How to understand the lack of appetite for investments among the largest oil companies?

We reiterate our long-held view that the basics - and from a global growth perspective, also the unfortunate risks - to the long-term raw material price cycle have not disappeared. However, with inflation at the highest level in decades and attempts by central banks to contain it with aggressive interest rate increases, the boom in recent quarters has become more uneven as it is driven by scarcity of raw materials.

The Bloomberg spot commodity index hit a new record high in Q1, then entered a phase of consolidation as concerns about global economic growth grew more attention. The following key developments will set the tone in the second half of the year: 2) Russia's readiness to end the war, thereby embarking on the long road to the normalization of its raw material supply chains; 3) slowing economic growth in China in the context of its ability to stimulate the economy, which is the world's largest consumer of raw materials; 4) the strength and pace of interest rate increases in the United States and their impact on inflation and economic growth; and XNUMX) whether commodity prices, in particular in the energy sector, have reached levels that will destroy demand and rebalance the market.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

However, while the destruction of demand by high prices and lower growth due to rapidly rising interest rates may contribute to halting the boom, they will not overcome the long-term supply problem. Supply is the product of factors that are not easy to adjust, such as 1) historical bad returns on investment in raw materials, 2) a high level of volatility that makes it difficult to project future revenues and 3) environmental, social and governance (ESG) regulationswhich increasingly prevent mining and energy companies from the "old economy" from attracting investors and obtaining the necessary approvals from local authorities.

Last quarter, the industrial metals sector moved in the opposite direction to the energy sector, with a focus on fuel products and natural gas. The sector has appreciated sharply for some of the reasons mentioned above, notably the inability of producers to increase production to cope with the recovery in overall demand from China to pre-pandemic levels and more recently in the wake of sanctions against Russia. At the other end of the scale, the industrial metals sector has struggled with concerns about global growth and protracted lockdowns in China restraining the activity of the world's largest consumer of commodities.

Agricultural products

Risks and concerns about the global food crisis have not gone away. As the growing season in the Northern Hemisphere continued, some production concerns have eased but not completely disappeared. The food product boom remains at the forefront wheat and edible oils, two categories of food that are heavily dependent on supplies from war-torn Ukraine. With millions of tonnes of grains left in the silos just weeks before the next harvest, which will require storage space, forecasts for food prices will depend on the weather that is favorable for world crops and whether an export corridor from Ukraine will be established.

Precious and semi-precious metals

Both goldAnd silver i platinum they struggled in Q1,8 as the dollar strengthened and US Treasury yields rose sharply at a historically rapid pace, while the outlook for industrial demand was put into question as global economic growth slowed. It struck the silver that suffered the greatest losses. In recent quarters, traders in the gold market have identified the real yields on 300-year US bonds as a key factor shaping the price of this metal. However, this year so far, this inverse correlation is being increasingly questioned. A XNUMX% jump in real yields from the start of the year would suggest that the price of gold is over $ XNUMX too high. Meanwhile, the price of gold has remained almost unchanged on an annualized basis, which is even more impressive considering that the dollar is hitting long-term highs against a number of major currencies.

We believe gold to hedge against the rising stagflation risk - central banks will hold back economic growth before inflation is under control - as traders respond to the highest inflation in 40 years, as well as turbulence in the stock markets and cryptocurrencyare some of the reasons why the price of gold has not fallen at the pace dictated by the increase in real yields. Accordingly, we observe what investors actually do, in contrast to what they say, based on flows in exchange-traded funds.

We maintain a positive outlook for gold, given the risk of further chaos in global financial markets as higher interest rates take their toll on businesses and individuals. We maintain our prediction from before QXNUMX that after the consolidation period in QXNUMX, gold - as well as silver - will strengthen in the second half of the year, and the price of gold will eventually reach a new record high.

Industrial metals

This sector underwent a significant correction in the second quarter, mainly due to the increasingly restrictive zero-tolerance policy of Covid in China, which negatively affected the forecast of economic growth in the country which is the world's largest consumer of raw materials. Moreover, the outlook for global growth remains uncertain given the need for higher interest rates to fight inflation.

As the situation develops, investors increasingly focus on problems with demand, rather than on forecasted supply, which in the case of a number of metals seems equally problematic.

Despite the predictions that the energy transition towards less dependence on coal in the future will generate strong and steadily growing demand for many key metals, the outlook for China, in particular for copper, is a big unknown at present, as the real estate market is responsible for a significant part of Chinese demand. . However, taking into account the relatively small supply of mined metals after 2024, we believe that the current negative macroeconomic factors related to the slowdown in the real estate market in China in 2022 will lose strength. You should also consider that the People's Bank of China (PBOC) and the Chinese government as opposed to the US Federal Reserve, are likely to seek economic stimulus with a focus on green transition initiatives that will require industrial metals.

Copper, which has remained within the range for more than a year, risks breaking down before finally confirming that there are grounds for a long-term strengthening. In this context, we present a neutral bias for Q4,65, meaning that the existing exposure to this sector should remain, but should not be increased until price action signals a rebound, potentially after a break above $ 3,5 or alternatively around $ XNUMX after an additional weakening.

Energy

Sanctions imposed on Russia, Europe's desire to become independent of Russian energy, and many producers from Organization of Petroleum Exporting Countries (OPEC) oil extractors at the limit of their capabilities are the main events supporting prices in the energy sector. If you add to this the effects of many years of underinvestment in terms of investment outlays both in the sector upstreamAnd downstreamOn a global scale, refineries' production reserves to meet the dual challenge of sanctions restricting Russian flows and the recovery in demand after the pandemic are small.

Inelastic supply and strong demand, despite the risk of an economic downturn, have prompted The International Energy Agency (IEA) to issue a warning about a growing supply deficit in early 2023. The lack of production reserves at refineries, exacerbated by lockdowns during the Covid pandemic, shifted the crisis away from the crude oil market - whose price remains well below the 2008 record. at $ 145 a barrel - for a fuel market where gasoline and diesel prices have already hit record levels.

The cash-flowing major oil companies and investors with no particular appetite for investing in new discoveries are the long-term reason that energy costs are likely to remain high for years to come. In addition to the aforementioned challenges of high volatility and historically bad returns on investment, the immediate challenge concerns future demand expectations.

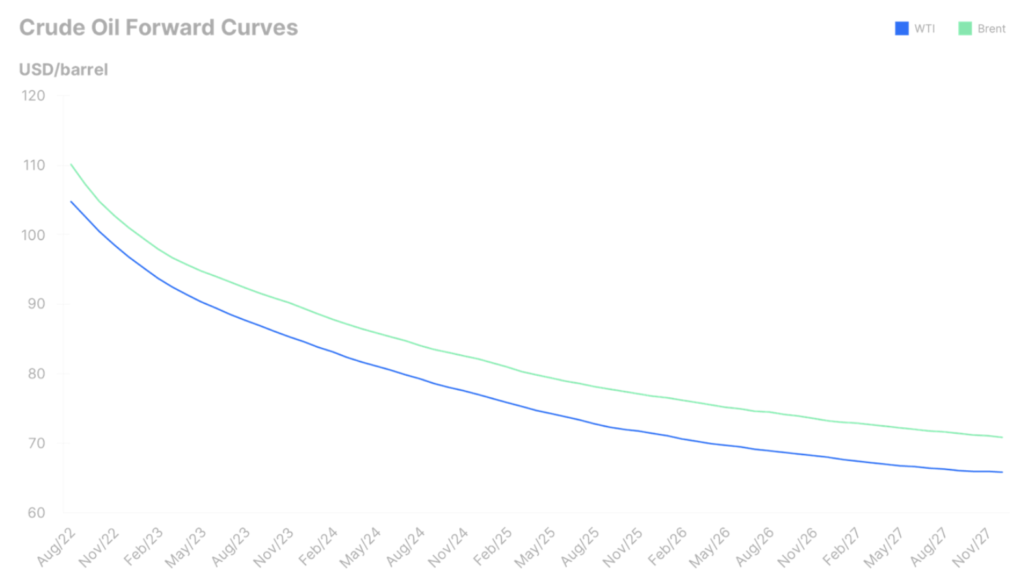

The green transition, which is getting more and more attention, will eventually start to reduce global demand for fossil fuels. It is the timing of this transformation that causes the investment appetite to remain low. Unlike new production methods such as fracking, where well drilling capacity can be a matter of just a few weeks, traditional oil production projects often require years of investment of billions of dollars before production can even begin. In other words, oil producers are not looking at the very attractive spot price of oil above $ 110 a barrel, but rather at how the market will price oil in the future.

The chart below shows the forward curves for Brent and West Texas Intermediate (WTI) crude oil and the dilemma faced by producers in five years' time as both crude oil trades more than $ 40 below current spot prices. These prices forecast the market with falling demand, and hence - even greater uncertainty about the long-term profitability of new investments.

Considering the above-mentioned aspects, we suspect that the corrections on the energy market in Q2008 may turn out to be short-lived, and the most probable risk is the risk of a prolonged period of high prices. A brief return to the 105 highs cannot be ruled out, but we generally believe that some weakening in demand after the peak demand in summer should limit the potential for price increases and keep them broadly within the $ 130-XNUMX range.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response