A surprise on the tech companies market

We compare the biggest tech companies in the US, Europe, China and other emerging markets (EM). They include the largest index companies, but they differ significantly from each other. The tech industry in the US and China focuses on online platforms, other markets on hardware, and Europe on two sectors - software and payments. This results in diversified results, a different level of margin and differences in valuation (see table).

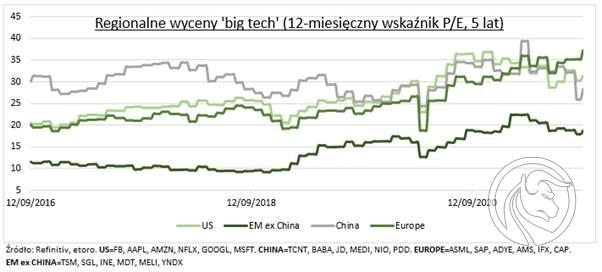

The technology industry is the largest segment of the market in the US and China - 52-58 percent. compared to 42 percent. in emerging markets (excluding China) and "only" 25 percent. in Europe. But Europe is, in terms of performance and valuation, a big surprise in our analysis, China is not cheap enough and the US FAANGM (Facebook, Amazon, Apple Lossless Audio CODEC (ALAC),, Netflix, Google - Alphabet, Microsoft) well placed.

About the author

Ben Laidler - global markets strategist in eToro. Capital investment manager with 25 years of experience in the financial industry, incl. at JP Morgan, UBS and Rothschild, including over 10 years as the # 1 investment strategist in the Institutional Investor Survey. Ben was the CEO of the independent research firm Tower Hudson in London and previously Global Equity Strategist, Global Head of Sector Research and Head of Americas Research at HSBC in New York. He is a graduate of LSE and Cambridge University, and a member of the Institute of Investment Management & Research (AIIMR).

Ben Laidler - global markets strategist in eToro. Capital investment manager with 25 years of experience in the financial industry, incl. at JP Morgan, UBS and Rothschild, including over 10 years as the # 1 investment strategist in the Institutional Investor Survey. Ben was the CEO of the independent research firm Tower Hudson in London and previously Global Equity Strategist, Global Head of Sector Research and Head of Americas Research at HSBC in New York. He is a graduate of LSE and Cambridge University, and a member of the Institute of Investment Management & Research (AIIMR).

European surprise

The European technology basket has the best results this year (+38%), the highest valuation (37 × 12-month P / E - Price / Earnings) and the second-best earnings forecasts (+ 25%). The high valuation partly reflects 1) the relative shortage of industry companies in European equities and 2) fewer regulatory hurdles compared to the US, especially China. Our European basket includes companies from ASML (ASML) and SAP (SAP.DE) to Infineon (IFX.DE) and CapGemini (CAP.PA).

Chinese context

China's eToro technology basket has fallen 15% this year as regulatory tightening continues. This lowered its P / E valuation by a quarter to 28, but still not far from the 31-fold for US FAANGM, despite earnings uncertainty. This is well above 19x for emerging markets (with a significant share of hardware manufacturers) led by Taiwan Semi (TSM) and Samsung Electronics (SGL). The situation for FAANGM looks good, with relatively attractive valuations, strong growth and a small share of debt on the balance sheet.

For great tech themes, see CopyPortfolios @ Four-Horsemen, @ Chip-Tech i @ChinaTech.

76% of retail investor accounts lose money when trading CFDs with this provider. Consider whether you can afford the high risk of losing your money.

eToro is a multi-asset platform that offers both stock investing and CFD trading.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford the high risk of losing your money.

Past performance is not indicative of future performance. The trading history shown is less than 5 full years and may not be sufficient as a basis for an investment decision.

Copy Trading is not synonymous with investment advice. The value of your investment may go up or down. Your capital is at risk.

eToro USA LLC does not offer CFDs and does not make any representations or be responsible for the accuracy or completeness of the content of this publication, which was prepared by our partner using publicly available information about eToro that is not specific to entities.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)