Why is saving as important as investing?

Why is saving as important as investing? If our goal is to build financial independence, then we need three components:

- savings,

- investments,

- time.

Most investors focus on the middle point, which is investments. As a result, many people striving for financial independence focus on finding an investment strategy that will generate a high average annual rate of return. However, for most investors, the first and third bullets are the most important. It is savings that are one of the main sources of providing the resources needed to carry out investments. Without generating savings, there is no chance of building adequate capital that will ensure financial independence in the future. Movement is an interesting solution FIRE (Financial Independence Retirement Early) that encourages large savings to quickly build net wealth that will allow you to achieve financial freedom.

Saving is difficult. Many habits make it difficult to generate significant financial surpluses. This article introduces you to a topic that will be developed in the coming months. In today's text, the reader will learn about:

- Why people don't like saving;

- Why people don't like to invest;

- How important is the savings rate when building an estate.

Why don't people like saving?

People don't like saving. This is due in part to the history of the evolution of our species as well as cultural circumstances. Most people don't like deferred gratification. For this reason, saving for retirement seems pointless because "I can die earlier". People don't like waiting to save money to buy a new smartphone or TV. Instead, they prefer to use credit cards or a consumer loan. Gaps in financial education prevent people from seeing the long-term effects of this behavior. Consumer loans have a destructive effect on net worth. Consumers are most often guided by the heart, not the mind. Unfortunately, saving is not fashionable. There are a number of factors that discourage people from managing their budgets wisely. These include:

- Deficiencies in financial education,

- Bad influence of social media,

- Cost of living inflation,

- Focus on the short term,

- Aversion to the capital market.

Low level of financial education

Most people are unaware of many aspects of financial management. For this reason, there are "outrageous" articles that the holder of a 30-year mortgage has to pay a multiple of the borrowed funds in the form of interest. This is a simple example of not knowing how the interest rate on a loan works. In extreme cases, problems with managing your home budget cause you to fall into debt loops. This is a situation when the household incurs further obligations to repay the previous ones. Due to the fact that the loans bear interest, the nominal debt is constantly growing. Along with them, interest costs, which eat up more and more of the household budget. In such a situation, it is necessary to use the consolidation of liabilities, which will lower the installment at the expense of a longer repayment time. Another way out of this situation is to simultaneously increase income (additional work) and reduce part of the expenses.

Another problem is performance compound interest. Ignorance of it is one of the reasons why people prefer to spend today than in a dozen years. Most people use a simple percentage when assessing an investment and do not see the delayed saving effect. People are often too lazy to enter a few formulas into Excel and see for themselves how important savings are. In addition, the lack of knowledge of how small a change in the obtained rate of return has an impact on the achieved final rate of return on investment. Let us take an example. If the investor invests PLN 10 for 000 years and achieves an average annual rate of return of 20%, then in 9 years he will have PLN 20. If the rate of return was 56%, then after 044,11 years the property would amount to PLN 12.

Social media builds bad habits

Currently, social media platforms have a very large impact on the spending of younger generation households. These are real temples of consumerism. As a result, people spend a significant amount of cash on trips to exotic countries or on the purchase of "fashionable" furniture, clothes or visiting popular restaurants. There is nothing wrong with the spending itself, the problem is that some people cannot afford it.

Instagram or TikTok it is meant to arouse emotions, and living below your earning potential is boring. Instagram photos taken from Bali or the Maldives look much better than those from cheaper Spain or Greece. Secondly, on social media, people who manage their budget wisely do not get too much publicity because they are "boring". Since the younger generation is "bombarded" with encouraging consumerism, very rarely will they choose the path of building up financial surpluses.

Cost of living inflation

An interesting phenomenon is the so-called cost of living inflation. This is due to the fact that as people increase their income, they adjust their spending to the new budget level. As a result, they exchange cars for more expensive ones, paying higher installments for the car. They change to a bigger apartment or start to spend more on travel or going to more expensive restaurants. As a result, despite the increase in revenues, costs are growing at the same pace. For this reason, despite the increase in the potential to generate savings, their rate decreases or still remains zero! In the extreme case, an increase in income can result in a much faster increase in expenses due to aspirations to the "upper class". In such a situation, higher income increases creditworthiness, which allows you to consume more than your actual financial capacity.

Focus on the short term

No big company has become a market leader because of luck but the ability to achieve long-term goals. Unfortunately, many households do not have a time horizon longer than a month. It is not always the result of extreme poverty, but the inability to set long-term goals and achieve them. As a result, people save most often "rainy day" or "for a wedding" or "car". For most people, the goal of building a lot of net wealth with financial independence will never arise. Financial independence requires patience and the ability to live below your earning potential. Patience refers to the fact that an ordinary household does not generate enough financial surpluses to quickly achieve the goal of financial independence. As a result, such a household must patiently deny itself pleasure in order to build up a financial surplus. It is especially frustrating when people compare themselves to people who are unconcerned about the future and live beyond their means.

Aversion to the capital market

It seems that the knowledge of financial instruments and building savings is not related. Seemingly it's true, but part of it people are not motivated to save because they cannot see readily available instruments ensuring a satisfactory rate of return. There are then objections as to the sense of investing. These include:

- The stock market is a casino - I do not know if I will make money on it,

- It is not profitable to save small amounts - they will not provide a large profit,

- Investing overseas is difficult - fear of legal costs and exchange rate risk.

These are the reasons resulting from the lack of financial education and looking for easy excuses. The stock exchange is not a casino if approached wisely. You don't need to know everything about all listed companies. Enough acquisition of ETFs giving exposure to the global stock market. Thanks to it, the investor has exposure to most important capital markets. Another advantage of acquiring ETFs is the simplicity of such a solution. A trader buys a diversified ETF each month and benefits from a cheap investment product. Of course, such a solution requires patience during periods of bear market and market panic.

Even the farthest journey begins with the first step. For this reason, the path to financial independence starts with small amounts. However, from the perspective of 20 or 30 years, every PLN 1000 of additional savings has a large impact on the level of net worth. 1000 zlotys per year is just 83,33 zlotys of additional savings per month. In the beginning, the profit from small amounts is not stunning, but it takes time to build significant wealth.

Investing abroad nowadays is not too difficult. All you need is a brokerage account with access to the foreign market. Many brokerage houses provide shipping PIT8-Cwhich facilitates tax settlements with the tax office.

Savings rate and the rate of return on capital

When building assets, you need a steady flow of financial surpluses, which will allow you to use market discounts to buy assets below their intrinsic value. The easiest way to make a financial surplus is to spend less than you earn. At the very beginning, building financial independence involves paying off loans and borrowings with high interest rates, which is the best type of risk-free investment. Another goal is to build a safety fund that ranges from 3-6 monthly expenses. Only after building the safety cushion is it possible to build your own investment portfolio.

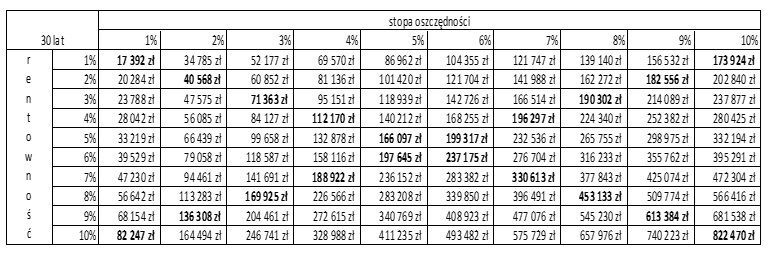

Many readers may object that a low savings rate does not have such a significant impact as achieving a higher rate of return on existing capital. In order to resolve this dispute, we will calculate various scenarios depending on the savings rate and the rate of return on capital.

Below you can see the effect of such a calculation. It was assumed that the investor achieves a net income of PLN 50 during the year (after deduction of taxes and contributions). The columns show the savings rates (from 000% to 1%), and the lines show the profitability rates (from 10% to 1%). Savings are assumed to be invested in arrears. This means that at the end of the first year, the investor had from PLN 10 to PLN 500 of savings, which were invested at a specific rate (from 5000% to 1%) for a period of 10 years. The following year, another batch of savings was invested for a period of 29 years. As you can see, if the investor saved 28% of his net income and invested at 10%, after 1 years he had a net worth of around 30. zlotys. On the other hand, if the investor saved only 174% of his annual income (PLN 1) and achieved a 500% return on invested capital, the assets amounted to PLN 10 thousand. zlotys. This means that the higher savings rate allowed to generate almost twice as much wealth while generating a low rate of return.

Summation

Of course, there will be investors who will be able to achieve a very high rate of return on their own. However, most will be lucky if they achieve a rate of return similar to that of the broad market. For this reason, the most important thing is to focus on generating savings that will provide the foundation for building financial independence.

However, to achieve a high savings rate, you need to change your financial habits. In generating financial surpluses, it is helpful to build your own household budget and manage it efficiently. However, the most important thing is patience and consistency. As a result, it will be easier to reject consumerism, which will allow you to increase the savings rate and enjoy the growing net wealth. Then you will achieve financial independence faster, which will translate into a better quality of life. If the household has sufficient net wealth, it will be possible to quickly quit the job you dislike or live in your dream place in the world.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)