Inflation is unfavorable even for inflation-protected bonds

After a long and warm holiday in Italy, Denmark welcomes me with 16 degrees Celsius and rain. This is a clear sign that the holidays are over and it's time to roll up your sleeves to get your hands dirty - and I assure you that there is plenty of dirt in the bond market.

To begin with, I would like to discuss one of the most heated debates right now: the issue inflation. Don't worry, I will not try to convince the reader that inflation is temporary or permanent. After all, I am a bond specialist: I am only interested in inflation if it is related to bonds, and in this case, to inflation-linked instruments.

About the Author

Althea Spinozzi, Marketing Manager, Saxo Bank. She joined the group Saxo Bank in 2017. Althea conducts research on fixed income instruments and works directly with clients to help them select and trade bonds. Due to his expertise in leveraged debt, he focuses particularly on high yield and corporate bonds with an attractive risk-to-return ratio.

Althea Spinozzi, Marketing Manager, Saxo Bank. She joined the group Saxo Bank in 2017. Althea conducts research on fixed income instruments and works directly with clients to help them select and trade bonds. Due to his expertise in leveraged debt, he focuses particularly on high yield and corporate bonds with an attractive risk-to-return ratio.

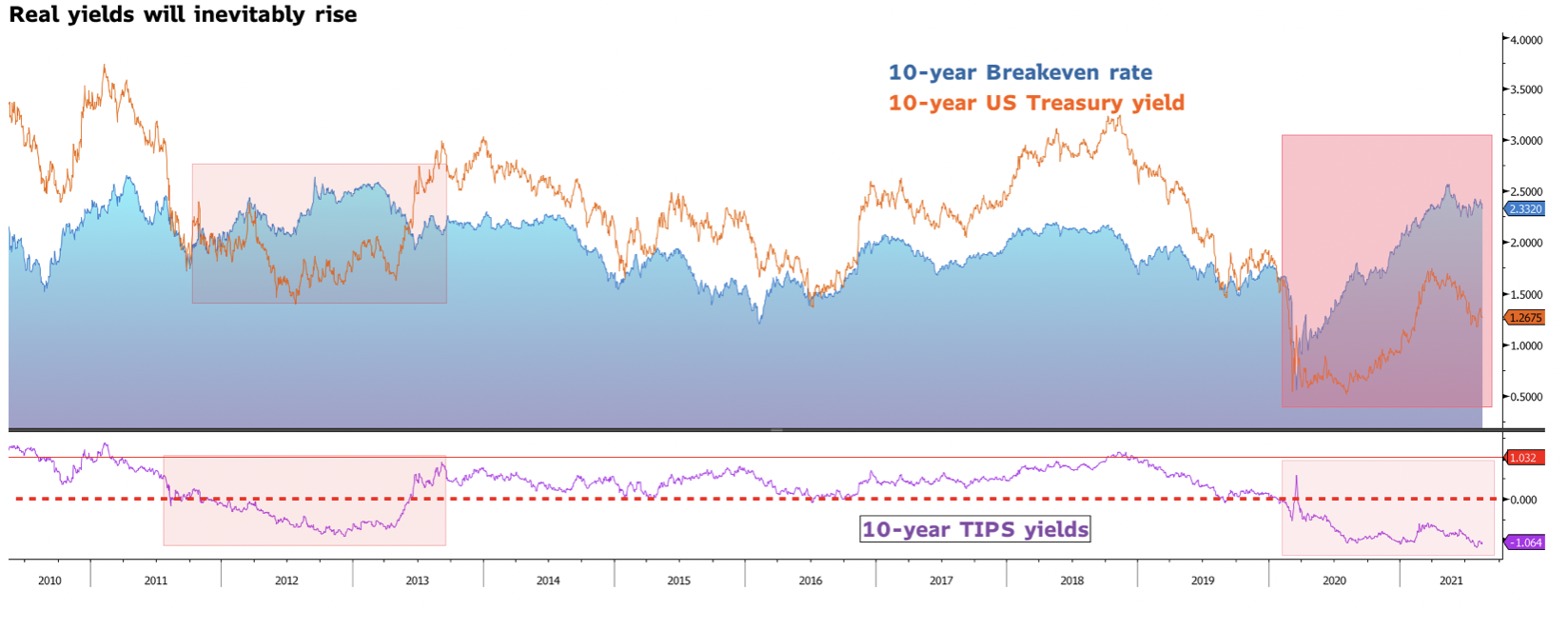

In the wake of the Covid-19 pandemic, central banks around the world have implemented an accommodative monetary policy, bringing real yields down to record lows. This means that investing in inflation-linked bonds has made no sense, and at the same time their performance has become more dependent on increasingly higher inflation readings.

Monetary policy of central banks has unexpectedly become less accommodative with more and more indications that inflation is more sustained than expected.

In the context of the United States, we believe that Federal Reserve may surprise the market by announcing an earlier start of curbing asset purchases next week in Jackson Hole. This would curb yields above the break-even point and provide a downside potential as a less accommodative monetary policy would slow down the pace of inflation. At the same time, nominal yields would go up, contributing to an increase in real yields.

In general, inflation is as bad for nominal bonds as it is for inflation-protected bonds. In fact, when nominal yields start to rise, investors will be willing to sell costly TIPS to buy higher yielding nominal US Treasury bonds.

However, how much should inflation rise to justify the use of inflation-linked instruments as a hedge against inflation?

TIPS: Buy to subsist or be prepared to lose your capital

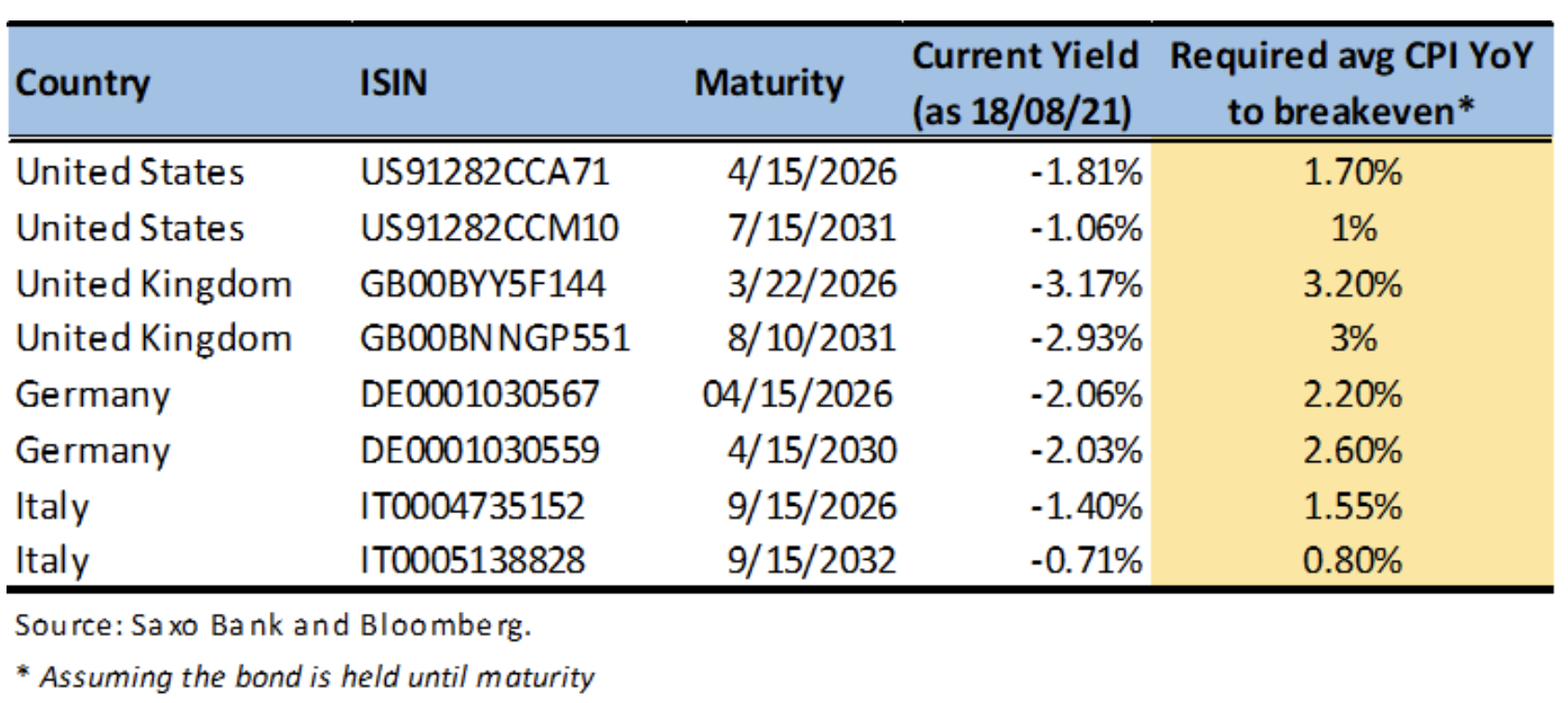

Taking the latest University of Michigan survey as our reference, let's take the average annual inflation rate over the next five years at 3%.

Currently, the five-year TIPS (US91282CCA71) offers a profitability of -1,8%. If we were to buy these bonds today and hold them to maturity, the annual total return would be 1,25%, or about 6% for the entire holding period.

The problem arises when it is necessary to sell the bonds before the maturity date. Let us assume that five-year real yields increase to 0%. If it is necessary to sell bonds within one year, the total return will be -4,6%.

Therefore, if we are concerned with hedging against inflation, TIPS may still perform well in a diversified portfolio. However, it may turn out that it will be necessary to hold them until maturity in order not to suffer losses amid rising interest rates. To that end, it may be wiser to invest in TIPS directly than to purchase them through funds.

Don't touch UK inflation-linked government bonds

In the case of hedging against inflation in the UK, the situation is quite depressing. Investors in UK inflation-linked government bonds will suffer losses, even if rates remain at their current record lows.

UK five-year inflation-linked government bonds (GB00BYY5F144) offer a yield of -3,2%. If they were kept to maturity with annual inflation over the next five years averaging around 3%, the investor would still suffer a small loss of -0,60%.

Nevertheless, the consensus assumes that inflation will normalize below 3% this year. The UK CPI (y / y) is projected to be 2,1% in 2021, 2,4% in 2022 and 2% in 2023. In this case, the loss of investors in UK five-year inflation-linked government bonds would be bigger. For the purchase of five-year inflation-linked bonds to be justified, inflation over the next five years should be around 3,2% annualized.

So while buying UK inflation-linked government bonds seems like a reasonable hedge, it doesn't make sense to keep them at current levels.

Arguments for inflation-linked bonds denominated in EUR

In the context of continental Europe, a number of hedges against inflation can be found depending on the country. In this analysis, we look at German and Italian inflation-linked bonds, respectively the most expensive and the cheapest European hedge against inflation. In both cases, they hedge against inflation in the euro area and are linked to the Eurostat Eurozone HICP Ex Tobacco index.

While real yields are clearly negative, the annual average inflation rate required to break even is significantly lower than that of comparable UK bonds. For the five- and ten-year German indexed government bonds, inflation should be 2,20% and 2,60% per annum, respectively.

The much cheaper Italian inflation-linked bonds offer better protection against inflation. If held to maturity, the five- and ten-year BTPS will break even with annual average inflation of 1,55% and 0,8% respectively.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-300x200.jpg?v=1709556924)