Shoper's debut - Polish Shopify goes public [Guide]

Shoper debuts on the stock exchange. What does the company do and what do you need to know about it before buying shares? It is a technology company that offers solutions for the e-commerce market. The main service of the company is the Shoper platform, which enables small and medium-sized companies to enter online sales. The online store software is sold under the SaaS model (software as a service). This allows you to reduce the initial costs of using the platform, which encourages customers to use Shoper's services. Interestingly, this is not an absolute debut of this type of company on the Warsaw Stock Exchange. A few years ago, MCI downloaded a competitor of Shoper - the company - from the stock exchange IAI.

In addition to the "script" of the online store, Shoper also offers additional services such as technical support, payment systems, integration with external platforms and consulting services. It is enough to mention that Shoper provides unlimited, free access to technical support and optimization services on the e-commerce market. All this is aimed at "attracting" customers and discouraging them from abandoning the company's solutions (trying to make the service more "sticky"). This is because companies that have become accustomed to additional services are less willing to switch platforms. This "stickiness" of the service means that companies in this market cannot compete only on price, but must try to "wrap" the company with their services, which are aimed at increasing sales efficiency. Ultimately, such a strategy is to extend the client's "monetization period" (extend retention and increase ARPU, i.e. average revenue per user).

Be sure to read: Pepco debut on the stock exchange - what do you need to know about this company? [Guide]

History of Shoper

The history of the company dates back to 2005, when it was founded by Krzysztof Krawczyk and Rafał Krawczyk under the name Devera sc. Initially, the software offer for online stores required installation on hosting platforms from third-party vendors.

In 2010, the company launched its SaaS offer, which was integrated with its own hosting platform. In the following years, the offer of software installed on external hosting platforms was marginalized.

In 2014, another "milestone" in the development of the company took place. A service appeared on the platform Shoper Applications, which allowed the company and external developers to create proprietary extensions on the platform. Two years later, another additional service appeared, which was the extension Shoper Campaigns.

In the years 2017, an extended service appeared Premium Shopwhich is intended for larger retailers who expect more advanced functionalities. In 2018, the company acquired another partner, which was the V4C fund. At the same time, the company once again extended its functionality, which was the service Shipment Shoper.

In the years 2018-2019, as a rule, the Shoper platform acquired about 5 customers per year. However, as a result of the COVID-19 pandemic, growth has accelerated. This was due to the transition of many companies to selling online. This applied to both large and local enterprises. The company hopes that the 2020 cohort will perform the same or better than the cohorts from previous years.

In 2021, an acquisition was made that extended the services with the ErpBox product, which offers better integration with external systems. This applies to both those for sale on foreign trading platforms (e.g. German Amazon or eBay) as well as warehouse and accounting systems (e.g. iFirma, Fakturowani, Enova).

People

- Marcin Kusmierz - performs the role of the President of the Management Board. He is responsible for the implementation and execution of the company's strategy. From 2007 he was the president of home.pl. In turn, in the years 1999 - 2005 he was the CEO of emedia. In 2015-2016, he was awarded the title of CEO of the year.

- Krzysztof Krawczyk - since 2021 he has been the Vice President of the Management Board, previously he was the president of the company. In the years 2000 - 2015 he was a Managing Partner at Innova Capital. For the last 6 years, he has been the head of the Warsaw branch of the CVC fund (owner of PKP Energetyka or Żabka Polska).

- Paul Rybak - in the company from April 2021, where he acts as COO (Chief Commercial Officer). Responsible for the development of Shoper's products and services. In 2013-2021 he worked at the Bauer Media Group. At the same time, in the years 2012-2021 he was the CEO of Sunrise System.

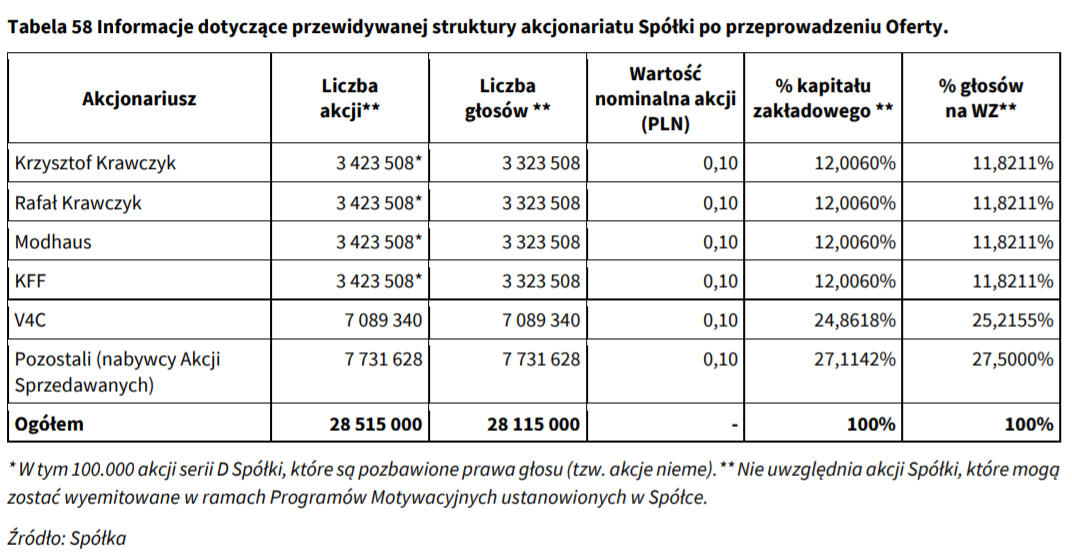

Shareholding

The company's IPO is a partial exit from the investments of the existing shareholders. The company will not receive a single zloty from the sale of over 7 million shares. This means that the company will not get additional fuel for further development, but will have to generate additional funds on its own (from its own operations or debt issuance).

The offerors are:

- KFF where the real beneficiary of KFF S.à rl is Marcin Kuśmierz - President of the Management Board of the Company;

- Krzysztof Krawczyk;

- Rafał Krawczyk;

- Modhaus, where the actual beneficiaries of Modhaus sp. Z oo are Jaromir Łaciński - Chairman of the Supervisory Board and Ewa Łacińska;

- V4C fund.

Ultimately, 7,7 million shares will be sold, representing 27,11% of the share capital.

The maximum share price has been set at PLN 47, which means that the maximum existing shareholders want to sell shares worth PLN 363 million. The company's capitalization will amount to over PLN 1,3 billion.

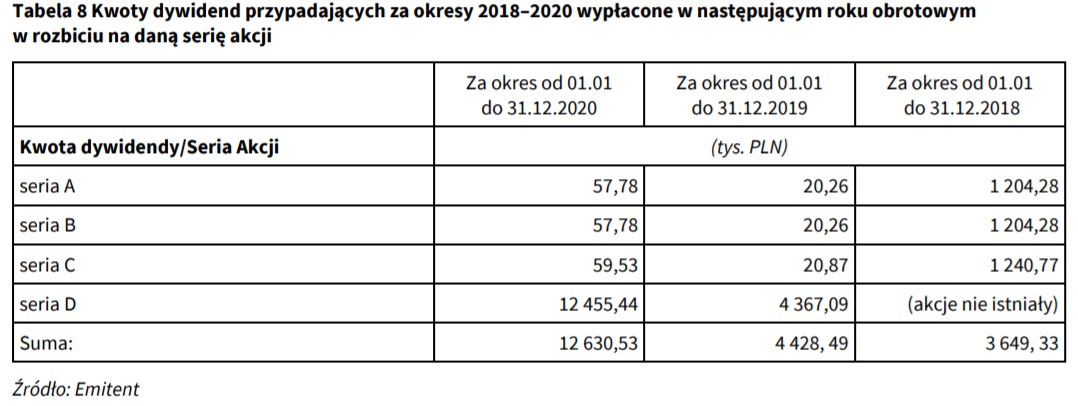

It is also worth mentioning series D shares, which are privileged in terms of dividends. The holders of series D shares are entitled to 5000 times the dividend due to the shareholders of non-preferred shares. Series D shares are redeemed after paying them a dividend of PLN 32,65 million. The prospectus contained a message that the Management Board would recommend allocating most of the profit to dividends (with the exception of 8% for capital increases). However, the dividend payment will depend on the company's needs for additional capital (investment plans, acquisitions).

Shoper offer

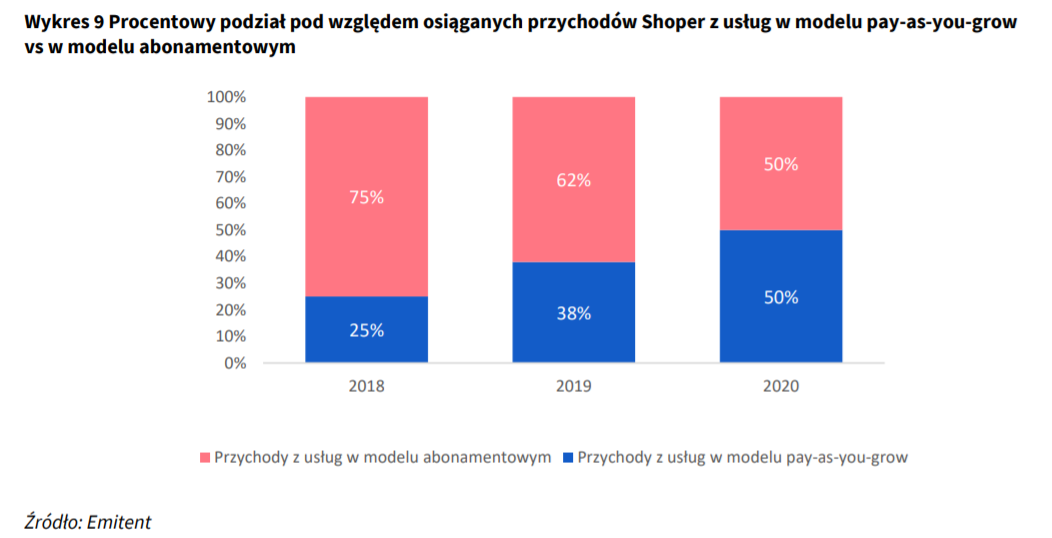

Shoper services are implemented based on the model pay-as-you-grow (payment services) and the classic model subscription. Thanks to the subscription model, the company obtains a more stable and recurring income, which allows for better cash management. This solution also allows you to track the behavior of individual customer groups (cohorts) over time. Especially about their retention, average revenue per customer and the number of transactions on the platform (especially important for payment services).

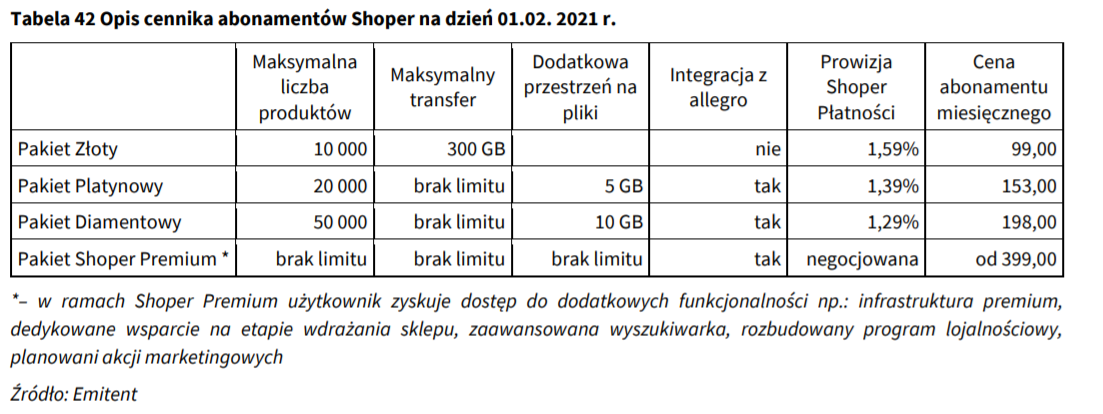

Shoper tries to differentiate its offer depending on the type of service recipient. The SaaS offer is sold in two variants: Shop Standard and Premium Shop. The first solution is tailored to the needs of small and medium-sized companies with standard requirements for online sales. The Premium variant, on the other hand, offers much more extensions and is dedicated to customers with a larger scale of operation.

Shoper sells its services in the SaaS model (Standard and Premium). Standard service is divided into Gold, Platinum and Diamond packages. With Rail, the Premium service is negotiated individually (due to the different offer of potential additional functionalities). The customer can pay for the subscription in 1-, 3-, 6- and 12-month periods.

Shoper also does not miss another trend on the e-commerce market, which is the increase in the popularity of omnichannel sales. It enables, among others, integration with popular trading platforms (eg Allegro, Amazon, eBay), social-media (eg Facebook, Instagram) or price comparison websites (eg Ceneo, Skąpiec). The integrations allowed to increase sales to Shoper's customers. The number of transactions concluded through multi-channel sales in Q2021 XNUMX doubled year on year.

The company, through Shoper Finance, offers financial products to ensure flexible financing for the development of the platform's clients. The offer includes financing of purchases by customers of websites (e.g. in installments) and financing of working capital (purchase of goods).

The company also offers solutions such as:

- Shoper Payments - offering payment solutions for online stores;

- Shipment Shoper - courier services and development of fulfillment services;

- Shoper Campaigns - an offer of effective advertising campaigns on the Internet.

An interesting solution is also Shoper Applications, which is a platform for selling "extensions" on the platform, which allows to meet more sophisticated customer expectations. It is also an additional source of customer monetization and providing them with a more unique offer, which allows you to build a wider "moat" compared to your competitors. However, it should be remembered that the offer of applications on such platforms is nothing new. Just take a look at the wide range of American Shopify.

Basic operational indicators

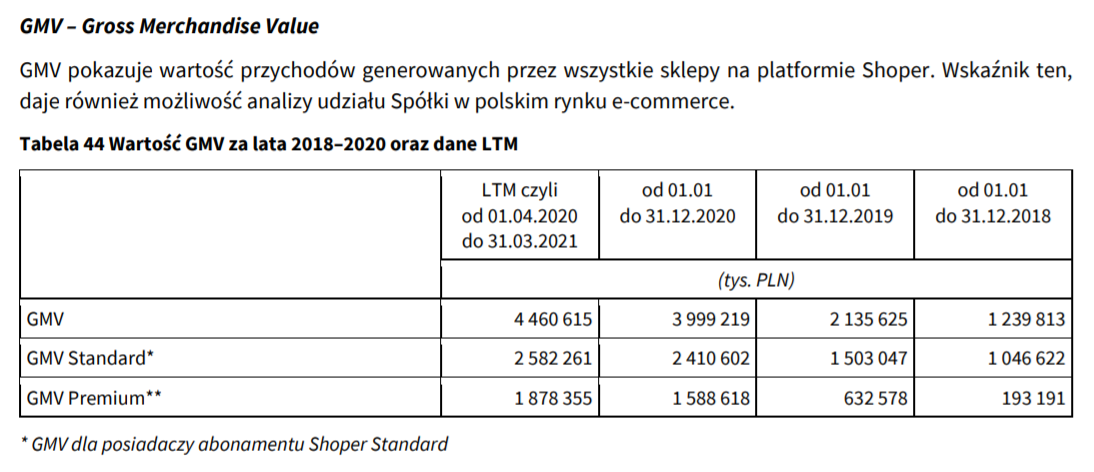

GMV

GMV indicator (Gross Merchants Value) informs about sales revenues generated from online stores "connected" to the Shoper platform. The greater the growth of GMV, the better it is for the company. First, Shoper can then generate more revenue from payment or shipping services. At the same time, the increase in the scale of the company's operation may result in the migration to more expensive subscription packages and the use of more additional services.

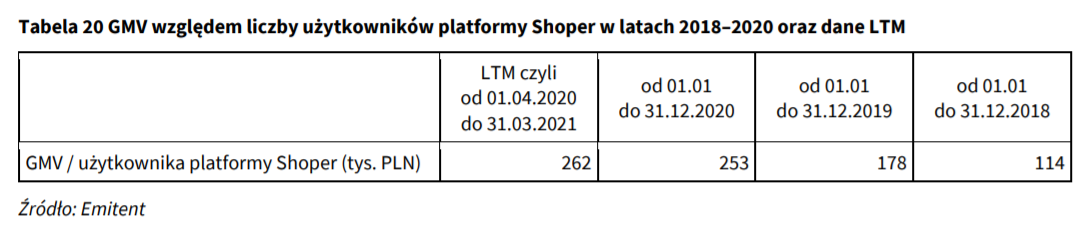

In 2020, GMV was generated on the websites connected to the platform at the level of PLN 4 billion, during the year the increase was about 87%. For comparison, in the Polish e-commerce market, GMV was generated at the level of PLN 83 billion. Interestingly, in 2018-2020, the Polish e-commerce market grew by an average of 25,1%. For comparison, sales on the Shoper platform grew by approximately 80% per year. The reason for such a rapid increase in sales on the Shoper platform was the increase in the number of platform users. It is especially worth looking at the Shoper Premium segment, which in 2020 generated 40% GMV of the entire platform. Over the past three years, GMV in the Premium segment has grown more than 8 times, despite the fact that the number of customers has increased 3 times. As a result, GMV per customer increased.

Another trend visible on the Polish e-commerce market is the increase in sales via mobile channels. It is also visible on the Shoper platform. According to the company's data, the share of mobile devices in total traffic in online stores amounted to approximately 70%. At the same time, about half of the transactions were concluded via the mobile channel. As a rule, these were transactions of less value. For this reason, GMV generated via mobile devices amounted to about one-third of the total GMV.

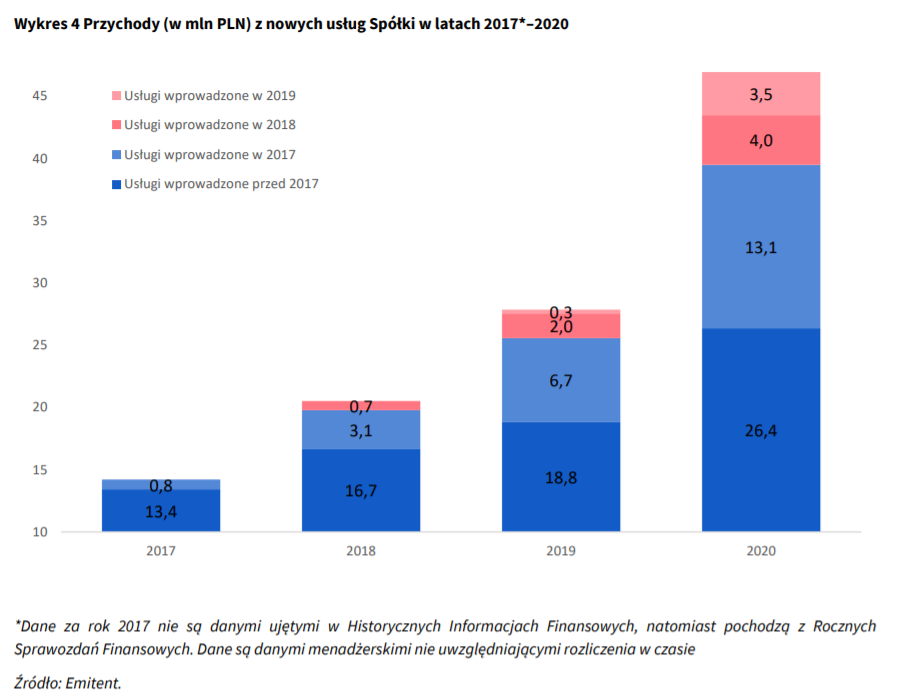

Pay-as-you-grow accounts for an increasing share of revenues. This is a positive development as it allows the company to benefit from the "growth" of their customers.

The main service of the Shoper platform operating in the model pay-as-you-grow is Payment Shoper. It is a service fully integrated with the online store software. Payment Shoper allows online store owners to accept and return payments using the most popular methods, including Blik, payment cards, express transfers, etc. Shoper makes money by receiving a share of the commission charged by a given payment service provider. As the number and value of transactions increase, revenues from the pay-as-you-grow model will take up an increasing share of revenues.

The GMV generated by Shoper Płatności users was 2020% in 24,9, which is 8 percentage points more than in 2018. This service was used by less than 33% of merchants in 2020.

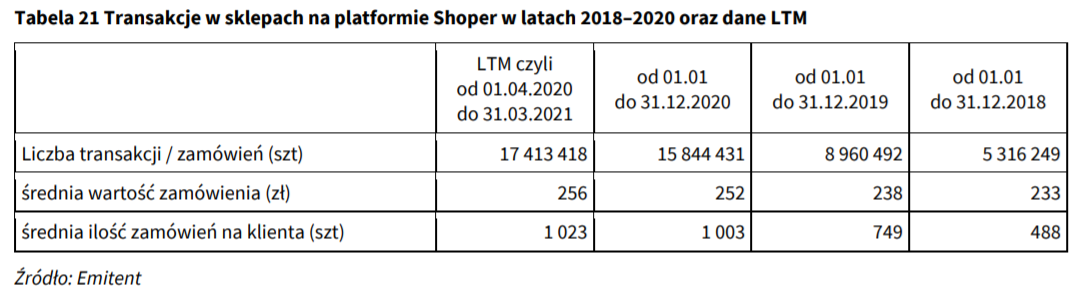

Number of customers and transactions

In the years 2018 - 2020, a significant increase in the number of customers on the platform by approximately 45% is visible. However, the number of premium customers grew the fastest, increasing by 2,7 times over the past three years. Faster growth of Premium customers is a positive development as they are much more "profitable" customers with a much larger scale of operation (which is beneficial for pay-as-you-grow solutions).

At the same time, as the number of customers increases, so does the number of transactions per customer and the average order value per customer. While the average transaction value increases slightly, i.e. by 8% over the next 3 years, the average number of orders per customer has doubled over the same period. This means that the scale of customer operations on the e-commerce market has significantly improved. Better sales of premium solutions certainly helped.

The average GMV per customer is also growing and exceeded a quarter of a million zlotys in 2020. In the following years, this indicator will increase.

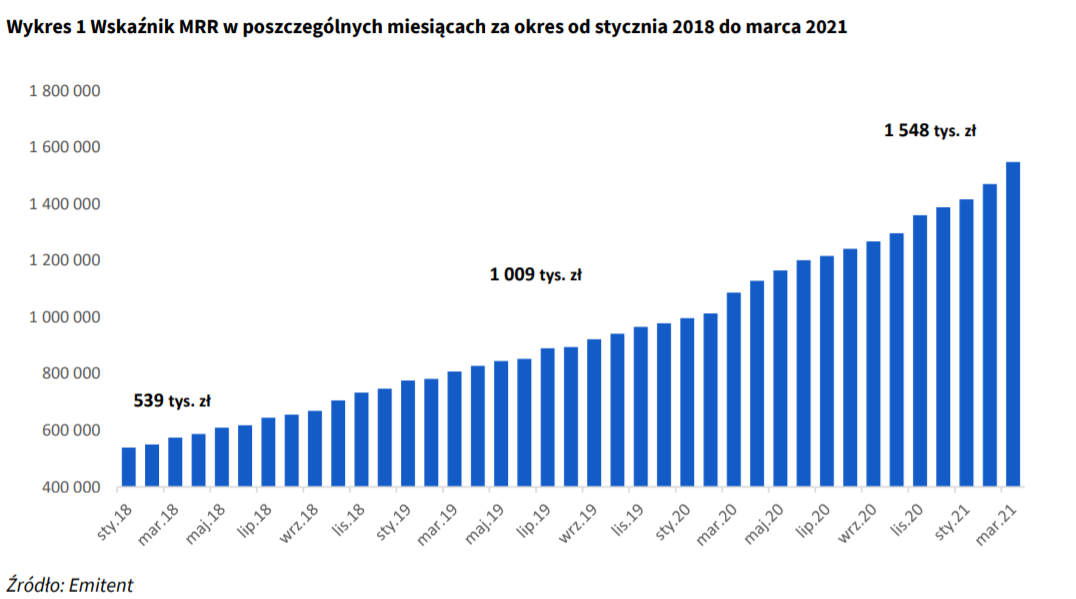

MRR

MRR is otherwise the Monthly Recurring Revenue. It determines the level of the expected monthly recurring revenues of the company. So this is the expected revenue from subscription services. As you can see, March 2020 brought a visible "leap" of the Ministry of Regional Development. As you can see, the increase was linear in the following months. Unless retention deteriorates significantly, the MRR should be expected to increase as the number of customers increases.

Financial results

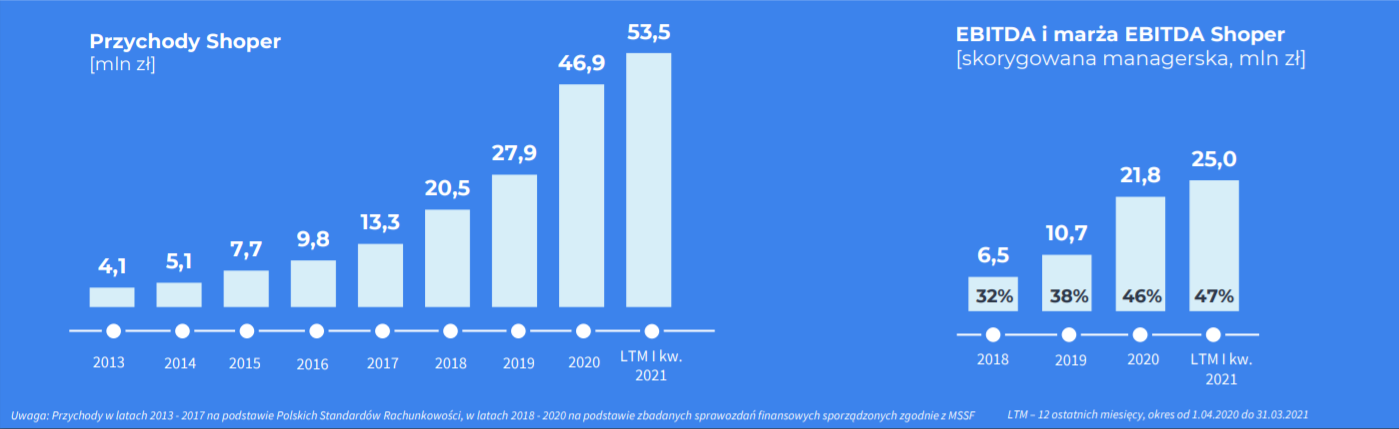

The growing scale of operations led to a significant increase in revenues, which exceeded PLN 45 million in 2020. At the same time, the company has a high margin, which can be seen in the operating and net margins.

It is worth noting that the characteristics of the company's operations mean that the conversion of EBITDA to cash flows from operating activities is very high and amounted to approximately 2020% in 97. The "lightness" of the business model means that Shoper does not have to invest significant capital in working capital (receivables are collected very quickly, no stocks). Interestingly, the company did not spend all the generated cash on scaling the business, but partially on paying dividends to shareholders (PLN 12 million).

| shoper | 2018 | 2019 | 2020 |

| revenues | PLN 20,51 million | PLN 27,86 million | PLN 46,95 million |

| Operational profit | PLN 4,29 million | PLN 5,45 million | PLN 16,66 million |

| Net profit | PLN 2,99 million | PLN 3,92 million | PLN 12,49 million |

| OCF * | PLN 6,16 million | PLN 7,64 million | PLN 19,17 million |

| CAPEX ** | PLN 0,93 million | PLN 0,88 million | PLN 1,37 million |

| FCF *** | PLN 5,23 million | PLN 6,76 million | PLN 17,80 million |

source: own study; * operating cash flows; ** investment expenditure (intangible and tangible assets); *** free operating flows

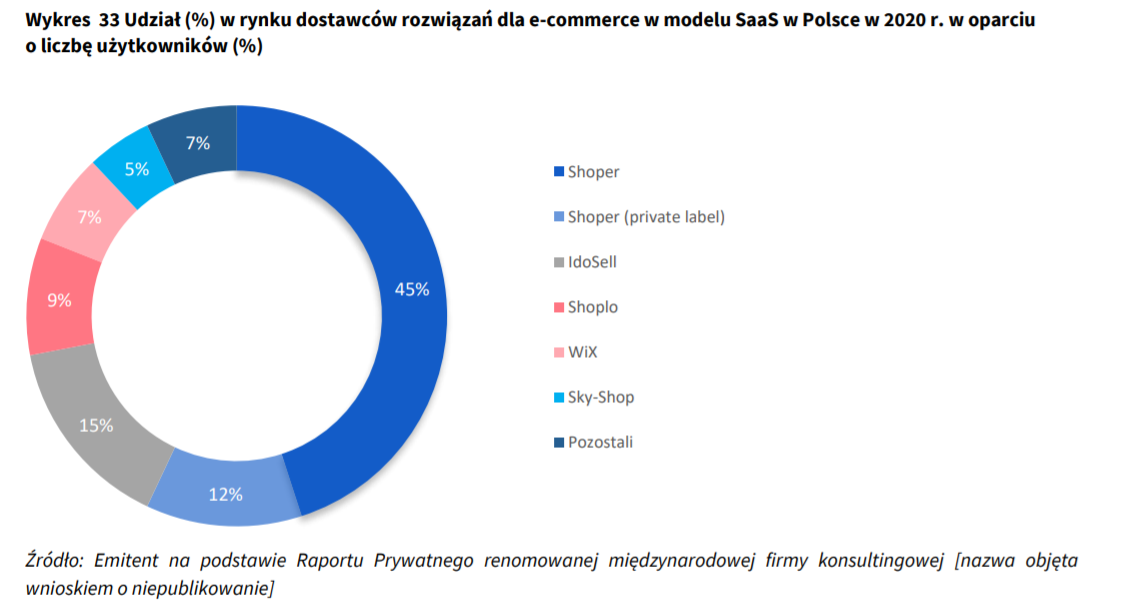

Competition

Due to the dynamic growth of the market, there is a very high demand for software for online stores. So it's no surprise that the competition in the market is crazy. There are both companies with a background in the form of financial investors (eg IdoSell, which is supported by MCI), and foreign players with a much larger scale of operations (Wix). Despite this, Shoper managed to become a leading software provider in terms of the number of users. Interestingly, despite the dynamic growth, the company is still profitable. This is a strategy opposite, for example, to the American Shopify, which prefers to build a scale first and then show the profits.

It is worth mentioning that the company IAI (IdoSell) was listed on the stock exchange a few years ago and was "pulled" through the MCI tender offer.

Where to buy Shoper shares

Shoper will debut on the stock exchange in July 2021. Below is a list of selected offers Forex brokers offering an extensive stock offer, including for companies from the Warsaw Stock Exchange.

| Broker |  |

|

|

| End | Poland | Denmark | Poland |

| Shares on offer | approx. 3500 - shares approx. 2000 - CFDs on stocks 16 exchanges |

19 - shares 8 - CFDs on stocks 37 exchanges |

approx. 1 - stocks + CFDs on stocks 5 exchanges |

| Min. Deposit | PLN 0 (recommended min. PLN 2000 or USD 500, EUR) |

0 PLN / 0 EUR / 0 USD | PLN 0 |

| Platform | xStation | SaxoTrader Pro Saxo Trader Go |

MetaTrader 5 |

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. From 72% to 89% of retail investor accounts record monetary losses as a result of trading CFDs. Think about whether you understand how CFDs work and whether you can afford the high risk of losing your money.

Summation

Shoper is certainly an interesting company that will soon debut on the Warsaw Stock Exchange. It operates in a similar business model to the American one Shopify (much smaller scale, of course). Shoper is one of the largest software suppliers on the Polish market. It is worth noting that additional services, such as Shoper Payments, are developing very quickly. Thanks to this, the company can benefit from the development of the e-commerce market. It's worth noting that Shoper's take rate (revenue / GMV) is 1,2%, which is only half of Shopify's take rate. Along with the increase in market saturation with e-commerce services, an increase in the take rate is also possible.

An investor deciding to buy Shipper's shares should be aware that for a few more years Series D shareholders will receive 5000 times the dividend of "ordinary shareholders". Payment of dividends by a company operating in such a young market is not always a good solution. This is due to the fact that the generated cash is paid to shareholders instead of acquiring customers and increasing the moat. This slows down the company's growth. The company's IPO will not generate cash for the company. This is due to the fact that the offer includes only existing shares (main shareholders reduce their share in the company). The company forecasts over PLN 77,6 million of revenues in 2021, which, with a valuation of PLN 1,3 billion, gives a multiplier to future revenues of approximately 16,75. It is worth bearing in mind that the current valuation already partially realizes the positive scenario. The pace of growth of the business scale is of key importance. If the company manages to accelerate its growth rate, it can be expected that the company's value will increase. If growth slows down, the likelihood of a positive scenario materializing will decrease significantly.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Shoper's debut - Polish Shopify goes public [Guide] stock shoper debut](https://forexclub.pl/wp-content/uploads/2021/06/debiut-shoper-akcje.jpg?v=1624605850)

![Shoper's debut - Polish Shopify goes public [Guide] cryptocurrencies dukascopy metatrader 4](https://forexclub.pl/wp-content/uploads/2021/06/kryptowaluty-dukascopy-metatraderr-4-102x65.jpg?v=1624602073)

![Shoper's debut - Polish Shopify goes public [Guide] beige book fed beige book](https://forexclub.pl/wp-content/uploads/2021/06/bezowa-ksiega-fed-beige-book-102x65.jpg?v=1624534836)