Fragmentation game: China lowers reference rate, more stimulus coming soon

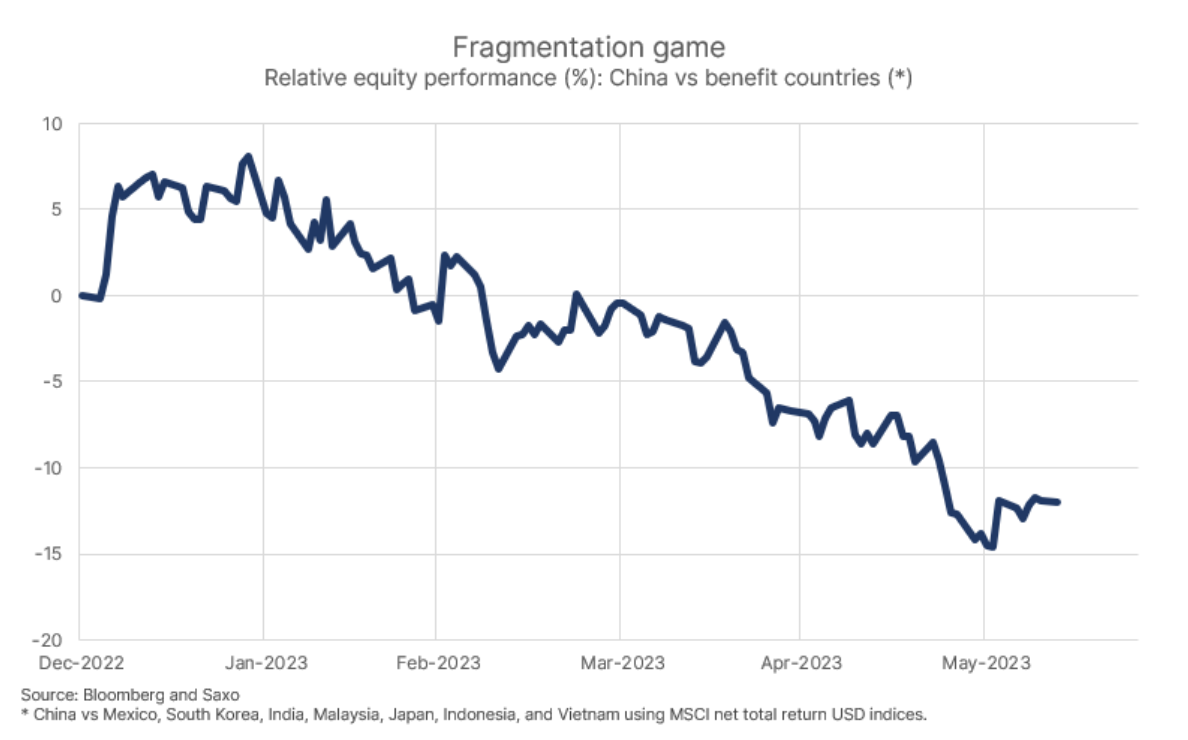

Chinese equities underperformed 12% this year Mexico, South Korea, India, Malaysia, Japan, Indonesia and Vietnamas global investors are increasingly concerned about China's economic growth and signs of moving some production out of China to mitigate geopolitical risks. It's worth revisiting our fragmentation game theory as we look at this year's performance of Chinese stocks and news that policy makers are gearing up for more stimulus to revive the Chinese economy.

Will China's stimulus get the economy going again?

The year started so beautifully: China lifted its strict zero Covid policy, and global investors bet on the reopening of the Middle Kingdom's economy, driving growth in the stock market. Chinese equities outperformed the entire stock market group* by 8% through Jan 27, 2023.

However, the optimism quickly faded. There was no sign of the relative better performance by late February, and by the end of March, Chinese stocks managed to maintain gains in line with other key emerging markets as economists and investors were willing to give the Chinese economy credit.

However, at the end of March, the Chinese stock market underperformed the countries we believe are most likely to benefit from our fragmentation thesis in our forecasts for Q2023 XNUMX. The game of fragmentation is essentially about reorienting and reconfiguring the global economy. This is because the world is moving towards bipolarity; with blocks led by the US and China. Within this framework, key manufacturing industries falling under the security policies of Europe and the United States will be moved out of China in order to reduce dependence on the second bloc.

The Chinese economy continues to struggle and policy makers there are increasingly expressing concerns and intentions to implement growth-enhancing policies. Data for May showed that Chinese demand for loans declined, which is another sign that economic activity is not accelerating.

At the same time, the country suffers from high youth unemployment and a structural weakness in the real estate sector. Recently, the government lowered the reserve requirement for Chinese banks and today the PBOC lowered the 7-day reverse repurchase rate by 10 basis points to 1,9%, a sign that the Chinese central bank is preparing for further monetary easing. Tax credits and further growth-enhancing initiatives are being considered by the Chinese government, and the relative performance of the basket will be a good indicator of how the market weighs fragmentation dynamics versus Chinese policies to stimulate the economy.

* The group of stock markets we compare Chinese stocks to are Mexico, South Korea, India, Malaysia, Japan, Indonesia and Vietnam

About the Author

Peter potter - director of equity markets strategy in Saxo Bank. Develops investment strategies and analyzes of the stock market as well as individual companies, using statistical methods and models. Garnry creates Alpha Picks for Saxo Bank, a monthly magazine in which the most attractive companies in the US, Europe and Asia are selected. It also contributes to Saxo Bank's quarterly and annual forecasts "Shocking forecasts". He regularly gives comments on television, including CNBC and Bloomberg TV.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![CRB index – one of the popular commodity market benchmarks [Guide] crb index](https://forexclub.pl/wp-content/uploads/2024/05/indeks-crb-184x120.jpg?v=1715055656)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response