Targeted by rising energy prices and US bond yields

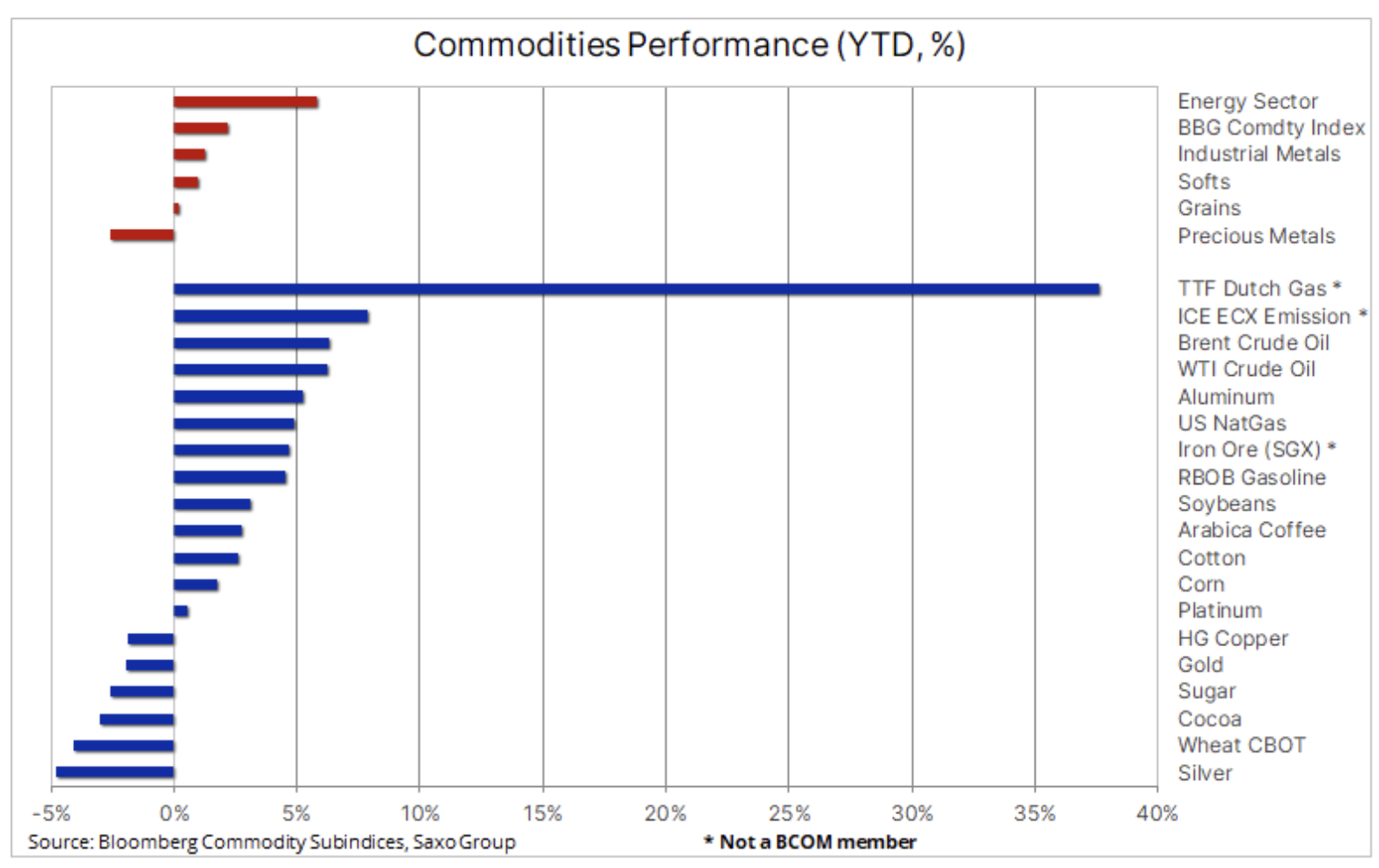

The first days of trading in 2022 are best described as "turbulent" and, as with the nervous beginning of 2021, the initial inspiration for the direction of prices of individual asset classes, including commodities such as gold and silver, was provided by a sharp rise in US bond yields fiscal. At the same time, the energy sector remained insensitive to these factors: limited supply pushed up oil and gas prices, while in the industrial metals sector the situation was mixed, with an emphasis on events in China, where the Covid-19 zero-tolerance policy could curb consumer spending at a time when when the economy is already operating in slowdown.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

The rise in government bond yields from Japan to Germany and the United Kingdom intensified after the publication of the minutes of the December Federal Reserve meeting, which increased expectations regarding the acceleration of the pace of rate hikes by the Fed in order to fight inflation. Federal Open Market Committee (FOMC) He also discussed the methods of direct balance sheet reduction, which further weakened the energy, which in the last three years had been driving the strong boom in the stock markets.

This was a signal that the Fed wanted to strengthen bond yields not only along the front of the yield curve, but also along its entire length. The benchmark yield on 1,77-year bonds dynamically increased almost to the maximum level in April, ie to XNUMX%.

Precious metals

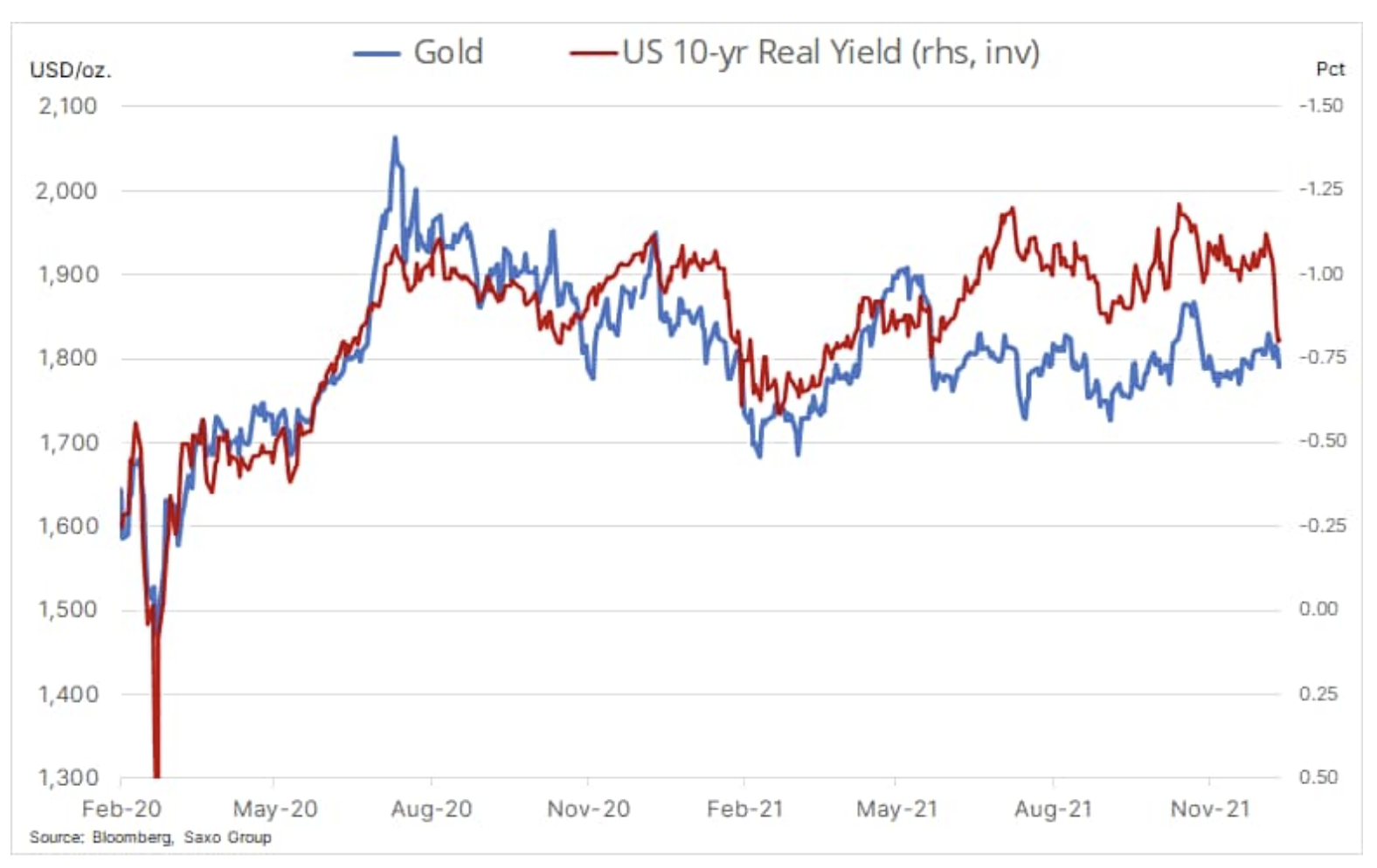

Metals, in particular gold, as one of the commodities most sensitive to interest rates, have declined, but not as far as the 0,3% increase in US ten-year yields would indicate. Part of the explanation may be that gold has been relatively cheap relative to real yields over the past six months, while a weaker dollar, increased stock market volatility, and virus and geopolitical risks also contributed to the rebalancing of conditions at the start of the year. which would otherwise be a significant challenge.

At the same time, the price of silver was negatively affected by a decline in risk appetite as well as a weakening of non-ferrous industrial metals such as copper. After some strengthening towards the end of the year, silver experienced another wave of technical sales, which slightly pushed its relatively low price relative to gold to a three-week high above 81 ounces of silver to one ounce of gold.

The forecast for 2022 remains problematic and most of the downward forecasts for gold are due to expectations of a sharp rise in real yields. As we can see below, real yields over the last few years showed a high degree of inverse correlation with the zloty and it is the risk that aggressive Fed policy will increase yields that currently worries the market.

In our first article on precious metals for the new year, entitled "Gold and silver may surprise us in 2022.", we listed the reasons why the negative performance of gold last year from a relative perspective was positive, and we also considered what should happen for the metal to surprise us to the upside in 2022.

The price of gold remains in the region of $ 1 within a wide range of $ 800-1; for the direction in the short term, it is crucial how the metal reacts to impulses in opposite directions in the form of rising yields and increased market uncertainty.

Industrial metals

The situation in the sector industrial metals was mixed: HG copper fell in response to a general decline in risk appetite and continued concerns about the outlook for the Chinese real estate market, as well as the short-term impact on economic growth of an increasing number of omicron contamination, causing industrial plant closures in China. The price of aluminum, one of the most energy-intensive metals to produce, has risen following the recent supply disruptions, fueling predictions of an ever-widening supply deficit this year. One of the important factors was the projected decline in productivity growth in China due to increased government efforts to combat air pollution; for the same reason, non-Chinese producers are very reluctant to invest in new potential.

Despite the predictions that the energy transition towards less dependence on coal in the future will generate strong and steadily growing demand for many key metals, the outlook for China, in particular for copper, is currently the great unknown, as the real estate market is responsible for a significant part of Chinese demand. .

Considering the small supply of raw materials from the mining industry, we are convinced that the current negative macroeconomic factors related to the slowdown in the Chinese real estate market will start to lose strength in the first months of 2022. from the fact that the People's Bank of China and the Chinese government, unlike the US Federal Reserve, are more likely to stimulate the economy, particularly in the context of green transition initiatives that require industrial metals. With both copper and aluminum stocks low, this could push prices back to or even exceed last year's record levels. The months-long sideline has reduced the speculative long position to an almost neutral level, thereby increasing the prospects for attracting new buyers as soon as the technical forecast improves.

Petroleum

Clothing grew in value in the first days of trading, thereby prolonging the end-December rally, against the general trend of risk aversion seen in other commodities and asset classes. The supply disruptions in Libya (a drop of more than 400 barrels / day compared to 000) and the geopolitical risks associated with the protests against a rise in fuel prices in Kazakhstan, a country producing 2021 million barrels per day, have helped offset any demand concerns over the increase in coronavirus infections around the world. This was the case, for example, in China, where an aggressive reaction to the largest Covid-1,9 outbreak since Wuhan could cause a decline in demand in the short term.

OPEC + has agreed to maintain the current pace of 400 barrels / day monthly production expansion and the market - despite projected oversupply this quarter - has risen with the prospect that a number of producers will not be able to meet their production targets. In addition to the prospect of a global excess supply in the first months of 000, forecast by both the International Energy Agency and OPEC, the futures market is also sending signals of less activity.

Open positions, a measure of the overall exposure - both short and long - investing in WTI and Brent crude oil have fallen to their lowest level in more than five years, and since the December 1 low of recent weeks, it has fallen further despite an increase prices by almost 20%. Perhaps this is a sign that many investors and traders remain skeptical of the potential for oil price increases, at least in early 2022.

However, despite these signals, we maintain a long-term positive outlook for the oil market as it faces long years of potential underinvestment - major players are losing their appetite for big ventures, partly due to an uncertain long-term outlook for oil demand, but also, increasingly, due to credit constraints on banks and investors due to ESG (environmental, social and governance issues) and the emphasis on green transition.

Global oil demand is not expected to peak in the near term, which will put even more pressure on production reserves, which are shrinking every month as OPEC + increases production. Add to this the prospect of a further decline in inventories in the second half of the year, the risk that higher energy prices keep inflation high is the most likely price scenario in 2022.

Energy crisis

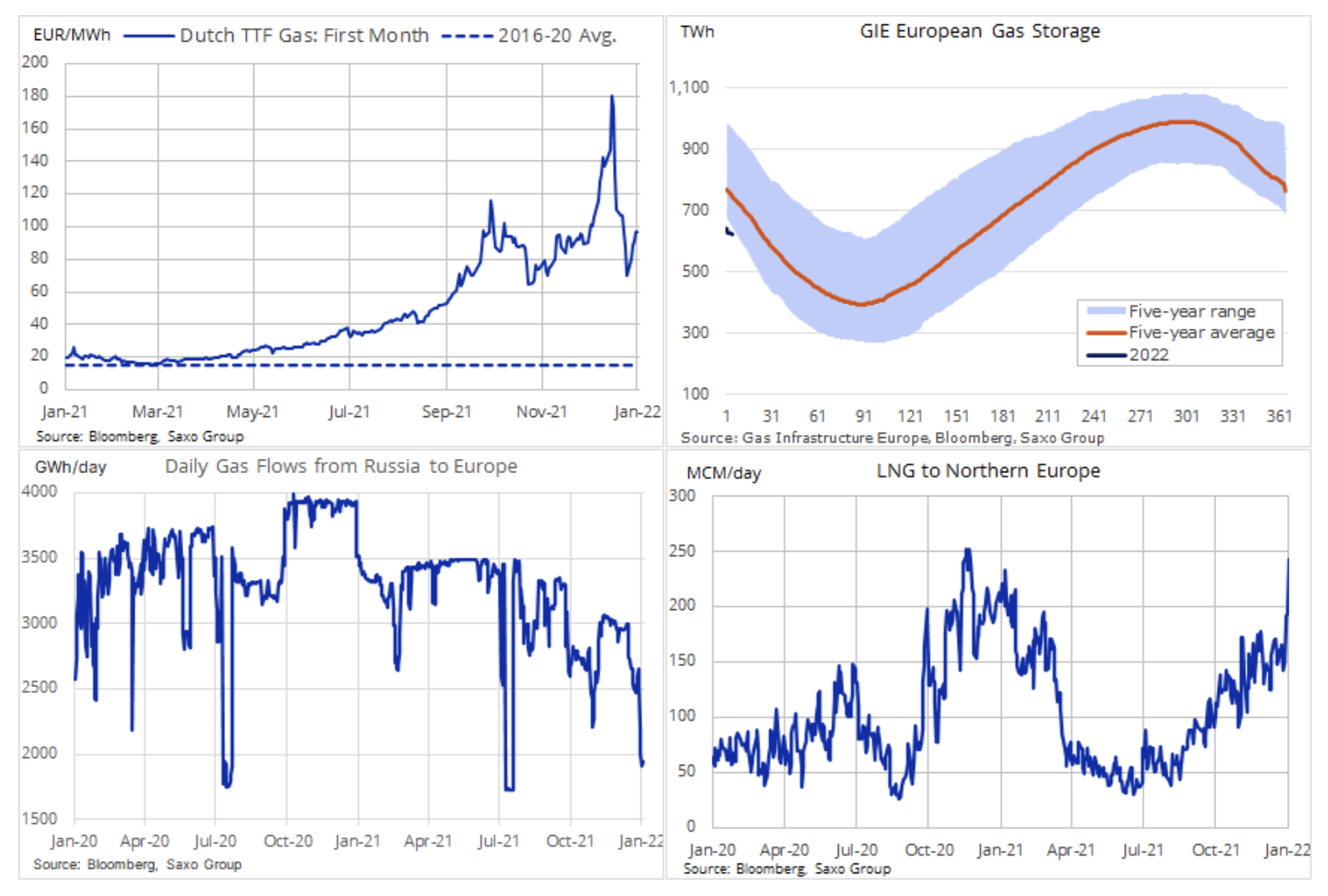

The European energy crisis shows no signs of improvement, and the trajectory of gas prices - and therefore electricity prices - is at the mercy of weather conditions, the level of Russian stocks, and the pace of LNG supplies to Europe.

Over the past few weeks, the gas market has been like an extreme rollercoaster. Before Christmas, a very large cooling down across Europe and the UK caused the price of the EU's benchmark gas to reach ten times its long-term average. This was followed by a 65% collapse in prices in response to the news that many LNG carriers had swung from Asia and South America to Europe to sell gas at the highest price in the world. The unexpected shift in weather that is milder than usual for this time of year has also contributed to easing the current concerns about very low gas stocks, at least in the short term.

At the beginning of January, the price of gas began to rise again on the prospect of cooling and frosts increasing demand for heating, as well as with extremely small supplies from Russia, in particular via two key pipelines running through Poland and Ukraine. It is difficult to say whether Russia is deliberately keeping supplies low due to delays in the approval of the Nord Stream 2 gas pipeline and the crisis on the border with Ukraine. However, this highlights the weakness of EU and UK energy policy and reserve management, making the region highly dependent on gas imports, in particular given the continued volatility of renewable energy production.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)