EUR / USD, bonds and macro data [Market comment]

EUR / USD exchange rate above 1,20 and the highest since March yield on 10-year US bonds are the two most important market topics now. The sentiment in all markets will depend on how the situation on these instruments continues. These decisions will depend on macro data and other figures in the starting week.

EUR / USD - fight for the level of 1,20

The starting week is not as rich in important macroeconomic publications and other events as the previous weeks. When analyzing the macro calendar, it promises to be calm. However, only theoretically. This peace is disturbed by the unsettled situation on the EUR / USD daily chart, where the battle for the USD 1,20 barrier is still going on. A key barrier, because it separates the growth scenario from the decline one. This is the equivalent of the level of 50 points. in the case of PMI indices.

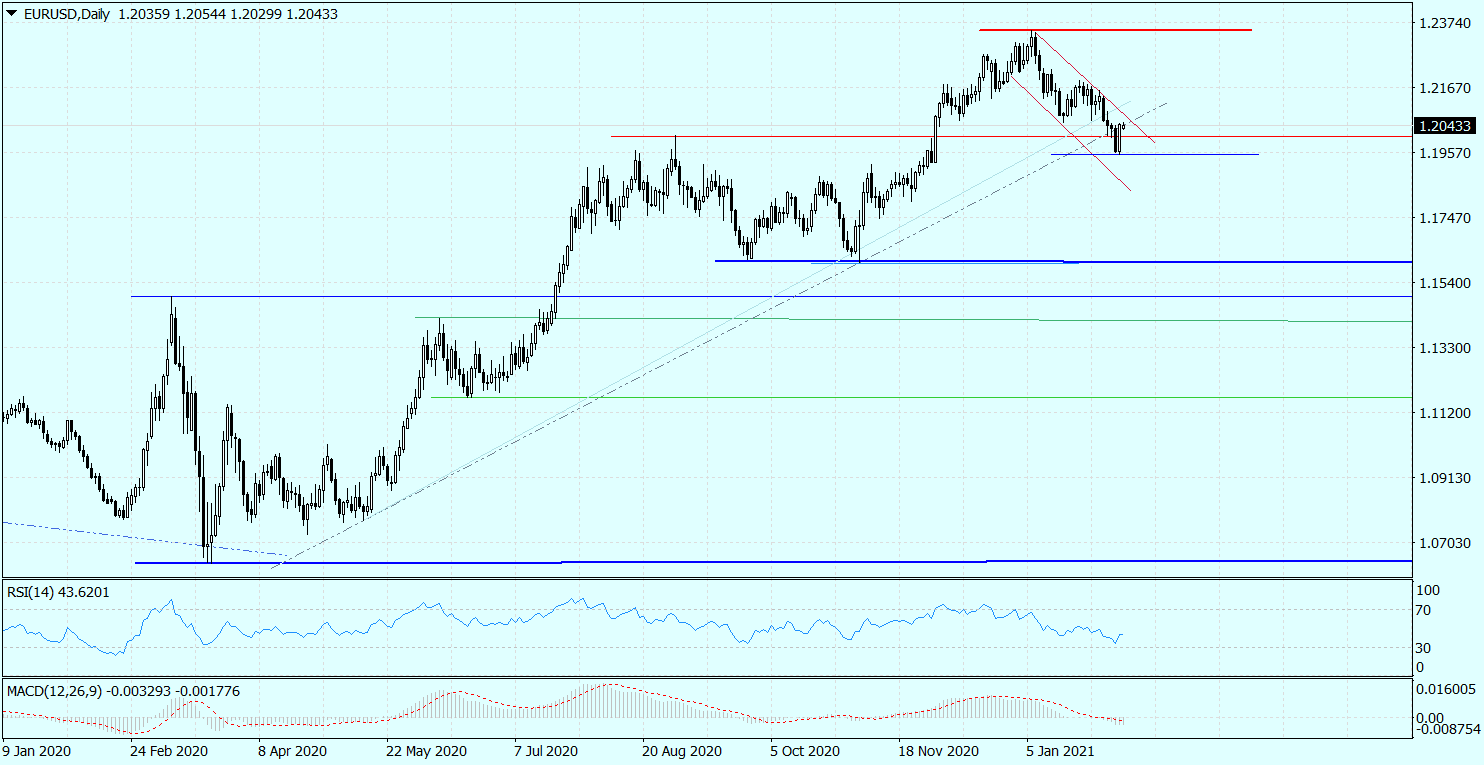

Daily chart EUR / USD. Source: Tickmill

On Thursday, the EUR / USD rate broke the 1,20 barrier, plotting a long black candle on the daily chart. There could be one interpretation of this state of affairs: the decreases observed since the beginning of January are not a correction in an uptrend, but a new downward impulse. Only that on Friday the situation turned 180 degrees. The rate returned above 1,20, marking an even bigger white candle on the chart. The demand side came back "from a very long journey" and is still in the game. And only that, because at the moment the chances of drops and increases are similar. Only when the euro breaks above 1,2080, and thus breaks up from the monthly downward channel, will buyers take the full initiative. Likewise, a drop below 1,20 will be a triumph for supply.

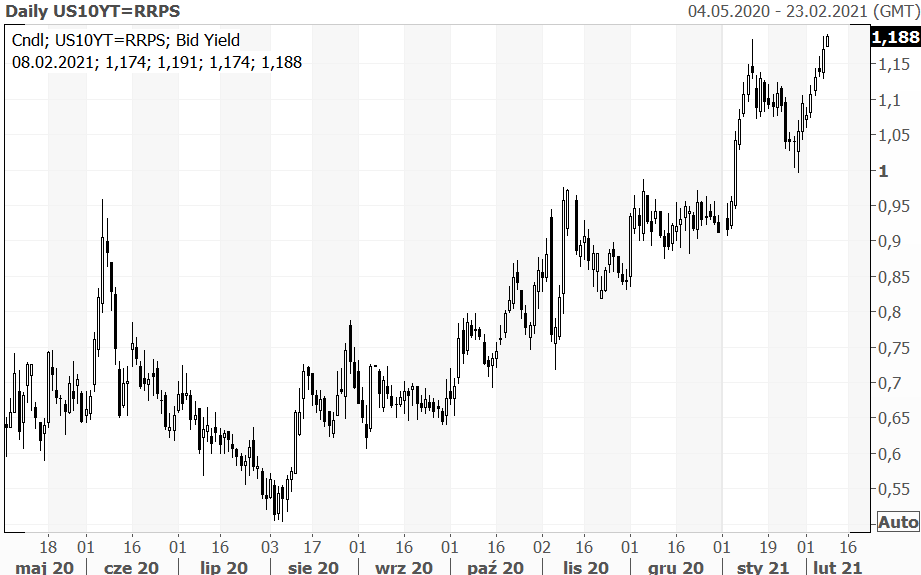

The fight for 1,20 on the EUR / USD looks even more interesting when we confront it with the situation on the US debt market. Today, 10-year bond yields increased to 1,188%. and were the highest since March 2020. This clearly shows that the markets are playing for the future economic rebound in the US, a higher-than-expected inflation path and faster normalization of monetary policy by the Fed. And these are favorable conditions for the strengthening of the dollar.

The direction of the changes in the EUR / USD and US debt charts may be determined by macro data and other market events released this week. Wednesday will be especially crucial here, when investors will first learn December's CPI inflation data from the US, and later they will find out what Fed boss Jerome Powell will have to say.

Other events that may affect the eurodollar and bonds, and indirectly almost all markets, are the ongoing negotiations in the US Congress on the fiscal package proposed by Biden, worth 1,9 trillion dollars, and the efforts around the Italian government created by Mario Draghi.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![EUR / USD, bonds and macro data [Market comment] eur / usd analysis February 2021](https://forexclub.pl/wp-content/uploads/2021/02/eurusd-analiza-luty-2021.jpg?v=1612772661)

![EUR / USD, bonds and macro data [Market comment] mexico economy](https://forexclub.pl/wp-content/uploads/2021/02/meksyk-gospodarka-102x65.jpg?v=1612769864)

![EUR / USD, bonds and macro data [Market comment] Forex Club - Tax 7.0](https://forexclub.pl/wp-content/uploads/2021/02/Forex-Club-Podatek-7-102x65.jpg)