Consolidation in commodity markets in terms of inflation

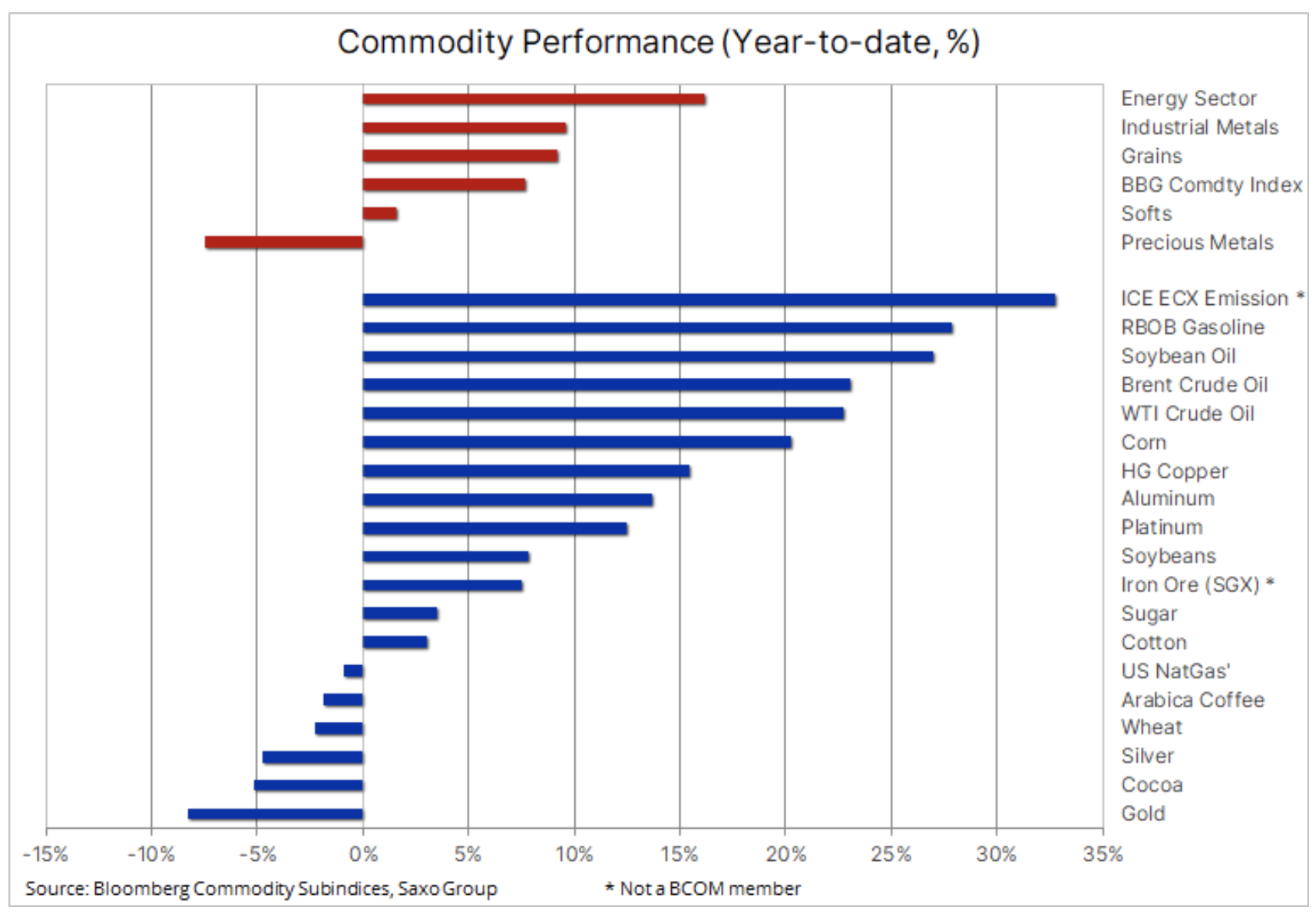

Commodity markets are consolidating and the Bloomberg commodity index has remained almost unchanged for the third week in a row. After reaching the three-year high in late February on the back of a 50% increase on the vaccination program and optimism about economic growth, there was a slight correction on the strengthening of the dollar and US Treasury bond yields, while prolonging the lockdowns, hampering the recovery.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

In the energy sector the price of oil Brent is consolidating in the range of $ 60-65 after its March rejection above the $ 70 / b level. The prospect of stronger global economic growth - the IMF recently raised its forecast to 6% - is now making it possible to offset the impact of new infections, while OPEC + prepares to increase supply in the coming months.

As a result, financial inflows in the commodity market also slowed down, and hedge funds have acted as net sellers over the past five weeks. During this period, the record net long position in 24 major commodity futures decreased by 18%; All sectors were affected by the scale of this reduction, but metals, in particular HG copper in particular, were hit hardest.

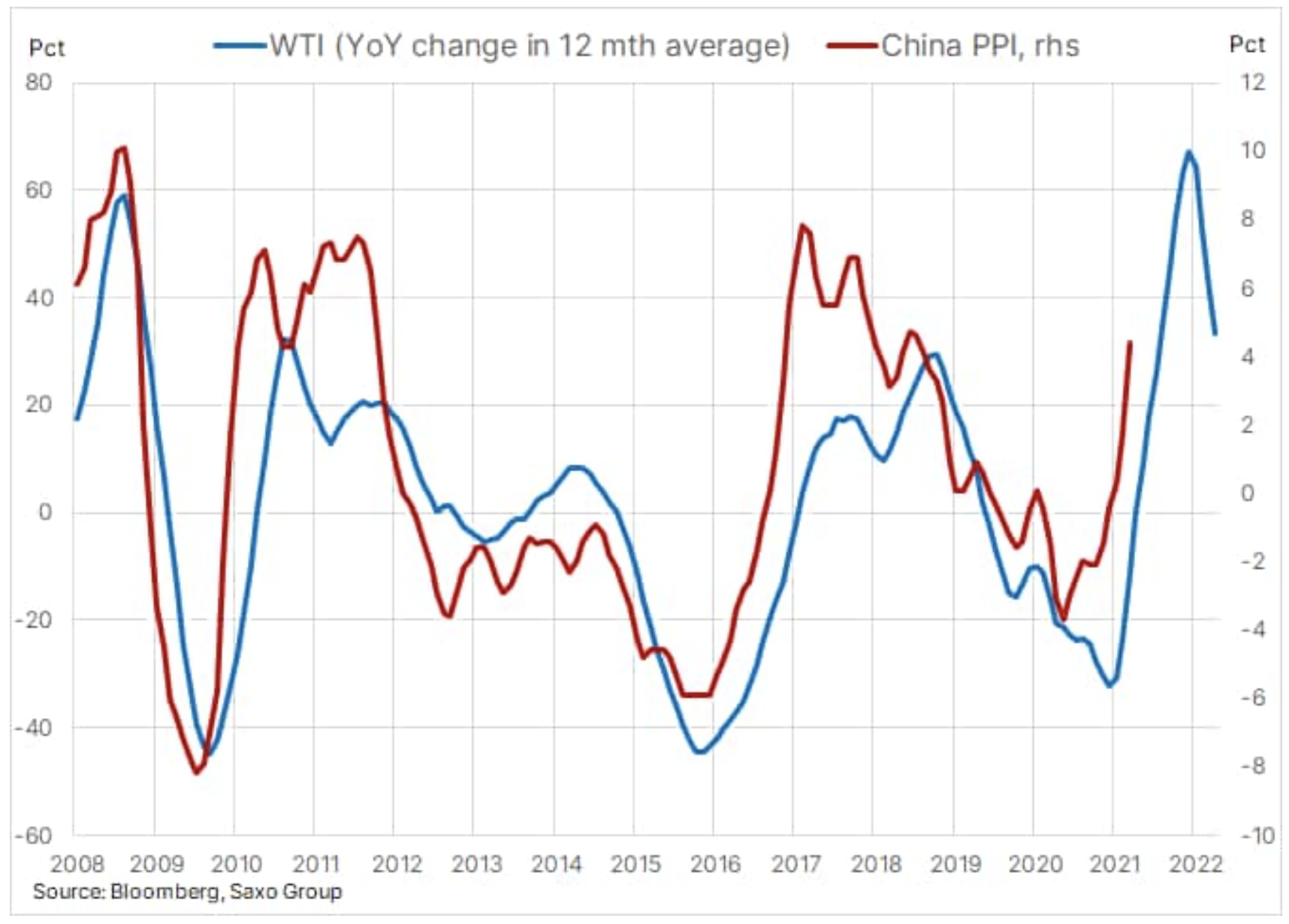

Industrial metals, mainly copper, gained over 40% in value last year; They have now also entered a phase of consolidation with a slight increase in supply as a result of rising inventories monitored by the London and Shanghai stock exchanges, as well as concerns that the rapid rise in producer prices in China could cause the world's second-largest economy to slow down and it will tighten monetary policy.

The March reading of the Chinese PPI, or producer prices, surpassed analysts' forecasts with an increase of 4,4% - the fastest pace of growth in annual terms since July 2018. Much of this recovery is the result of a sharp rise in commodity prices, which means that you can expect further improvement in the coming months. The chart below shows the continued upward pressure from crude oil not only on the Chinese PPI, but on the global inflation overall, as the impact of last year's price increase year on year will be felt until at least next January. This raises concerns that despite the growing economic momentum, the Chinese central bank will tighten its monetary policy and thus weaken the flow of money to financial markets.

Agriculture

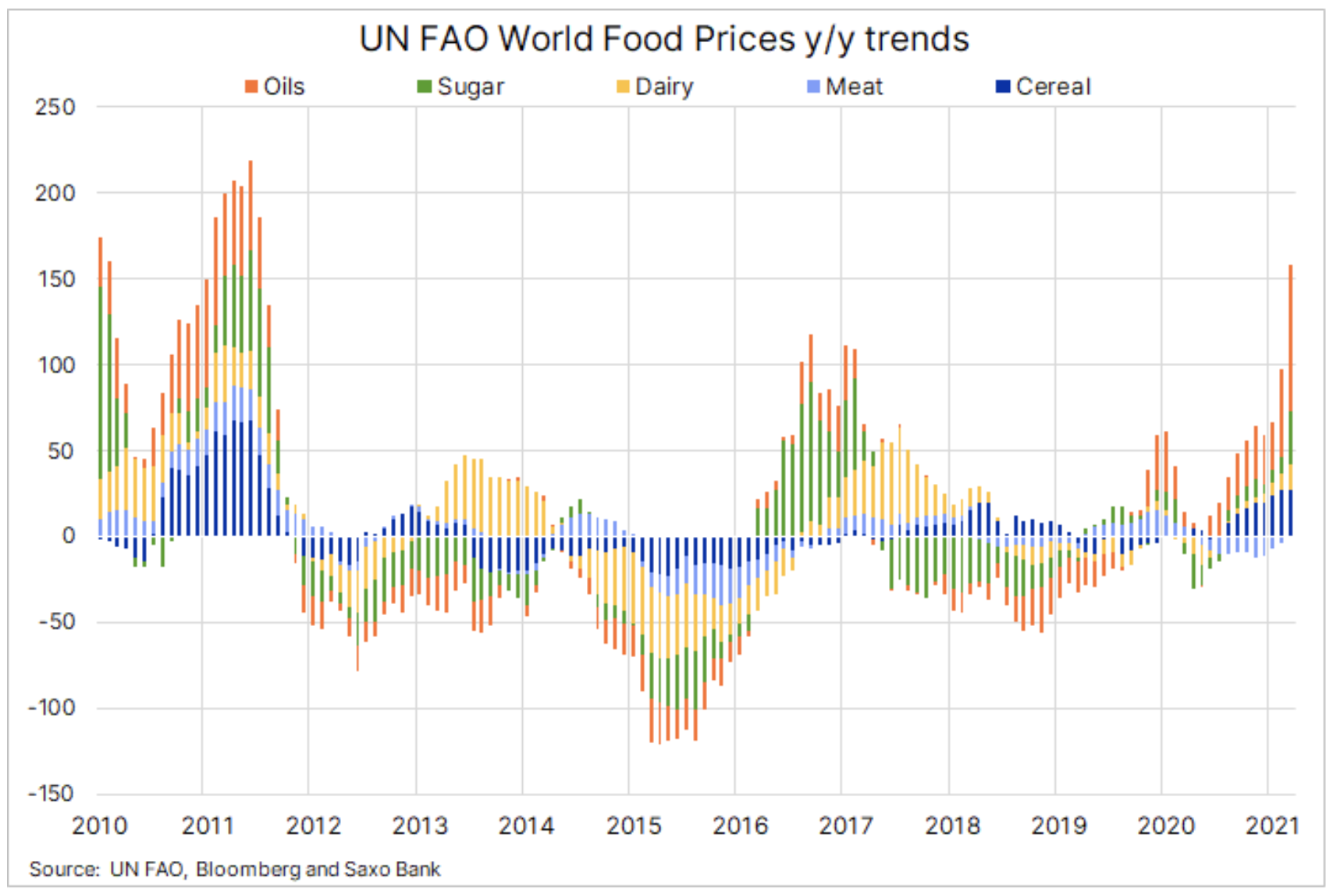

A further rise in food price inflation was confirmed by the recent publication by the FAO of the global price index for March. The index, which includes 95 product prices from five different groups, recorded an increase for the tenth consecutive month, reaching the highest level since June 2014, representing an annual increase of almost 25%. All sectors, except meat, showed a dynamic increase in prices on an annual basis, mainly vegetable oils, incl. 86% palm, soybean and rapeseed oil, as well as sugar (+ 30%) and grains (+ 26,5%). The latter group includes the key crops in the form of wheat and rice, which luckily saw only modest gains at this stage, lowering the risk to food security.

At the same time, US maize and soybean futures approached their multi-year highs following the recent publication of the Prospective Planting report, which came as a surprise for both crops being lower than expected. Meanwhile, wheat is trying to recover from the recent decline of 14% by taking advantage of the dry weather conditions in numerous spring wheat growing regions. In the short term, however, maize will get the most attention, as strong export demand continues to depress domestic stocks, with prices hitting an eight-year high.

While both soybeans and wheat have seen the liquidation of long positions by speculative investors in recent weeks, long positions in maize futures hit a ten-year high at 396 USD. flights. Long net position in six grains and soybeans, currently at 684k contracts, has recently experienced the largest weekly reduction since last May, and maize now accounts for as much as 58% of total net long position.

Precious metals

Investor confidence in precious metals declined in the first quarter as gold and silver performed the worst of all commodities. Gold depreciated almost 10%; silver was in a slightly better position because of its association with better-performing industrial metals. However, it became clear that these metals are not able to defend themselves against the rise in bond yields and the strengthening of the dollar. This weakening was not particularly surprising given that these metals are the most sensitive of all commodities to changes in interest rates and the dollar exchange rate - the dollar strengthened and bond yields definitely rose after a more dynamic than expected recovery in global economic growth and especially in the United States.

After falling almost 20% from its August peak, last month's gold managed to find support twice in a key area below $ 1, and in recent days backed by a lenient US Federal Reserve, he managed to hit a five-week high and almost threatened an equally important area of resistance around $ 1. Although the Fed chairman in his statements downplayed the risk that inflation could run out of control, gold could suffer further losses if the market accepted this view, and US government bond yields continued to rise amid the prospects of stronger economic growth instead of higher inflation.

However, given the outflow of most of the "hot" short-term money, at this point we are predicting an upward risk. The data shows the level of current underinvestment in this market. The number of COMEX gold futures open fell 25% from its July 2020 peak, while the speculative long position of cash managers shrank by 82% from last year's high. Total investment in funds listed on the stock exchange has seen an almost continuous decline since January; so far, it has amounted to 10% compared to the record position in October last year, amounting to 3 tonnes.

In the event that the gold managed to break higher, it seems that it will be most beneficial for silver, which is currently relatively cheap compared to gold - the XAU / XAG ratio increased to the highest level in 2,5 months, to around 70 (ounces of silver). to one ounce of gold) from the last minimum, i.e. 64.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)