Another European debt crisis due to higher US Treasury yields?

In a situation where the market is controlled by an excessively accommodative monetary policy of central banks, the dynamic growth of government bond yields is a positive change. Projected inflationary pressures, rapid vaccination program and deadlock Federal Reserve suggest that this growth will continue, if not accelerate, in the coming months. This poses a dilemma for the rest of the central banks around the world, which may have recently witnessed a sell-off of their government bonds at the same time as US papers.

Higher US government bond yields are contributing to higher yields in Europe, Australia and emerging markets. While such a trend may be tolerated in the United States due to the improved economic outlook, other countries fear that it may worsen financial conditions as the local economic outlook remains negative.

About the Author

Althea Spinozzi, Marketing Manager, Saxo Bank. She joined the group Saxo Bank in 2017. Althea conducts research on fixed income instruments and works directly with clients to help them select and trade bonds. Due to his expertise in leveraged debt, he focuses particularly on high yield and corporate bonds with an attractive risk-to-return ratio.

Althea Spinozzi, Marketing Manager, Saxo Bank. She joined the group Saxo Bank in 2017. Althea conducts research on fixed income instruments and works directly with clients to help them select and trade bonds. Due to his expertise in leveraged debt, he focuses particularly on high yield and corporate bonds with an attractive risk-to-return ratio.

Europe is of particular concern because capital markets are clearly more correlated than the economy, which is a serious threat to economic recovery.

In this analysis, we found that an increase in US Treasury yields will inevitably mean an increase in German government bond yields. However, the monetary policy of central banks may significantly weaken this correlation. In the context of the peripheral countries, the situation is particularly worrying. After securing against EUR, US Treasury Bonds they currently offer much higher profitability than the most exposed countries in the European Union. This means that there may soon be a shift from peripheral bonds to securities on the other side of the Atlantic, which could trigger another crisis for European government bonds.

In the event that such a scenario materializes EBC and the European Union could be forced to take extreme measures to tackle this problem, which would further deepen the monetary union, leveling the financing costs in the euro area once and for all.

The positive correlation between German and US government bonds is holding back the economic recovery in Europe

The correlation between the bonds of both countries is justified, as higher yields in the United States may induce investors to invest larger amounts in American securities than in European ones, causing a correction with regard to Treasury securities on the Old Continent.

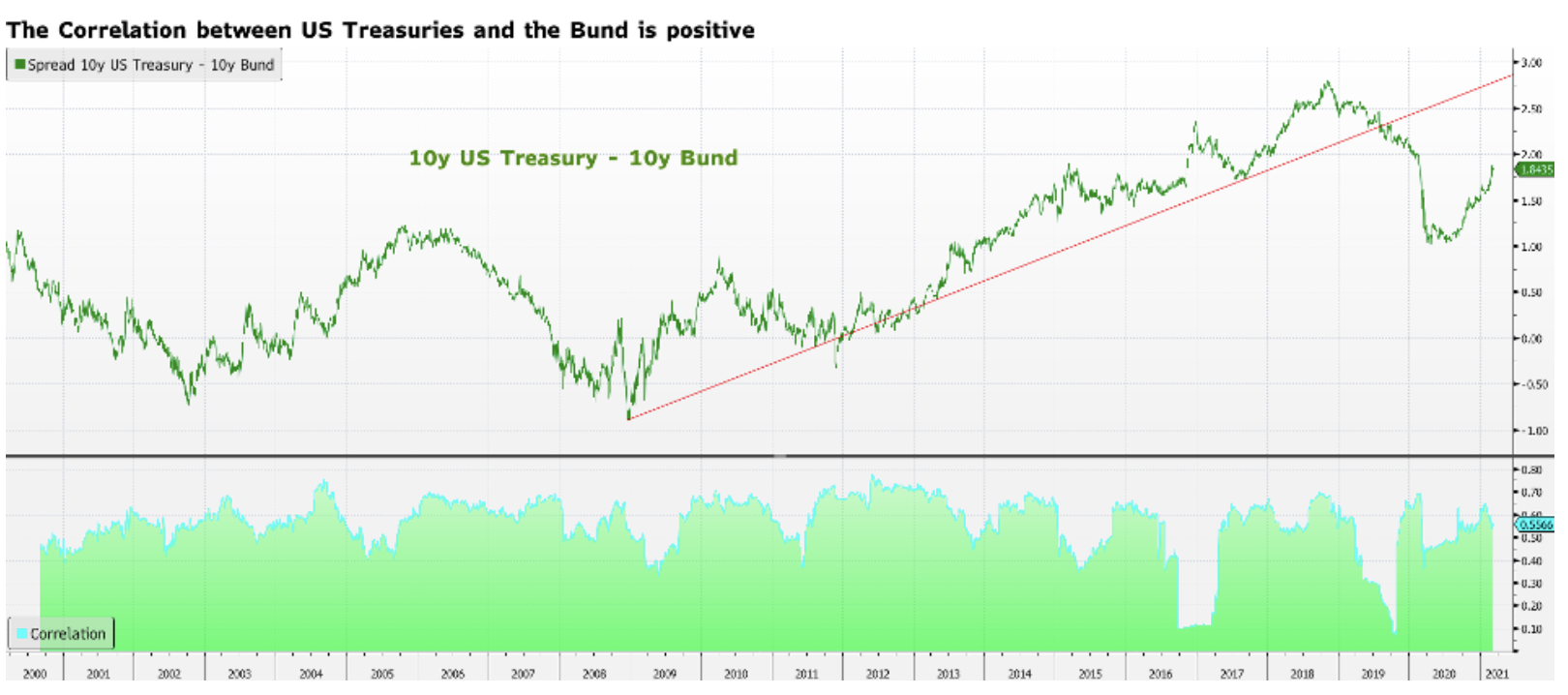

It is worth noting that since the global financial crisis in 2008, the spread of ten-year German and US government bonds has been growing, despite the fact that yields on both continents are lower and lower. This suggests that the yields of German papers are going down faster than the yields of US papers. During the Covid-19 pandemic in 2020, in particular, the gap between these yields began to narrow very quickly. Why? In the case of the yields of German bonds, there is not much room for maneuver to further decline. Hence, the narrowing of the spread is primarily attributed to a decline in US government bond yields. This is important because it tells us that although the potential for a decline in the profitability of German securities is limited, their growth potential is unlimited.

It is worth noting that in the last 20 years the correlation between US and German government bonds has only fallen almost to zero twice: in 2016, after Trump won the presidential election, and in 2019. In both cases, US Treasury yield movements were greater than in the case of German securities for the simple reason that European monetary policy has anchored German bond yields at an ultra-low level.

All in all, as yields in the United States continue to rise, German bond yields will follow, unless the European Central Bank intervenes to lower or even break the correlation between these papers.

The risk for peripheral countries in the context of rising US government bond yields

The synchronized relationship between US and German government bonds is crucial for all assets with prices above German bonds, in particular peripheral government bonds, as it represents a significant risk factor for economic recovery across Europe.

Since the crisis of European government bonds, we have seen a rapid decrease in the gap between the yields of European bonds and that of German securities. The smaller yield gap has managed to camouflage, but not change, the investor's approach to risk in the peripheral countries until the Covid-19 pandemic. In fact, with the spread of the coronavirus in Italy and the start of the lockdown, investors swiftly turned their backs on the debt of peripheral nations. Today's risk premiums in peripheral countries are even lower than before the Covid-19 pandemic. This does not mean, however, that investments in this region are now safer.

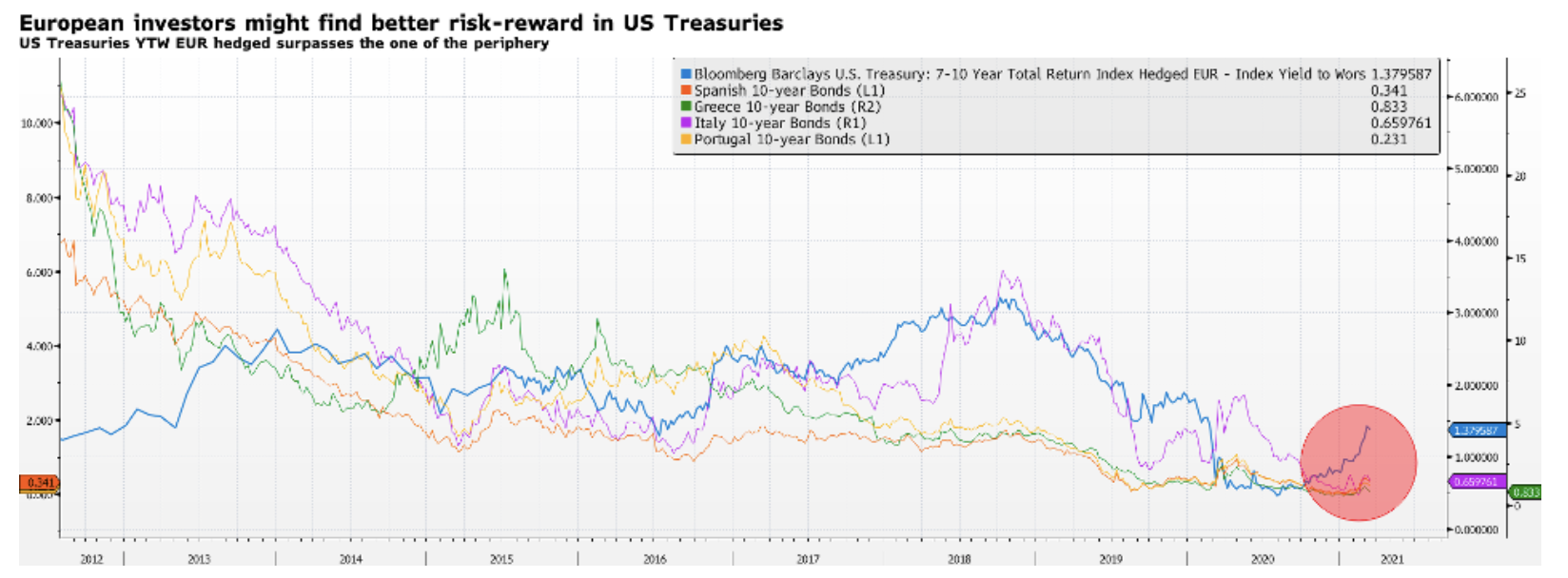

The lack of aggressive monetary policy and the new soft targets of the central bank mean that peripheral countries are now even more exposed to risk. In the event of a further sell-off of US Treasury bonds, investors will most likely turn from peripheral bonds to investments on the other side of the Atlantic. After all, ten-year peripheral government bonds offer almost zero return today. According to the Bloomberg Barclays indices, US government bonds with seven- and ten-year maturities hedged against the EUR currently offer the lowest potential yield (YTW) of 1,3%. The difference in return is enormous and it will be very difficult to justify an investment in Greek government bonds of 0,8% when the safe havens provide 1%.

This is a hard nut to crack for the ECB, which is fully aware that the increase in the cost of capital in the euro area will harm the implementation of all the current directions of monetary policy.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-300x200.jpg?v=1709556924)