Industrial and precious metals are back in the game

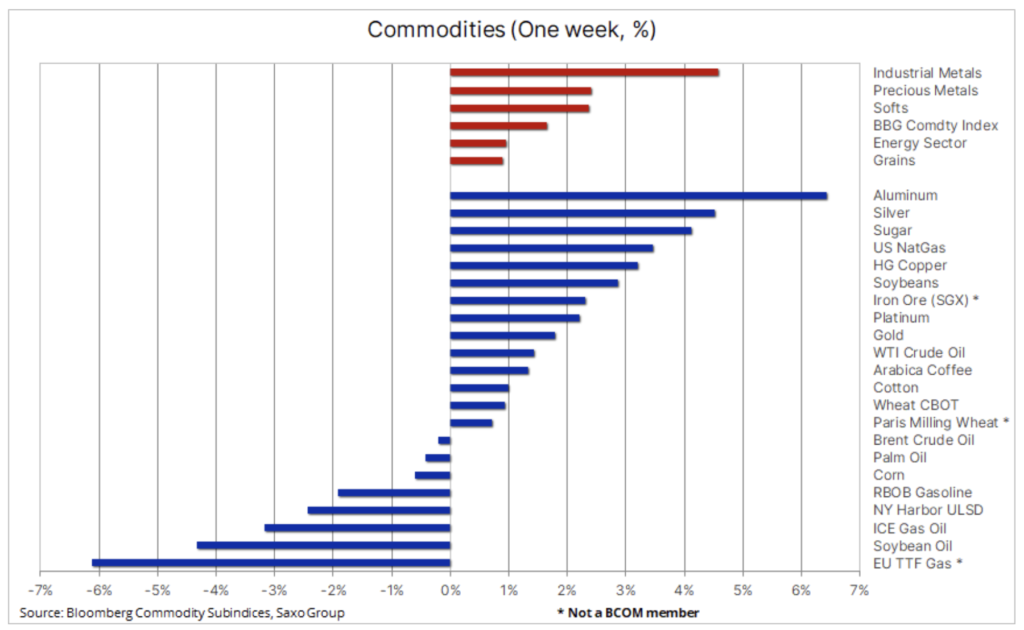

The commodity sector has continued to find support in recent days, despite the hurricane that swept through global equity markets S&P 500 index recorded the fourth-largest decline since 2010. Profits concentrated in sectors industrial metals and noble ones, which have shown declines in the last two months. Moreover, the risk of a global food crisis continued to provide support to the agricultural products sector, while the limited supply of the fuel products market kept crude oil in a narrow range despite concerns about economic growth.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Commodities up, stocks down

The commodities sector continued to find support last week despite the hurricane that swept through global stock markets. US stocks posted the biggest daily decline in nearly two years on Wednesdaydue to rising inflation, low gains and the prospect of aggressive monetary policy tightening, which poses a threat to economic growth. Even so, the Bloomberg spot commodity index managed to climb 1,6% and while the S&P 500 index showed its fourth-largest decline since 2010, the commodities sector continues to emphasize the need for both supply and demand to keep prices stable.

As the supply of many key raw materials - from cereals and coffee to fuel products and some industrial metals - is under threat, support in this sector is likely to continue despite weaker economic growth, in particular given the prospect of a post-period fiscal stimulus by the Chinese government. lockdowns. Economic growth in the Middle Kingdom faces more and more new barriers due to the persistent adherence to the dynamic "zero Covid" policy despite its growing economic and social costs.

Earnings last week concentrated in the industrial and precious metals sectors, which have shown declines over the past two months. In addition, the risk of a global food crisis continues to increase, and Russia's aggression towards Ukraine and bad weather conditions are the main factors behind disruptions in the supply of key food products.

The cereals sector reached a new record high and the Bloomberg spot cereal index rose by as much as 30% over the year. Soybean was the leader, followed by wheat, while maize recorded a slight weekly loss. Global concerns about the food crisis continue and disruptions to supplies from Ukraine, one of the world's most important suppliers of high-quality wheat and sunflower oil, have had a knock-on effect around the world. The agriculture ministry said on Friday that Ukrainian farmers had almost finished sowing spring wheat for harvest in 2022, and that the overall rate of this year's spring crops is 25% lower than at the same date in 2021.

A few positive supply news, however, helped ease fears of the global food crisis somewhat, although by no means allaying them. The price of palm oil fell sharply after Indonesia lifted its short-term export ban. Wheat prices, which hit new highs in Europe and the US earlier this week amid concerns about Indian deliveries, declined on the release of a record-breaking forecast for Russia. Prices, however, support comments from the analyst company Gro Intelligence, according to which the world has wheat reserves allowing only ten weeks of consumption. This situation will continue at least until there is more clarity on production levels in Europe and North America - both regions had a difficult start to the sowing season due to the weather.

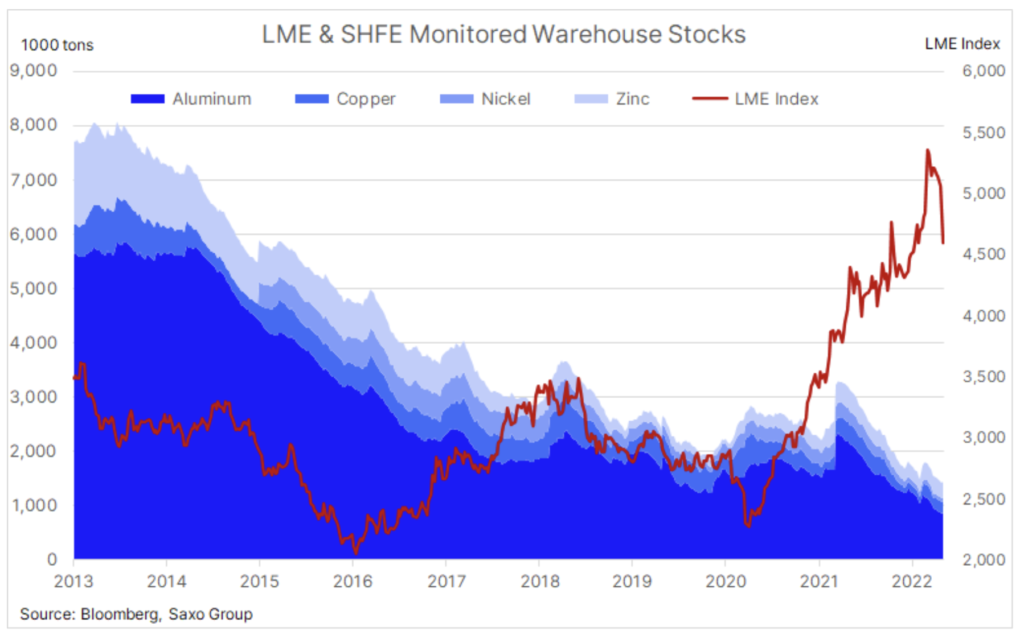

In our last article devoted to industrial metals, we wrote that the precious metals sector is waiting for a rebound in China, and indeed - there were some signals last week that China is starting to provide more support. Until then, the Bloomberg industrial metals index had plunged 25% from its peak in early March, and the main catalyst, in addition to concerns about global economic growth, was China and its zero-Covid policy. Outbreaks of infections in Shanghai and Beijing caused a prolonged lockdown, which negatively affected economic growth and created significant bottlenecks in global supply chains.

In China, retail sales fell 11% last week, youth unemployment hit a record 18,2%, and economists predict a decline in GDP forecasts. In response to these events, Chinese banks cut interest rates on five-year loans by a record 0,15 basis point on Friday. Keep in mind that this is happening at a time when the rest of the world is moving in the opposite direction, underscoring the willingness of the Chinese government to support the economy. Further support is likely to emerge as the government tries to support infrastructure and real estate projects that are critical to the demand for industrial metals.

At about the same time that prices peaked in early March, the four most important industrial metals were stocked in warehouses monitored by the London Metal Exchange and the Shanghai Futures Exchange was 1,77 million tonnes. However, instead of rising as demand weakened, inventories continued to decline, reaching 1,43mn tonnes last week, down 19% over the period.

This is in line with our view that the global economic slowdown is not an obstacle to rising industrial metal prices, although supply may struggle to keep up with demand not only from China, but also as a result of the move away from fossil fuels. This transformation is referred to as "green", but in reality it is very black given the number of different metals required for this process. These range from aluminum, copper and nickel to more exotic metals such as rare earth metals, cobalt and lithium.

HG copper

Despite the correction that has been going on for a month, copper HG remains in the range, having failed to break key support in the $ 4 / lb area so far. The recovery last week brought HG copper price back to the XNUMX-day moving average, and a break above this level will signal a loss of negative price momentum. If it did, it might soon force it speculative investors to cover a short net position, which doubled in the week preceding May 10 and reached the highest level in two years, 17,7 thousand. flights or 201 thousand. metric tons.

Gold

Gold

From mid-April, gold market, showing a downward trend, found new buyers in the face of further turmoil in global equity markets. Over the past month, gold has suffered a double blow from the strengthening of the dollar and the FOMC announcement of the aggressive pace of future interest rate hikes to fight inflation at its highest level in several decades. Such a strategy will be beneficial as long as the economy does not suffer too much, which could increase the risk of a recession. What changed last week is the release of extremely negative earnings news from major US retailers, which increases the risk of a deeper-than-predicted economic slump.

We maintain a positive outlook for gold, given the need for diversification in the context of the stock market chaos and the aforementioned potentially heightened risk of FOMC policy bias that could lower yields and weaken the dollar. The chart below shows that gold still has a lot of work to do to repair the damage it has done over the past month. However, the first sign of recovery is a break above the two-hundred-day moving average at $ 1 - the next big challenge is the $ 839 mark, a 1% retracement of the $ 868 line of the April-May correction.

It appears that silver, fueled by a rebound in the industrial metals markets, found ground on its feet after a 22% correction that at one point fell below the earlier support around $ 21,50. As speculative investors have reduced their positions to a neutral level, a possible growth impulse is likely to attract new buyers in the form of under-exposed funds.

Petroleum

Petroleum

Most of the week Petroleum it attacked the top of the range in which she had stayed for the past six weeks. The relatively calm market behavior at the time, however, provided a cover for the fact that the market was still chaotic and that oil prices remained within the range as a result of key opposing forces. Meanwhile, the US government, in an unsuccessful attempt to contain the rise in prices, provided the market with millions of barrels injection, while Chinese demand suffered from the zero Covid strategy.

The fact that the market has not dropped below USD 100 underlines its strength - support is provided by the limited supply of key fuels, self-sanctioning of Russian crude oil recipients, OPEC with increased production and political tensions in Libya. Due to the possible easing of lockdowns in China and an aggravation of the situation in Libya, the short-term price risk still strongly indicates an increase in prices.

In the past few weeks, investors have shifted their focus to a fixed range for oil prices, focusing instead on the crude oil products market, where gasoline, diesel and kerosene costs have risen to levels unheard of in years - or never. As a result of refinery renovations, the reduction of production capacity after the pandemic and the phenomenon of self-sanctioning of recipients of Russian petroleum products, the supply decreased on an unbelievable scale. This is particularly true of North America, where refineries are working at full capacity to produce as much as they can while taking advantage of exceptionally attractive margins.

Therefore, despite the prospect of a slowdown in global economic growth, the price of crude oil continues to gain support. If we reaffirm our broad range forecast for Brent for the current quarter, with a broad range of USD 90-120, and also take into account structural issues, notably the continuing level of underinvestment and OPEC's drive to increase production, these factors will continue to support prices in the coming quarters.

Natural gas

For American natural gas it was another exciting week after price hit resistance around $ 8,5 / therm twice without hitting the highs. The current price is 200% higher than in the same period last year, driven by record LNG exports, flat production growth, and the recent heatwave in the southern states increasing cooling demand. However, the weekly injection of 89 billion cubic feet (bcf) to 1 bcf was as expected, reducing the deficit from the five-year average to 732%. In addition, the upcoming easing of weather conditions and the temporary harvest for LNG in Europe may indicate a period of stable prices. Overall, however, rising global demand and a strong discount to prices in Europe and Asia are likely to prevent any significant weakening in the coming months.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)