The Brexit series continues, the pound up

Trade negotiations between the European Union and the UK will continue, and a new agreement it can be worked out by mid-November. It was these reports that were behind the pound's appreciation on Wednesday.

The pound goes up considerably

On Wednesday, the pound clearly appreciated against the currency basket. Including the dollar and Polish zloty. Course GBP / USD it broke with force above the local peak of October 12 this year. (1,3083), testing levels not seen since the first half of September, and above all opening the way for further gains.

The increases in GBP / USD went hand in hand with the increase in GBP / PLN. Especially that the zloty additionally lost under the influence of disastrous covid statistics in Poland. As a result, the pound increased from PLN 4,9890 yesterday at the end of the day to PLN 5,0660 and reached its maximum from September 29 (PLN 5,0665). It is also on the verge of breaking this resistance, which, similarly to GBP / USD, would open the way to strong gains.

The day for the pound began with the publication of September's inflation data in the UK. Both CPI and core CPI inflation slightly increased. However, the data were in line with expectations and they were not the reasons behind the subsequent strengthening of the British currency.

The pound appreciated sharply after reports that the trade negotiations between the European Union and the UK, suspended last week, are to be resumed. Their truthfulness was additionally confirmed by the European negotiator Michel Barnier, who admitted that an agreement with Great Britain was within reach.

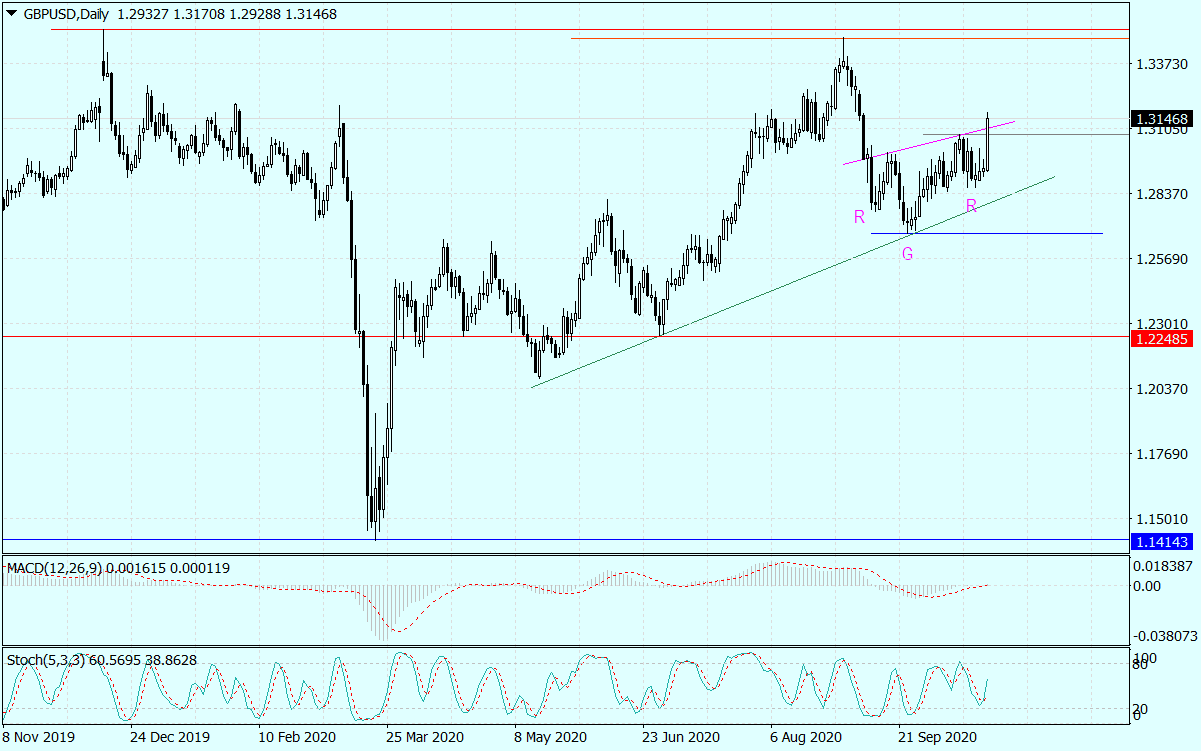

GBP / USD chart, D1 interval. Source: MT4 Tickmill.

Today's gains in GBP / USD, including breaking the local high from the first half of the month, strongly affected the balance of power on the daily chart. The broken resistance in combination with the visible pro-growth formation of the inverted head and shoulders paves the way for the pound even to the September high at 1,3482. However, the supply will definitely defend the levels above 1,33 a lot.

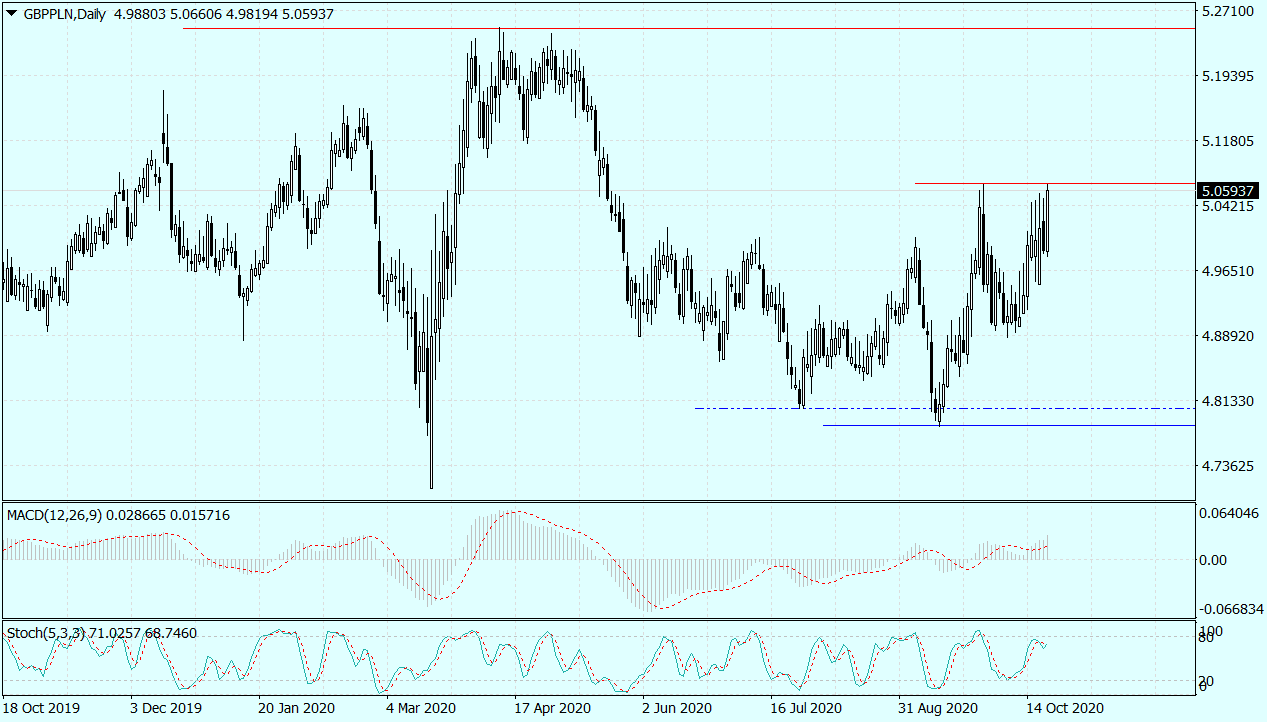

GBP / PLN chart, D1 interval. Source: MT4 Tickmill.

The GBP / PLN pair is just a step away from generating a strong demand signal. Such a signal will be a break above the resistance at PLN 5,0665. If this happened, and the balance of forces on the daily chart indicates that it will be so, then the pound will have an open road to the level of PLN 5,20.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)