ECB versus Germany. What does the euro say?

German court judgment on politics EBC it was not a lofty and significant (from a macroeconomic point of view) event. For us, however, this is a clear signal about a certain internal scorch that has taken place between Germany and the European Union. Although this dispute did not attract too many investors in the form of investors, its importance, taking into account further assistance policy, is extremely important. As in light "Little conflict" will the euro look like? Is this a chance for strengthening or is it the beginning of a major depreciation against currencies from the region?

Excessive generosity?

Europe, which is slowly starting to recover from a pandemic, is currently facing a mass of new, "Pokoronawirusowych" challenges. The aid programs issued by the ECB and individual euro area countries were not economical. Certainly they can be called generous, although they hid a little in the shade in the light of those that the US offered the Federal Reserve. Money for these ventures did not come out of nowhere. Cheap cash and low interest rates were conducive not only to buying, but above all to debt issuance. A very large part of the developed countries that are building the EU economy were heavily indebted before the pandemic. Therefore, it is not difficult to guess that the current debt to GDP ratio is and will be much larger than before.

The ECB wanted joint bonds

One of the ideas of the European Central Bank, which de facto Germany did not agree to, was the issue of joint bonds. The court ruled that part of the ECB's activities did not comply with German law and that the Bundesbank would withdraw from joint financial operations within the next three months. Of course, policies that take account of the struggle between the ECB and the German government are unrealistic. Certainly the Central Bank of the Community will ensure that a common compromise is found. The court's verdict on the non-standard measures taken by the European Central Bank will certainly be used by opponents of collective and mass debt financing at European level.

A bit around

The ECB's workaround is certainly at least partially successful. The debt that Italy and Spain had incurred could not have been possible had it not been for the substitute for joint bonds. Transferring part of the cash to the BTP purchase program and accelerating it, about which we wrote in this articlebecame part of the response to opposition and reluctance to introduce joint bonds. How will the euro react to this? Looking at the current weakness against the dollar, it reflects extremely well this depreciation, appreciation against exotic currencies.

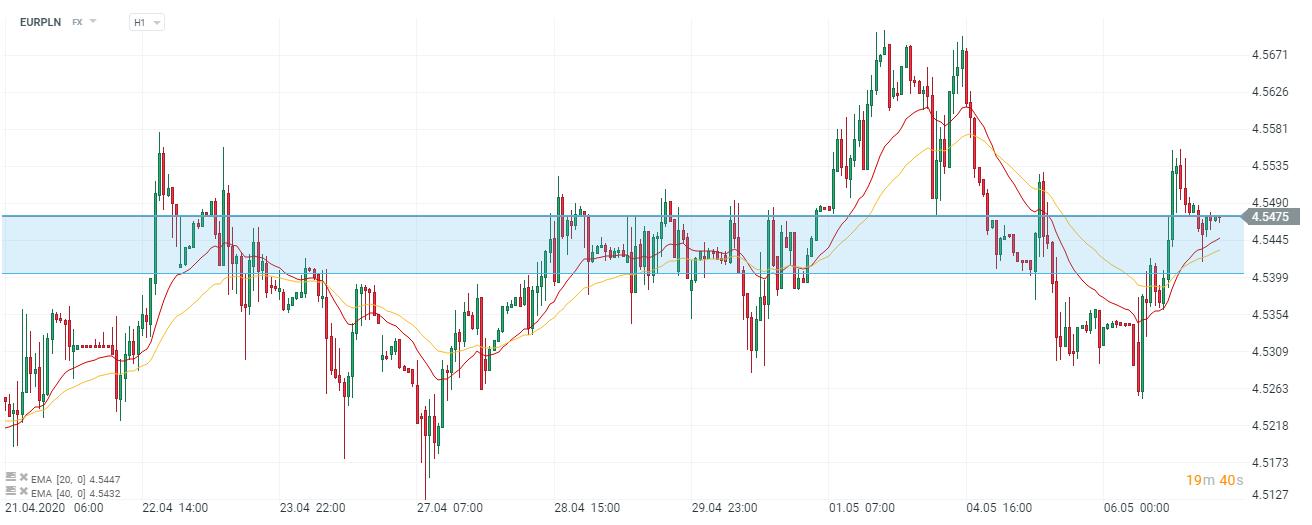

EUR / PLN chart, H1 interval. Source: xNUMX XTB xStation

Recently, the zloty has been quite reluctant to make room for some EUR / PLN. The rate only fluctuates within an ever narrower range. The good condition of the euro against the zloty also results from the weak economic situation in Poland. Yesterday WIG20 was the worst performing index on the Old Continent. We take into account that short-term fluctuations may result from "currency whims". Under this concept there is even a brief, technical testing of current demand zones. However, looking from a long-term perspective, this year's euro will probably be expensive for us.

Certainly, the demand for debt in the European currency will keep it at high levels. However, it is difficult to estimate how long EU countries will intend (and to what extent) to issue new liabilities. In fact, as long as there is a demand for it, EUR has a chance for further increases.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)