Stable business and dividends - How to invest in Euronext? [Guide]

In the following cycle, we will present the activities of the largest stock exchanges. Many of the entities we intend to characterize are public companies. For this reason, they can be an interesting investment idea. Stock exchanges are interesting and in most cases very profitable businesses. Therefore, it is worth presenting the operational and financial activities of these companies. In today's article we will answer the question is it worth it and how to invest in Euronext and what the operational activity of this company looks like. After reading this article, the reader will learn about:

- What is Euronext,

- Stock exchange history,

- What are the company's business branches,

- What is the financial situation of the enterprise.

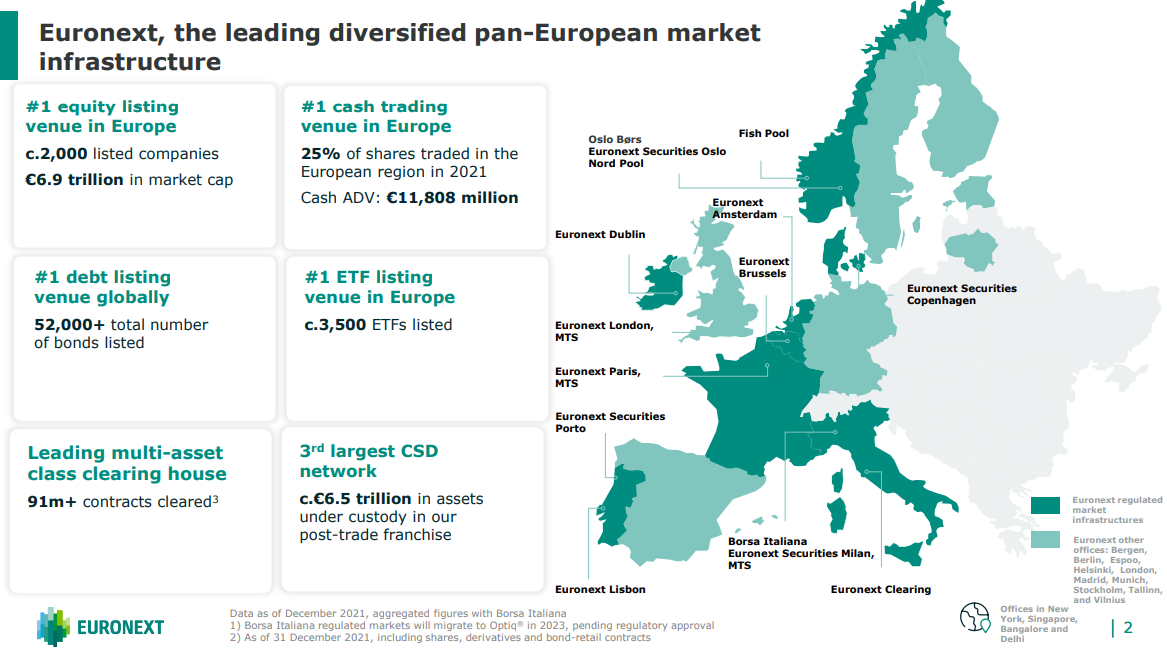

Source: Euronext NV investor presentation

What is Euronext

Euronext NV is a pan-European stock exchange that in recent years has been a consolidator of the European stock exchange market and companies operating in the post-trading segment. It offers its clients the opportunity to trade on 7 European markets. Euronext provides stock trading, ETFs, warrants, investment certificates, bonds, commodities, derivatives and currencies. The company is one of the largest bond and listed fund trading venues in the world. At the end of December 2021, over two thousand companies with a total capitalization of more than EUR 6 billion could be traded on the exchanges associated with Euronext.

In addition, the platform provides the opportunity to raise capital by small and medium-sized companies by offering Euronext Growth and Euronext Access. It is also worth mentioning that Euronext is also the majority shareholder in the Nord Pool electricity exchange. Through its subsidiary (Oslo Børs), Euronext controls the Fish Pool exchange, where salmon futures are traded.

Euronext develops services indirectly related to asset trading on the stock exchange [incl. clearing services or CSD (Central Securities Depository) offer]. As a result, an increasing percentage of revenues is not related to trading on stock exchanges. This causes the revenues to become more stable, which helps to better manage the costs of the enterprise.

The history of Euronext

2000 - 2007: The beginnings

Although the alliance of exchanges itself was established in 2000, the origins of exchanges in individual countries date back to really ancient times. For example, the Bruges Stock Exchange was founded in 1285, the Antwerp Stock Exchange was established in 1485, and the Amsterdam stock exchange dates back to 1602.

Euronext was established in connection with the planned close cooperation between London Stock Exchange (LSE) and Deutsche Börse (DB). The plans to merge these two European giants were heard at the turn of the XNUMXth and XNUMXst centuries. The potential merger of these exchanges would mean that Europe would become the largest trading venue for European equities. This would undermine the position of local European exchanges that would most likely be marginalized in the long term. For this reason, there was an initiative to face the LSE-DB alliance.

In April 1999, the concept of an alliance between the stock exchanges in Paris, Zurich, Madrid, Brussels, Amsterdam and Milan appeared.. The Madrid Memorandum announced the creation of the largest stock trading platform in Europe. The problem was the prestige of individual exchanges and the division of shares in the new company for shareholders of various exchanges. As a result, on September 22, 2000, only 3 exchanges merged: the Amsterdam, Brussels and Paris stock exchanges. Of course, each of them continued to operate and "competed" in the IPO market. The combination of the three securities trading venues was in line with the visible trend of further integration of European financial markets. This was helped by the introduction of a new common currency - the euro. An alliance of two "Medium players" (Paris, Amsterdam) and one "Little" (Brussels) created a large player on the European capital market. In 2001 there was an IPO of Euronext.

Along with the increase in the scale of operations, there was an appetite for increasing market shares. In December 2001, Euronext took over LIFFE (London Financial Futures and Options Exchange). Following the acquisition, LIFFE was renamed Euronext LIFFE. In 2002, the stock exchange alliance began to expand. Merged with Bolsa de Valores de Lisboa e Porto (BVLP), the Lisbon Stock Exchange. In the next two years, the integration of trading in cash products (NSC platform) and derivatives (LIFFE CONNECT) was also introduced. This has created more competitive pricing conditions for funds investing in various European stock markets. The dynamic development of the Euronext exchange has attracted the attention of larger players. Two heavyweight players stood up to fight for its takeover: NYSE (owner of the New York Stock Exchange) and Deutsche Börse.

Deutsche Boerse. Source: wikipedia.org

The fight between the two stock exchanges was very fierce and ended after a few months of voting by stock exchange shareholders (98,2% for the takeover) - the NYSE turned out to be the winner. One of the reasons the NYSE offer was chosen was the chance for greater autonomy. Some shareholders feared that after the takeover, the Frankfurt Stock Exchange will marginalize the European rival. The choice of the US stock exchange also had a greater chance of approval by EU regulators. The transaction was finalized on April 4, 2007. The new company was renamed NYSE Euronext. The Americans had plans to join the Milan stock exchange alliance, but the transaction was ultimately not concluded.

2008 - 2012: Frankfurt does not lose its appetite

Deutsche Börse was constantly trying to take over NYSE Euronext by sending two offers. The first one took place in 2008 and the second one in 2009. Both were just "stalkers" and did not end with larger negotiations. The stock exchange in Frankfurt am Main did not say the last word. In 2011, talks about the merger of the New York Stock Exchange with Deutsche Börse began. After obtaining the shareholders' consent, another, more difficult stage followed: talks with regulators. The combination of these two entities would create the largest stock exchange in the world. This aroused the vigilance of regulators who feared too much concentration of trade. On December 22, 2011, American regulators gave the green light. They did not find any violations rights antitrust. EU officials were the problem. In their opinion, the merger created the risk of creating a quasi-monopoly on the EU securities market. As a result, on February 1, 2012, the European Commission rejected the request for permission to merge the two exchanges. The appeal by the Frankfurt Stock Exchange was rejected.

2012-2014: re-ownership change

Another change of ownership took place in 2012, when the Intercontinental Exchange purchased NYSE Euronext for $ 8 billion. Pursuant to the terms of the takeover, Euronext shareholders could decide whether they would like to receive for 1 share:

- 33,12$

- 0,2581 Intercontinental Exchange (ICE) Stocks

- $ 11,27 + 0,1703 ICE shares

The merger of ICE with NYSE was due to the fact that both entities specialized in other areas of the market. ICE generated most of its income from trading in commodities, while the NYSE specialized in trading in stocks and bonds. As a result, the merger quickly obtained regulatory approvals. For the Intercontinental Exchange, the most important part of the merger was to increase its share in the US market. Euronext itself was to be partially sold (i.e. exchange: Paris, Amsterdam, Lisbon and Brussels).

Despite the turmoil related to the ownership changes, Euronext continued to expand its product offer. Enternext was founded in May 2013. It was a subsidiary that was supposed to help small and medium-sized companies make their debut on Euronext.

2014 - 2020: spin-offs and further expansion

ICE decided to carry out spin-off, or exclusion of Euronext from its structures in order to carry out its IPO (i.e. stock market debut). Before the debut, a series of intra-group transactions were carried out. The most important transaction was the shutdown of Euronext.LIFFE and its transfer to ICE (renamed ICE Futures Europe).

In order to stabilize the quotations, part of the shares was sold to a consortium of 11 investors who decided not to get rid of Euronext shares for 3 years (the so-called lockup). Investors include: Euroclear, BNP Paribas, BNP Paribas Fortis, Société Générale, Caisse des Dépôts, BPI France, ABN Amro, ASR, Banco Espirito Santo, Banco BPI and Belgian Federal Holding and Investment Company (SFPI / FPIM).

In June 2014, EnterNext signed a partnership with Morningstar for analytical coverage of small and medium-sized enterprises (SME) and companies from the TMT (telecomunications, media and technology) sector. This was to allow individual investors to obtain extensive analyzes of less popular companies.

The following years are marked by development through acquisitions. Thanks to them, Euronext has become more diversified in terms of products and geography. In August 2017, the company acquired FastMatch - currency trading platform. The company paid € 90 million for the 153% stake. FastMatch managers retained 10% of the company. The acquisition allowed Euronext to diversify its source of income. In 2019, FastMatch was renamed Euronext Fx.

In March 2018, Euronext announced the acquisition of the Irish Stock Exchange. The acquisition cost the company € 137 million. The transaction beyond geographic diversification allowed the group to introduce cost synergies of € 6 million per year. In 2016, ISE generated revenues of € 29,4 million, achieved € 9,6 million in EBITDA and € 8 million in net profit. This meant that the company paid a P / E ratio of 17,1 for ISE.

Another acquisition took place in June 2019. This time, the Oslo Stock Exchange was purchased. The transaction was much larger than the previous ones. It closed at over $ 780 million. The acquisition was not without its problems. An American competitor is among those willing to buy the Norwegian stock exchange - Nasdaq.

This was not the end of the acquisitions. In December 2019, Euronext acquired 66% of shares in Nord Pool, one of the largest electricity exchanges in Europe. At the time of the transaction, the economic value of the company was estimated at € 84 million. Nord Pool was then active in 14 markets and had a strong position in the Scandinavian and Baltic countries. In 2018, Nord Pool generated revenues of around € 80 million. The transaction allowed Euronext to diversify its product mix and a chance to fight more effectively for shares in the energy market with Deutsche Börse.

Another takeover took place in April 2020, when Euronext announced the purchase of approximately 70% of the DCSD (Danish Central Securities Depository). The transaction increased the business segment related to post-transaction services. At the time of the acquisition, the DCSD was valued at € 150 million.

Takeover of the Milan Stock Exchange

Despite the large number of acquisitions in 2017-2020, Euronext continued to look for opportunities for further purchases. This happened in 2020. Sales negotiations between LSEG (London Stock Exchange Group) and Euronext began in the second half of 2020 the Milan Stock Exchange. The transaction was to involve a subsidiary of London Stock Exchange Group Holdings Italia SpA LSEG decided to sell the Milan stock exchange due to regulatory requirements. Due to the acquisition of the data provider Refinitiv by the London Stock Exchange Group, the London Stock Exchange had to sell some of its assets.

As part of the acquisition, Euronext estimated that it would generate synergies worth around € 3 million within 60 years. Including € 45 million related to cost savings and € 15 million of additional revenues related to cross-selling.

The transaction for the sale of the Milan stock exchange was valued at € 4 million and the funds for this purpose were to be organized as follows:

- € 0,3 billion of cash owned by the company,

- EUR 1,7 billion obtained by Euronext from the loan,

- Approximately € 2,3 billion obtained from the participation of other investors (including Intensa Sanpaolo and CDP Equity [Cassa Depositi e Presiti]) and the current shareholders of Euronext.

The transaction increased the company's debt, but the management board believes that the net debt to EBITDA level will fall below 3 at the end of 2022.

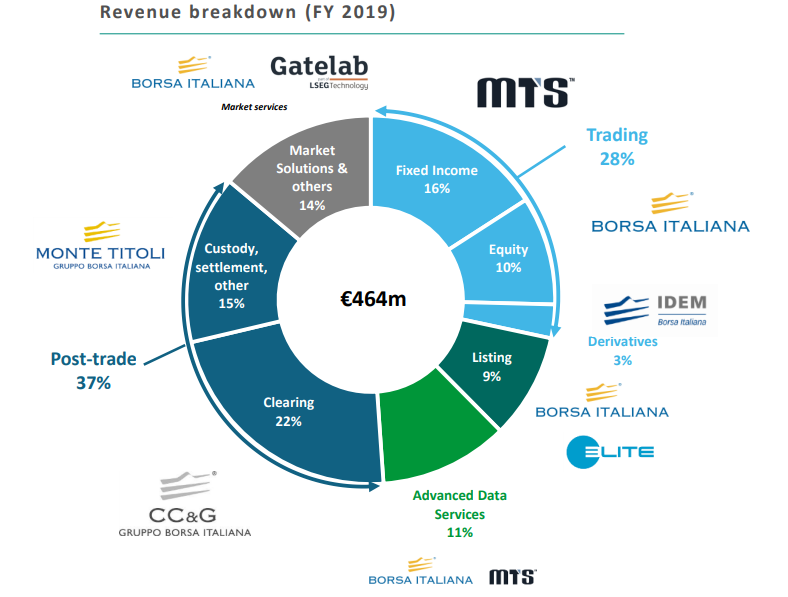

The mere acquisition of the Milan stock exchange meant that Euronext strengthened its position on the European stock exchange market. There were 370 companies listed on Borsa Italiana alone, most of them from the SME segment (small and medium-sized companies). The total capitalization of companies listed on this stock exchange exceeded € 600 billion. The group also included the MTS trading platform, which enables trading in debt securities. The package with the stock exchange and the platform also included the clearing segment and the securities depository. Post trading services generated approximately 37% of Borsa Italiana's revenues.

Source: presentation for investors of Euronext NV

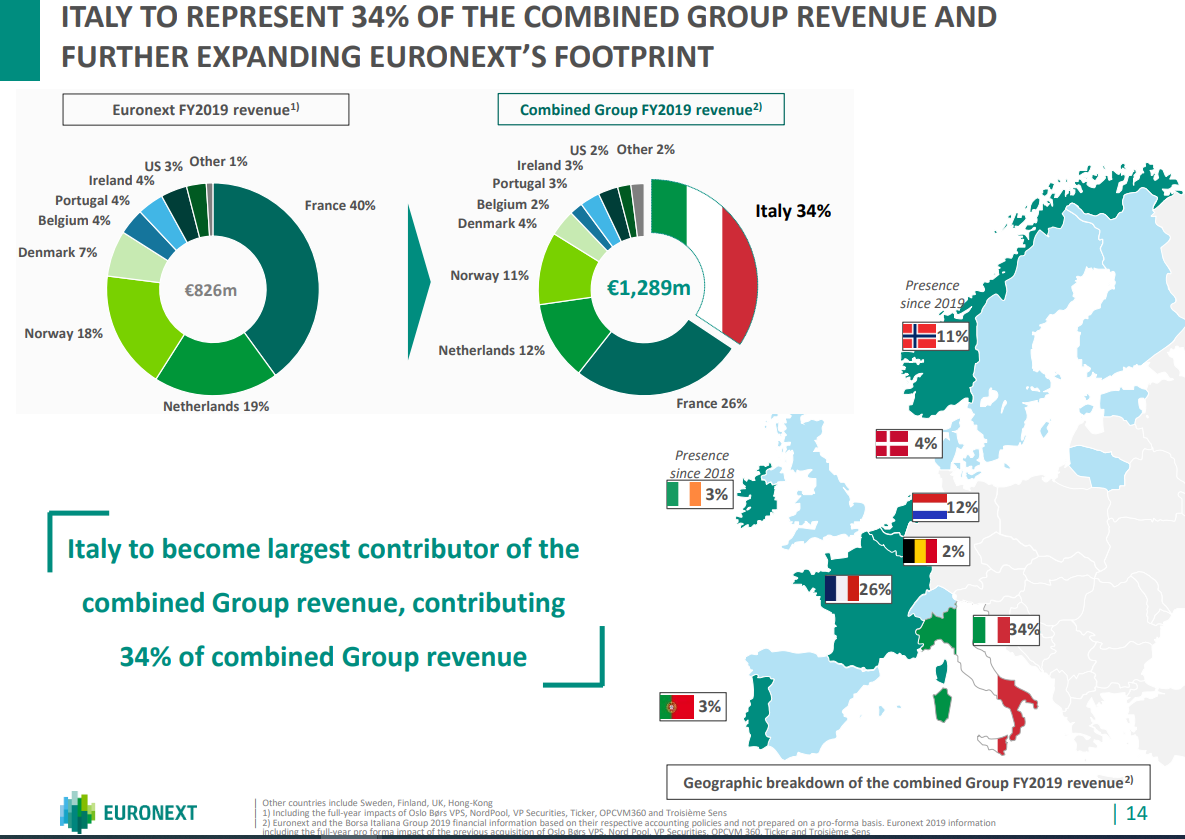

Following the transaction, the Italian subsidiary was to be responsible for more than 33% of the combined company's revenues. Euronext has become the largest stock exchange in Europe in terms of cash turnover on the stock market and was second in terms of ETF trading in Europe. At the end of 2021, around 3 ETFs were traded.

Source: presentation for investors of Euronext NV

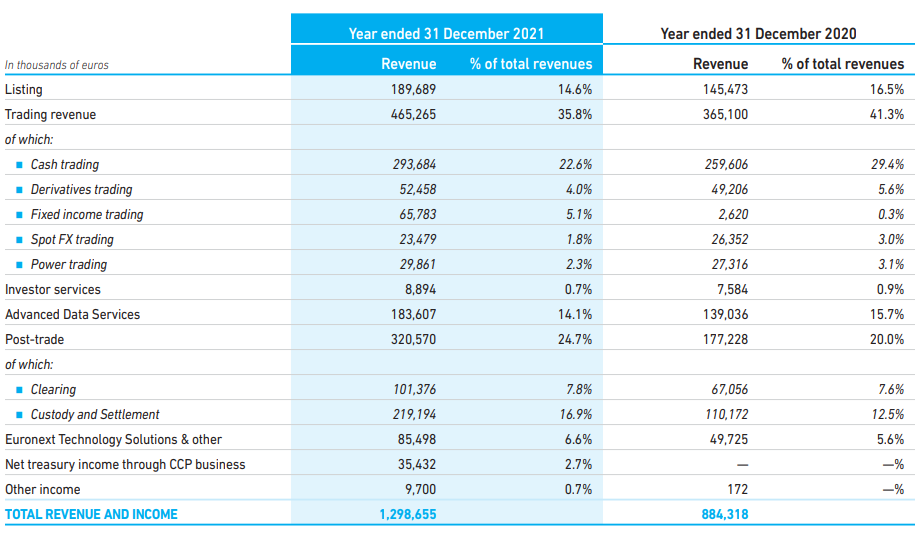

Thanks to the transaction, Euronext significantly improved its position on the market of depository and clearing services. Bond trading revenues also appeared in the revenue mix. On the other hand, the share of revenues from trade on the cash market decreased from 25% to 20%.

Euronext - detailed information

About 7 companies are listed on 2000 stock exchanges owned by the company. At the end of December 2021, the market capitalization of all companies listed on Euronext was € 6 billion. Additionally, about 900 products classified as warrants and investment certificates are listed on the stock exchanges belonging to the company. It is the 110nd largest market of this type in Europe.

Euronext is also the leading derivatives market (futures and options) in Europe. The company's portfolio includes derivatives on CAC 40 (main index in France). The CAC 40 futures contract is the second most traded instrument of its kind in Europe. The company also has a highly developed portfolio of derivatives based on raw materials and agricultural products.

Euronext also has exposure to the bond trading market. The pearl in the crown is the MTS trading platform. 52 instruments are traded on Euronext. MTS is the largest European platform for trading European government bonds in the D000D (Dealer-to-Dealer) model. It is also a leader in the Italian repo market. MTS is also the 2rd largest platform enabling European government bonds in the D3C (Dealer-to-Client) model.

Euronext FX is a platform of the type ECN (Electronic Communication Network) enabling trade in currencies or precious metals. The platform is powered by FastMatch technology which gives clients access to a liquid market held by multiple liquidity providers. The Euronext FX offer is used by banks, hedge funds, prop trading companies and retail brokers.

Euronext must endeavor to encourage market participants to use its platform. One of the programs that helps to direct traffic to Euronext exchanges is the SLP (Supplemental Liquidity Provision) program. The program rewards liquidity providers who ensure low spreads and high quality order execution regardless of size.

Euronext is also developing its technological solutions. The flagship product is the Optiq platform. It is a solution that replaces the UTP (Euronext Universal Trading Platform) solution. From July 2017, the solution it is used for trading in cash and derivative solutions. A year later, the solution was implemented for trading on the debt instruments market. In 2019, Euronext Dublin fully implemented the Optiq solution. In turn, the Norwegian stock exchange also migrated to Optiq within 17 months of the takeover. In 2023, trading on the stock market and derivatives on the Milan Stock Exchange will also move to the new trading system.

Management

The company's CEO is Stephane Boujnah, who has served since 2015. Previously, Mr. Stephane worked in senior positions at companies such as Deutsche Bank, Credit Suisse and Santander Global Corporate Banking. It is worth mentioning that for two years he cooperated with the French Ministry of Economy (1997 - 1999).

Most of the heads of local exchanges have been in office for many years. The exception is Ms Delphine d'Amarzit, who took the position of CEO of the Paris Stock Exchange in May 2021. Before taking up this position, she worked as Deputy CEO at Ornage Bank (2016-2021).

Source: Euronext company report for 2021

Shareholding

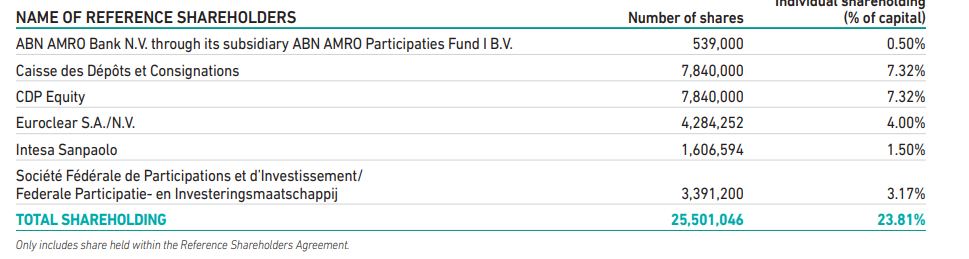

In Euronext's shareholder structure, approximately 23,8% of the shares are held by so-called reference shareholders (ie RS). The largest shareholders in this group include CDP Equity and Caisse des Depots et Consignations. Both companies have a 7,32% stake in the company. Each of the shareholders included in RS undertakes not to sell the shares until the term of the agreement signed between RS and Euronext. The current contract will expire in 2024. It is worth mentioning that contracts with RS are regularly extended, but often with a different composition. The aforementioned group of shareholders is entitled to 3 seats on the Supervisory Board of Euronext.

Source: 2021 annual report

The other shareholders are very fragmented. None of them have sufficient stake to significantly influence the shape of the supervisory board or the composition of the senior management. Such a situation may not appeal to investors who prefer the shareholding structure of the majority owner who can create a long-term strategy for the company's operations.

Business segments

Euronext NV's revenue is highly diversified. Nevertheless, revenues from trading in financial instruments are still dominant. This area of activity accounted for approximately 36% of the company's revenues. In this segment, the most important thing is trade on the cash market, which accounted for 22,6% of the company's total revenues. Euronext is a leader on the stock market in 7 markets which include: Belgium, France, the Netherlands, Portugal, Norway, Ireland and Italy. According to the data prepared by the company, about 71% of the turnover on these markets was carried out by the Euronext ecosystem.

Source: 2021 annual report

The company has a strong presence in the European blue-chip market. 58% of the components EUROSTOXX 50 is listed on stock exchanges belonging to the alliance. In the case of Euro STOXX 600, as much as 32% of companies are listed on stock exchanges belonging to Euronext. The analyzed company is also in the first place in Europe in terms of capitalization of domestic companies and is the European leader in terms of average daily turnover.

Trading in derivatives and debt securities accounted for approximately 9% of revenues. Trading in bonds and bills takes place mainly on the MTS platform, which was acquired "in a package" with the Milan stock exchange. Trading in derivatives is focused on futures and options. Very high liquidity is visible in derivatives on such indices as AEX or CAC 40. Euronext introduced derivatives to pan-European indices such as FTSEEurofirst or FTSE EPRA / NAREIT (exposure to the real estate market). In 2021, the nominal value of the concluded futures contracts exceeded € 5 billion. On the other hand, the average nominal value of contracts concluded during each session exceeded € 100bn. In addition to trading in derivatives based on indices and shares, the offer also includes electricity derivatives and agricultural commodities. There are even salmon futures on offer.

Euronext is constantly developing its activities related to post-trading servicesi. The company has a minority stake in an entity that performs this type of service on a global scale - LCH SA. Euronext owns 11% of the company's shares. Euronext also has a minority stake in Euroclear SA. In addition, the owner of 7 European exchanges develops its clearing services, which currently operate under the name Euronext Clearing (formerly CC&G).

Advanced Data Services (ADS) is another part of Euronext's business. It is an activity related to providing real-time data and historical data. The data applies to both the cash and the futures market. Clients using the services of Euronext are both the largest investment banks and individual investors (through Live.Euronext.com or through brokerage houses). The actual data relates to information on both the buying and selling prices, the transaction price or the so-called order book. The data is "packaged" into various products that are purchased by customers depending on their needs. Of course, the more detailed the data, the higher their price. An e-commerce platform has been operating since 2018, which enables individual investors to acquire data online. Recently, Euronext expanded its offer with data on the bond market and funds. In 2019, Euronext introduced Market Flow to its offer, which shows daily inflows to the order book. In addition, the possibility of performing extensive analyzes based on anonymised and aggregated data has been introduced.

Indexes are another group of products included in Advanced Data Services. Euronext has a wide range of benchmarks that are used by both ETFs and actively managed funds. The most frequently used indices are: CAC 40, AEX and MIB. Euronext is constantly developing new indices to meet customer expectations. The ESG indices segment is developing particularly dynamically. In 2021, the company introduced 20 indices of this type. One of them was the CAC 40 ESG Index. The MIB ESG Index, the first of its kind for Italian blue chip companies, was also introduced.

Financial results

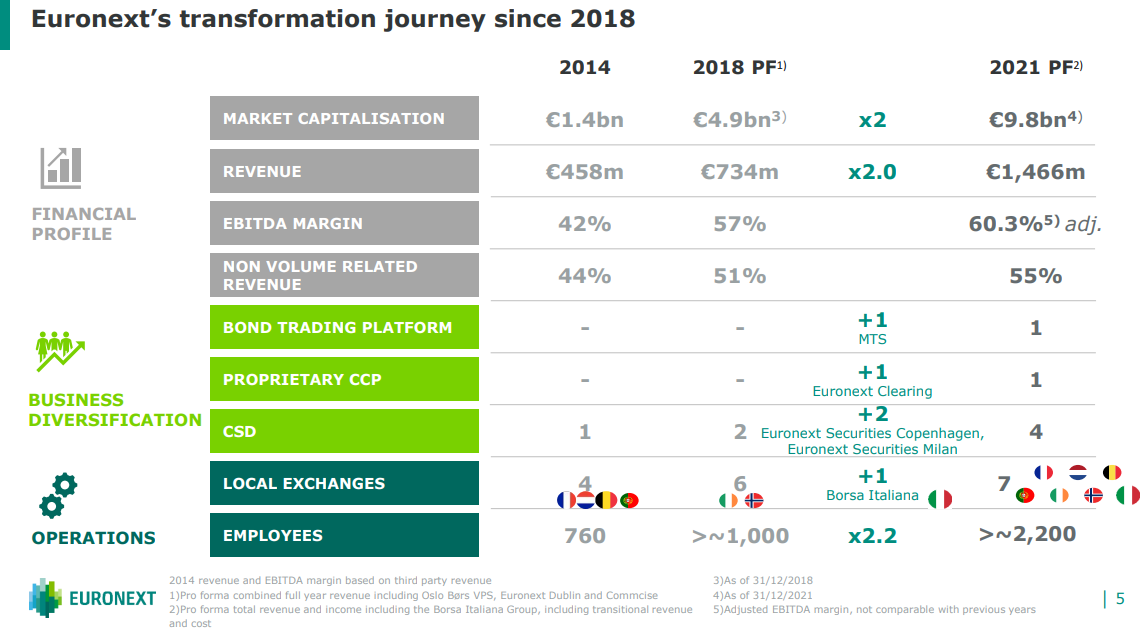

Since its debut on the stock exchange in 2014, Euronext has significantly expanded its operations. This can be seen in the number of stock exchanges owned by the company, capitalization of listed companies or revenues. What's more, despite the increase in the scale of the business, the company managed to significantly improve the margin EBITDA. This means that there is operational leverage in the company.

The expansion of the company into areas of activity that have so far been "blank spots" is also significant. It is enough to mention having a bond trading platform (MTS) or a clearing segment. It is noteworthy that the company increases the share of revenues that do not depend on trading on the stock exchange. As a result, the company's revenues are more predictable and allow for a better adjustment of the cost structure.

| € million | 2018 | 2019 | 2020 | 2021 |

| revenues | 615,0 | 679,1 | 884,3 | 1 288,9 |

| Operational profit | 330,9 | 355,7 | 460,8 | 627,7 |

| Operating margin | Present in several = 53,80% | Present in several = 52,38% | Present in several = 52,11% | Present in several = 48,70% |

| Net profit | 215,9 | 221,9 | 315,5 | 413,3 |

Source: own study

As you can see, the company is regularly increasing its scale of operations. As a result, revenues and net profit are growing. Interestingly, Euronext still maintains a very high operating margin, which ranged between 2018% -2020% in 52-53.

| € million | 2018 | 2019 | 2020 | 2021 |

| OCF * | 223,5 | 253,8 | 278,0 | 543,7 |

| CAPEX ** | 22,3 | 26,1 | 19,2 | 67,6 |

| FCF *** | 201,2 | 227,7 | 258,8 | 476,1 |

Source: own study / * OCF - operating cash flow, ** CAPEX - capital expenditure, *** FCF - free cash flow (FCF = OCF - CAPEX)

Cash flows from operating activities grew each year, in line with increasing net profits. Low investment outlays are a characteristic feature of this type of business. Euronext does not need production plants or large warehouses. Thanks to this, the increase in the business scale does not entail the necessity to drastically increase capital expenditures. However, the organic growth itself for such a mature company is moderate: it amounts to several percent. For this reason, if a company wants to grow faster, it is doomed to take over. The recent acquisition of the Milan stock exchange caused the company to be heavily indebted:

| € million | 2019 | 2020 | 2021 |

| Cash | 369,8 | 629,5 | 804,4 |

| Interest debt | 1 073,4 | 1 331,7 | 3 133,4 |

| Net debt | 703,6 | 702,2 | 2 329,0 |

| EBITDA | 399,4 | 518,6 | 753,5 |

| Net debt / EBITDA | 1,76 | 1,35 | 3,09 |

Source: own study

The pace of acquisitions can be expected to slow down in the coming years so as not to increase the debt level of Euronext NV too much. Despite this, the company still intends to share its profits with shareholders and pay dividends on a regular basis. This is due to the fact that Euronext has a very stable business model and does not have strong competition in its local markets. Only the slowdown in the IPO and market segments and the bear market in the market may be worrying. During the bear market, the number of new IPOs, attracting investors' attention, declines. Additionally, the bear market causes funds to struggle with capital outflow, which reduces their assets under management. A drop in prices causes the turnover on the stock exchanges to decline, which affects the revenues dependent on the turnover.

However, the bear market and weaker economic conditions are only a temporary obstacle to the further development of Euronext's business. In the next 5-10 years, the company should increase its revenues and profits. Along with them, the dividend per share will also grow. Thus, dividend investors may be interested in investing in Euronext.

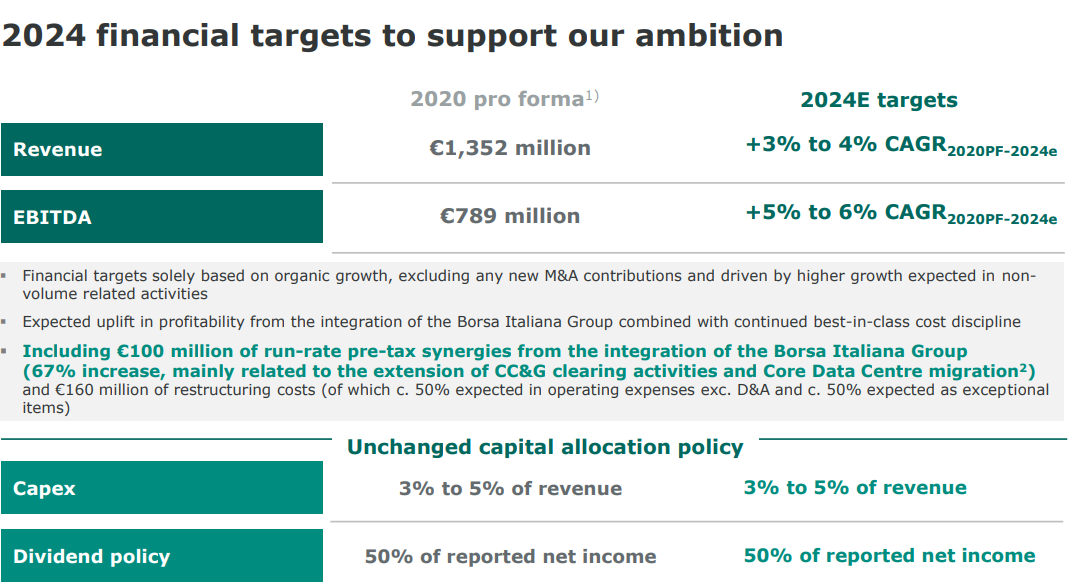

Strategy 2024

Despite the dynamic development, Euronext believes that it still has room for further growth. In addition to focusing on revenue growth itself, the company intends to increase operational efficiency. As a result, the assumed organic growth rate of revenues (3% -4%) is lower than the forecast average annual increase in EBITDA (5% -6%). The reasons are to be, among others synergies as a result of the acquisition of Borsa Italiana and the development of the clearing segment. Moreover, the transition of all exchanges belonging to Euronext to the Optiq transaction system will help in optimizing costs. On the other hand, capital expenditure (CAPEX) will be maintained, which will amount to approximately 5% of revenues each year. The company intends to provide approximately 50% of its net profit to shareholders in the form of dividends every year.

Source: presentation on the company's strategy until 2024

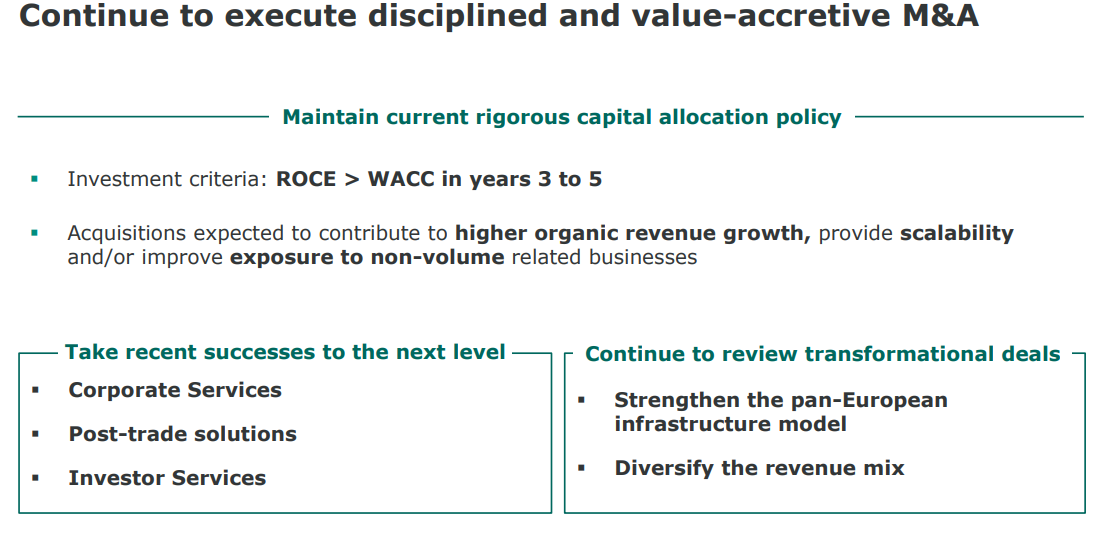

A sound capital management policy is helpful in sustainable development. As a result, Euronext does not take over all entities available for sale. It is very important for the company's managers that the acquisition or new investment has a higher return on the invested capital than the weighted average cost of capital.. The acquired company should ensure scalability of operations and, ideally, it would diversify the product mix. Euronext will be looking for companies to take over whose revenues will not depend on the stock exchange turnover. Segments with services for corporate clients, post-trading solutions and products for investors are preferred.

Source: presentation on the company's strategy until 2024

How to invest in Euronext?

Currently, most brokers provide their clients with the opportunity to invest in foreign markets. However, instead of choosing the first broker from the edge, it is better to look for one that offers favorable commissions or access to a wide group of products.

The easiest way to invest in Euronext is to buy the company's shares on one of the available markets. The company is listed on the Paris Stock Exchange (nota bene owned by Euronext NV). When purchasing shares, the investor must be aware of the currency risk as the company's shares are priced in Euro. Another potential problem is the necessity to settle the tax on capital gains from foreign markets and the payment of the tax on dividends.

You can also invest in Euronext using futures or contracts for difference (CFDs). This gives you the opportunity to take advantage of financial leverage. It is also possible to invest both on the long (play on highs) and short (play on downs) side of the market. Of course, investing with futures requires good preparation. It is necessary to have a proven investment strategy and investment risk management skills.

How else to invest in Euronext? One of the ideas is investing in options for this company. This solution has a number of benefits. Thanks to the options, you can build a strategy tailored to your own investment needs and risk profile. Examples include such strategies as: covered call, protective put, collar, bull spread or bear spread. Another solution is to treat options as a safe instrument to invest in the long term. An example is the purchase of long-term call options (LEAPS). Thanks to them, you can take advantage of the financial leverage with a limited potential loss (premium paid).

Just finding an instrument that will allow you to invest in Euronext is definitely not enough to make an investment decision. It is much better to get to know the history of the company and its activities in order to form your own opinion about this company.

Euronext chart, interval W1. Source: xNUMX XTB.

Forex brokers offering stocks, CFDs on stocks and options

How to invest in Euronext in practice? Of course, the simplest option is to buy the shares themselves, but we also have the choice of CFDs on shares, which allow you to trade both on increases and decreases in price, and with the use of leverage. In addition, we can use the options that are available in the offer Saxo Bank.

For example on XTB Today, we can find over 3500 equity instruments and 400 ETFs, a Saxo Bank over 19 companies and 000 ETF funds.

| Broker |  |

|

|

| End | Poland | Denmark | Cyprus * |

| Number of exchanges on offer | 16 exchanges | 37 exchanges | 24 exchanges |

| Number of shares in the offer | approx. 3500 - shares circa 2000 - CFDs on shares |

19 - shares 8 - CFDs on shares |

approx. 3 - CFD on shares |

| The amount of ETF on offer | approx. 400 - ETF approx. 170 - CFD on ETF |

3000 - ETF 675 - CFD on ETF |

approx. 100 - CFD on ETF |

| Commission | 0% commission up to EUR 100 turnover / month | according to the price list | Spread depends on the instrument |

| Min. Deposit | PLN 0 (recommended min. PLN 2000 or USD 500, EUR) |

0 PLN / 0 EUR / 0 USD | PLN 500 |

| Platform | xStation | SaxoTrader Pro Saxo Trader Go |

Plus500 platform |

* PLUS500 CY offer

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. From 72% to 89% of retail investor accounts record monetary losses as a result of trading CFDs. Think about whether you understand how CFDs work and whether you can afford the high risk of losing your money.

Summation

Certainly, Euronext does not fit in with the characteristics of the company - a dysruptor who changes the world. The company's revenues and profits will grow at a single-digit pace (excluding acquisitions). Therefore, it is not a company for investors looking for growth companies.

Instead, Euronext offers investors stable business, established market position and annual dividends. For this reason, people who are looking for a stable company for their dividend portfolio can invest in Euronext. So far, the company's operations are not threatened by a rapid "disruption" by fintechs. Moreover, the development in the post-trading segment slightly makes the company's revenues independent of the market situation. In the coming years, there is a good chance that Euronext will increase the scale of operations and the level of net profit per share.

The market bear market can be an interesting time to invest in Euronext. The company is currently valued at 14 times its net profit. It may not be very cheap, but well below the average of recent years.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Stable business and dividends - How to invest in Euronext? [Guide] euronext exchange](https://forexclub.pl/wp-content/uploads/2022/11/gielda-euronext.jpg?v=1667726619)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-300x200.jpg?v=1676364263)

![Stable business and dividends - How to invest in Euronext? [Guide] precious metals silver gold](https://forexclub.pl/wp-content/uploads/2020/07/metale-szlachetne-srebro-zloto-102x65.jpg?v=1595421545)

![Stable business and dividends - How to invest in Euronext? [Guide] WIG index, GPW](https://forexclub.pl/wp-content/uploads/2019/02/dukascopy-wig-20-102x65.jpg)