Low interest rates - counterproductive?

Low interest rates - counterproductive? Could central banks have predicted it?

The policy associated with strong monetary easing has long been a reality. Markets live in an environment of low interest rates, which have increased at a pace with the coronavirus outbreak. The reason, of course, was prosaic. Lower interest rates mean the possibility of cheaper loans. This environment is not conducive to saving too much, which is why there should be more cash on the market. The phenomenon of lowering rates is now visible all over the world. A certain "trend" in this area imposes Federal Reserve, which through its actions paves the way and, to some extent, forces other central banks to follow a similar path. It is true that interest rate changes are a very easy process to reverse (in the context of broadly understood monetary policy), but there is no real prospect of its tightening in the coming years.

Low interest rates and capital migration

At least in theory, low interest rates prompt investors and consumers in the broadest sense of dislike towards thesaurization. All deposits, bonds and savings with a relatively small but stable percentage are simply unprofitable for us in the world. Therefore, they are withdrawn from this type of asset and used to increase investments with a higher risk level or simply increase consumption. More money on the market is also cheaper credit. Low interest rates tend to incur liabilities. The lack of satisfactory interest rates on safe savings affects not only individual investors / consumers, but also companies. Talking about alternatives in finding more profitable places to invest capital in the context of companies, we are talking about the search for new investments. Summing up purely theoretical considerations, we should notice an increase in new investments, an increase in loans (including mortgages) and an increase in consumption.

Reverse effect?

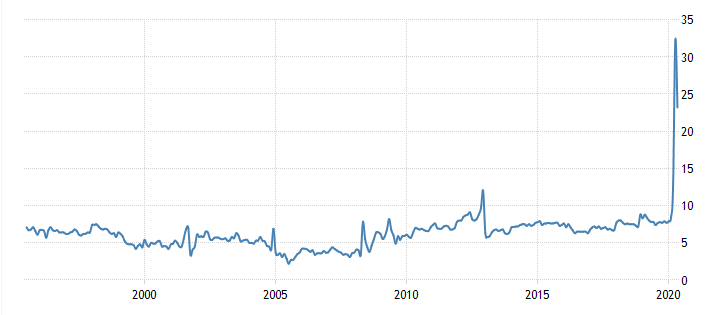

Speaking of the reverse effect, it is worth saying that I mean the opposite to the theoretical effect. Let's look at the first factor, which is household savings. At present, when we are moving at extremely low interest rates, savings have increased dramatically.

Household savings in the US. Source: Trading Economics

The data, of course, relate to the US, but it is a global trend. Equally popular is what we observe in Poland, even analyzing the structure of savings. The vast majority are still accumulated in cash or simply deposited in deposits. Apart from the inflation factor for now, it is worth taking a look at the level of consumer spending in the US.

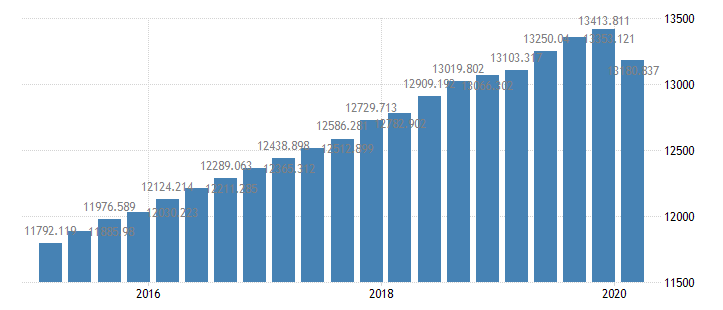

Consumer spending in the USA. Source: Trading Economics

A fairly clear decrease from the expropriated increases y / y from previous years shows that the environment of low interest rates has not fully met the requirements set for it. No one, of course, counts on 100% fulfillment of theory in practice. Nevertheless, recent reductions have resulted in consumers starting to save money while reducing consumption. For comparison, let's also take consumer expenses, whose data come from the Eurozone.

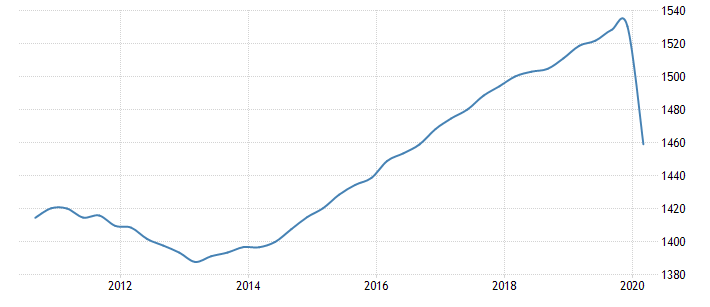

Consumer expenses, Eurozone. Source: Trading Economics

The low interest rate has therefore begun to lead to new savings, while at the same time cutting down on expenditure that is currently very much needed by economies recovering from the crisis. Of course, the fall in consumer spending is primarily due to the coronavirus epidemic.

Where to look for reasons for growing savings?

Of course, it is logical to accumulate savings when their interest rate is very low and high inflation devours them. The phenomenon we are currently dealing with is what we could observe for a long time in the markets. We have been living in low interest rates for some time. As a result, the process of saving savings had to be reduced to such an extent that it would accumulate again. In addition, the concerns that coronavirus feeds on markets encourages the public to "protect" itself just in case, thus increasing the austerity needs. Of course, lower consumption and no search for alternatives to increase capital profitability will lengthen the process of economic recovery.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)