The raw material boom slows down [Metals, oil, agricultural commodities]

In the third trading week, we saw more and more signs that the strong momentum that has kicked up many markets in recent months, including commodities, is starting to fade. It was linked to at least two events in early November, when optimism about the vaccine and the election of Joe Biden as the next president of the United States raised market expectations for growth, inflation and dollar depreciation.

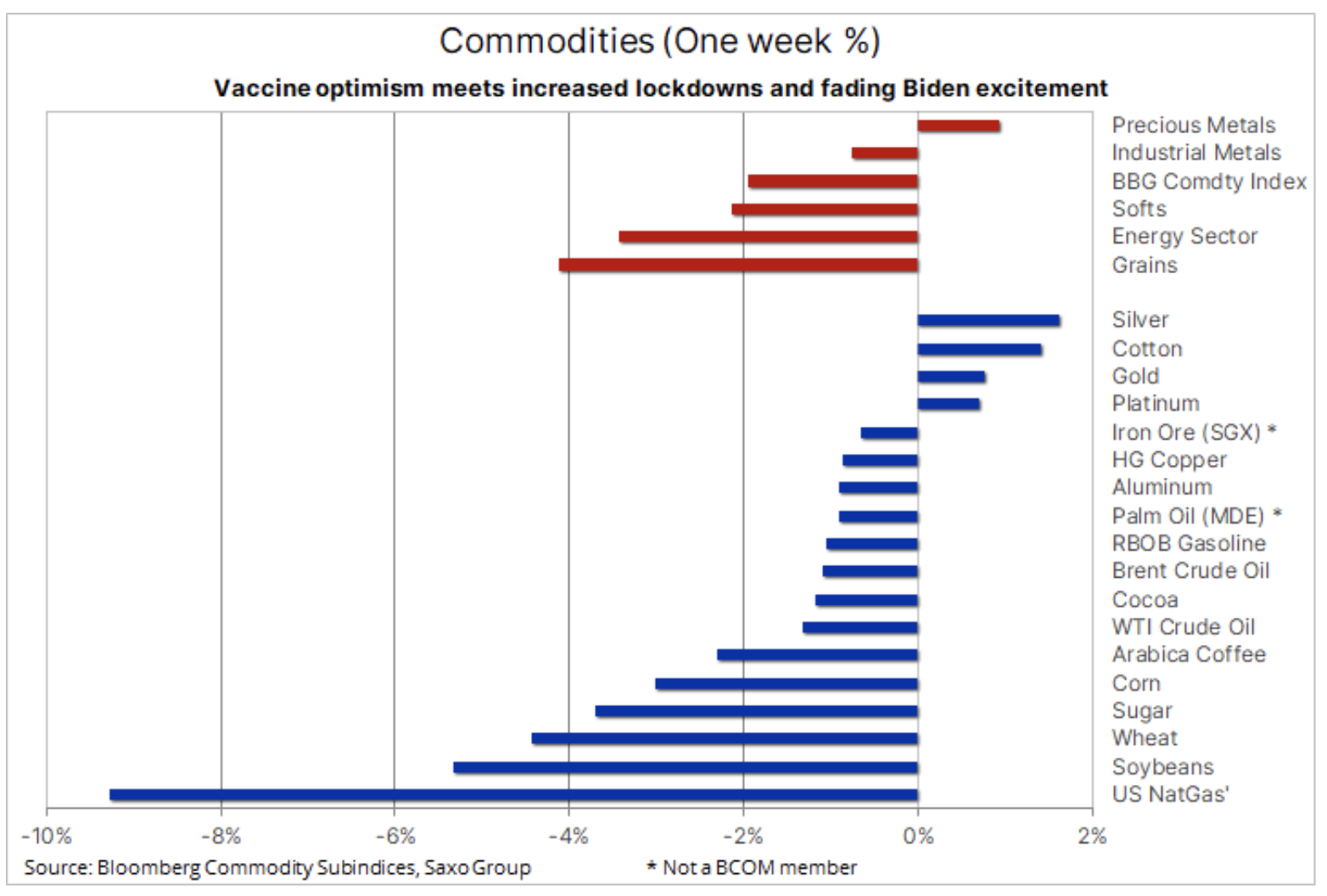

In our last analysis of commodity markets, we mentioned that momentum in these markets, with a few exceptions including arable crops, is starting to weaken. Last week, the slump in momentum translated into direct losses, primarily in the agricultural and energy sectors. However, after abnormally high returns on key commodities, from crude oil to corn and copper, the risk of a deterioration, or at best a consolidation period, increases.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Several factors could have influenced the recent shift in sentiment towards increased caution. Following the peaceful handover of power in Washington, the joy of Biden's victory seems to be superseded by mundane realities. More than 100 Americans could lose to Covid-000 before the pandemic wears off in the second half of 19. At the same time, hopes for a swift adoption of new fiscal stimulus by the Senate are waning due to growing opposition among Republicans. Inflation remains moderate, and forecasts do not assume an acceleration until the second half of the year, when the base effects of last year's oil price slump begin to fade. Another cause for concern is the rise in US long-term bond yields and the strengthening of the dollar.

In addition, in addition to further lockdowns around the world, new pandemic outbreaks have emerged in at least three provinces in northern China. This raises concerns about the forecasts of short-term demand from a country that managed to support a number of key raw materials almost on its own in certain periods of last year, from oil i copper po soybeans. Lockdowns and restrictions around the world are unlikely to be a thing of the past soon, which may further delay the timing of the expected recovery, which in turn will further worsen the short-term outlook.

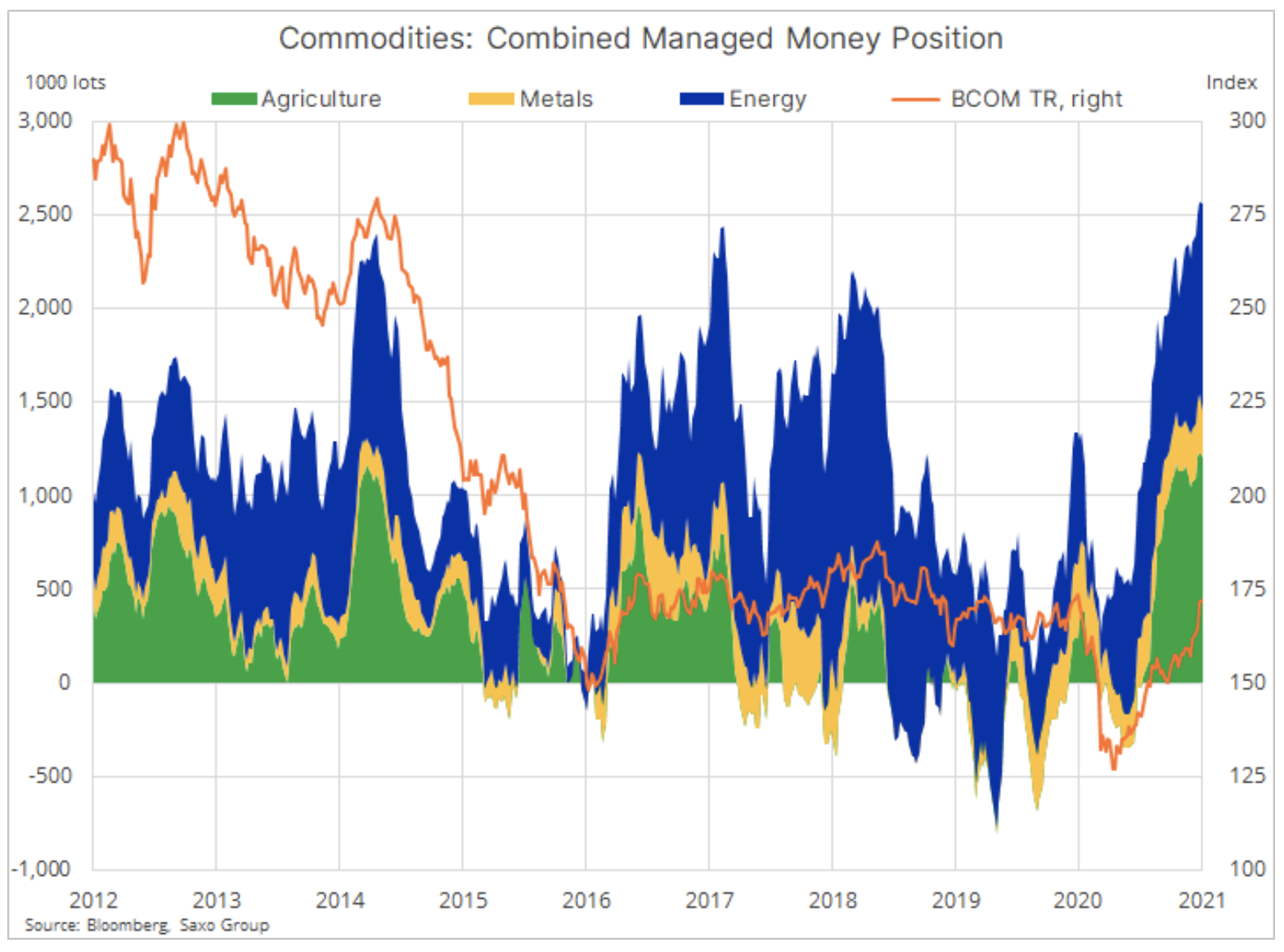

With this in mind, the market focuses on the risks associated with a record long speculative position for a short-term forecast. After many months of focusing on reflation, the expected revival in global demand for raw materials due to the vaccine, and the decreasing supply of key raw materials, there has been a strong increase in demand from speculative investors. In the week ending January 12, they held a long 2,6 million lots in futures and net options on 24 commodities contracts valued at $ 128 billion. This would have been a new record were it not for a 31% drop in net long gold position.

Precious metals, oil

Gold i silver they are still struggling to attract new buyers after the sell-off in early January, triggered by rising yields and covering short positions that translated into a strengthening dollar. The prospect of further sprint gains has turned into a marathon and investors will need to be patient as favorable inflation increases are only expected in the second quarter and beyond. While the overall position of stock funds in silver reached a record high last week, speculative investors in the gold market are increasingly voting with their portfolios and reducing long positions in gold futures. As already mentioned, in the week ending January 12, speculative investors reduced their net long position by 31% to almost the lowest level since June 2019.

Hedge funds are generally not "tied" to their positions, which often leads to a violent reaction if the technical and / or fundamental forecast changes. However, based on our still optimistic view of inflation, we maintain a positive outlook for precious metals, although once again be patient.

Immunity observed in the last few months oil was an important topic and contributed to the stabilization of the commodity markets. Oil price hit its highest in a year last week despite pandemic demand fears, now also from China, as new lockdowns begin ahead of the Chinese New Year celebrations. The downside potential is hampered by the prospects of a vaccine-related revival in mobility, hopes for US fiscal stimulus, unilateral production cuts in Saudi Arabia, and continued strong investor demand for raw materials, including oil.

We maintain a positive long-term outlook for crude oil, but in the short term the risk of a correction increases by + 10%. In this context, watch for Brent crude oil, where a breakthrough below the rising trend from the November low could signal a reversal back towards $ 49 / b.

Agricultural commodities

Cereals i soybean, the best-performing sector in recent months, also entered a profit-taking phase, with the Bloomberg crop index falling for the first time in seven weeks. The + 50% maize and soybean boom since August has contributed to a significant increase in the long speculative position, now about 50% above the previous highs in 2016 and 2018. This position is negatively affected by expected rainfall in key South American cultivation areas. that can improve harvest prospects and reduce concerns about global supply.

Prior to profit taking, wheat prices surged sharply on both sides of the Atlantic, with the Chicago and Paris exchanges reaching their highest levels in eight years. This strengthening was a result of Russia's decision to tax exports to contain the recent rise in domestic food prices. Due to the fact that Russia is the world's largest exporter of wheat, this decision, as in 2011, raised concerns about the potential political and social implications of a further boom.

WisdomTree Grains (AIGG: xlon) is a commodity exchange fund (ETC) that meets the EU's criteria for a collective investment in transferable securities company and monitors the performance of the Bloomberg Crop Index. Since August, this fund has increased by 56%, increasing the need for consolidation more and more.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![The raw material boom slows down [Metals, oil, agricultural commodities] raw materials slowdown goods](https://forexclub.pl/wp-content/uploads/2021/01/surowce-towary-wyhamowanie.jpg?v=1611573782)

![The raw material boom slows down [Metals, oil, agricultural commodities] green energy investments](https://forexclub.pl/wp-content/uploads/2021/01/zielona-energia-inwestycje-102x65.jpg?v=1611563832)

![The raw material boom slows down [Metals, oil, agricultural commodities] US stock market $ 2 trillion](https://forexclub.pl/wp-content/uploads/2021/01/gielda-usa-2-bln-usd-102x65.jpg?v=1611566630)