle - Berkshire Hathaway.

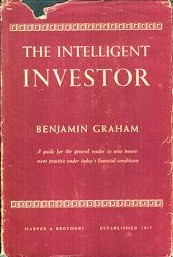

He included his thoughts in a book "Intelligent Investor"that changed the world of investing. First published in 1949, the book became a guide for all investors who wanted to apply the fundamental approach. Warren Buffett was delighted with the bookwho announced it "The best book on investing ever written". Buffett was so fascinated by Graham's approach to investment that he wanted to work for him ... free.

Opinions about the market and companies

Graham believed that, in the short, the stock market was the aggregate value of individual investors' votes. It is therefore susceptible to market sentiment or rumors. The result is that stock prices can fluctuate significantly, much more than fundamental changes in a company. On the other hand, he believed that in the long term the market is so-called weighing machine (in the long term, stocks of companies coincide with the fundamental value). Thus, the best potential investment were enterprises valued well below the intrinsic value, and they have the potential to increase the value of the enterprise in the future. Graham also developed the passive and active investor concept. Passive investor invest safely and for the long term, while an active investor has time to conduct fundamental analyzes of companies, which allows them to look for market opportunities during market declines.

Graham avoided investing in companies that avoided publishing complete information about the company's financial condition. He was also not a supporter of companies that put the generated cash on their accounts, even though they did not need it. He was of the opinion that the surplus cash should either be spent on business development or given to shareholders in the form of dividends. Another book is also worth mentioning - "Security Analysis"which was Graham's first book.

Intelligent Investor

The intelligent investor. Source: wikipedia.org

It is one of the "Bibles" of value investing. Thanks to this book, the figure of Mr. A market that behaves irrational in the short term, but always follows in the long term "Intrinsic value" enterprises.

One of the universal conclusions can be drawn from the book. Following short-term price fluctuations leads to mental fatigue and an increased likelihood of losing some of your investment funds. Instead of following emotions such as greed and fear, the investor should focus on understanding the business and its proper valuation. Only then should an investment decision be made with a long-term investment horizon. A conscious investor should buy market pessimism (periods of bear market or negative events affecting the company's valuation) and sell pessimism (periods of investment mania).

In the book, the author warns against blindly following the crowd or buying a company just because you like it. You should always be aware that the most important thing is not to overpay for company shares and to accept market volatility, which is not a threat but an opportunity to find investment opportunities. Graham also recommends having a bond or cash portion in your investment portfolio. This safe part of the wallet can be used in times of pessimism in the stock market when good quality companies are very cheap.

The first modern investor - activist

Although Graham was usually a minority investor most of the time, he did not remain passive to the actions of the boards of directors. He was of the opinion that corporate culture, operational efficiency as well as honest and competent management are key factors in the long term. Even the most profitable company will not generate added value for shareholders if managed by fraudsters. For this reason, Benjamin Graham closely watched the actions of the boards and senior management. When he invested a lot of money in GEICO, he began restructuring the company to take full advantage of its potential. He was determined enough to overcome the initial "resistance of the organization." Ultimately, the investment in GEICO and the introduced improvements allowed it to generate an amazing rate of return for the company's shareholders.

However, sometimes activism required a lot of stubbornness and a wealthy wallet. The case with the Northern Pipeline was the best example. It was this situation that made him a symbol of an investor-activist. Northern Pipeline was established after Standard Oil was split into several smaller entities. The newly formed company had liquid assets worth approximately $ 95 per share. These were, among others shares in railway companies or other liquid securities. At the same time, the share price was around $ 65 per share of the company. However, the management of the company was very conservative. It did not want to sell assets and give cash to shareholders, preferring to keep these funds "rainy day". At the same time, these assets were not working to create additional value from operating activities. According to Graham, they should be liquidated and either invested in the company's business or given to shareholders. The problem, however, was that Graham had not enough action to force managers to change their mind. Benjamin started a larger share buyback and convinced some minority shareholders to support his idea. Thanks to the support of shareholders holding 37,5% of the company's shares, Graham became a member of the company's management board. Eventually, he managed to force the liquidation of a significant portion of the non-working assets and the payment of $ 70 per share to the company's shareholders.

By his actions, he showed minority shareholders that, if they wanted to and if there were appropriate conditions for it, they could force the company's management board to act. As a result, many investors began to look at the asset structure and control whether the company's capital is invested effectively. Moreover, Graham has shown that even a small shareholder is a co-owner of the company and has the right to loudly claim his rights.

Heirs of Graham's Thought

Market successes combined with great writing "Manuals for investors" caused Graham to find many followers. One of the most famous is "The Oracle of Omaha", that is, Warren Buffett, who is considered one of the greatest investors of all time. Since the XNUMXs, Buffett has been generating an above-average rate of return that far exceeds that of the American indices. While Warren's investment style has evolved over the past decades, he initially invested in copying Graham's stock selection. The situation changed only after Buffett became friends with Munger, who convinced Warren to abandon the orthodox following of Graham's teachings. Another example is the Indian investor - Mohnish Pabrai. This Asian investor is known for both his strategy (investing in value) and his situation several years ago, when he paid $ 650 for a dinner with his guru - Warren Buffett. Pabrai is also an advocate of looking for undervalued companies and the use of "safety margins".

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)