The good (central banks), the bad (inflation) and the ugly (limiting asset purchases)

The recent drop in profitability is diverting attention from the long-term factors influencing the level of interest rates: inflation and asset purchase constraints, which will undoubtedly lead to higher profitability on both sides of the Atlantic.

At such moments, you should focus on the economic megatrend and catch less obvious signals. One of such signals was the recent disastrous auction of German XNUMX-year government bonds. German financial agency (Finanzagentur GmbH) had to retain part of the EUR 2,5 billion sales target, placing bonds of just EUR 1,73 billion due to exceptionally weak demand. Demand to supply ratio (bid-to-cover) was 1,06x, which is the lowest value ever recorded for securities with this maturity, even though the bonds offered positive yields while most German bonds continue to return negative.

About the Author

Althea Spinozzi, Marketing Manager, Saxo Bank. She joined the group Saxo Bank in 2017. Althea conducts research on fixed income instruments and works directly with clients to help them select and trade bonds. Due to his expertise in leveraged debt, he focuses particularly on high yield and corporate bonds with an attractive risk-to-return ratio.

Althea Spinozzi, Marketing Manager, Saxo Bank. She joined the group Saxo Bank in 2017. Althea conducts research on fixed income instruments and works directly with clients to help them select and trade bonds. Due to his expertise in leveraged debt, he focuses particularly on high yield and corporate bonds with an attractive risk-to-return ratio.

The weirdest thing about this story is that the market completely ignored this auction. The yields of European government bonds, including German bonds, fell at the close.

This situation is highly worrying. Is anyone outside the European Central Bank buying German Treasury bonds? This is a pivotal question with regard to German bondsas well as those whose profitability is dangerously close to 0%, incl. French, Spanish and Portuguese. In fact, it can be assumed that the demand for European sovereign bonds will start to decline sharply before the start of reducing asset purchases by EBC. In this case, it can be expected that after the elimination of the main source of support, the reassessment will be dramatic.

European government bonds are closely correlated with their US counterparts. Therefore, as long as US yields are within a narrow range, European bond yields will also remain limited. We predict that both markets will continue to follow the same path until the German elections. The new German government will most likely lead to the necessary changes in the European bond market - higher yields and smaller spreads in the area of government bonds.

Until fall, however, it is important to determine whether or not US Treasury bonds will remain at their current levels. If so, the yields on German 0-year treasury bonds may not exceed XNUMX% by the time of the elections. On the other hand, if the yields of US securities reach 2% by September, there is a chance that the yields of German government bonds will turn positive before the elections.

US yields send conflicting signals. Wednesday's bidding metric for the sale of $ 61 billion five-year treasury papers was exceptionally solid. Indicator bid-to-cover was the highest since September, and the demand from foreign investors - the highest since August.

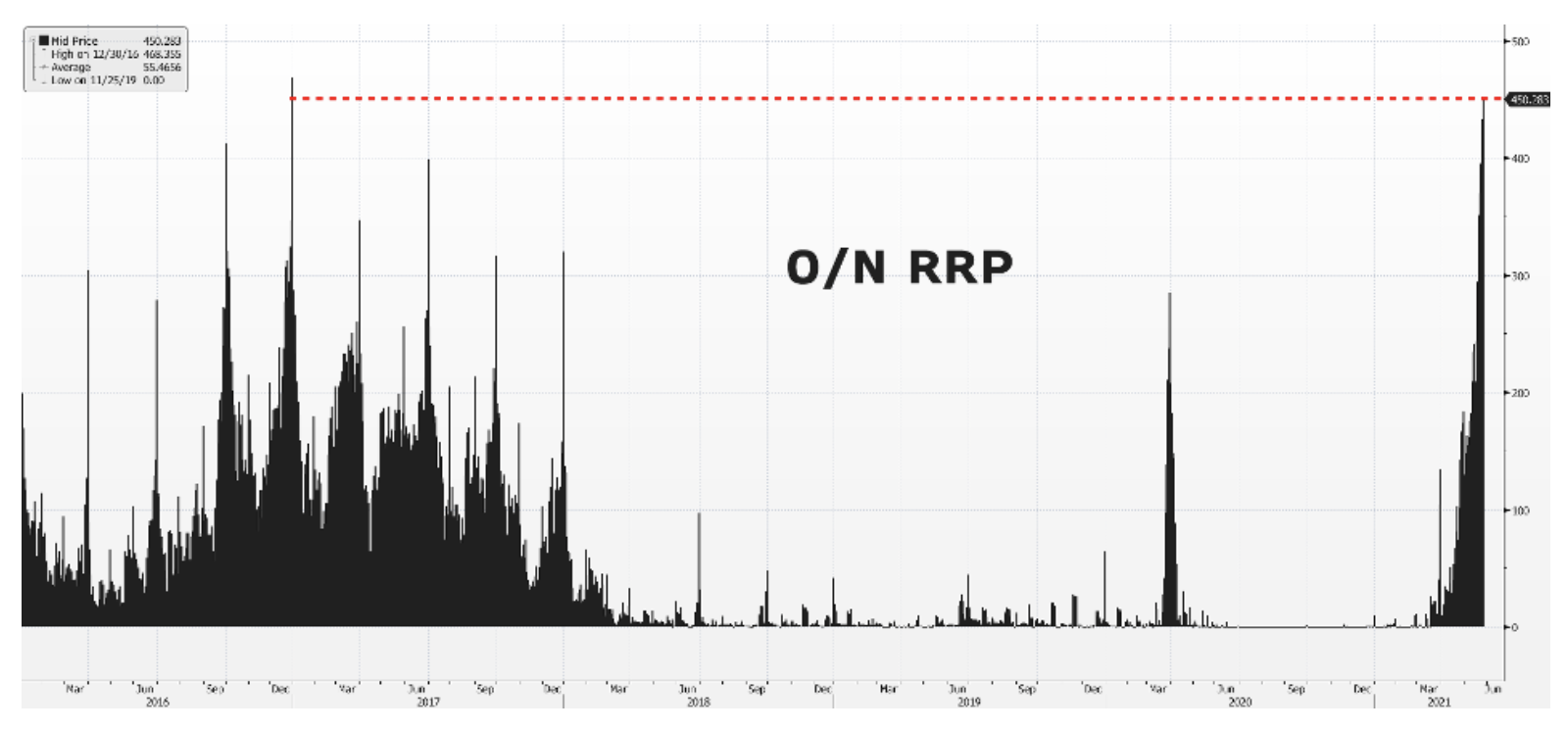

The rise in demand for US Treasury bonds can be explained by a liquidity tsunami that the money market alone cannot contain. Conditional sale transaction volume (reverse repos) Fed is constantly growing, and some of this liquidity may begin to penetrate the market for securities with longer maturities. This suggests the possibility that this could be a Fed strategy to keep the US yield curve under control as the economy starts to recover. However, we doubt whether such a strategy would prove effective should inflationary pressures continue to rise.

Why are US Treasury bonds in a tight range?

US Treasury yields remain in a narrow range between 1,50% and 1,70% as macroeconomic data are increasingly mixed. While bottlenecks and the opening-up of the economy are clearly exacerbating inflationary pressures, the lack of labor and a slowdown in consumer confidence growth have the potential to hinder economic recovery. Such a scenario would deflect expectations that the Federal Reserve will start reducing asset purchases earlier than expected, keeping yields within a narrow range.

What could be a catalyst for US yields to break above or below this range?

# 1. Inflation

In our view, US 1,75-year government bond yields are more likely to break above 2% and rise above 65% as inflationary pressures increase, rather than going down. According to preliminary data from the University of Michigan, 3% of respondents expect inflation to rise above 55% next year. Expectations for the next five years are still high - 3% of respondents believe that inflation will be well above XNUMX%. The bond market is more priced-in inflation expectations, than hard data on inflation. Today's PCE data and the final data from the University of Michigan study may therefore be crucial for profitability growth above the break-even point.

# 2. Limiting asset purchases

Concerns about limiting asset purchases will increase the yields on US Treasury bonds, and thus inhibit the rise in inflation expectations. We could see this last week, when yields above the break-even point dropped from the multi-year highs after the publication of the minutes of the FOMC meeting, indicating the readiness of the Committee members to raise the issue of limiting asset purchases at the next meetings. Restricting asset purchases is essentially a form of tightening financial conditions by the Federal Reserve by reducing the amount of financial injection to the market. In a recent study, Credit Suisse's money-market guru, Zoltan Pozsar, stressed that should the Federal Reserve announce a restriction on asset purchases while lifting the Wells Fargo ban on asset enhancement, the system would benefit from additional demand for U.S. Treasury bonds. While this is a valid argument, it largely depends on if inflation rises. According to preliminary data from the University of Michigan, 43% of respondents expect inflation to rise above 5% next year. In such a situation, limiting the purchase of assets could not stop inflation quite effectively, and the central bank could be forced to raise interest rates.

Any considerations about limiting asset purchases in Europe are pointless, unless they are first carried out in the United States. In fact, the economy on the Old Continent is lagging behind the American boom. Therefore, any mention of the ECB on a possible limitation of asset purchases would be premature before the Fed raises this issue. This does not mean that European government bonds will not react to talks on limiting asset purchases. Exactly that limiting asset purchases, not inflation will be a factor in shaping the bond markets on both sides of the Atlantic, as it evokes echoes of the infamous "hysterical limiting"From 2013.

# 3. Internal factor

There are many internal factors that may affect the decline in profitability. Although it is difficult for us to predict such a scenario, it is important to emphasize that in the event of a decline in the yield of ten-year government bonds below 1,5%, the next support will be at the level of 1,2%. One such internal factor could be a massive sell-off in the stock market, which would drive investors to safer assets, and a mild Fed response in lowering yields.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-300x200.jpg?v=1709556924)