Cereals lose, cocoa gains, gold and oil tend to strengthen: commodity markets in February

Commodities saw a general but moderate decline last month; This was mainly the case for cereals, whose prices fell to a three-year low, while the price of cocoa rose by a third - the biggest monthly increase in 22 years - due to the deepening supply crisis in West Africa. EU natural gas and emissions contracts listed on the ECX also showed significant losses due to warmer temperatures and the rapid adaptation of the power grid to greener energy sources, which reduced demand for CO2 emission permits.

Gold and silver are awaiting a decision on interest rate cuts in the United States, while remaining resilient to rising Treasury yields and a stronger dollar. Oil remains range-bound despite some signs of strengthening, with traders focused on the meeting OPEC + and tensions in the Middle East.

Supply crisis in West Africa

Last month, commodities recorded a broad but moderate decline across all sectors; this was mainly the case for grains, which fell for the third month in a row, reaching a three-year low due to the abundance of supply and causing speculative short positioning to rise to record levels. Overall, the Bloomberg Commodity Total Return (BCOM), which tracks a basket of 24 major commodity futures contracts with almost equal splits between energy, metals and agricultural products, declined for a fourth straight month in February amounting to 1,5%.

The table below presents the results of selected commodity futures contracts, some of which are not included in the BCOM index. Examples include Kakao, whose price rose by a third, recording its biggest monthly increase in 22 years, as the supply crisis in West Africa continued to cause losses for the chocolate industry. At the bottom of the table we see EU natural gas, which suffered further losses due to high supply and a warm end to winter, and the partially related emissions contract listed on the ECX exchange, which fell to near a three-year low, i.e. by more than half in compared to last year's peak value. Sticking with the energy theme, it's worth noting that without the notoriously volatile U.S. natural gas contract, which has dropped to a near four-year low, the BCOM loss would have been less than 1%, given that crude oil and fuel products have gone up due to signs of strengthening.

It was a relatively quiet month for the metals market, with both industrial and precious metals posting small declines, a relatively decent showing in a month where economic data from China continued to be disappointing, while U.S. Treasury yields rose sharply after how strong data from the United States further delayed the expected date of the first cut in US interest rates and reduced the size of subsequent cuts.

EU emissions and the green transformation are still in trouble

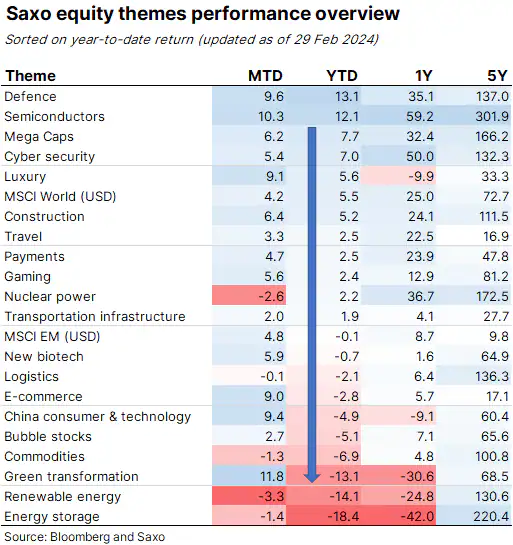

Wall Street's stock market hit new highs last month and, unsurprisingly given the current enthusiasm for artificial intelligence and the focus on defense, Saxo's thematic stock baskets are showing strong year-over-day gains across defense and semiconductors, and in further, also to large-capitalization companies and companies related to cybersecurity. At the bottom of the table there are four baskets covering companies dealing in raw materials trading and green transformation.

Last year, with rising financing costs and the realization that interest rates would not be reduced at the pace expected, capital-intensive industries involved in developing solutions for the green transition, renewable energy and energy storage saw sharp declines. In addition to high financing costs, these industries have also been hit by the sharp decline in natural gas prices, which has increased the relative cost of developing alternatives.

Information on Saxo's thematic share baskets and the underlying shares in each thematic area is available at the following links: defense, semiconductors, raw materials, green transition, renewable energy and energy storage.

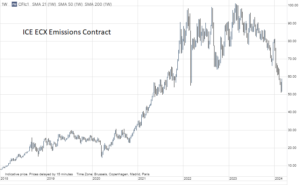

Relatedly, another market that has seen sharp declines in recent months has been the carbon offsetting market in Europe, with the ECX-listed emissions contract at one point falling to close to €50 per tonne, down from €105 in same period last year. The decline in the cost of pollution fees has been partly due to the fact that Europe's energy grid is switching to greener solutions at such a rapid pace that it is destroying demand for CO2 emissions permits. The massive expansion of solar and wind farms across the EU over the past few years, as well as the revival of nuclear power production in France, combined with lower industrial activity and mild winters, have caused natural gas prices to plummet and reduced demand for more environmentally harmful coal.

The energy transition and focus on tackling harmful emissions supported much higher carbon prices until last year, thereby helping to create a speculative long bubble as speculative traders/investors believed that prices could only go higher. After falling by almost half over the past year, the bubble has burst, reducing selling pressure. Overall, however, the prospects for renewed strength depend on economic activity and whether there is a recovery in energy-intensive industries that were hit by last year's gas price increases. As supply in the carbon market is expected to decline significantly at the end of this decade - as more and more industries are forced to purchase allowances - a bottom will eventually be established, but whether it will be above EUR 50 remains to be seen and will depend, among other things, on whether Europe will be able to avoid a prolonged economic slowdown.

Speculative investors are no longer to blame for the further increase in cocoa prices

Last month, cocoa futures extended their parabolic rally, strengthening by more than a third and posting their biggest monthly gain in 22 years. The rally that gained momentum late last year saw New York Stock Exchange futures prices rise to record highs above $6 per tonne, about 000 times higher than the five-year average through 2,5. This was the result of a larger, than expected deficit in the 2023-2023 season - the third in a row - due to the unfavorable situation in West Africa, which is the world's main growing region responsible for about 2024% of global production. Heavy rains early in the season damaged crops and spread disease, and then aging trees had to deal with heat and drought. All this has contributed to lower production, and as individual farmers have failed to generate adequate profits, they will continue to struggle to purchase much-needed but expensive pesticides and fertilizers to combat disease while maintaining production from aging trees.

Shipments from cocoa farmers to ports in Ivory Coast, a major shipper of the commodity, are now about a third lower than last year, and with the mid-season harvest at the end of March also looking at risk, this has raised concerns about the availability of cocoa in the need to meet sales commitments already made, potentially putting some of the largest chocolate producers in a difficult position and forcing them to enter the futures market to secure supplies, thereby involuntarily turning into buyers of futures contracts instead of conducting regular sales (hedging) activities ). The weekly Commitment of Traders report shows that producers are increasingly the main buyers as they reduce their short positions, while hedge funds have been net sellers for several weeks, reducing their net long position to the lowest level in 11 months.

Springy gold

We maintain an optimistic outlook for gold and silver, but as we have repeatedly emphasized in recent months, both metals are likely to strengthen significantly until we gain more insight into future interest rate cuts in the United States. Until the first cut, the market may be a bit too optimistic, increasing expectations regarding a rate cut to levels that expose prices to a correction. In this context, the near-term direction of gold and silver prices will continue to be dictated by incoming economic data and their impact on the dollar, yields, as well as expectations of interest rate cuts.

One key factor remains the short-term interest rate market, which has gone from pricing in more than six 25-basis-point cuts in US interest rates this year to fewer than four cuts, while the expected date of the first cut has moved to June, potentially leaving a very tight window window for remaining rate cuts. This is based on the assumption that FOMC it is unlikely to cut rates around the November presidential elections in the United States to avoid accusations of favoring the incumbent president.

That said, last month gold managed to defend itself very well against a stronger dollar and rising Treasury yields, particularly two-year bond yields, which rose over 40 basis points to 4,62%, thereby once again raising the opportunity cost of maintaining a non-interest-bearing position in gold. Overall, the metal ended the month with a slight loss, and ahead of Thursday's long-awaited reading of the US core PCE deflator - the Fed's preferred indicator of inflation - gold acted like a spring, seeking to strengthen despite the headwinds of yields, while remaining held back by fears of an inflation surprise. However, when the reading turned out to be consistent with expectations, the price of the yellow metal went up, approaching the February high of USD 2 per ounce.

Oil remains neutral despite strong fundamentals

WTI and Brent futures continue to trade in relatively tight ranges - WTI between $76 and $80 and Brent between $81 and $84 - with technical trading dominating while fundamentals are unable to guide prices .

Overall, we remain of the view that Brent and WTI prices are likely to remain within ranges of around USD 80 and USD 75 per barrel respectively in the first and subsequent quarters, but the risk of disruptions in the Middle East and OPEC+ production cuts may suggest that the risk/reward ratio will increase rather than decrease. In the short term, the market will focus on WTI crude oil and whether traders can manage to break through the resistance just below $80, a level they unsuccessfully tried to breach last week. At the same time, in the case of Brent crude oil, a potential breakout attempt requires more effort, and the level worth watching in this respect is slightly higher ($85).

There was some fundamental strengthening last month, and increasing price differentials between monthly contracts point to a more robust outlook in some segments of the physical market. In the short term, investors remain focused on the Red Sea, where Houthi attacks continue, and next week's OPEC+ meeting, which is expected to decide to extend the current production cut agreement beyond March.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response