What is the Recession, or what bulls like the most

word in recent months recession every now and then it returns in the media. Analysts, economists, journalists and politicians outdo each other in their forecasts regarding the economic condition. Some fear recession, others see it as an opportunity for a better allocation of capital in the future. How is this recession? Does it have a positive or negative impact on economic development in the long term? Today we will try to answer these questions.

What is Recession

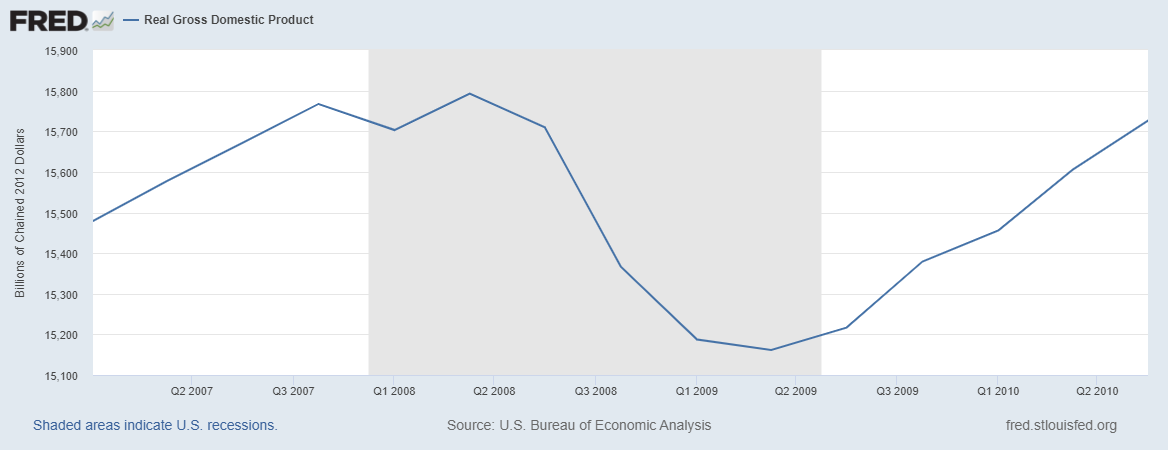

According to the basic definition, a recession is a decline in GDP for at least two consecutive quarters. Below is an example of a recession recorded in the United States.

US GDP. Source: fred.org

Gross domestic product (GDP) is the value of all goods and services that were produced in a given area in a given time. Gross Domestic Product is a stream of goods produced in a specific time and in a specific area. Most often, Gross Domestic Product is calculated for a country on a quarterly or annual basis. GDP only takes into account the final good. Intermediate values are not counted to avoid double counting. For example, the production of bread already contains flour. For this reason, the flour used to make the bread is already included in the value of the loaf. So no need to add it again. GDP is not synonymous with wealth held by citizens, companies or government agencies. Thus, a 10% decrease in GDP does not mean that the wealth of the entire country is less by 10%.

Thus, a recession is a situation when the flow of goods produced by the entire economy is smaller than in the previous year. It is therefore a weakening of economic activity. Some view the decline in economic activity differently. For example, the NBER (National Bureau of Economic Research) measures recession using, among others, changes in earnings in the non-agricultural sector, industrial production and retail sales. So this is a slightly different perspective on measuring economic activity than in the case of simply measuring economic activity by means of changes in GDP.

Causes of the recession

Recessions usually don't happen suddenly. This is a series of processes that are behind the slowdown in economic activity. The reasons for the slowdown may be internal as well as external. Internal are, for example, macroeconomic imbalances caused by credit expansion. Its collapse may cause a sharp contraction in economic activity. An example is the strong recession of 2007-2009, which was caused by the bursting of the bubble in the subprime market. An external factor is, for example, a deterioration in the economic situation in a country that is the main trading partner. As a result, exports fall drastically, which is reflected in the deterioration of economic activity.

Recession and the economy

A recession always causes a decline in activity in the economy. Private investment is slowing down and consumer sentiment is deteriorating. As a result, there is a decline in consumption and investment. What's more, the increase in unemployment means that households are forced to manage their budgets more wisely. For this reason, sectors that sell discretionary goods are most vulnerable to a decline in revenue. This, in turn, contributes to the decline in sales of such companies. The result is lower profits and even losses. Companies are forced to optimize costs, which results in delaying investments and sometimes even reducing employees.

Since the beginning of the industrial revolution, most economies have been developing steadily and periods of recession are rather a short break in further development than a signal of structural economic problems. Data compatible Of the International Monetary Fund (IMF) between 1960 and 2007, 122 periods of recession were reported in 21 advanced economies. This means that, on average, one developed country experienced about 6 periods of recession over a period of 47 years. Moreover, the IMF calculated that only 10% of the time these economies were in recession.

The decline in economic activity is visible on the labor market and in retail sales as well as in investments. Very often in a recession there is a feedback loop. Declining consumer spending causes companies' revenues to decrease. This, in turn, forces many of them to lay off some of their employees, which is reflected in lower household incomes. As incomes fall, so does private consumption. Sometimes households maintain their current level of consumption, but this is reflected in a decrease in the level of savings or an increase in the level of debt.

Financial institutions also have problems. Banks that granted loans in periods of good economic conditions report deterioration of the loan portfolio during economic downturns. The increase in problem loans (NPL - non-performing loan) is growing, which forces the bank to make write-offs and start restructuring the loan portfolio, which is at risk of default. Sometimes, if the banking sector is struggling with a very high level of NPLs, there may be a need to buy out bad assets by the central bank (e.g. using QE - quantitative easing).

Except that, in the United States and countries where citizens invest a significant part of their wealth in the stock market, there is a negative income effect. The decline in share prices causes a decrease in the net wealth of households that allocate significant funds on the stock market. This makes such households feel "poorer", which discourages consumption growth.

After some time, the decline in activity stops. The financially weakest entities are unable to continue their activities. As a result, their market shares are taken over by companies better prepared for the economic slowdown. At the same time, the slowdown in lending means that investments with an expected low rate of return do not obtain financing. Thus, a recession is sometimes a catharsis for the economy and allows it to be "cleansed" of inefficient companies.

Fighting the crisis

Ever since Great Depression governments of many countries have adopted fiscal and monetary policies to limit the size of the recession. Some of the solutions are called automatic stabilizers. Examples include progressive income taxes, social assistance and unemployment benefits. In addition, governments can introduce fiscal packages to increase consumption and investment in the economy.

In turn, the Central Bank can provide liquidity in the financial sector and reduce interest costs in the economy. Liquidity can be provided through intervention asset purchases, reduction of mandatory reserves or transactions on the interbank market. Interest costs can be lowered by falling interest rates. This is reflected in the decrease in market interest rates (e.g. WIBOR, LIBOR) to which consumer or commercial loans are "attached". Reducing reserve requirements means that banks have more free capital to invest, which can help resume lending.

Recession and the stock market

As already mentioned, the stock market usually begins economic growth before there is a trough in economic activity. For this reason, it seems absurd to the outside observer that the stock market is growing as newspaper headlines inform about bankruptcies and rising unemployment. The market always discounts the future. For this reason, the worse economic situation has long since been "included in prices". In turn, the longer the recession lasts, the paradoxically better the future of enterprises that survive the economic slowdown. The market is starting to forecast an improvement in the financial results of listed companies. Along with better forecasts, the valuation of companies in financial models is also growing. This in turn encourages investors to buy overvalued stocks.

So a recession is a time when bulls should frantically look for companies that are overvalued too much. A recession can cause many great companies to be valued well below their intrinsic value. Therefore, the purchase of shares of such companies "when blood is spilled" may allow to achieve an above-average rate of return over the next few years.

What predicts a recession?

One of the most media indicators that are supposed to predict a recession is inversion of interest rate curves. Since 1955, each of the 10 US recessions has been preceded by an interest rate inversion. It is worth noting, however, that not every inversion led to a recession.

What is an inversion of interest rate curves? To understand it, you need to know what "normal" curves should look like. In normal times, short-term interest rates are lower than long-term ones. This is due to the fact that long-term debt has a greater so-called "duration risk". Simply borrowing money for a longer period involves greater investment risk. The investor simply does not know how the interest rate and inflation will develop in the future. For this reason, investors demand a higher risk premium.

Therefore, the yield on a 2-year bond in "normal times" is lower than the yield on a 10-year bond. If the yield curve begins to invert, it means that the interest rate on long-term bonds goes down, while the interest rate on short-term debt does not fall and sometimes even rises. Investors simply anticipate that interest rates will be lower in the long run because the central bank will want to lower market interest rates.

Inversion of interest rate curves is not the only indicator that claims to predict a recession. Many traders focus on analyzing leading indicators. Among them are:

- ISM Purchasing Managers Index,

- Conference Board Leading Economic Index,

- OECD Composite Leading Indicator.

Some analysts and investors look to the PMI, which measures the current business sentiment. The analysis of the PMI trend allows you to determine whether business sentiment is deteriorating or improving.

Of course, the actual occurrence of a recession is always known with a significant delay. For example, in June 2020, the NBER announced that the peak of economic expansion in the United States took place in February 2020. As a result of countering the spread of Covid-19, the federal and state governments have introduced a temporary "economy shutdown". As a result, there was a sharp decline in economic activity. The pandemic brought to an end the longest economic expansion in US history. It lasted 128 months and lasted from June 2009 to February 2020. The NBER mentioned that the 2020 recession was the shortest on record, lasting only two months. The recession trough fell in April 2020, two months after the NBER announced that the economy was in recession.

What causes a recession?

There are many economic theories that try to explain how the economy is headed for recession. Most theories can be categorized as economic, financial, psychological or mixed factors (a combination of the three above).

An example of an economic factor that causes a change in economic condition is structural change in specific industries. This is, for example, a sharp increase in oil prices. It causes an increase in transport costs, which "spreads" to other industries. An increase in prices causes a decrease in demand and contributes to an increase in inflation. If the central bank wants to fight rising inflation, it will have to raise interest rates. An increase in interest rates cools the economy, which is another brick that is added to the development of recession in the economy.

Some theories focus on the financial aspect of the recession. A great example is the notion that credit growth accumulates financial risk in the economy. As the credit expansion expires, there is an increase in interest costs. This forces companies to reduce their investment plans and sometimes it is necessary to restructure their operations. At the same time, a decrease in the money supply (or a slight increase) causes recessionary signals to appear in the economy. One of the examples that connects the recession with the supply of money that is not adjusted to the needs of the economy.

Some theories focus on the psychological factors that cause too much optimism in boom times and deep pessimism in economic downturns. According to the supporters of Keynesianism, animal instincts (fear and greed) are responsible for imbalances in the economy. For this reason, according to the supporters of this theory, the state should play a contrarian role. In times of prosperity, they should slightly slow down economic growth (higher taxes, reduced social transfers) and during recessions they should stimulate the economy (investment projects, tax cuts, social transfers). Another example is the concept of Hayman Minsky, who came to economics with the view of the so-called Minsk moment.

The difference between a recession and a depression

According to the NBER, there have been 1854 recessions in the United States since 34, but only five since 5. Of course, economic downturns vary in severity, some of them short and mild, others very deep. An example of a deep recession is the financial crisis of 1980-2007.

In economics, economic depressions are distinguished from recessions. Depression lasts longer and is deeper. This is extremely rare. Most often it is the result of large macroeconomic imbalances appearing in the economy, which are strongly visible at the time of recession. The adjustment of the economy to the new reality is long and painful. Sometimes it is referred to as the "lost decade". An example of an economic depression is the Great Depression that began in 1929 or the financial crisis caused by the bursting of the subprime market bubble in 2007-2009. Another example is the 1937-1938 period in the American economy. Then GDP fell by 10% and unemployment rose to 20%.

Summation

A recession is a slowdown in economic activity. During this economic and social event, there is an "economy contraction". Private investment and consumption are falling. As a result, unemployment is rising. In order to counteract this, there is an increase in fiscal spending and easing of monetary policy. As a result, government spending is rising and interest rates are falling. Over time, such actions allow economic recovery to start again. As a rule, recessions do not last long. According to NBER data, the average recession in the American economy lasted 17 months, while since the 10s the average economic slowdown lasts about XNUMX months. It is worth mentioning that the stock market usually begins to fall before a recession begins and starts a boom even before the "hard data" appear suggesting that the economy is in a recovery phase.

Key conclusions:

- A recession is a significant decline in economic activity lasting at least two quarters.

- Economists measure the length of a recession from the peak of economic expansion to the trough of contraction.

- Sometimes it happens that a recession lasts only a few months, while the economy needs years to return to the previous maximum level of Gross Domestic Product.

- Inversion of interest rate curves is one of the signals of a possible recession in the economy. This relationship does not always work, but it is a warning signal for fiscal and monetary policy makers.

- Unemployment very often rises during recessions and remains at a higher level during the initial recovery phase of economic activity. For this reason, many people do not see the initial stages of economic recovery because they "still can't find a job".

- During a recession, monetary and fiscal impulses are developed to end the period of recession.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)