Is AI the new crypto? – Saxo Bank forecasts for QXNUMX

Enthusiasm about AI has made the technology the investment of choice: capital is pouring into AI companies, pushing cryptocurrencies more and more to no man's land as the number of people investing in the once favorite in the speculative space dwindles. Although both of these investments enjoy diametrically different interest, there are striking similarities between artificial intelligence and cryptocurrencies. If the situation comes full circle, there will be a departure from AI in favor of speculative bubbles.

The cryptocurrency market is volatile, largely unregulated, has a limited trading history, and there are currently heated discussions about whether cryptocurrencies still have any intrinsic value. Regardless of the position on the issue, there is broad consensus that these attributes make the cryptocurrency market stand out from most other markets. As such, cryptocurrencies are a poor benchmark against other markets; the only exceptions are speculative bubbles created by fledgling but long-awaited technologies. In this case, no other market is better suited for comparison purposes. Putting the two markets together, there are significant parallels between cryptocurrencies and the recent surge in artificial intelligence, including the seemingly one-way flow of capital to anything related to AI.

In recent years, the cryptocurrency market has witnessed this kind of one-way inflows twice before capital pools were exhausted, leading to speculative bubbles bursting. These bubbles occurred in 2017 and 2021, when value Bitcoin, Ethereum and various other cryptocurrencies rose sharply, and then fell by as much as 90% the following year. During this period, not only did prices rise, but crypto enterprises and companies were able to raise funds with ease as everyone wanted to enter the market - then suddenly everyone seemed to lose interest and only a handful of investors remained in the crypto market.

CHECK: How to invest in artificial intelligence? [Guide]

At what point does the collective imagination of the market end?

Both cryptocurrencies and artificial intelligence have great prospects for the future as key technologies for an ever-growing number of people. While acknowledging that we share this view, we must also acknowledge that both cryptocurrencies and AI have yet to be deployed on a large scale around the world, showing limited potential to generate value for now. Worse, there is no way to know when these technologies will reach the appropriate maturity for widespread adoption, if at all. However, it is fundamentally certain that people will overestimate the short-term importance of AI, as with most other emerging technologies, including - previously - cryptocurrencies.

Until they reach technical maturity, the market evaluates technologies de facto blindly, relying on the collective imagination. As he once said Benjamin Graham, "[n]on the speculative market, it's the imagination that counts, not the analysts". Graham, often credited as the father of value investing, probably wanted his words to be a cautionary tale for any market where judgment is based primarily on guessing the future. Because cryptocurrencies and artificial intelligence are not yet established technologies, ideas about the future win over the tangible aspects of the present, so instead of relying on specific data and numbers, market participants let their imagination shape the perception of the industry's future impact on the world, and subsequently - its values. This picture is likely to be very different from how AI will develop in the coming years, similar to how it has happened many times in the case of cryptocurrencies.

Moreover, this judgment is primarily guided by retail investors. The group was largely absent during the AI rally earlier this year as many retail investors reduced their stock holdings after a major interest rate hike, but they seem to be making a comeback in recent months, particularly for stocks related to artificial intelligence. We anticipate that the influx of retail investors into AI will continue, gradually transforming the technology into a new favorite among retail investments, as this group favors markets with a higher risk-reward ratio, similar to cryptocurrencies and meme stocks, where retail investors are dominant. The significant presence of this group driven by the fear of missing out (the so-called fear-of-missing-out, FOMO) in a market shaped by the imagination means a cocktail in which promising speculative bubbles may appear.

We'd be surprised if this cocktail didn't include at least one significant disadvantage of AI-related tradables, as with cryptocurrencies and in particular the dot-com bubble of the late XNUMXth century. as the technology is maturing slower than expected, while other challenges are materializing, including regulatory uncertainty, which, as with cryptocurrencies, is likely to negatively affect the field of AI. In addition, with the exception of a select few companies, not knowing the extent to which individual companies are able to capture AI-generated value increases uncertainty, potentially exacerbating additional volatility.

"During the Gold Rush, Sell Your Shovels"

One of the few companies that has already demonstrated its ability to capture the value of artificial intelligence is the GPU maker Nvidia. As a leading provider of computations needed to train AI models (such as those developed by OpenAI), Nvidia saw a marked increase in revenue last year, primarily due to the drive by enterprises to purchase GPUs as part of the AI frenzy. In late May, Nvidia announced that it expected revenue of $2023 billion in Q11 7,18, well above the average analyst forecast of $1 billion. As a result of this pooling of AI resources, the company's valuation exceeded $2022 trillion, which only five other entities managed to do, quadrupling the share price compared to the annual low of October XNUMX. Increase in market capitalization Nvidia by USD 750 billion compared to USD 250 billion less than 12 months ago, it is a clear signal that artificial intelligence is a speculative market where investors' imagination has convinced them that something really big is coming.

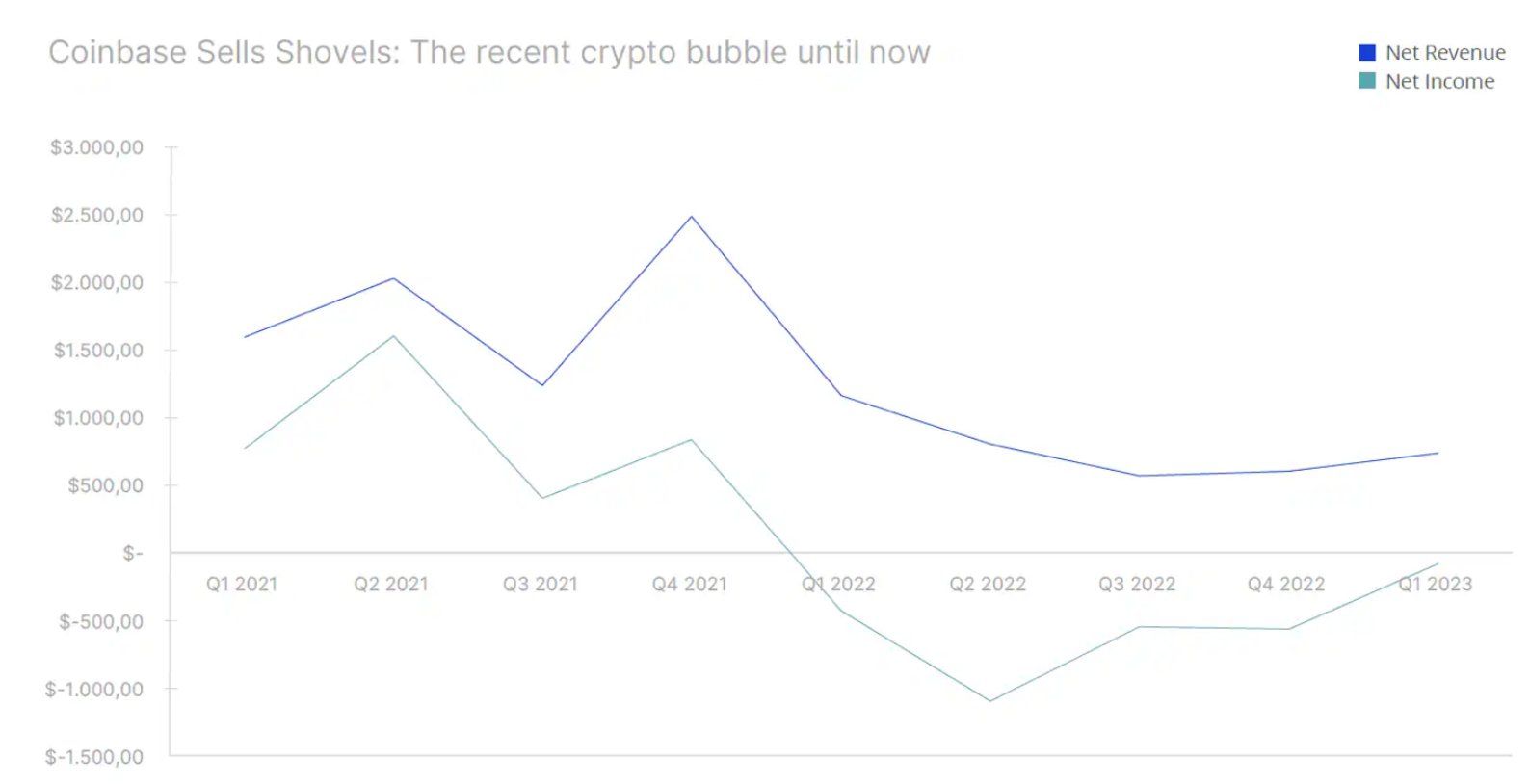

Nvidia history illustrates the saying "during gold rush, sell shovels". This suggests that it is more cost-effective to provide the required infrastructure to those who follow a booming trend than to follow it alone. During the 2021 cryptocurrency rush, Coinbase profited heavily from the sale of pickaxes and shovels, facilitating cryptocurrency trading, much like Nvidia is doing now. After some time, the cryptocurrency bubble burst, significantly reducing Coinbase's revenue and causing the company's share price to fall by up to 90% in just one year. Time will tell if Nvidia will stay on the wave of an endless gold rush or will follow Coinbase's lead as the saying goes "The greater the success, the more painful the fall".

About the author

About the author

Mads Eberhardt, Cryptocurrency Market Analyst, Sax Banks. Cryptocurrency Market Analyst at Saxo Bank. He gained experience as a trader at Bitcoin Suisse AG and founder http://BetterCoins.dk (website taken over by Coinify).

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![STI 30 – Singapore Stock Exchange – Does a great country also mean a great index? [Guide] singapore stock exchange sti 30 singapore](https://forexclub.pl/wp-content/uploads/2024/05/singapurska-gielda-sti-30-singapur-184x120.jpg?v=1715232642)

![CRB index – one of the popular commodity market benchmarks [Guide] crb index](https://forexclub.pl/wp-content/uploads/2024/05/indeks-crb-184x120.jpg?v=1715055656)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response