Coinbase debut. Has the crypto industry surpassed the Rubicon?

Coinbase is listed on the stock exchange It was basically successful, although the closing price was less than the opening price, however, relative to the original reference price of $ 250 per share, the direct listing proved to be a success for the world's largest cryptocurrency exchange. We analyze what this means for the industry as a whole and for potential regulations, but also what are the key risk factors to consider when dealing with Coinbase. In addition, we are launching a new thematic basket for companies dealing with cryptocurrencies and blockchain technology. This basket offers inspiration and alternatives for investors who want to get involved in the crypto market without having to own their own exchange-traded debt securities (ETNs) or physical cryptocurrencies.

About the Author

Peter potter - director of equity markets strategy in Saxo Bank. Develops investment strategies and analyzes of the stock market as well as individual companies, using statistical methods and models. Garnry creates Alpha Picks for Saxo Bank, a monthly magazine in which the most attractive companies in the US, Europe and Asia are selected. It also contributes to Saxo Bank's quarterly and annual forecasts "Shocking forecasts". He regularly gives comments on television, including CNBC and Bloomberg TV.

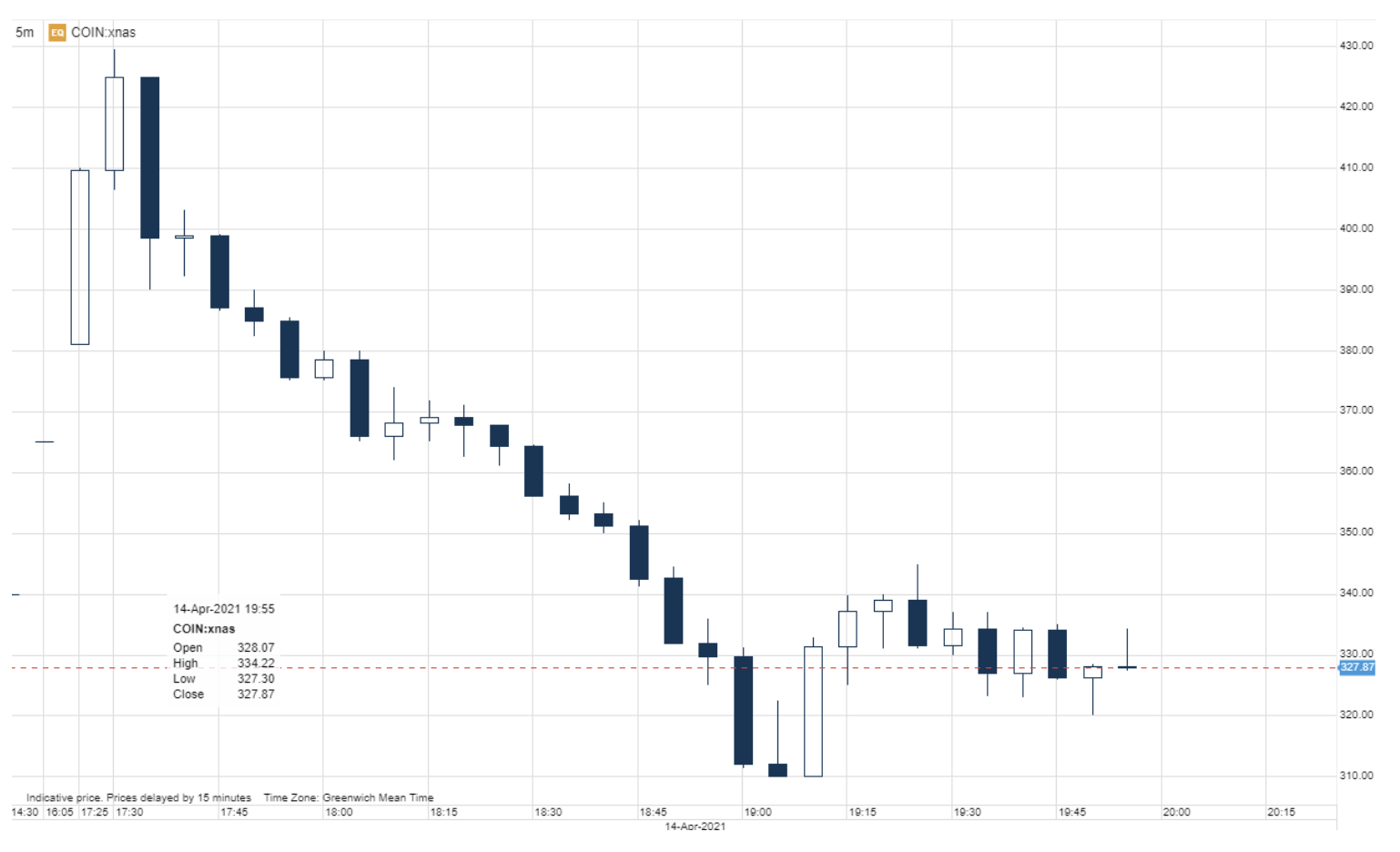

Launch of futures contracts on Bitcoin in December 2017 was a real breakthrough for cryptocurrency validation across the industry and the institutional finance sector. The cryptocurrencies then hibernated for almost three years before bitcoin prices rose again. Price increases have contributed to a dramatic increase in interest in cryptocurrency trading, and mining them increased the demand for computer integrated circuits. It culminated on Wednesday with the entry of the world's largest cryptocurrency exchange, Coinbase, which opened at $ 381 per share, an increase of 52% compared to the $ 250 reference price set at the initial auction prior to the first transactions. The price of Coinbase shares reached $ 429,54, however, during the session, it recorded lower results and closed at $ 328,28.

Crypto thematic basket and risk

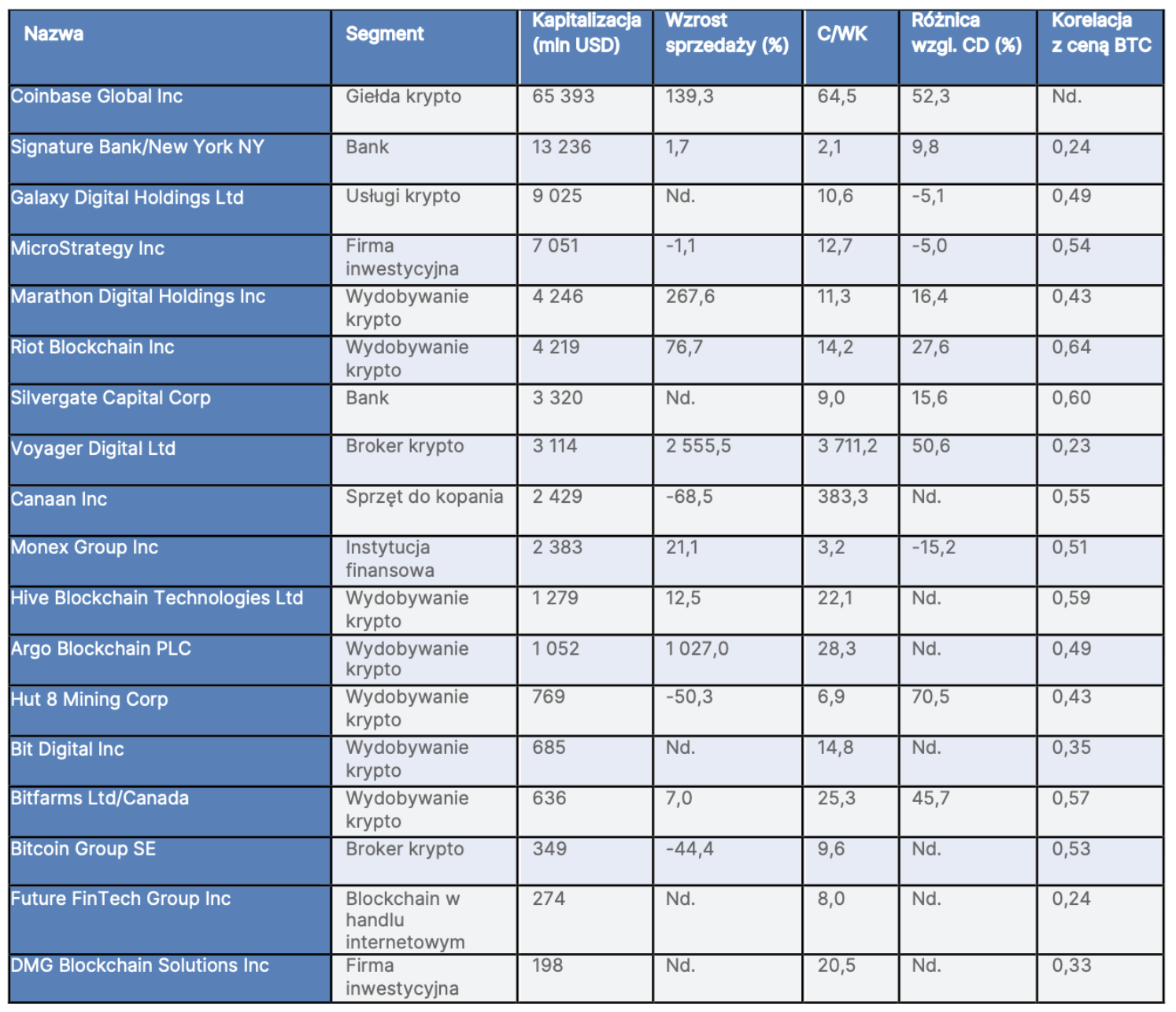

After Coinbase went public, the crypto industry has finally reached a level of maturity that allows us to launch a thematic basket for companies dealing with cryptocurrencies and blockchain technology. This is our smallest basket so far, comprising only 18 companies operating in such segments as the stock exchange, crypto services, cryptocurrency mining, investments, blockchain technology applications and cryptocurrency mining equipment.

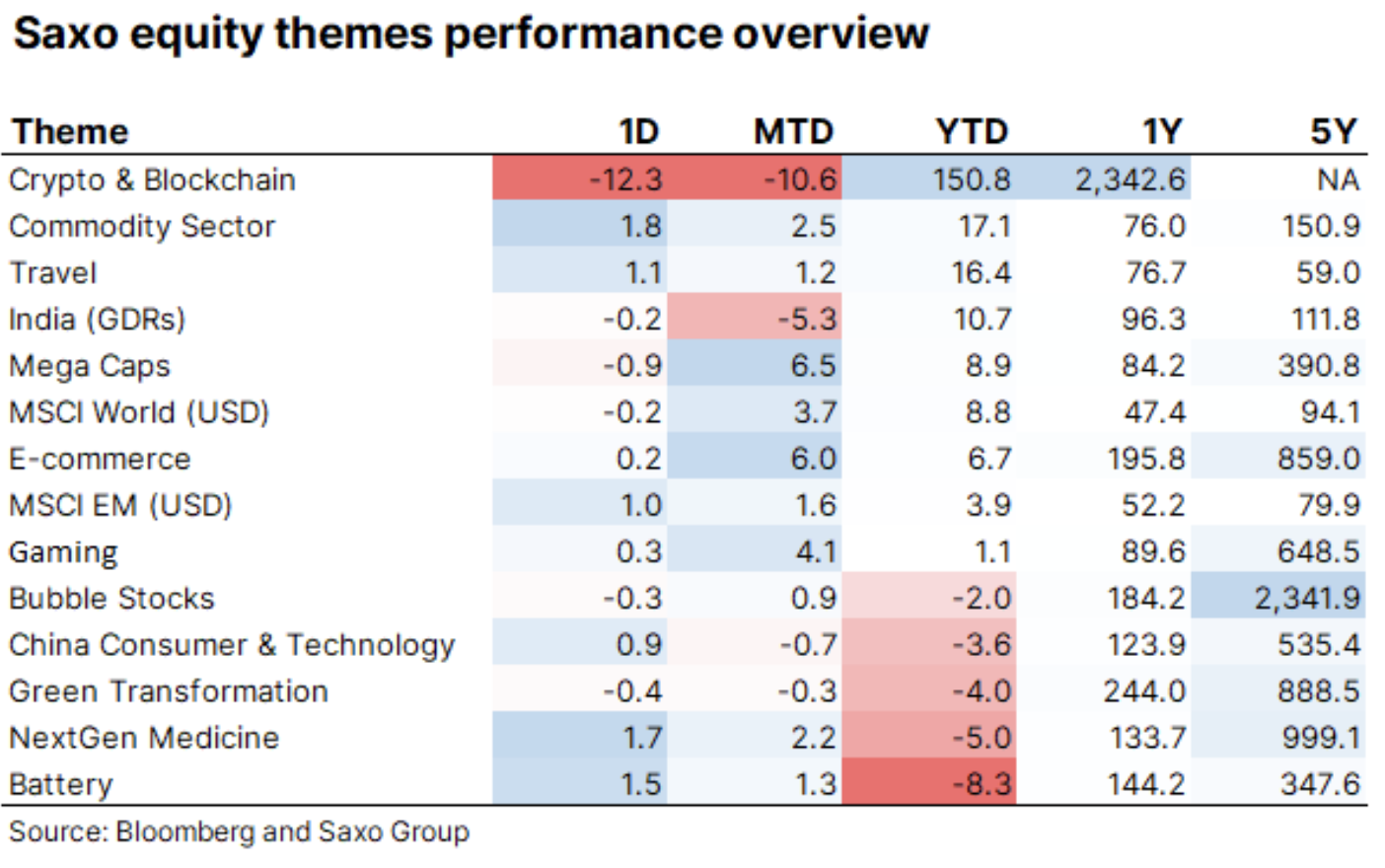

The history of the basket does not go back five years, as five years ago many high-quality companies were not yet operating on the market. Last year and on a year-to-day basis, the overall return was not - unsurprisingly - particularly high due to the boom in cryptocurrency prices, but recently our basket has come under some pressure. As we are dealing with a new industry, the rules of which may be difficult to understand for many investors, we will soon publish an analysis of the individual companies included in the basket, prepared by our cryptocurrency analyst.

The three main risk factors for this basket are new regulations that could weigh heavily on the future use of cryptocurrencies, fairly aggressive valuations of companies related to the crypto industry, making their shares more sensitive to changes in sentiment, and finally - the key risk is related to the price of bitcoin as such. The correlation to the price of bitcoin is 0,45 on average, which means that bitcoin prices will affect the profits of this basket.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response