Fed, Remdesivir and unemployed and exaggerated optimism in the markets

April for the broad market has certainly been one of the better months since the beginning of the year. What we have written many times, i.e. the slowdown of stock exchanges response to central bank activities, will take its toll later. "A little bit later" clearly began to show up in the fourth month of the year. However, are there really reasons for this? Market sentiment is optimistic, but at the same time alarming. Being up to date with the main macroeconomic data from several leading global economies, it is impossible to get the impression that the enthusiastic approach is inflated. It is a bit difficult (due to the multitude of factors) to clearly determine whether it is the result of actions FED or maybe a second wave of excitement caused by Remdesivir.

Remdesivir - China has a different opinion

About the effectiveness of Remdesivir appeared some brief information at the beginning of April. Of course, the drug was already known much earlier in the world. As a reminder, it is not a specific drug that is able to fight coronavirus entirely, but (as American doctors say) is able to significantly affect the course of the disease. Patients given it earlier this month had a much milder infection. Due to the fact that the research sample was small (about 50 people) and its age range not fully known, there was no great difficulty in refuting the theory on the effectiveness of the drug. China did it last week, thus causing a small panic on the market. It is worth adding that after the announcement of the information about Remdesivir, the stock exchanges reacted with great enthusiasm to these news. Therefore, it is not surprising that the reaction to poor Chinese comments has the opposite effect.

The current situation looks a little different. The United States set out to expand research into the effectiveness of Remdesivir. The involvement of the American Institute of Health in its work has brought the expected results. Researchers have shown that administering the Gilead drug (which was developed to fight Ebola) reduces mortality by as much as 30%. Of course, from a rational point of view, there are reasons to be happy, although it is still not a vaccine or any breakthrough. Of course, the emotion of the effectiveness of such support in the treatment of patients had their mark on the market. The question is, for how long?

The role of the Fed

We can already see perfectly well how much growth on the pace of economic growth has gathered several restrictions introduced in the United States. This problem does not apply only to the USA. Negative GDP forecasts are a real spectrum weighing on the vast majority of global economies.

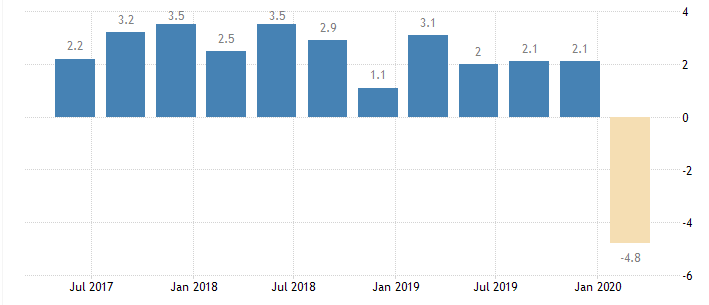

US GDP, source: TradingEconomics.com

In the current quarter, GDP fell almost 4,8%. Of course, you don't need more analytics to find out what factor affected such poor results. It should not be surprising that so willingly lifting at least part of the restrictions. The need to defrost the economy is a priority. A few weeks contributed to enormous economic losses. Could it be worse? Of course. FED's quick actions and huge sums of economic support that flowed from the Federal Reserve from the current point of view are almost salutary. Of course, the nature of these activities has largely focused on the psychological aspects of keeping investors in the market. The feeling of security that the FED has created by maintaining a large share of investment capital has certainly contributed to maintaining good liquidity on most assets.

The meeting brings nothing

The yesterday's meeting did not have to be spectacular. Good information about Remdesivir has again injected optimism on the stock exchanges. Powell could afford a bit of objective pessimism, which he underwent without much reaction from investors. He warned against a difficult period for the American and global economic situation, while pointing out that both the FED and global central banks must be ready to return. It is worth considering what financial steps the reserve can take and how far they go? According to the FED announcement, there is no fixed aid limit. Powell is prepared for further actions if the need arises. However, the meeting lacked specifics. Not discussing the next reduction or applying a negative interest rate solution.

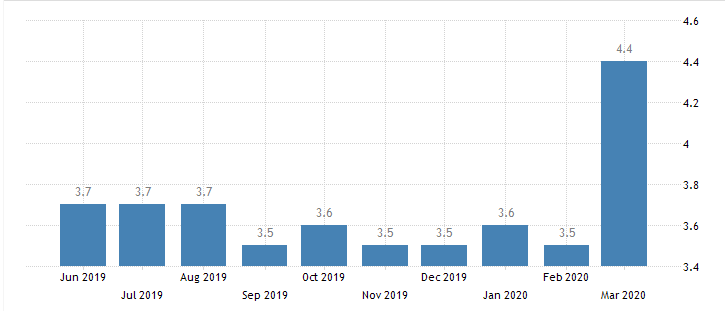

Unemployment rate in the USA, Source: TradingEconomics.com

We are no longer surprised by data from applications for benefits in the United States. The market has become accustomed to millions of readings, and the Fed has ceased to be optimistic about the employment market. The unemployment rate has necessarily increased. This indicator seems more "pleasant" than indications for benefits. The United States is counting on the situation to improve based on the gradual defrosting of service industries. Therefore, we get the impression that issues related to the labor market have been pushed into the background.

What will be the result of the above events? Considering the current, moderate (weekly) volatility, we should rather count not only on moods improvement, but also on successive increases in indices. For now, the dollar is under a big question mark. You cannot deny that it is at full strength, but they are not stable enough to not lead to its mass depreciation. The ECB's activities will be key to its currency listing on the Old Continent. Lowering interest rates by European Central Bank will introduce cheaper money to the market that will be readily absorbed by budget deficits. The increase in demand for the euro will have a positive impact on the USD.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)