Report from the event: Finance and Investment Forum 2020

On January 10-11, 2020, the first edition took place at PGE Narodowy Finance and Investment Forum. The weather was exceptionally favorable for mid-January, and the agenda, although it only touched on the subject of the currency and raw materials markets to a small extent, was extremely interesting. As Forex Club we had pleasure take the patronage over the event.

For two days over 40 lectures, speeches and debates took place. Association of Individual Investors, which was the organizer of the event, put a lot of differentiation. Real estate, pensions, crowdfunding, ETFs, PPK, gold, blockchain, currency market ... After all, a professional investor focuses on diversification, right? Probably no one doubts that the fashion phenomenon also occurs in investments. What was the most popular?

OBI results

Of course, this is not about a DIY store, but about the famous report - General Investor Research. It was with the presentation of the results for 2019 that the substantive part of the conference began. More than 2600 people took part in last year's survey - this is much less compared to the 2018 OBI, which was attended by 3912 people (details can be found in a separate article here).

Check it out: Results of the General Investor Survey 2019

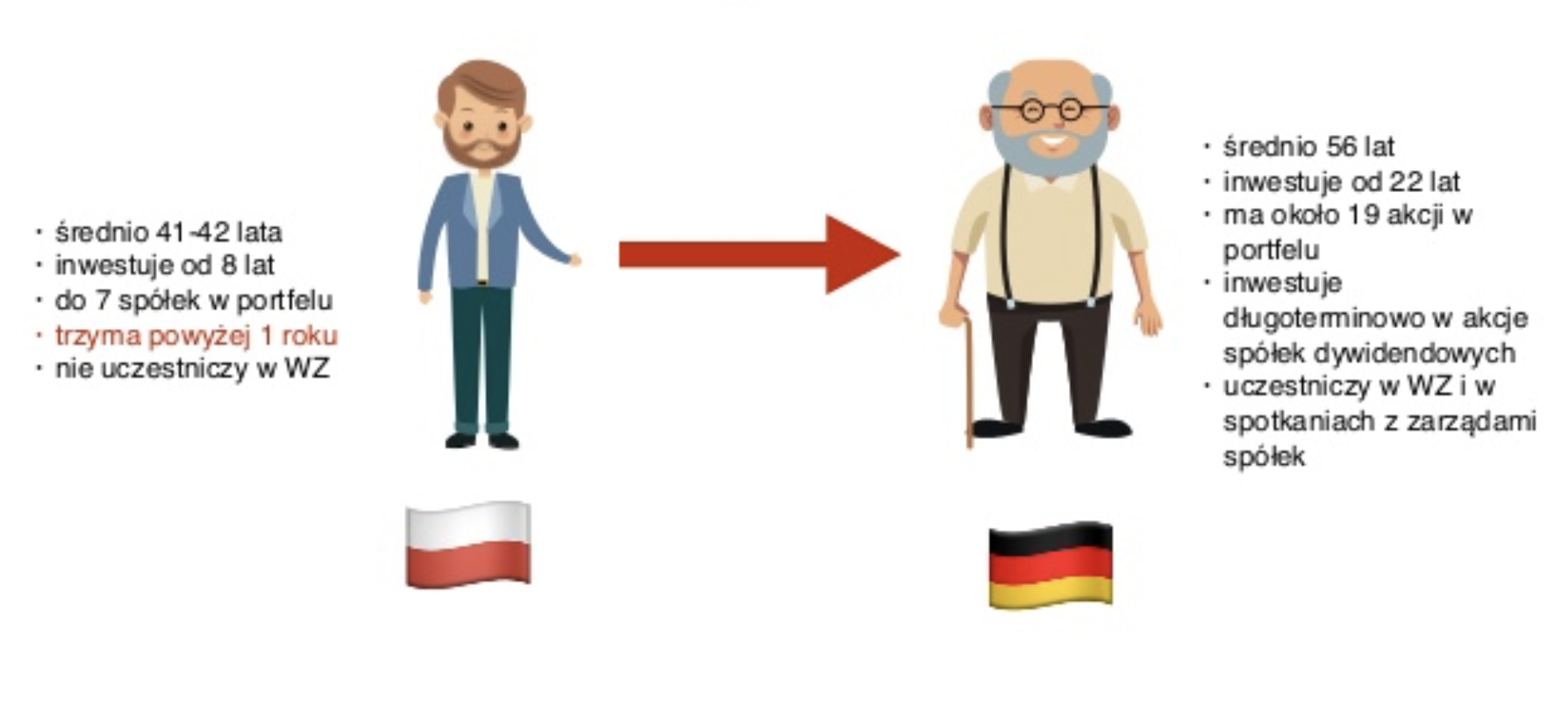

The results show clearly - a statistical Polish investor is a middle-aged man with higher education, who has been investing for about 8 years and has up to 7 listed companies in his portfolio. Compared to the 2018 results, however, there is a difference in the investment time horizon - previously it was declared that shares are held for up to 12 months, now it is over a year. Could this be the effect of "stagnation" on the WSE?

As many as 60,8% of respondents said that they deal with overtime investing, and only 2,9% consider themselves a professional investor. As many as 95% of Poles choose investing on their own, and only every fourth decides to choose TFI funds.

As last year, the Polish investor was compared with the German one.

Actions above all

Compared to 2018, there are no big differences. Shares dominate with 82% interest and a gigantic advantage over other instruments. Interestingly, as many as 11% more people declared that they kept funds on bank deposits, despite high inflation and low interest rates.

However, there is an increase in interest in other instruments such as Forex (+ 5%), New Connect shares (+ 5%), real estate (+ 1%), cryptocurrency (+ 3%) or ETFs (+ 8%). It's fair to say that we're looking for alternatives and diversification options compared to 2018, while not losing hope in the boom on the WSE.

Does technical analysis work?

OBI does not answer this question, but shows that almost 16% of investors use this tool. Little? Let us remember that the surveyed are mostly stock market investors. Interestingly, less than 10% more people use fundamental analysis, and more than 45% have declared that they combine both methods.

However, it is puzzling that as many as 11% of investors think they cannot analyze. So on what basis do they make decisions?

Real estate is hot

Undoubtedly, investing in real estate has become fashionable. Galloping prices and low interest rates have attracted to this market people who previously did not even think that they would invest in it. A large part of the conference was dedicated to this segment.

Michał Masłowski, vice president of the Association of Individual Investors:

“Real estate ruled without a doubt. It was during these lectures and discussion panels that people stood in the aisle, did not let the lecturers leave the conference rooms. The second thematic area, which mainly interested investors, was crowdfunding, and the third, to our great satisfaction, ETFs. Personal finances also turned out to be a huge hit. An interview with Marcin Iwut, a well-known specialist in personal finance, attracted a record audience ”.

Do we have a bubble That question must have been asked. According to Radosław Chodkowski (Humanist on the Stock Exchange), Nope. And even so, the risk of "typical" investments is assessed as low, at least in relation to the stock market and based on the "effect" of the bear market on real estate from a decade ago.

Do we have a bubble That question must have been asked. According to Radosław Chodkowski (Humanist on the Stock Exchange), Nope. And even so, the risk of "typical" investments is assessed as low, at least in relation to the stock market and based on the "effect" of the bear market on real estate from a decade ago.

"Buy, renovate, sell", so called flips this is by far the largest hits among the strategies on the real estate market - according to those who train and practice it personally, it allows you to earn relatively much and quickly, without much capital (but with creditworthiness).

But there are more ways to invest capital in real estate. The Saturday debate on the subject of exceptionally stormy Investments in condo - opportunities and threats. What to watch out for when investing in condo hotels? ”. Rafał Jerzy (Grupa Kapitałowa IMMOBILE SA) predicts that this market guarantees illusory profits, is burdened with many risks and will become the "real estate Amber Gold". Will it really be that bad?

Crowdfunding as an introduction to the debut on the stock exchange?

Is crowdfunding safe? It depends. The Polish Financial Supervision Authority has created a separate section for this segment on its website, in which it addresses many significant risks - read. There are many risks, but the trader's task is not to eliminate them completely (because it is impossible), but to minimize the expected benefits.

According to debating guests and speakers Equity crowdfunding is a good introduction to the way companies acquiring funds in this way will find their way to New Connect in the future. They agree that the market potential is enormous, although it should be noted that not every startup will be CD Projekt. What's important? The business model, the team leading the project and its previous experience, and… broad and cool analysis.

Gaming - a recipe for success?

The gaming industry has developed wings rapidly. Interest in investing in companies dealing with their production is growing all the time. But is this industry a guarantee of success? Among other things, this was discussed in the debate "Do gaming companies have a chance to attract new investors to the WSE?".

The gaming industry has developed wings rapidly. Interest in investing in companies dealing with their production is growing all the time. But is this industry a guarantee of success? Among other things, this was discussed in the debate "Do gaming companies have a chance to attract new investors to the WSE?".

The interlocutors clearly admitted that this market still has potential, but it will be increasingly difficult to achieve success. The winners are heard of, but the industry is haunted by failed companies. There are tons of games that no one is playing, and this suggests that someday there will be a "market cleanup". When? It is not known.

So how do you choose a successful company? According to the participants of the debate, people are the key - a team with experience, the way of running projects and focusing on… earning money. Ultimately - diversification is the key, because at the beginning it is difficult to judge whether a given game will become a hit or not.

Fair

The Finance and Investment Forum is not only lectures but also industry fairs. The current companies included the Stock Exchange, most Polish brokerage houses, companies offering alternative investments, start-ups and technological innovations.

Summary of FIiF 2020

We present only a small portion of what you could have learned during the two-day event. In our opinion, a currency trader must especially think about diversifying his investments. There is once changeability, once there is no change. The systems work and at some point they stop. Trends can last several months, but consolidations even longer.

The dynamically developing gaming, cryptocurrency and real estate market may prove to be tempting alternatives for us. And this also with less wealthy wallets. The speakers' practical knowledge and different points of view in debates allow you to form an opinion before taking any risk.

The event itself can certainly be evaluated very positively. The great diversity meant that everyone could find a topic of interest to him. Despite the unique location, it turned out that it was the biggest problem. The rooms separated in the business part of the National Stadium, where the lectures were held, were clearly too small and notoriously lacking seating. But it is a good sign that the next edition is quite certain! 🙂

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)