Macroeconomic data is bad and the ball is going on the stock exchanges

It was definitely a day of bad news for the world economy. And from every direction. The published data showed the extent of the damage widespread lockdowns have caused in individual economies. Many sectors practically stopped. Especially services. This is perfectly illustrated by the preliminary readings of April indices. The industrial sector is not doing much better.

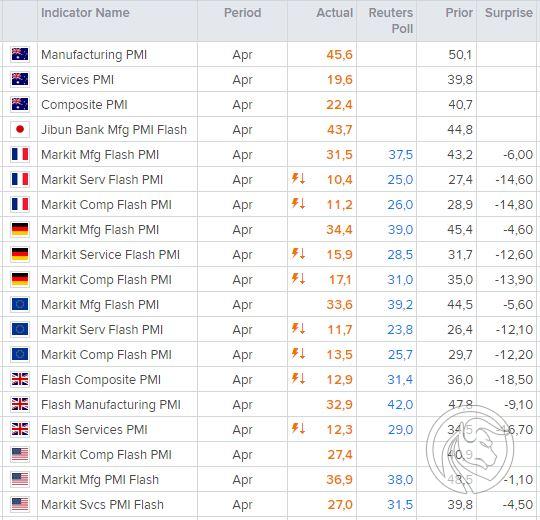

Macroeconomic data from the world

PMI indexes for individual countries. Source: Reuters

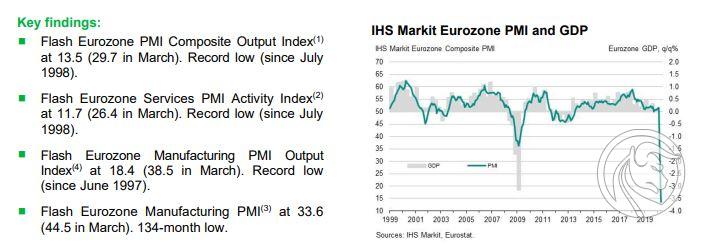

To more accurately illustrate how tragic the situation is, just look at the selected data. Eg PMI indexes for the Eurozone. In April, the index for the services sector dived to 11,7 points. from 26,4 points a month earlier and had the lowest value since the beginning of the study, i.e. since July 1998. The industrial index was only slightly better. It fell to 33,6 points and completed a 134-month hole.

PMI indexes for the Eurozone. Source: Markit

The PMI Composite Index, which is the result of published data, dived to 13,5 points, not only including the lowest value in history, but also signaling a huge slump in GDP growth.

The situation is no better in the US, where from week to week new unemployed arriving for the first time for benefits. In the last week there were 4,427 million (seasonally adjusted data) compared to forecast 4,2 million and compared to 5,237 million a week earlier. In total, in the 5th week 26 million new unemployed persons appeared in the USA.

Applications for new unemployment benefits. Source: Reuters

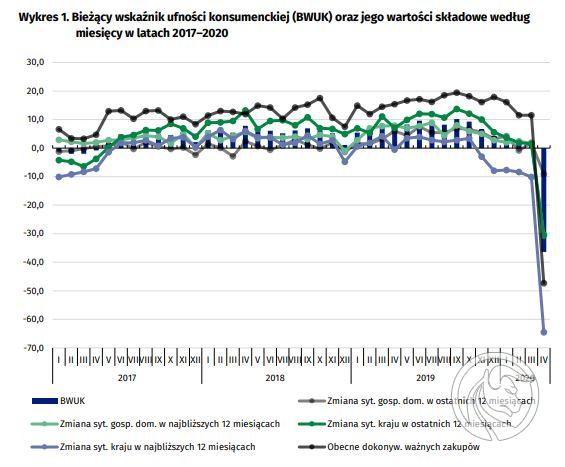

Poland is also not a green island. Of course, the data released today show that the lockdown did not have a big impact on the results of construction and assembly production, but it already strongly scared Polish consumers. Indicators of the current and future situation flew to the head and neck. Over 80% consumers are concerned that the coronavirus outbreak will have a greater or lesser impact on their finances. And if there is fear, then later it is difficult to start spending money suddenly. Hence, even after lifting the bans, the process of returning to normality is very long.

Current Consumer Confidence Indicator. Source: GUS

If it's so bad, why is it so good on the stock exchanges?

Paradoxically, the answer is very simple. Markets already treat this data as historical, treating the coronavirus epidemic and its associated lockdown as one-off events. That is why they are ignoring the data, counting on the defrosting processes already started in many countries and the effectiveness of support programs launched by governments and central banks.

This is an obvious mistake of thinking. Defrosting itself, as the example of Austria shows, where sales in newly opened stores dropped by 90%, it will be a very slow and long process. Ba, in half a year the situation may repeat. Many forecasts indicate that the coronavirus epidemic will return in the fall and the vaccine will not be invented by then. Therefore, what we are currently observing on the stock exchanges is a bit like the Titanic ball. This ship collided with an iceberg in March, but it is still moving forward. In a moment, however, he may start taking in water to return to the March lows at the turn of June and July. And probably break them.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)