A mortgage and its cost - that is, a wise Pole after an interest rate increase

In recent months, mortgage loans have become a popular topic again. A few years ago, hysteria of a similar scale began with regard to Swiss franc loans. The reason was really the same: an increase in the loan installment.

We will not deal with the legal and moral aspects as we believe that this is not our role. Forex Club from the beginning of its activity tries to financially educate investors. Today's text will focus on the credit mechanics aspect. We hope that after reading this article, readers will be able to estimate the risk of assuming a long-term financial obligation. Unfortunately, recently it turned out once again that a wise Pole after the damage. The interest rate hike surprised many borrowers.

Credit and accrued interest

What is credit? According to the basic definition, a bank loan is a written agreement between a bank (lender) and a borrower. Under the agreement, the lender makes funds available for a specific purpose. The borrower is obliged to repay the principal with interest within the time specified in the contract.

Why is there interest in the loan? The three basic factors that determine the cost of a loan are:

- loss of money over time

- investment risk

- loan financing costs

Current money loses its value over time. The process of losing money value is called inflation. In the long run, inflation has a devastating effect on the value of money. For example, if the average inflation is 3% annually, in 30 years the value of today's PLN 100 will drop to a level of just over PLN 40. If inflation in this period was 5%, the value of PLN 100 would drop to around PLN 21,5. As you can see if someone raises an argument "I borrow PLN 100 and I want to return PLN 100 within 30 years" he doesn't know what the time value of money is, or he wants to give back less than he actually borrowed. Due to the loss of money over time, banks try to transfer this risk to the customer. Of course, with varying degrees of success. There are situations when the loan interest rate is lower than the inflation rate. This is a theoretically favorable situation for borrowers. One condition is one borrowers' income must grow at a similar rate to inflation.

Investment risk is another factor that borrowers “forget” about. The bank is not a charity and must also take into account certain risks. One of the main risks that the bank has to deal with is the quality of the loan portfolio. Banks are aware that not all loans will be repaid. Some borrowers will default on their liabilities. The most popular measure of the "health" of a loan portfolio is NPL indicator (non-performing loans). The ratio is calculated by dividing the value of non-performing loans by the entire loan portfolio. The higher the index, the worse the quality of the loan portfolio. According to data European Central Bank, in September 2021 the level of the NPL ratio in the euro area countries amounted to 2,2%. As a rule, NPL levels in excess of 5% are considered dangerous. In the euro area, the highest NPL ratio was in Greece (double-digit!), Cyprus (around 8%) and Portugal (over 4%).

Loan financing costs. The higher the banking sector financing costs, the higher the loan interest rates offered. Also, a lot depends on the loan financing structure. If a bank finances long-term loans with short-term assets, it has a mismatched balance sheet. As a result, the risk that the bank will have a liquidity problem in the future increases. Some banks issue covered bonds to finance mortgage loans.

Types of mortgage loans

Loans can be divided due to, for example:

- type of interest,

- type of installment (decreasing, fixed, balloon),

- loan currency.

The loan may be granted for a fixed or variable interest rate. In the case of a fixed rate, the borrower is sure about the cost of the entire loan. Certainly, fixed rate lending benefits banks in an environment of falling interest rates. In such a situation, the bank's assets (granted loans) are at a fixed rate, which are financed with liabilities for which the bank pays less and less each quarter (falling interest rates). When interest rates rise, the borrower is in a favorable position. In turn, the bank does not earn additional interest income, and interest costs increase (deposits, cost of interbank loans, etc.).

As a rule, banks provide loans with a fixed interest rate if they manage to find someone willing to finance such a loan within a given period of time. This is especially important in the case of mortgage loans, in order to grant a loan with a fixed interest rate for 5, 10 or 30 years, the bank must find a bank willing to borrow (deposit, buy a covered bond) for a given period. A covered bond is a security in which a bank (usually a mortgage) undertakes to repay interest and principal in a specific schedule. The covered bond is secured with loans granted by the bank (its assets).

Floating interest rate means that the bank offers a loan with an interest rate consisting of two parts: bank margin and benchmark. As a rule, the benchmark ratio is related to the approximate values of bank financing costs in the interbank market. In Poland, the WIBOR index (3- or 6-month) is usually adopted. A floating interest rate is more risky for borrowers. This is due to the fact that the borrower is not sure what the capital and interest installment will look like in the longer term. During an increase in interest rates, the installment will increase, while during a decline it will be lower and lower. When taking a loan with a variable interest rate, you should carefully consider the amount of debt to maintain a buffer for significantly increasing the size of the loan installment.

Since it is already known that the loan can be granted on a fixed or variable interest rate, it is worth mentioning the types of installments. The most popular are: descending, constant and balloon. Each loan installment consists of a capital and an interest part.

In Poland, the most popular solution is a fixed installment. It is interesting because it is a much more expensive option than the decreasing installment. In the case of a fixed installment, the borrower knows how much he will pay in a given settlement period (e.g. a 3-month or 6-month period). The formula itself is quite complex, but you can make it much easier with Excel.

Interest rate and loan installment - mechanics

Let's take an example of where the borrower took PLN 500 of credit (including commission) on in equal monthly installments. The loan interest rate is 5% per year. To calculate the installment size of such a loan, you can use the PMT function, which consists of:

- interest rates (converted into installments per year),

- number of installments,

- amount of credit.

In effect, the formula would be:

= PMT (0,05 / 12; 360; -500000)

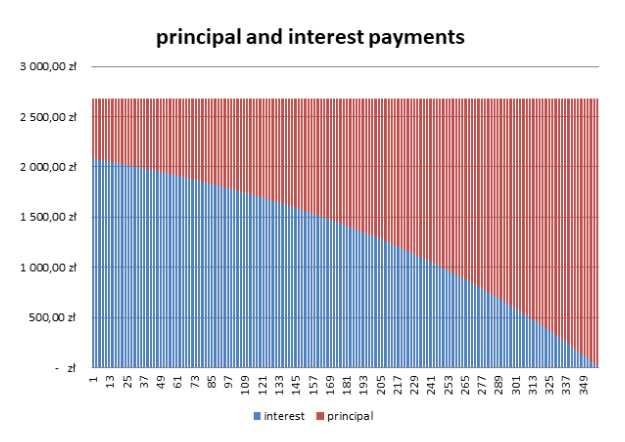

The installment in this example is PLN 2684,11. Of course, the fixed installment consists of the interest and capital parts. In this construction of the loan, the borrower pays mainly the interest first, and then the principal.

To calculate the proportion, you can use a simple Excel table. In the case of the first installment, the interest is as follows:

PLN 500 (capital) * 000 / 0,05 (monthly loan interest) = PLN 12.

Knowing that the entire installment will be PLN 2684,11 means that the principal repayment will be PLN 600,78. In this example, the value of the interest amount will be equal to the equity amount only after 16 years. The table below presents the structure of the loan installment in a simplified manner (taking into account the fixed interest rate).

To sum up, the borrower using such a loan will have to pay back PLN 966. Thus, the interest is over 279,6% of the value of the loan taken. Of course, this is face value and not real. In 93 years, the purchasing power of PLN 30 will most likely be much lower than today.

To sum up, the borrower using such a loan will have to pay back PLN 966. Thus, the interest is over 279,6% of the value of the loan taken. Of course, this is face value and not real. In 93 years, the purchasing power of PLN 30 will most likely be much lower than today.

The second solution is to use decreasing installments. This is not a popular solution because at the beginning the installment is much higher than in the case of a loan with an equal installment. For a loan with a value of PLN 500 with an interest rate of 000% per annum and taken for 5 years, the value of the first installment was PLN 30. As much as 3472,22% more than in the case of a loan with a fixed installment amount. The amount of the decreasing installment will be equal to the size of the fixed installment only after 29 years.

To sum up, the borrower using such a loan will have to pay back PLN 876. Thus, the interest represents over 041,67% of the value of the loan taken. By choosing a loan with decreasing installments, the customer would save over 75 in interest over 90 years.

Credit costs and the amount of interest

It is worth seeing how the size of the loan costs will change if the interest rate changes at the beginning, 10 and 20 years after taking out the loan. Let's create base scenarios for a loan with decreasing and fixed installments:

- an increase in the interest rate to 8% in the 6th month of taking out the loan (then the rate does not change)

- an increase in the interest rate to 8% in the 120th month of taking out the loan (then the rate does not change)

- an increase in the interest rate to 8% in the 240th month of taking out the loan (then the rate does not change)

| amount of installment | standard variant | after the increase in the 6th month | after the increase in the 120th month | after the increase in the 240th month |

| fixed installment | PLN 2684,11 | PLN 3659,04 | PLN 3404,39 | PLN 3073,33 |

The longer the time to pay off the loan, the more the installment grows. This is because increasing the interest rate on your loan means there is more interest to pay. Due to the fact that the number of installments to be repaid is constant, this must result in an increase in the loan installment. You can't fool math.

| the total cost of the loan | standard variant | after the increase in the 6th month | after the increase in the 120th month | after the increase in the 240th month |

| fixed installment | 966 279,6 zł | 1 312 378,9 PLN | 1 139 866,6 PLN | 1 013 375,4 PLN |

| decreasing installment | 876 041,7 zł | 1 095 451,4 PLN | 977 295,1 zł | 901 670,1 zł |

As you can see, the higher the interest rate, the greater the benefit of selecting decreasing installments. Of course, the benefit is higher the longer the loan repayment period is (assuming that after the rate hike they remain at the same level).

Balloon installment is a completely different type of loan repayment than the previous two. In this case, the payment of a significant part of the borrowed capital takes place, for example, only at the end of the loan term. Thanks to this solution, customers can benefit from lower installments at the beginning of the loan period. The highest loan costs are usually in the last installment. As a rule, the balloon installment is used to finance a car loan.

Loan currency

We are not law specialists. For this reason, we will not deal with legal loops. We will focus on the reasons why customers prefer to use foreign currency loans:

- benefit from a lower interest rate

- earning on the exchange rate

- having income in the currency of the loan

Before crisis on the subprime market (2007-2009) in Poland, Swiss franc loans were very popular. The reason people took foreign currency loans was because they wanted to take advantage of a lower interest rate. Loans in francs bear interest based on CHF LIBORwhile loans in PLN are WIBOR. In 2006 CHF LIBOR (3M) was about 1,5%while WIBOR 3M over 4%. Lower interest costs translated into a lower cost of the loan, which meant that the loan in francs had a lower installment than the loan based on PLN. Due to the fact that customers usually looked at the size of the installments, loans in Swiss francs were a sales hit in Poland. People "forgot" about the exchange rate risk. This was due to a mixture of: greed, laziness i deficiencies in financial education.

Greed resulted from the situation in the currency market just before the crisis. The strengthening of the zloty against the franc meant that "The loan pays itself off." The installment dropped, and the loan size with it. The laziness resulted from not checking the history of the CHF / PLN exchange rate. And in the history of this currency pair, there have been periods of weakness in the Polish currency. For example, between May 2001 and March 2004, the CHF / PLN exchange rate increased from 2,22 to 3,13. In turn, in the years 1997 - 1999 the CHF / PLN exchange rate increased from 2,11 to 2,81. So when you looked at the fluctuations in exchange rates, you could realize that the Swiss Franc was able to gain significantly in a relatively short time. In turn, deficiencies in financial education meant that people were not able to calculate for themselves how the loan installments will be shaped if the scenario of rising interest rates in Switzerland materialized and the franc strengthened. The mortgage is usually for 20-30 years. For this reason, you have to be prepared for different situations.

The desire to earn on the exchange rate resulted from the unconscious use of the strategy carry trade. The borrower borrowed in a currency with a lower interest rate and invested in a market with a higher interest rate. The risk was the exchange rate. However, since Poland joined the European Union, there has been a spectacular inflow of EU funds and foreign investments. This resulted in the strengthening of the zloty. Between 2004 and mid-2008, borrowers in foreign currencies benefited from lower interest rates and falling loan value (converted into PLN). Back then, the frankers did not think that they had been cheated by the banks. Only the sharp depreciation of the zloty against the franc made customers see what credit risk is. Then began the search for "justice" in order not to make money "bankers".

Sometimes borrowers take advantage of foreign currency denominated debt because they themselves earn income in the same currency. In such a situation, there is no currency risk or it is significantly limited. an example would be exporting companies that earn revenues in euro. For such a company, taking a loan denominated in euro should not pose a threat (as long as the principal and interest installment is much lower than the average export receipts).

Summation

In the article, we only briefly described some mechanisms that affect the size of the installment. Credit itself is not bad, it is important that it is used wisely. Taking debt for ordinary consumption does not build up the borrower's net worth. Moreover, he will have to pay back more than he borrowed because of the interest. Of course, in times of negative real interest rates, such a strategy does not have to be meaningless (as long as the borrower's income grows with inflation). By taking a long-term loan (e.g. a mortgage), the borrower makes a wager on:

- long-term interest rate

- household income in a given period

- economic and political situation

If a long-term loan was taken at a variable interest rate, the borrower must be aware of the risks posed by such a decision. In such a situation, he should conduct his own home “stress testing” (how much will the installment be in the event of an increase in interest rates by 1, 3, 6 or 9 percentage points). This will allow you to develop a plan on how to deal with the budget in the event that the installment increases by several dozen percent.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)