Concerns about economic growth are growing

While inflation remains the main concern for the markets, unfavorable US retail sales and industrial production data overnight has raised some fears of an economic slowdown. The strong labor market situation continues to offer a soft landing to avoid a deep recession, while markets will become increasingly sensitive to wage data in the longer term. The profits of enterprises will also gain importance - from next week, the largest entities from the technology industry will start publishing reports.

The global business cycle is at a tipping point and investors are trying to gauge their options depending on whether we are facing a soft landing or not. recession. While US housing and survey data has been disappointing for months now, real economic data is now starting to show a significant deterioration.

Markets also evolve in how they interpret economic data: it was initially assumed that bad news is good news implying that Fed changed the policy regarding the cycle of interest rate increases, which ensured a steady flow of buyers of shares. These days, bad news is just bad news; as a result, markets are becoming increasingly concerned about what the Fed's tightening cycle might mean for economic growth forecasts.

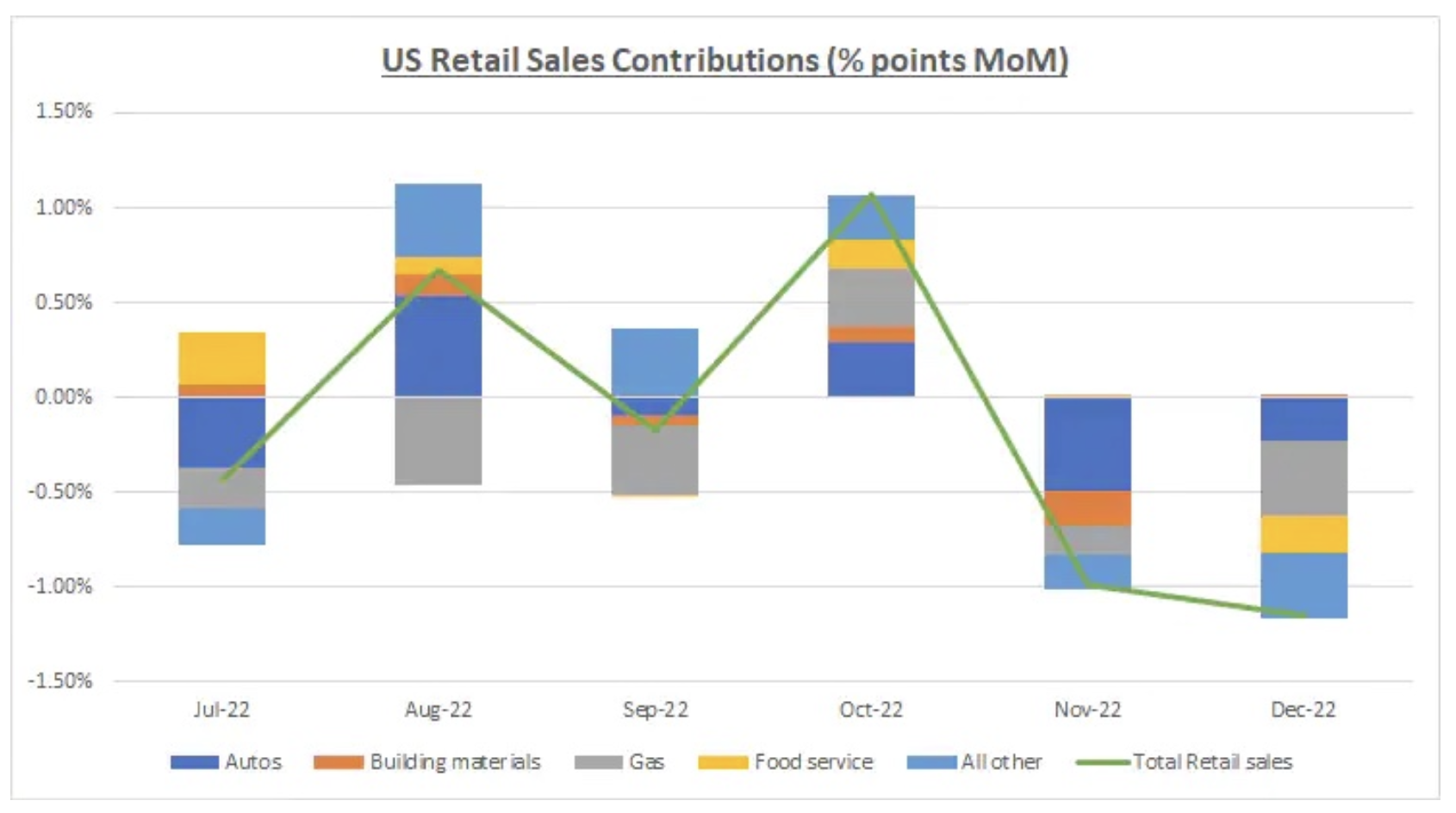

Such a change of perspective is the result of the recent publication of unfavorable data from the United States. In December, US retail sales fell by 1,1%MoM - more than the expected 0,8%, with a significant downward revision of the previous reading from -0,6% to -1,0%. Industrial production in December fell by 0,7% m/m vs. -0,1% expected, with the previous reading revised down from -0,2% to -0,6%. Manufacturing production also recorded a larger fall, down 1,3% from the expected -0,3%, and the previous reading was revised down from -0,6% to -1,1%.

The condition of the American consumer

This change in narrative raises several fundamental questions about the condition of consumers, which was a real pillar of strengthening in an exceptionally difficult macroeconomic environment. With inflation and interest rates at record highs, consumers are likely to find their own ways to cut costs.

Last year, this approach translated into a reduction in excess savings by shifting spending from goods to services and from high-priced goods to cheaper ones. There was also some risk of deterioration in the demand for services - the December retail sales reading showed, among others, decrease in turnover in restaurants, which is an indicator of expenditure on services.

However, given the still limited supply in the labor market, a sharp decline in consumer spending seems unlikely. Despite this, markets will continue to look for further signals to assess the condition of the US consumer, with labor and wage data in the spotlight. Wage pressures are easing, particularly in industries that saw the highest wage gains last year due to labor shortages; this applies, among others, to sectors such as recreation and hospitality or wholesale trade. For now, however, the number of jobs continues to grow, and this makes consumer forecasts safe from sudden and significant changes. In the coming weeks, market volatility may shift from the days of the CPI reading to the days of the publication of the report on employment in the non-farm sector (NFP, nonfarm payroll), as employment data will gain in importance.

Attention to corporate profits

The latest data on employment in the non-farm sector will be released on February 3. Until then, the markets will be mostly concerned with the numerous reports on corporate profits. Next week we will know the profits of tech companies like Microsoft and Tesla, and a week later - Apple Lossless Audio CODEC (ALAC),, Amazon, Alphabet and Meta. Factset estimates that the profits of companies from the S&P500 index for the fourth quarter will fall by 3,9% y/y due to downward revisions of estimates. Our equity strategist Peter Garnry has also repeatedly suggested that corporate profits and margins could come under pressure this year as valuation power declines and costs (particularly salaries) remain flat.

Investment implications

We believe disappointment in corporate earnings reports will continue to fuel fears of an economic slowdown. Concerns about a global recession, on the other hand, are temporarily receding as Europe recovers from its energy crisis and China's economy reopens at a rapid pace. For now, inflation concerns remain significant, but if recession fears start to strengthen, this could lead investors to look for safe-haven investments such as bonds.

If the market valuation of economic growth deteriorates further, earnings estimates could suffer even more, which could negatively impact growth stock prices. This reiterates the importance of a diversified and balanced portfolio, despite the dismal performance of the 60/40 portfolio last year. We also believe that Asian equities have the potential to outperform US equities in 2023 and provide attractive valuation levels worth considering.

About the Author

Charu Chanana, market strategist in the Singapore branch Saxo Bank. She has over 10 years of experience in financial markets, most recently as Lead Asia Economist in Continuum Economics, where she dealt with macroeconomic analysis of Asian emerging countries, with a focus on India and Southeast Asia. She is adept at analyzing and monitoring the impact of domestic and external macroeconomic shocks on the region. She is cited frequently in newspaper articles and appears regularly on CNBC, Bloomberg TV, Channel News Asia, and Singapore's business radio channels.

Charu Chanana, market strategist in the Singapore branch Saxo Bank. She has over 10 years of experience in financial markets, most recently as Lead Asia Economist in Continuum Economics, where she dealt with macroeconomic analysis of Asian emerging countries, with a focus on India and Southeast Asia. She is adept at analyzing and monitoring the impact of domestic and external macroeconomic shocks on the region. She is cited frequently in newspaper articles and appears regularly on CNBC, Bloomberg TV, Channel News Asia, and Singapore's business radio channels.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response