Changing balance of power on the oil market. The price per barrel is down significantly

Yesterday's decline in the oil market completely changed the balance of power on the chart. We can forget about a future attack on the round level of $100 per barrel, and we need to start getting used to the idea of a drop to $82.

But won't a barrel cost $100?

Wednesday brought a very strong decline Brent crude prices, bringing with it a massive change in the balance of power on the daily chart. As a result, the chances of an attack on the level of USD 100 at the end of the year, which was the base scenario just a moment ago, are close to zero. However, the downside risk has increased significantly. The first significant supports are around USD 82.

Today morning Brent crude oil is slightly rising in price, returning above the level of USD 87, after yesterday its prices dropped at the end of the day to USD 86,86 from USD 91,90 on Tuesday, drawing a large bearish candle on the daily chart. However, the technical consequences of yesterday's strong depreciation are so great that... we can talk about a change in trend.

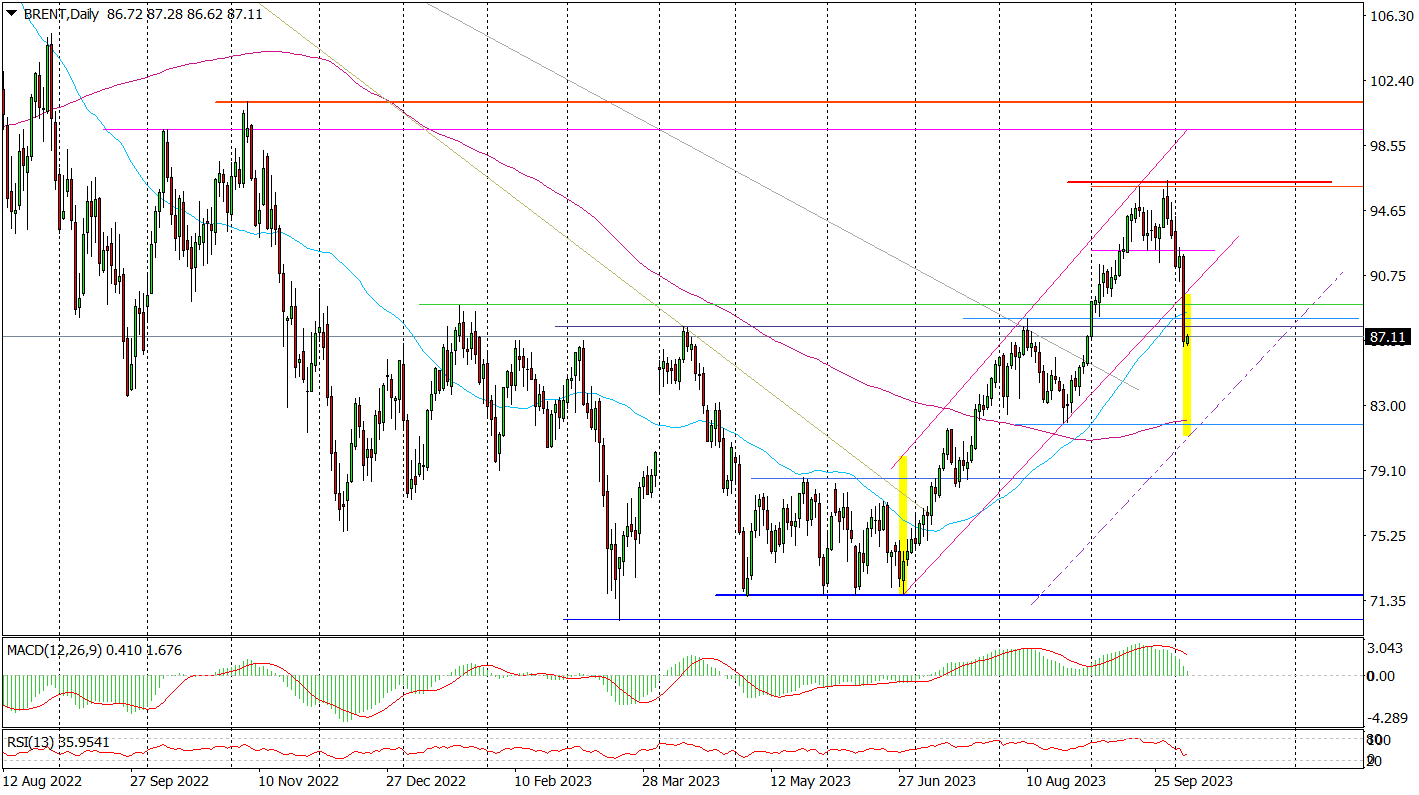

Brent crude oil daily chart. Source: Tickmill

The daily chart of Brent crude oil has broken out of the upward channel that has been drawn since the end of June. This opens the way for the minimum to fall by the width of the channel from which the breakout occurred.

Yesterday's sell-off led to a break of the 50-day average. Oil prices were below it for the first time since the beginning of July. This could even suggest declines towards the 200-day average, which is currently at $82,07.

The price of Brent crude oil fell below the supports created by the local peaks in January, April and August this year. This, first of all, negates the breakout from the wide channel of USD 70-89, which makes the prospect of attacking USD 100 a thing of the past. In the short term, breaking such an important support zone may herald a decline to USD 82, i.e. to the low from the second half of August.

To sum up, the situation on the oil chart has changed 180 degrees. A breakout from the channel, broken key supports, a drop below the 50-day average and preliminary sell signals on indicators mean that oil prices will drop to around USD 82.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)