The history of crises - the panic of 1907 and the rise of the Fed

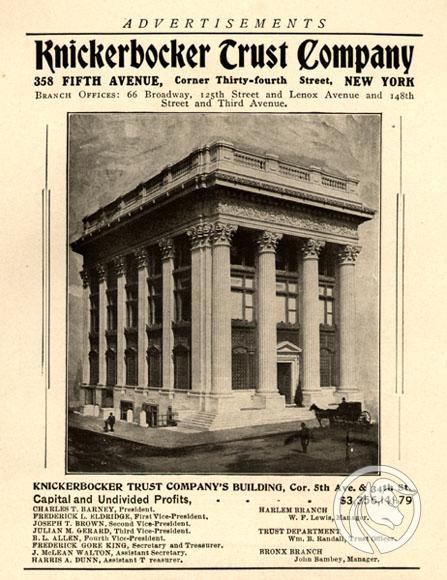

It was a financial crisis that began in mid-October 1907 and lasted for three weeks. During the crisis, they happened run on the banks and on trusts. The panic of 1907 is also known as the Knickerbocker Crisis. The years preceding the crisis of 1907 were characterized by progressive globalization (thanks to, among others, the spread of telephones and telegrams around the world) and the rapid development of banking trusts.

The start of the crisis was the loss of liquidity by several banks and trusts in New York as a result of the failed manipulation of United Copper United stocks. As a result, the Knickerbocker Trust Company, which was the third largest trust in New York at that time, collapsed. It was the collapse of this trust that caused a panic among investors and depositors. As a result, there was a loss of liquidity with many trusts and regional banks. Panic was saved only by the intervention of JP Morgan, who organized the injection of liquidity into the capital market.

Market environment in 1906 and 1907

At the beginning of the XNUMXth century, in the United States - unlike in developed European countries - there was no central bank. The former central bank (Second Bank of The United States) ceased to operate in 1836. There was therefore no lender of last resort and no regulator of the money supply in the American economy.

In effect money supply it has changed with the agricultural annual cycle. In the fall, "traditionally" there was an outflow of capital from New York due to the purchase of agricultural products. As a result, banks tried to attract capital through a raise interest rates. The increase encouraged foreign investors to locate their capital in New York, mainly from London.

It is also worth mentioning that the turn of the nineteenth and twentieth centuries is a huge increase in capital concentration (including JP Morgan, Rockefeller) and a sharp increase in banking trusts. According to data collected by Tallman and Moen, in the 10 years leading up to the panic outbreak, the value of trust assets increased by 244%. At the same time, the New York State banking sector increased assets by "only" 82%. The expansion of trusts resulted from a more aggressive policy of obtaining deposits and lighter regulations (lower reserve requirement ratio). It was one of the volatile components of the US financial sector.

In early January 1906, the index Dow Jones Industrial Average established the peak at 103 points. Then there was a slight correction. The market was also not helped by the San Francisco earthquake in April 1906. This resulted in increased market volatility and an outflow of capital from New York to San Francisco (needed to rebuild the damage).

At the same time Bank of England was forced to raise interest rates. The increase was due to the outflow of capital from London to New York. This was because British insurance companies had to pay policies to insured Americans. The interest rate hike significantly reduced the inflow of British speculative capital to the US market. This led to a decrease in liquidity in the New York market. In June 1906, the market was already 18% lower than the January peak. However, after the correction, there was a slight calming of moods.

ICC logo.

Another increase in uncertainty on the capital market was the implementation of the Hepburn Act, which gave the ICC (Interstate Commerce Commission) the right to set the maximum rail rate. The law entered into force in July 1906 and reduced the profit-generating potential of railway companies. It is worth mentioning that rail companies had a large share of the market capitalization.

The first panic occurred in March 1907, which was known as the "panic of the rich." The initial nervousness was followed by a calming down of moods. In the summer there was once again nervousness on the market. Panic also affected companies included in the "blue chip". An example would be one of the largest companies at the time - Union Pacific - which lost over 50% of its value.. This was a problem because the shares of this company were used as security for many investor loans. The fall in collateral value forced investors to reduce leverage or raise additional capital. As if that were not enough, in August Standard Oil Company was fined $ 29 million. During the first 9 months of 1907, the DJIA index fell by 24,4%.

Failed attempt to manipulate the market

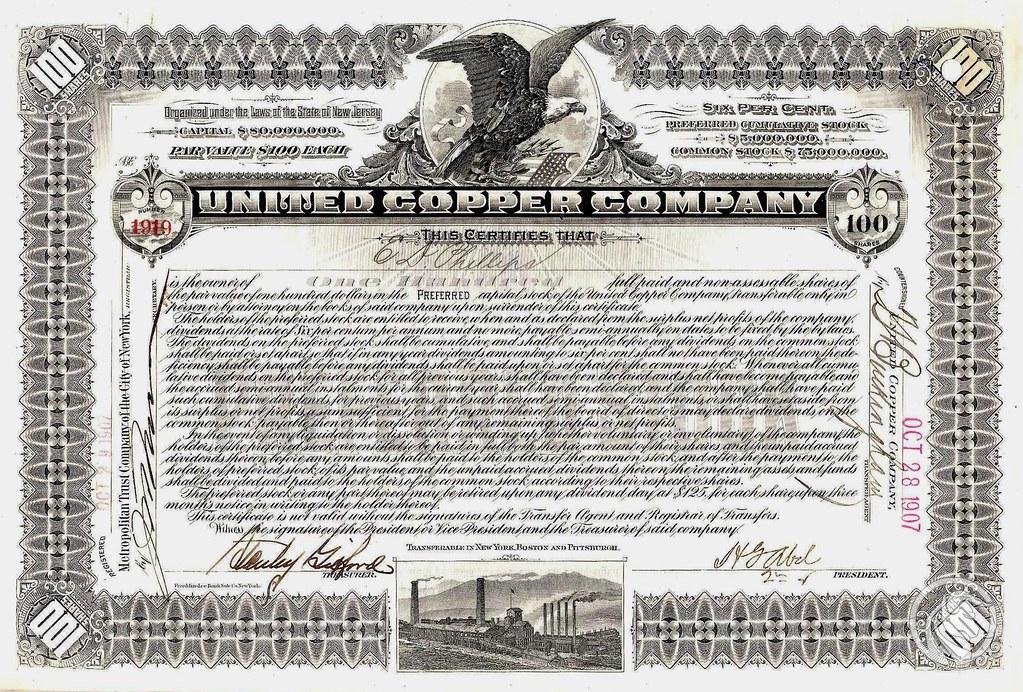

The prelude to the panic of 1907 was an attempt to manipulate the stock market by magnate Augustus Heinze and his brother Otto. The manipulation concerned the company United copper company, whose shareholder was Augustus Heinze. The company produced 19 tons per year copper annually. It was therefore much less than its biggest competitor - Amalgamated Copper - with an annual production of 65 tonnes of copper. It is worth mentioning that the shares of United Copper Company were not listed on the New York Stock Exchange, but on the crub, which eventually became the American Stock Exchange.

Augustus and his brother Otto planned to bring it about "Corner the market" on the shares of United Copper Company. It is a strategy that, in short, is about carrying out "Squeezing short positions" (short squeeze). The Heinze brothers believed they controlled enough of the company's shares. At the same time, they estimated that a large number of the company's shares were sold for a short time.

A short sale is a transaction that involves borrowing from the market. The shares are then immediately sold on the stock exchange. Sellers briefly earn money when the stock price drops. In such a situation, investors buy back the shares at a lower price than they sold. The redeemed shares are returned. The difference between the selling price and the buying price is then the investor's profit.

Squeezing out short positions occurs when there are so many short positions on shares that the rise in the price of the company's shares causes large losses in portfolios that play short. This forces them to close their positions, i.e. buy shares from the market. Such an imbalance between supply and demand causes the share price to rise rapidly. It was visible, for example, in actions GameStop i AMC in early 2021. The Otto brothers wanted to do the same 114 years earlier.

Source: NYC Architecture

Augustus and Otto Heinze needed additional capital to acquire the shares. One of the financing companies for this project was to be the Knickerbocker Trust Company. It was then the third largest such trust in New York. Charles T. Barney, then president of the New York trust, had financed similar operations in previous years. However, he now found that the amount needed to make a short squeeze was too large and refused to participate in the trust in financing the entire venture..

Interestingly, this did not deter the Heinze brothers from undergoing surgery. Despite having insufficient capital, Augustus and Otto decided to carry out the operation. The reason for such certainty was most likely erroneous estimates of the scale and wealth of the portfolios of investors playing shortly on United Copper Company shares.

The entire operation began on October 14. The start was very promising for the Heinze brothers. Due to the demand for United Copper Company shares, the company's share price rose very quickly from $ 39 to $ 52. The next day, the Heinze family announced a call for the return of the company's shares they had borrowed. There was a buy panic for a while and the United Copper Company stock rose to $ 60 per share. However, the brothers did not expect that there were enough stocks on the market to be available for short sale. Due to the fact that the supply of shares available for borrowing was much greater, holders of short positions could borrow the company's shares from another investor and return the previously borrowed shares to the Heinze brothers. As a result, the expected increase in share prices did not take place. On the contrary, there was fresh capital on the market that acted briefly. This resulted in a sharp drop in the company's price, and at the end of Tuesday's session (October 15) the share price fell to $ 30. A day later it was just $ 10. The Heinze brothers admitted defeat. Not only did they lose a lot of money, but the family's wealth was significantly depleted (share value drop). In addition, due to the loss of liquidity, the brokerage house of the Heinze family (Gross & Kleeberg) was forced to close its operations.

Panic spreads

This is not the end of the blows to the Heinze family. Already on Tuesday, the New York Stock Exchange suspended Otto Heinze's right to participate in organized stock exchange trading. Following the collapse of the United Copper Company, owned by the Heinze family - State Savings Bank - declared insolvency. The collapse was due to the fact that the bank accepted a pledge on the company's shares as security for some loans.

The bankruptcy of this bank meant that all entities in which the Heinze family was involved were included in the censorship. Augustus Heinze was forced to resign as president of Mercantile National Bank. However, this desperate move did not save this bank. Rumors of another imminent bankruptcy were already raging in New York. As a result, there was a classic bank run. Clients wishing to save their money demanded immediate withdrawal of the deposited funds. By saving their money, they reduced the bank's liquidity. The more such people there were, the more difficult it was for the bank to make its payments.

The panic spread to other entities. Due to the fact that the Heinze family had ties to Charles W. Morse, related banks were targeted. He had problems with liquidity National Bank of North America and New Amsterdam Bank. To save the New York banking sector, the New York Clearing House forced Morse and Augustus Heinze to abandon all banking activities. Despite the difficult liquidity situation in some banks, there was no outflow of funds from the entire banking sector. The panic was local and the withdrawals were deposited with banks of much better reputation.

However, that was not the end of the problems. On October 21, 1907, the board of the Knickerbocker Trust Company asked the current president (Barney) to step down. This was due to a desire to clear the image and cut off rumors that Knickerbocker was involved in the latest Heinze venture. However, Barney's departure did not save the company. On the same day, information appeared that the National Bank of Commerce is ceasing to provide clearing services to the trust. This news triggered a panic among Knickerbocker's clients which sparked a run on the trust. On October 22, $ 8 million was withdrawn from the trust within hours. Knickerbocker was forced to suspend operations.

The collapse of the Knickerbocker Trust Company wreaked havoc on the financial market. Banks and trusts stopped lending because they needed liquidity. At the same time, more customers began to fear for their deposits. This resulted in another abrupt withdrawal of funds from the banking system. problems faced two big trusts: Trust Company of America and Lincoln Trust Company. Several banks also reported liquidity problems, including First National Bank of Brooklyn, Empire City Savings Bank or Twelfth Ward Bank. The situation seemed much worse than a few days earlier.

JP Morgan's actions during the panic

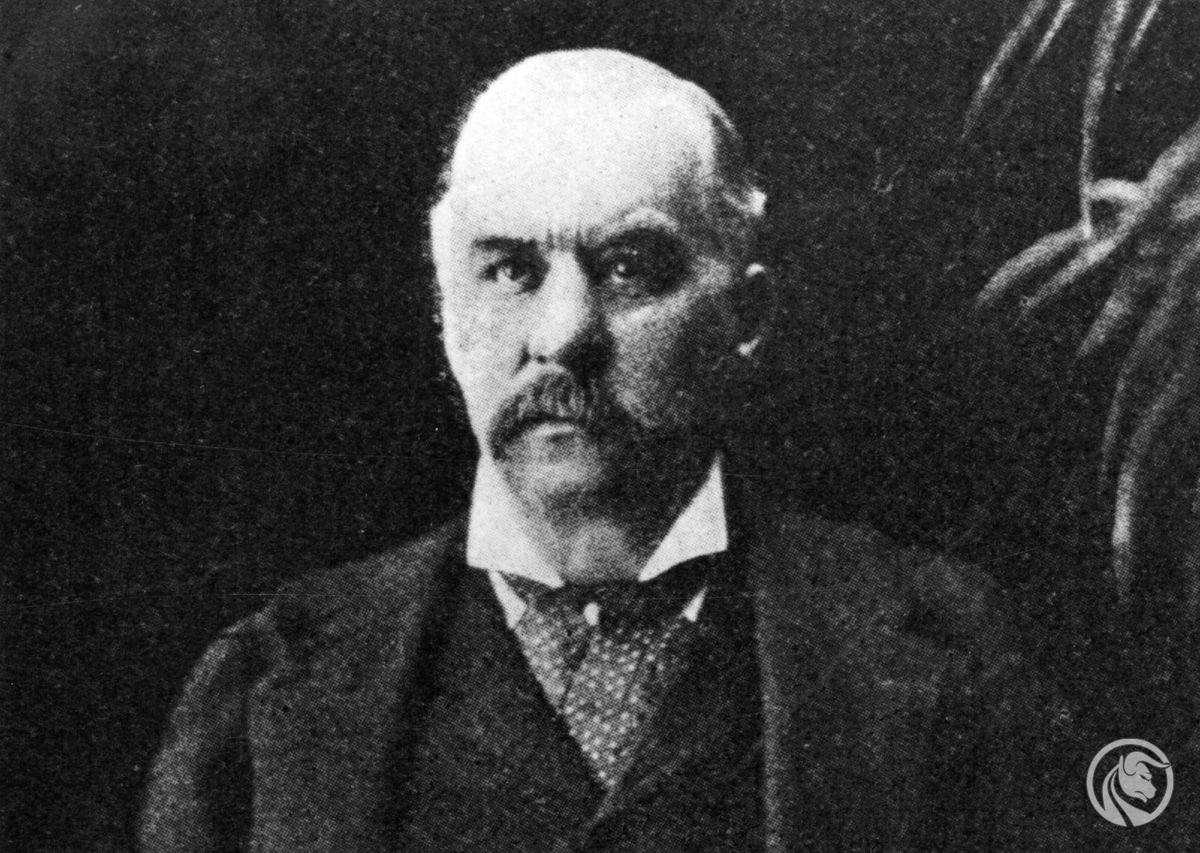

JP Morgan. Source: NY Daily

Morgan was out of New York when the panic started. He did not return to the city until the night of October 19. Over the weekend, he and other CEOs of major banks and trusts began looking for a solution to stop panic. After checking the books, Knickerbocker decided there was no point in saving the trust as it was already insolvent. As it turned out, this was a mistake that did not nip the panic in the bud.

As early as three days later, panic in the market caused the Trust Company of America to ask for help. After checking the books of accounts, it was found that this trust was only in temporary liquidity problems, so it was decided to help him. Another help came from the government. The U.S. Treasury Secretary agreed to deposit government funds with New York City banks, which was supposed to "inject" liquidity into the financial sector. At the same time, Mogan, together with the presidents of First National Bank and the National City Bank of New York, developed a plan to liquidate the trust assets. After surviving on October 23, the Trust Company of America continued to face liquidity problems. As a result, he needed $ 8,25 million in additional capital, which he received in the form of a loan. At the same time, the richest man in America - John D. Rockefeller - announced that the liquidity of the trust was guaranteed with half of his estate. This helped calm the moods.

While the situation with trusts has calmed down relatively, the stock market has started to lack liquidity. This was because, despite the liquidity injection by the US Treasury, the stability of New York's banks was still "fragile". For this reason, banks stopped lending against shares. This resulted in investors being unable to use leverage. As a result, investors in the stock market began to lose liquidity. This caused a panic sale of stocks ("cash flight"). The situation became so difficult that the president of the NYSE suggested that the trading session be interrupted. JP Morgan was of the opposite opinion, believing that this would only deepen the panic among investors, which would quickly transfer to the banking sector. Morgan wasted no time, convincing CEOs of New York banks within 45 minutes to shell out $ 23,6 million to save liquidity in the stock market. The crowning argument that convinced the bankers was risk of rapid bankruptcy of 50 brokers. The next day, the banks provided an additional $ 10 million, as long as it was not used to finance leveraged transactions. The stock market was saved on Friday, October 25.

However, that was not the end of problems. Two days later, on October 27, Morgan was informed that the city of New York could go bankrupt if it did not raise $ 1-1907 million by November 20, 30. The problem was that the city was unable to issue debt in the market because it lacked liquidity. Morgan was aware that if New York City became insolvent, the panic would be much greater. Within two days, he managed to raise $ 30 million and avert the risk of the city going bankrupt.

Theodore Roosevelt. Source: politico.com

On November 2, another problem appeared. The broker Moore & Schley was on the verge of bankruptcy as it secured its loans with Tennessee Coal, Iron & Railroad Company shares. As a result, there was a plan to take over TC&I by US Steel (a company related to Morgan). Despite initial objections from the President of the United States (Theodore Roosevelt), the plan eventually comes into effect. This meant further monopolization of the steel market, which was contrary to the president's policy to date.

At the same time, the problem of trusts, which were still in a very difficult financial situation, was resolved. At the same time, banks did not want to continue their trust financing policy. As a result, debates on the methods of financing trusts continued throughout Saturday. JP Morgan opted for stronger trusts to take over weaker competitors. The deliberations lasted until 5 a.m. and finally the trusts decided to agree to Morgan's proposal.

Recession of 1907

Stock market panic coincided with an economic recession, which according to National Bureau of Economic Research took place between May 1907 and June 1908. In 1907, industrial production fell by 11%, imports also shrank and the unemployment rate rose (3% to 8%). At the same time, with the economic downturn, the number of bankruptcies increased, reaching a record level in the "crisis year". At the same time, the "tightness" in the money market caused a hunger for money. Charles P. Kindleberger's book Madness Panic Crash cites an example where future proceeds from a Harvard football game against Yale were sold for $ 48 for $ 1000 in future revenues. The panic of 1907 sparked a polemic about the need to create a central bank that would be the "lender of last resort" as was the case in Europe (eg, the Bank of England or the Bank of France).

FED - the "child" of the panic of 1907

Source: Federal Reserve Bank of Atlanta

The panic of 1907 was nothing special from the perspective of the previous several decades. Similar crises occurred in previous years, e.g. in 1873, 1893 or 1857. The frequency of financial crises meant that there were supporters of introducing a central bank in the European style. To this end, Senator Nelson Aldrich (president of the National Monetary Commission) traveled to Europe for two years to take a closer look at the functioning of the local banking system. The establishment of the central bank was also supported by the banking sector.

The main role was played by JP Morgan. The project slowly matured in the years 1910–1912. The most medial stage in the preparation of the project was a conference organized on Jekyll Island, Georgia, in November 1910. It was then that the main outline of the project was created. JP Morgan did not live to see the establishment of the Fed. He died on March 31, 1913, and less than six months later, Congress passed the founding law Federal Reserve System.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)