Hopes for the vaccine versus fears about the virus

As predicted, after the US elections, market attention swiftly shifted back to the Covid-19 pandemic and promising vaccine news, to which precious metals and energy commodities reacted sharply, though completely differently. He was the impetus a statement by Pfizer and BioNTechthat the coronavirus vaccine under development has over 90% effectiveness. Gold has plunged over $ 100, while oil has risen almost 10%.

However, as the week progressed, further increases in the number of infections in Europe, and above all in the United States, dampened moods somewhat. Investors realized that the economic problems are likely to worsen in the short term before recovery can take place once the vaccines are delivered to the market for a gradual recovery in the second half of 2021.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

This is of particular interest from a commodity market perspective, given the possibility that the next short-term policy response will turn out to be a mistake due to the implementation of excessive fiscal stimulus. In our opinion, this would cause the market to focus again on reflation in early 2021, which would be beneficial for metals.

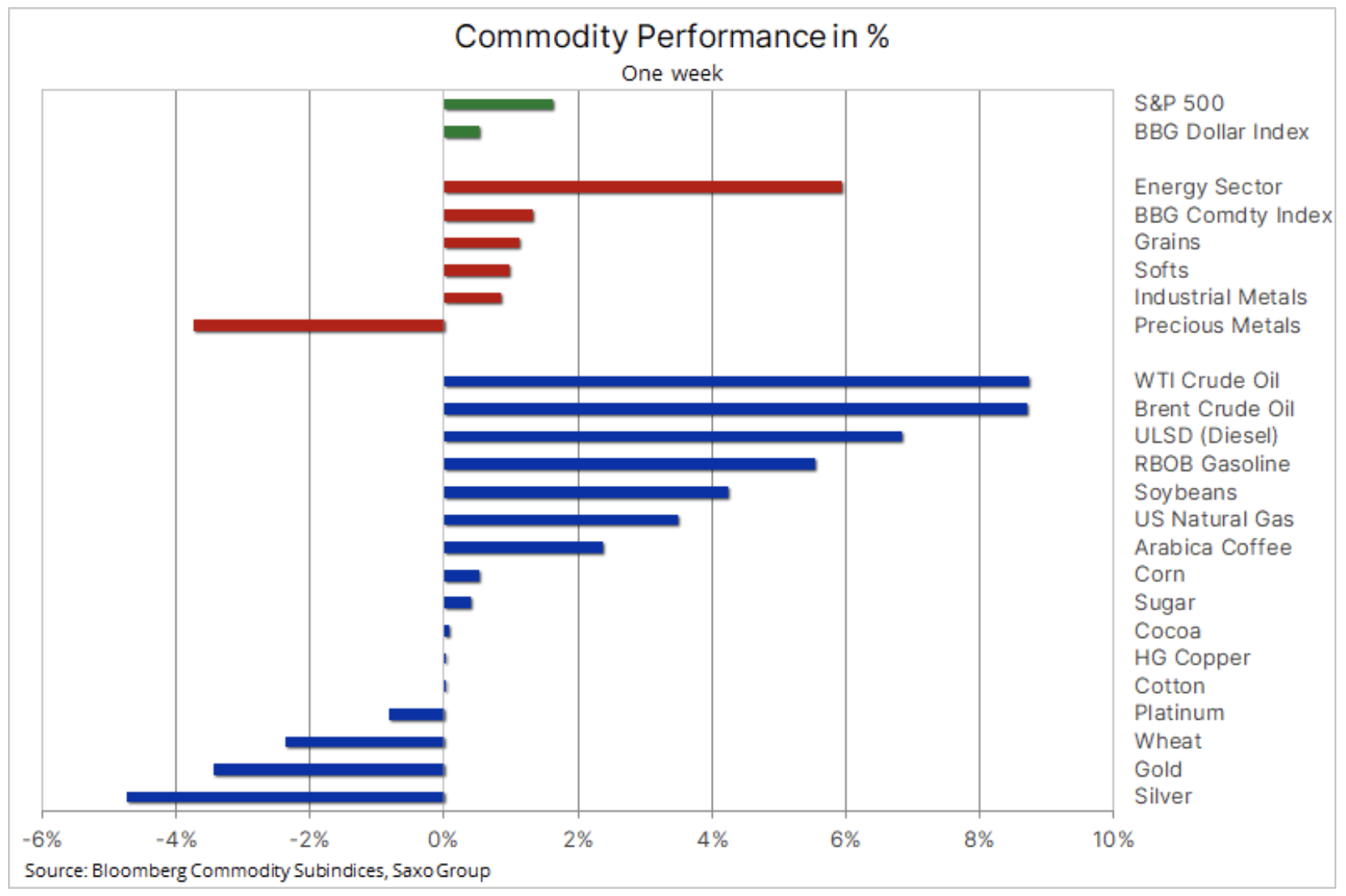

The Bloomberg Commodity Index gained 1,3%; precious metals fell 3,8% more than offset by gains in the agricultural and energy sectors, which rose by 6%.

Agricultural commodities

Crop sector according to the Bloomberg index (example ticker ETF: AIGG: arcx) recorded another 2020-month high, continuing the strong boom that started in August. The latest growth was driven by a report by the US Department of Agriculture, which concluded that US corn and soybean stocks at the end of fiscal 2021/XNUMX will fall to their lowest level in seven years.

The November report on World Supply and Demand Estimates (WASDE) usually does not matter much to investors given that the production and stock situation is already clearly defined by then. However, this year was far from normal due to unfavorable weather conditions and accelerated purchases from China. Soybeans hit a four-year high, with maize hitting a 15-month high before profit-taking after the bullish news was exhausted.

(The WisdomTree Grains fund, which meets the EU's collective investment criteria, monitors the Bloomberg crop sub-index with an exposure of 37,5% to soybean, 34,8% to maize and a total of 27,6% to soft (CBOT) and hard winter red wheat (KCBT).)

Petroleum

Clothing gained value after news on the vaccine, then fell slightly as global demand revised up in reports from the US EIA, OPEC, and the International Energy Agency (IEA). In its monthly oil market report, the IEA lowered its projected global oil demand amid new virus-related constraints and increased production in countries such as Libya. IEA also put pressure on OPEC + to have the organization postpone the increase in production scheduled for January. The group will meet on December 1 to discuss the follow-up.

In this context, MAE stated: “Since the Covid-19 vaccine will not be able to save the world oil market for some time to come, weaker demand combined with increasing oil supply will significantly hinder market conditions. Unless the fundamentals change, the process of rebalancing the market will be slow ". The group lowered its forecast for oil demand both for this year and for 2021, predicting that there will be no significant recovery until the second half of 2021.

Even though we believe the energy sector will definitely come back to the game eventually, at this point it is essential to be patient. The sector has suffered the most from a decline in demand for fuel due to lockdowns and reduced mobility. While the vaccine will eventually normalize demand, it should not be forgotten that oil and commodities in general are not as comfortable - as stocks - to allow forecasts to be rolled over as demand and supply should balance each day. With too much supply, the price goes down to force a reduction in supply while increasing demand, for example by manipulating the level of inventories.

(Brent crude oil is likely to stay in the range around $ 40 / b, and favorable reports on OPEC + ahead of the meeting could offset a further rise in Covid-19 infections.)

Precious metals

Post-election boom precious metals it turned out to be short-lived, as the reports of the Pfizer vaccine affected the short-term forecast. The dollar reversed and bond yields soared, while safe-haven tech stocks depreciated as investors chose small-cap Russell 200 stocks, seen as a barometer of the health of the US economy and its economy. potential recovery. The massive shift from defensive assets towards value impacted gold as it forced a rise in US real rates - a key driver of the metal's price.

We believe the vaccine will improve the outlook for 2021, but in the short term, politicians and central banks are likely to panic as the number of cases increases further. This highlighted three members of the world's top central banks, warning that the mere prospect of a vaccine for Covid-19 would not be enough to address the economic problems caused by the pandemic.

As the world is on the verge of a scientific breakthrough at the vaccine front, additional stimuli could raise inflation expectations for next year. This is due not only to excessive liquidity, but - what is equally important - to an increase in expenditure as a result of higher food and energy prices. Taking this into account, we expect an increase in the yields on longer-term bonds, mainly due to an increase in inflation expectations, which will result in real yields stuck in the negative area for good.

In addition, we still see a possible weakening of the dollar. Not only would this lower the appetite for dollar-priced safe-haven tech shares, it would also boost emerging-market growth and hence revive jewelry demand, which, according to the World Gold Council, fell by 29% y / y in QXNUMX. r.

Summing up, we maintain a positive outlook for goldand with it the possibility of even better silver and platinum results. The timing of the next move up is still uncertain as new reports on the vaccine could lead to a deeper correction than before. The key support remains in the area between $ 1 / oz and $ 850 / oz, while a break above $ 1 / oz is required to attract more buyers.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)