New year, new volume report. We are looking at turnover on the forex market in January.

Last year ended with very mixed data in terms of volume. Despite the fact that the results on a monthly basis were usually neutral, and their dynamics in individual quarters were at least tolerable, comparing them to 2018 they were not so colorful. Most of the time, we've seen a lot of regression taking the readings as reference (currently 2 years ago). The falls were not small, sometimes even two-digit. In the following text we will look at how we started in 2020 and what turnover selected brokers and liquidity providers presented.

Read: Currency trading is again at a good level. Turnover increases in December

Worse start?

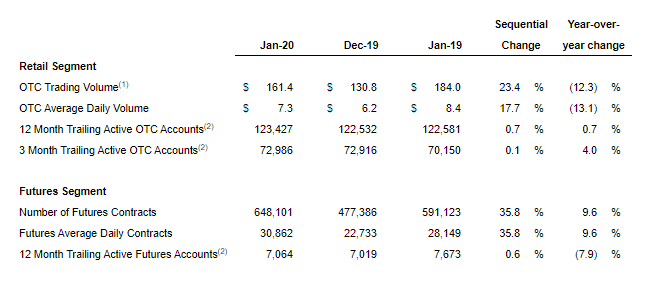

At first, we'll take the largest broker in the US, about which we often write in monthly summaries. It is Gain Capital. One main conclusion can be drawn from the published data. It is difficult to achieve (especially on the currency market) a relatively steady and satisfying turnover. In the context of retail customers, the currency space is still regressing and despite the fact that it was possible to make up for them on a monthly basis, January 2019 presented better data. Volatility is still not spoiled, which has a direct impact on the results.

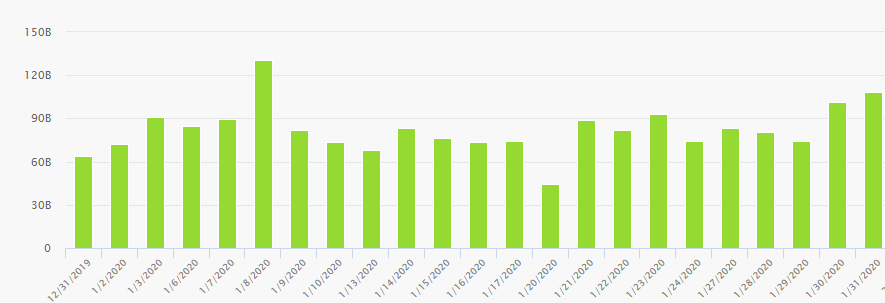

In January 2020, customers made transactions worth USD 161 billion. This amount represents an increase of 23% in m / m terms. In an annual context, Gain registered a regression of 12%. The average daily volumes of the group (ADV) amounted to USD 7,3 billion in January 2020. This means an increase of 18% compared to USD 6,2 billion in December 2019. In annual terms, this number decreased by 13%.

Generally speaking, trade conditions in January improved significantly, which lasted around the middle of the month. However, this was enough to improve turnover data on a monthly basis.

USD 18,2 billion a day

When examining the stock market volume, it is difficult not to stop at one of the largest European liquidity providers. We'll look at Euronext reports. Like the Gain group, you can see the same relationship. Published volumes managed to ensure growth from month to month, however, their monthly value was less than a year ago. The January result was exactly USD 398 billion, a 13% increase compared to December. Taking January 2019 as a benchmark, turnover decreased by exactly 9%. Meanwhile, the average daily volume on the Euronext FX instant market was USD 17,3 billion, which is 9% more than in December (where the result was exactly) USD 15,85 billion.

Source: Euronext

Volatility problems that affected us in January will be visible in February, which is why the published data are still growing. We do not have any outstanding reasons to complain, which does not mean that temporary stagnation in the economies (especially Eastern ones) will not affect the turnover and results for February.

27,5% less than in 2019

Speaking of the poor economic situation of eastern economies (with a huge emphasis on the Chinese), it is worth mentioning the turnover from those regions. Therefore, we will look at the results of the Japanese giant in the field of retail brokerage activities - GMO Click.

In the case of GMO Click, the broker consistently reported in the publications presented a decrease in the volume of trading on the OTC market. The regress lasted from June last year, practically until November 2019. It was only in December that we could observe the increase in volatility and improvement in the reports of the Japanese company. In January, however, it reported a trading volume of USD 568,2 billion, which gave us a monthly increase of 16,7%. The dynamics is of course favorable, however, similarly to its predecessors, taking January 2019 as a benchmark, the current volume is significantly lower by 27,5%. This is a major regression. Similarly, low trading activity prevailed outside the OTC market.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)