Additional time intervals in MetaTrader 5. Do they really help?

One of the elements that distinguishes the MetaTrader 5 (MT5) trading platform from the previous version (MT4) is the availability of additional time intervals. Standard and commonly used by traders in MT4 and not only are: M1, M5, M15, M30 and higher H1, H4, D1, W1, MN. The time interval or a group of them will be largely adapted to the given investment strategy. The M1 and M5 compartments are mainly used for scalping where, on the margin, we can also specify its two options. With low dynamics and range of movement, positions can be taken with a larger volume focused on profit taking by a small number of pips and vice versa - with greater volatility, it plays with a lower lot but taking profit from a much larger number of pips. When switching to a higher time frame, traders aim to take positions in line with the trend, be it short, medium or especially long term, and that's how positions are closed.

Be sure to read: MetaTrader 4 vs MetaTrader 5 - Platform comparison

There are questions

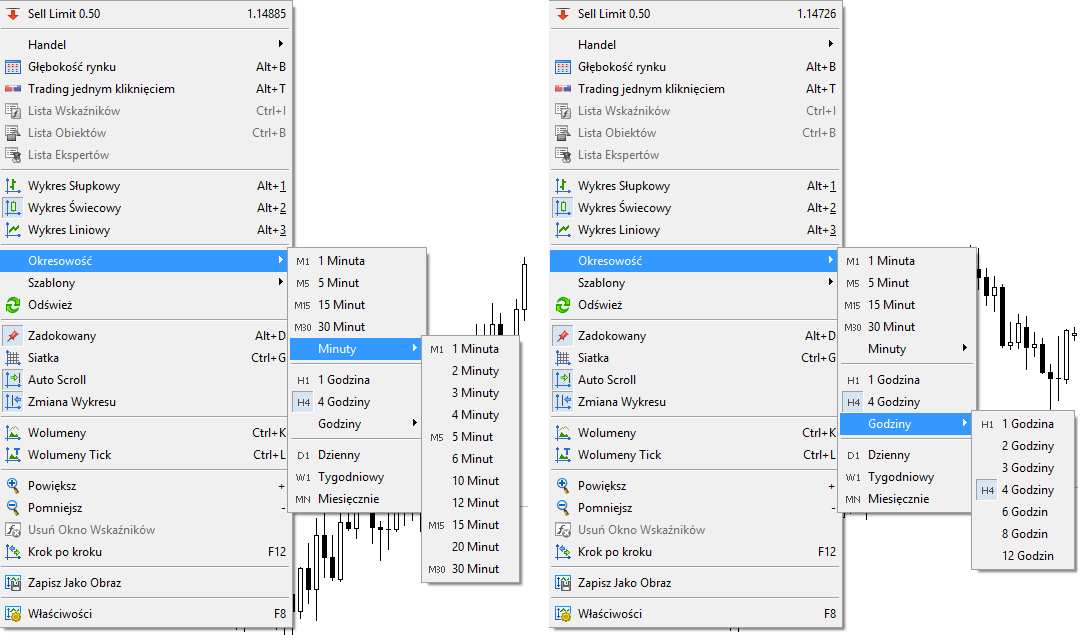

Since additional time intervals are available, questions are asked whether there is something in between, or will they serve as an additional preview? Will they help or introduce unnecessary confusion? After right clicking on the chart in MT5 we enter the periodicity tab and there we will find additional time intervals: M2, M3, M4, M6, M10, M12, M20 and H2, H3, H6, H8, H12. Today we will focus only on the M1, M3 and M5 compartments.

Selection and ordering

To get the exact answers to the above questions, you need to trace the operation of new intervals while combining them with the standard ones and complete it with technical analysis and indicators. At the beginning we will start with low intervals and in this case it will be best discuss it's on the example of scalping. We will use the following statement:

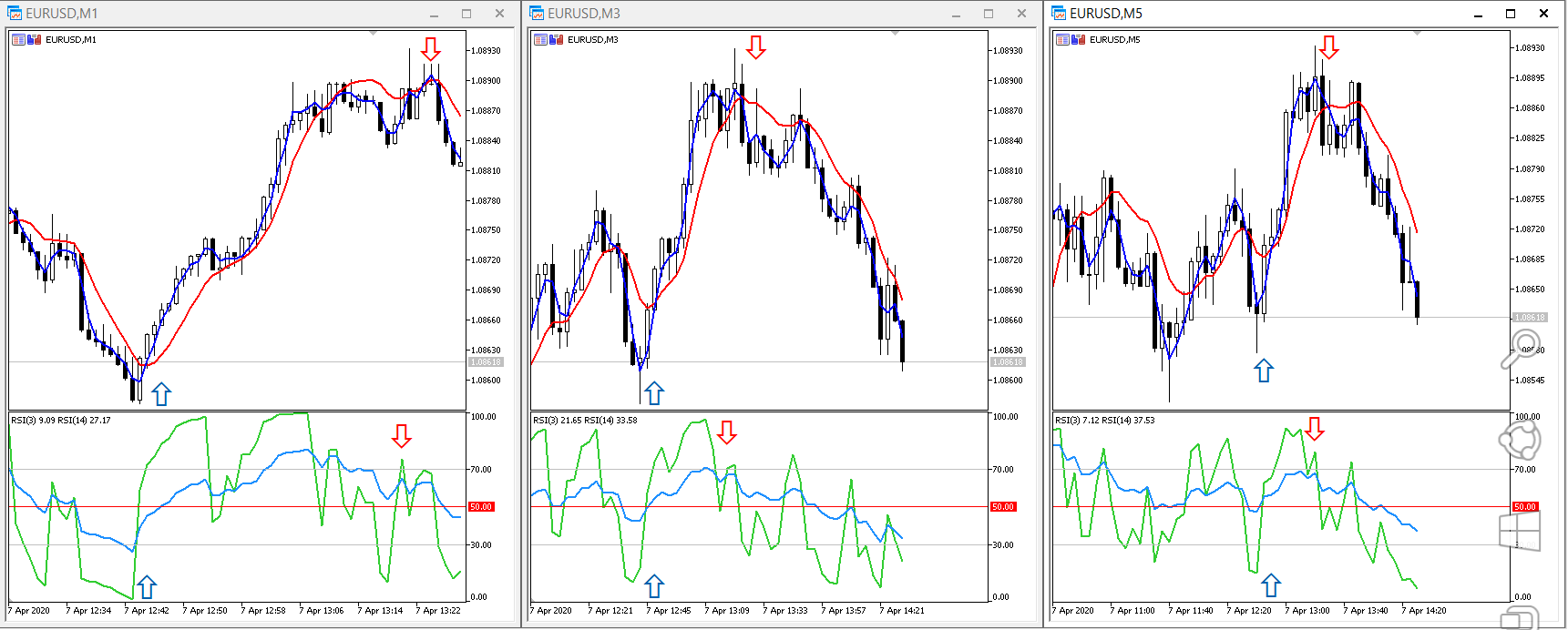

M1 respectively M3 and M5 - in this case the M3 interval will be this additional signal connecting M1 with M5. The indicators we will use are RSI and Double Moving Average, i.e. double exponential moving average, which is used to quickly identify price changes. Looking at the graph, we notice that the intersection of two lines means a change of direction. The parameters Period 3 for the blue line and 14 for the red were used here. Of course, you can set and test other or similar indicators, but now we mainly focus on whether additional intervals will be useful to us in this not very complicated connection. This does not mean that it will not be accurate.

Practical application on the chart

The solution discussed above can be easily seen on the chart. Arrows indicate good opportunities to open a position. Of course there are more of them but we can see that the M1 chart is compatible with M3. The window with M5 will show us, or rather give confidence that we will definitely conclude transactions in the right direction.

Additional channel lines almost perfectly intersect with designated places on the chart where positions should be taken. This is additional support, although it can also be an additional indicator or a group of them.

Summation

When considering the use of additional intervals such as M2 and M3, we must bear in mind that analyzing one of them will be more crucial for the image between M1 and M5. Setting them all in turn will introduce too much confusion and question marks, hence the decision to open the position will be troublesome. Not everyone uses the above setting, be it screens or even more so indicators, so maybe in another set additional intervals will be unnecessary, and in others it will be salutary. It should be approached with common sense and certainly a demo account should help us, where we will check the operation of additional time frames for the tools and analyzes we use.

We can also check how and if our trading will change based on the patent presented above. Today we based mainly on the scalpownia strategy, which, as you know, is not for everyone, but it's worth trying your hand at a demo account. Perhaps we have not had relevant guidelines and practices in this field so far. There is not always a clear trend on the market, but there are plenty of opportunities to conclude even a few transactions during the day and this is why you should spend some time on it. However, in this situation, we cannot indifferently go past new, higher time intervals and we will soon look for their advantages in the next analysis.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)