The price of coffee is the highest in a decade due to the forecasted reduction in supply

Arabica coffee futures hit their highest price in a decade, surpassing $ 2,50 per pound; after five years of a side course this year the price of coffee almost doubled as a result of the worst drought and frost season in several decades, which decimated Brazilian crops. As a result of supply constraints, the market has returned to deportation for the first time in years, and after five years during which negative rollover gains have benefited short sellers, the sharp reversal to supply constraints is back supporting long positions.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Omikron scares the markets

The resilience of coffee to last week's spread of omicron weakness, which led to a (temporary) deterioration in global risk appetite, is evidence of growing support for this market from current supply problems in many key arabica producing countries.

The March Arabica futures contract hit its highest price in a decade, surpassing $ 2,50 per pound; After five years of sideline, this year's price has almost doubled as a result of the worst drought and frost season in several decades, which has decimated Brazilian crops - not only for 2021, but also potentially for at least two consecutive seasons.

Above $ 2,56 per pound, the next significant level for the Arabica futures contract will be the 2011 high of $ 2,90 per pound, followed by the 3,09-year high of $ XNUMX per pound.

The weather is not the only obstacle

After the year being one of the worst for crops due to unfavorable weather conditions in Brazil, coffee exports were also negatively affected by the shortage of containers, which translated into a reduction in deliveries to roasting plants in Europe and the United States. In November, Brazil's coffee exports amounted to 2,918 million 60 kg bags, lagging 8% of the five-year average, while Colombia, the world's second-largest exporter of this product, fell 11% to 1,132 million bags. The decreasing supply and problems in the supply chain contributed to the decline in coffee stocks in the warehouses monitored by ICE to 1,6 million bags, which is 11% below the five-year average.

While these levels as such do not justify an almost doubling of the Arabica coffee price this year, the prospect of an even greater drop in supply over the next few years still leaves the market significantly nervous. Damage to frost earlier this year led to replantings in some areas, and some farmers switched to other crops.

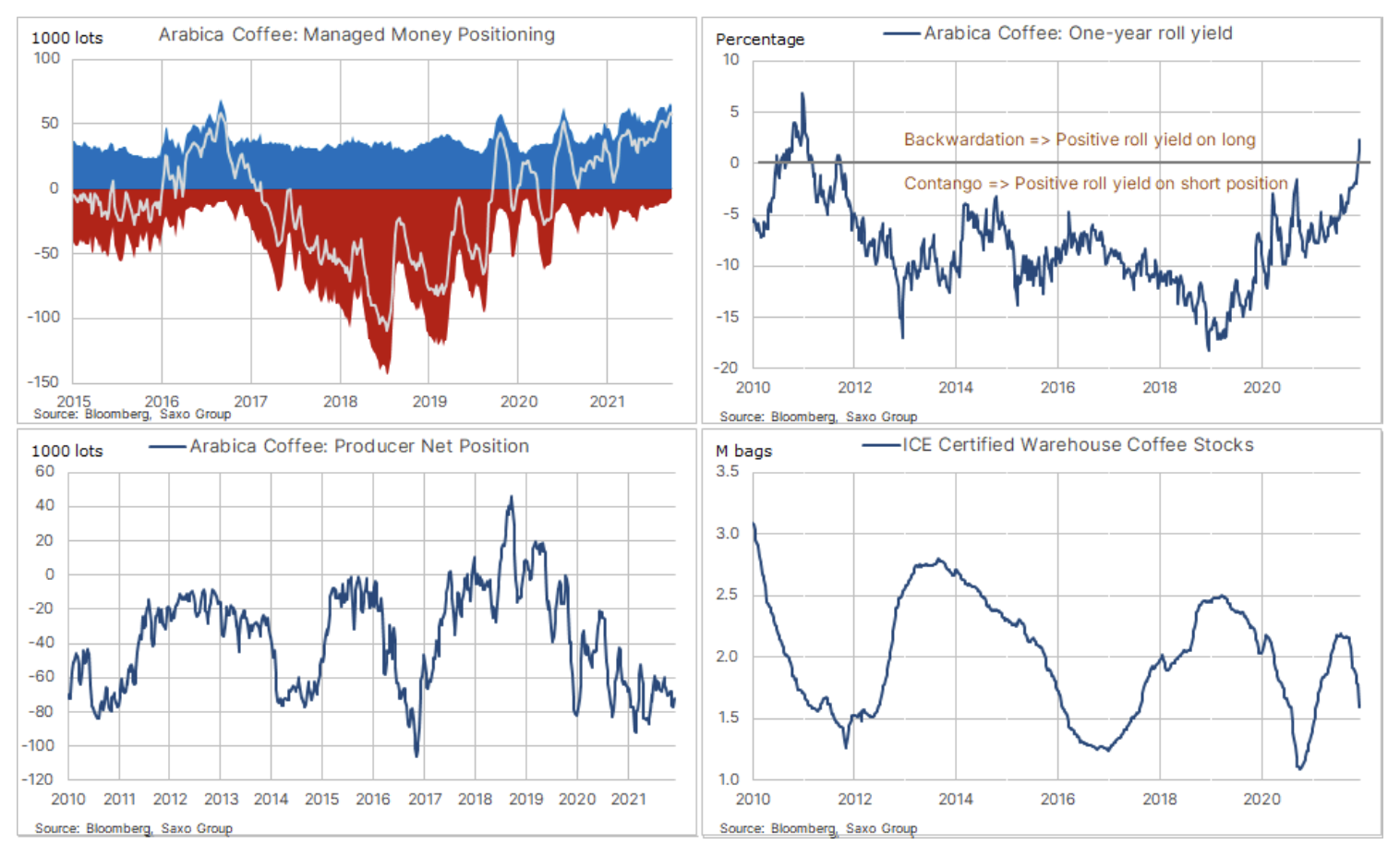

The charts below show some of the recent market support developments.

Curves forward Commodity futures often provide more information than just watching stocks over the next month. The five-year period of oversupply (2015-2020) meant buyers were constantly loss-making. During this period, a jump in prices was always followed by a sharp reversal the main factor of which was the shape of the curve forward. An oversupply market has an upward forward curve with the lowest price at or near the spot price. Rolling over long essentially meant that traders were consistently selling at a lower expiry price than the next month's price.

In 2015-2020, the percentage spread between the spot price and the annual forward price averaged around 10%. The so-called phenomenon negative carry (when the cost of holding a position exceeds its profits) takes place when there is an oversupply on the market, i.e. contagion. For many years, coffee was characterized by the highest contagionmaking it the raw material preferred by financial investors in the context of short positions. This year's deterioration in market supply caused the annual rollover profit to return to positive values or to the state of deportation, thanks to which, for the first time since 2011, the investor now has a positive carry due to maintaining a long position on the futures market.

This is reflected in the position of money managed by mutual funds (managed money), where net long position peaked in 5 1/2 years in the week ending November 30. Since positions add up to zero in the futures market, there must be a short position for every long position. Much of these short positions are held by producers and traders, and as prices increase, these coffee-oriented traders must increase their resources to maintain an increasingly costly short. In its latest report, Sao Paulo-based Archer Consulting estimates that margin calls for positions in the New York futures market in the last five months alone have cost traders around $ 13,4 billion, potentially forcing some of them to buy back their futures. short position, thus increasing the upward pressure in prices.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Will global warming help wheat? [Webinar] wheat raw materials webinar](https://forexclub.pl/wp-content/uploads/2024/03/pszenica-surowce-webinar-300x200.jpg?v=1711099347)

Leave a Response