Fed suspends rate hikes - macroeconomic analysis

American Federal Reserve at the July meeting, it raised interest rates by 25 bp, and President Powell refrained from making an initial commitment to further increases, making them dependent on the incoming data. Markets may view this decision as a potential end to the Fed's tightening cycle, unless labor market conditions deteriorate. With the decline in bond yields, there is an opportunity to catch up with stock market valuations. Energy industry, real estate investment funds (REIT) and renewable energy sources may be interesting for investors, but in QXNUMX there may be a risk of reflation i recession.

No surprises from the side FOMC. Interest rates were raised by 25 basis points to the level of 5,25-5,50%, and the accompanying statement was not much different from that of June. Although Chairman Powell of the Fed did not exclude the possibility of a September rate hike, the July meeting emphasized the dependence of future decisions on the incoming data. Before the next Fed meeting scheduled for September 19-20, two reports on CPI inflation and two reports on employment in the non-farm sector will be published.

What can the data suggest?

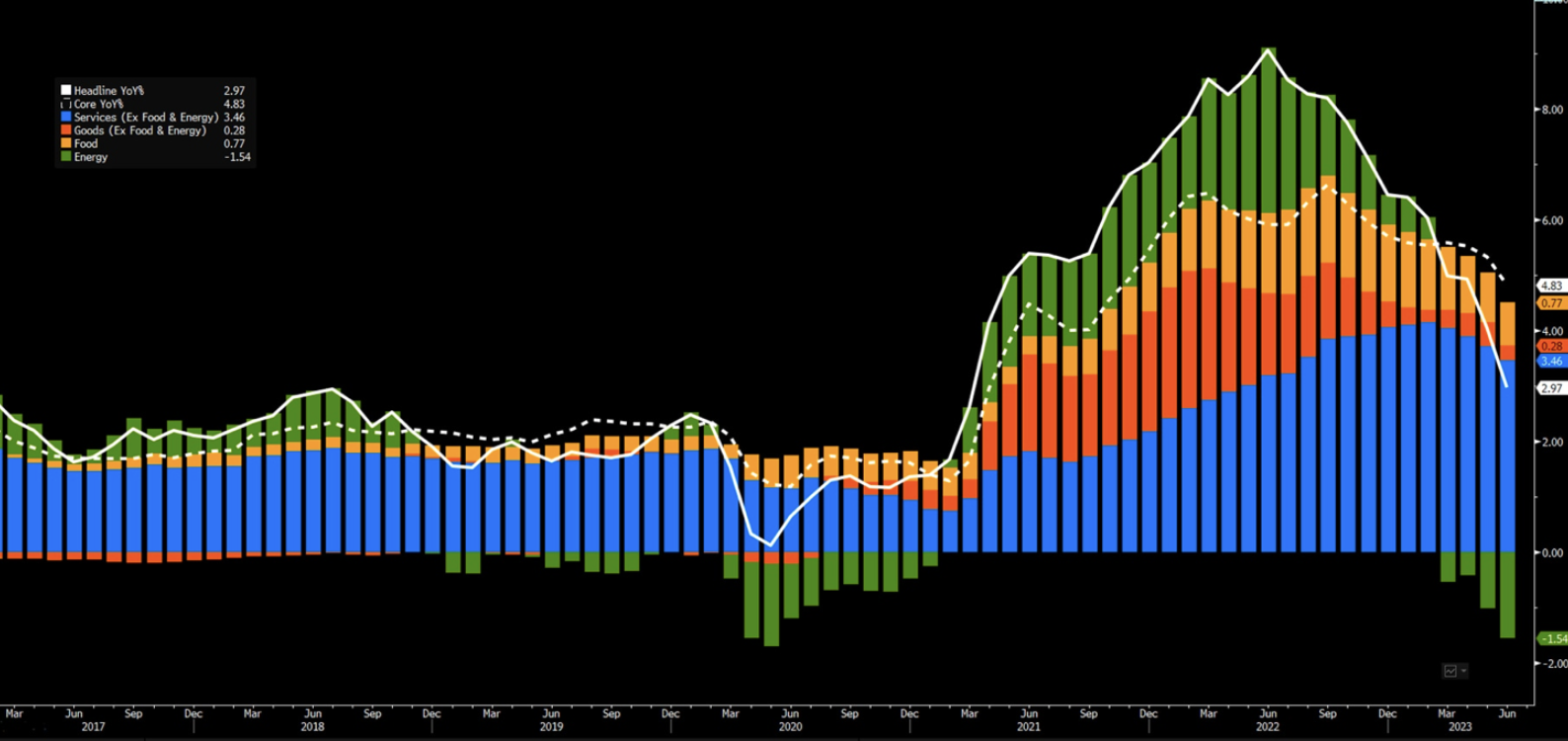

At this point, the market is expected to disinflate. There is reason to believe that this may change as base effects weaken in the second half of the year, but the Fed will potentially take this into account.

With regard to the labor market, the current easing is not a sufficient argument for the need to cut rates, but from now on tracking unemployment data will be much more important in the context of determining the timing of the cycle reversal. Powell noted that the effects of policy tightening are not yet fully felt. While he still does not expect inflation to return to 2% before 2025, he mentioned that in the event of a credible decline in inflation, the Fed could bring rates to neutral and then - at some point - below this level, although he rejected the possibility of any rate cuts at this point year.

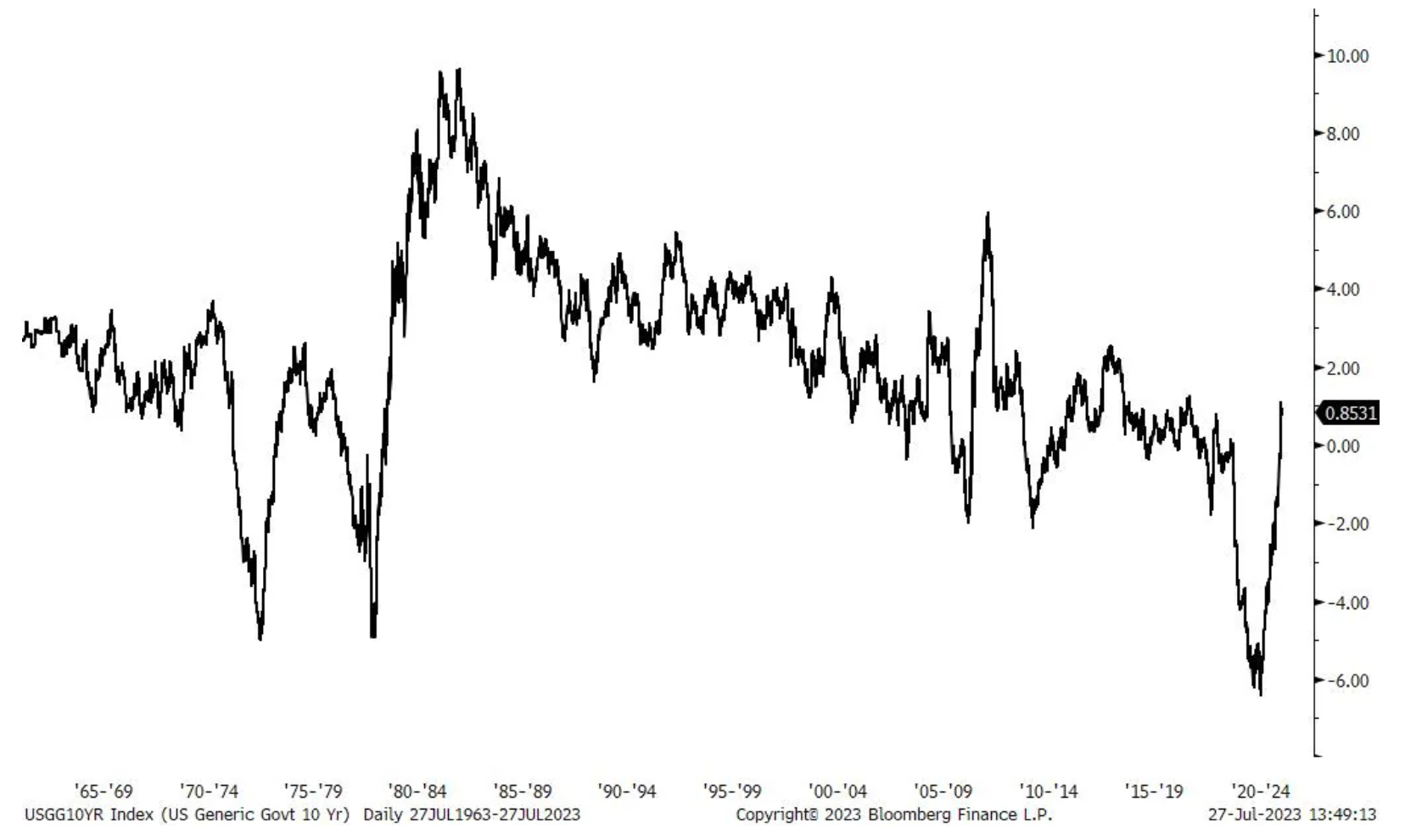

In general, disinflation may not lead to further rate hikes, and labor market data may not justify a cut, suggesting that we may be dealing with higher interest rates for a longer period of time or with a longer pause in decision-making.

What could this mean for investors?

Unless the economic data deteriorates, there may be reasons why the stock market will continue its repeated gains on the wave of expansion that was the main cause of the rally in the first half of the year. With the decline in bond yields, there will be an opportunity to catch up in valuations. This points to stock rotation after seven or eight top-performing stocks accounted for most of the gains in the first half.

Stock sector rotation has been gaining momentum over the last few weeks, with the DJIA (+3,2%) and Russell 2000 (+4,85%) so far this month outstripping the gains S&P500 (+2,6%) and NASDAQ 100 (+2,1%). While Big Tech returns are mostly in line with expectations, investors are looking to cheaper stock sectors to capitalize on the current bull market. In this context, it comes to the fore energy sector, the lowest-priced sector in the S&P 500 Index, gaining traction with the US downgrading economic risk rating, China stimulus announcements and supply risks. In addition, energy companies are increasing their investments again after years of underinvestment.

A longer break in rate decisions could also give the housing sector a boost as it effectively reduces mortgage rates. In a situation where economic conditions are good, but central banks do not increase interest rates, real estate investment funds - REITs (Real Estate Investment Trusts) become particularly interesting. We discuss REIT opportunities in this movie. With interest rates peaking, renewables and electric vehicles are also back on investors' radar, and we expect the risk-reward ratio to be favorable across the value chain, including battery manufacturers, battery suppliers or the charging network. In our electric car video we discuss stocks and publicly traded funds to capitalize on the current boom in the electric vehicle industry. Emerging markets could also get support from a pause in Fed decision-making, as it will give them the opportunity to cut interest rates before the Federal Reserve does, due to a faster rate of disinflation, weak demand and higher real interest rates.

The risk of inflation cannot be completely ignored, given the resurgence of commodity prices, which could bring back commodity price inflation, which has been the main driver of disinflation so far. Real interest rates will continue to rise if the Fed's policy trajectory is re-evaluated upwards due to the re-emerging risk of inflation. Passive tightening or growth in real yields, even if nominal yields remain unchanged, is also likely due to the effects of lower inflation. This makes it difficult to continue the rally based on valuations unless the risk premium is significantly lowered. Sentiment and positioning in the stock market also seem a bit exaggerated, which may suggest the need for caution.

A pause in the Fed's decision-making on rates could also signal the countdown to a recession. There are many risks to watch out for - especially deteriorating credit conditions and financial arrears. This could negatively affect economic growth in QXNUMX, along with reflation in commodity prices and weakening in Europe and China. Extending bond durations could help investors diversify risk and cope with a potential recession as well as uncertainty about the Fed's policy trajectory. If the risk of a recession materializes, long-term US Treasuries will have more upside potential due to their long duration. Gold, which may continue to struggle in the near term due to rising real interest rates (stable nominal rates and falling inflation), may prove interesting for investors again in QXNUMX if recession fears intensify and the market's forecast rate cuts by the Fed will accelerate.

About the Author

Charu Chanana, market strategist in the Singapore branch Saxo Bank. She has over 10 years of experience in financial markets, most recently as Lead Asia Economist in Continuum Economics, where she dealt with macroeconomic analysis of Asian emerging countries, with a focus on India and Southeast Asia. She is adept at analyzing and monitoring the impact of domestic and external macroeconomic shocks on the region. She is cited frequently in newspaper articles and appears regularly on CNBC, Bloomberg TV, Channel News Asia, and Singapore's business radio channels.

Charu Chanana, market strategist in the Singapore branch Saxo Bank. She has over 10 years of experience in financial markets, most recently as Lead Asia Economist in Continuum Economics, where she dealt with macroeconomic analysis of Asian emerging countries, with a focus on India and Southeast Asia. She is adept at analyzing and monitoring the impact of domestic and external macroeconomic shocks on the region. She is cited frequently in newspaper articles and appears regularly on CNBC, Bloomberg TV, Channel News Asia, and Singapore's business radio channels.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![CRB index – one of the popular commodity market benchmarks [Guide] crb index](https://forexclub.pl/wp-content/uploads/2024/05/indeks-crb-184x120.jpg?v=1715055656)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)