Emerging Markets Bonds: The bull market is not over yet

As 2020 passes, investors are starting to take stock of this de facto special year. As a result of the Covid-19 pandemic, volatility increased significantly. While many assets are still on the way to recovery, some have already rebounded solidly. Emerging market bonds rebounded particularly, making many people wonder if further growth is still possible.

Our positive view of emerging markets is due to several reasons.

About the Author

Althea Spinozzi, Marketing Manager, Saxo Bank. She joined the group Saxo Bank in 2017. Althea conducts research on fixed income instruments and works directly with clients to help them select and trade bonds. Due to his expertise in leveraged debt, he focuses particularly on high yield and corporate bonds with an attractive risk-to-return ratio.

Althea Spinozzi, Marketing Manager, Saxo Bank. She joined the group Saxo Bank in 2017. Althea conducts research on fixed income instruments and works directly with clients to help them select and trade bonds. Due to his expertise in leveraged debt, he focuses particularly on high yield and corporate bonds with an attractive risk-to-return ratio.

First, Federal Reserve will not raise interest rates, until inflation rises. This means that investors will be forced to look for solid returns outside their comfort zone. It also means that if interest rates do not rise, emerging markets will be able to continue to finance themselves with ease.

Emerging markets' continued need for funding is a concern of investors as they increasingly rely on capital markets. In our opinion, this is not a significant problem. Emerging markets have been given the green light by the IMF to embark on an expansionary monetary policy, which in turn will ultimately support the market value of their bonds.

Second, even if the Covid-19 pandemic exacerbates pressure on certain regions or sectors, in 2020 Maturities of emerging market bonds have lengthened, not shorter. This is a positive trend as it means that countries can lock in low interest rates for longer, lowering refinancing risk in the short to medium term. One of the best examples is Turkey, which was able to extend the maturities of both dollar and lira bonds despite the currency crisis. Likewise, Peru, which issued $ 4 billion in bonds this week with maturities of 12, 40 and 100 years. The 170-year Peruvian bonds have been valued XNUMX basis points above US Treasury bonds, making them the XNUMX-year bond with the lowest yield of any emerging market.

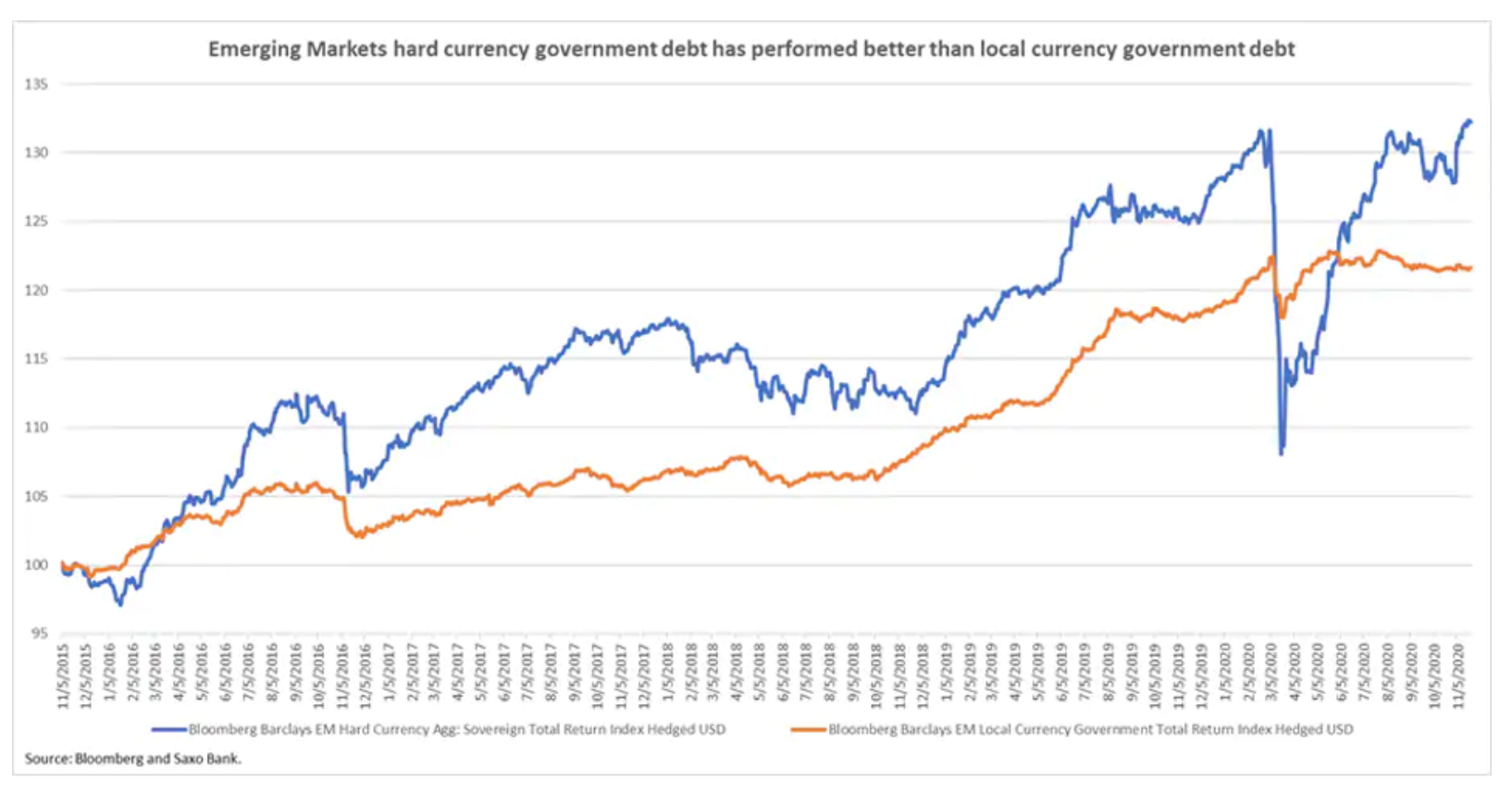

The implementation of accommodative monetary policy by central banks of developed countries also positively affects the debt of emerging economies. As can be seen in the chart below, hard currency denominated government bonds outperformed local currency government bonds. The explanation for this may be the expansionary policy of the Federal Reserve i EBC after the Covid-19 pandemic, which led to a decline in the profitability of all asset classes. As central banks around the world continue to implement new fiscal stimulus, it can be expected that these assets will continue to be supported.

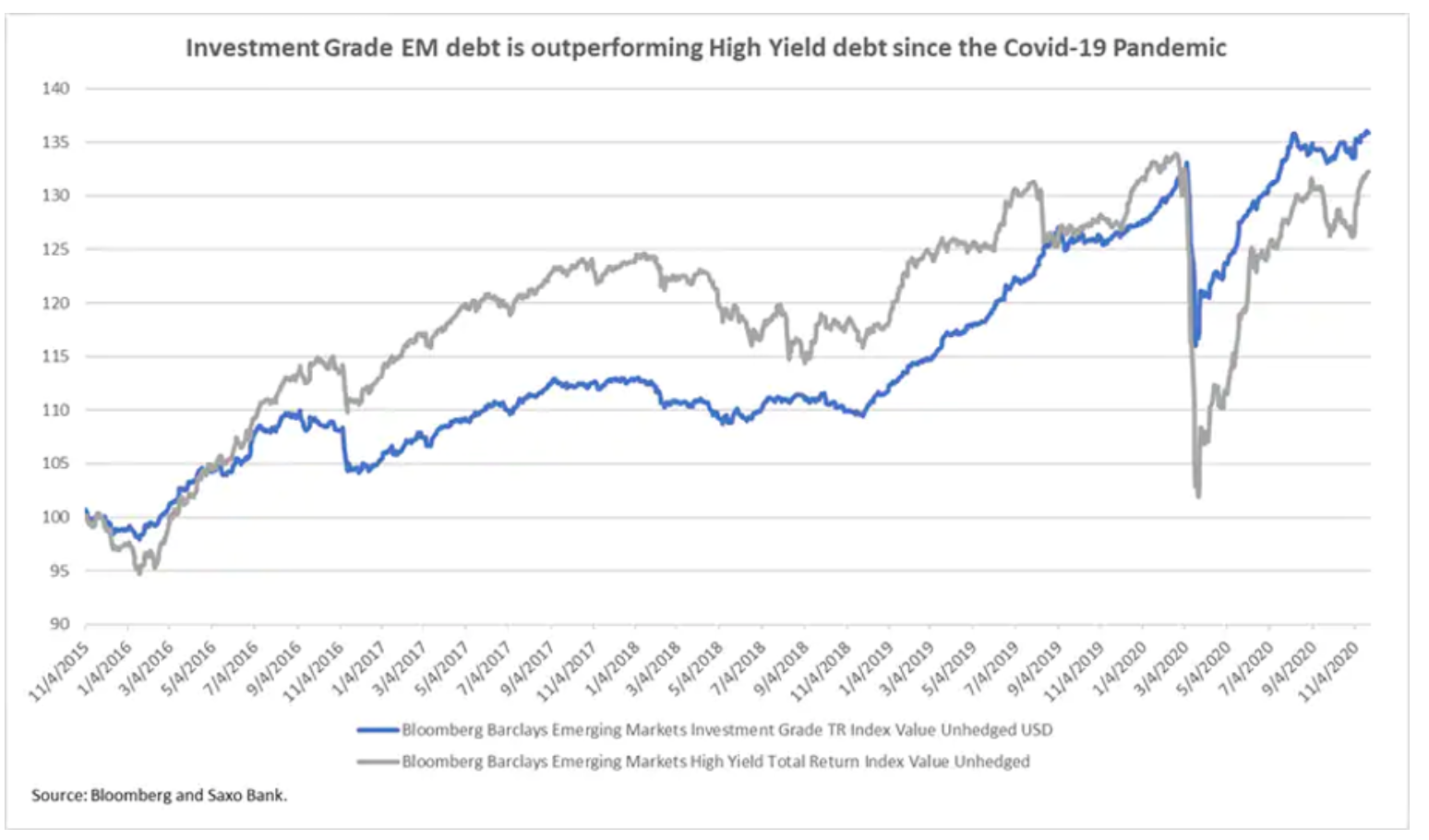

Interestingly, after the pandemic, better quality emerging-market assets rebounded much more than junk bonds. Prior to the pandemic, high yield emerging market debt outperformed investment grade bonds. This could be a signal that riskier assets are still undervalued.

Interestingly, after the pandemic, better quality emerging-market assets rebounded much more than junk bonds. Prior to the pandemic, high yield emerging market debt outperformed investment grade bonds. This could be a signal that riskier assets are still undervalued.

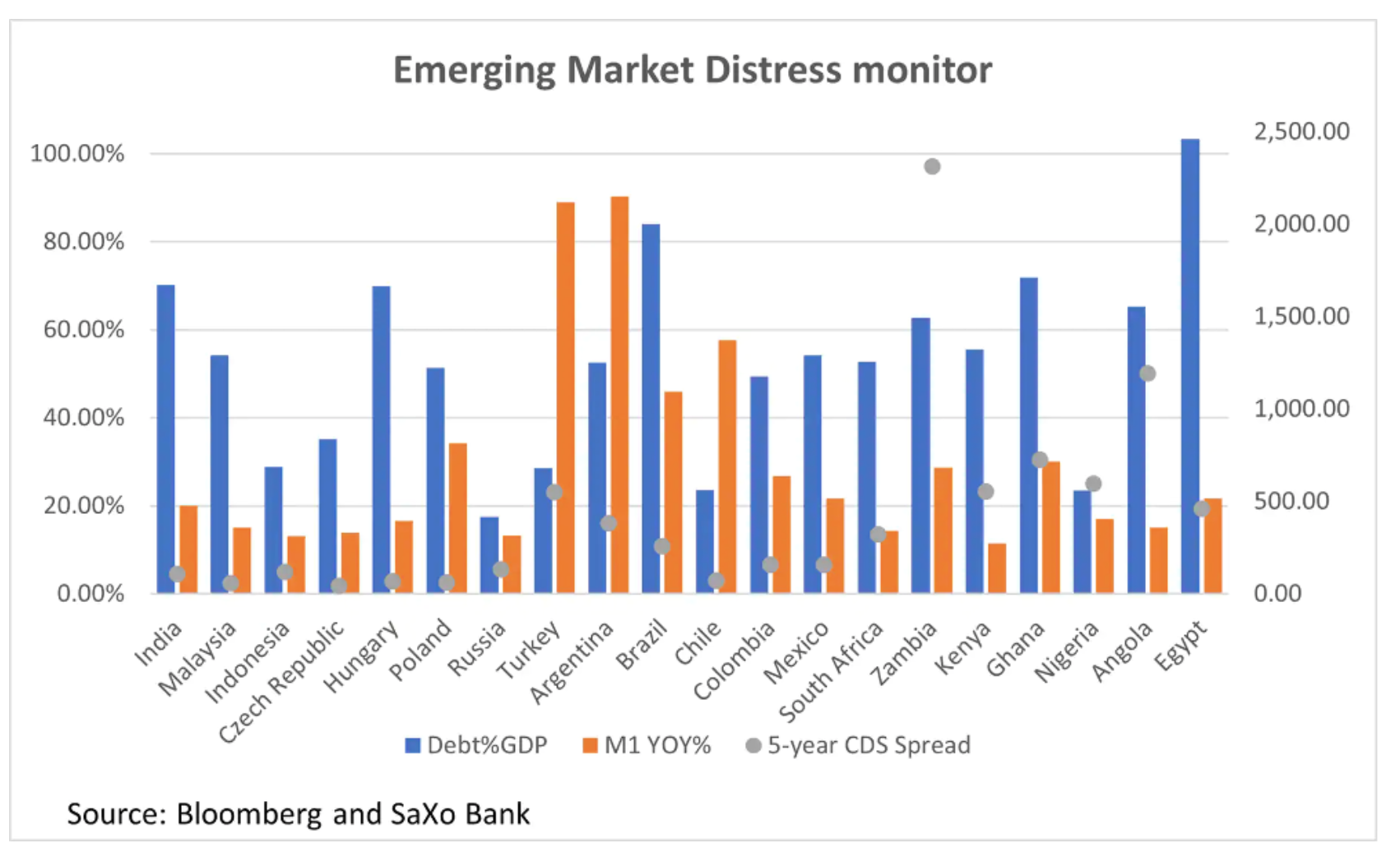

As we pointed out earlier, careful risk selection is important as some countries may be over-leveraged. Our EM stress index (below) shows that Russia, Indonesia, Mexico and the Czech Republic all offer stable market conditions. On the other hand, Turkey, Argentina, Egypt, Angola and Chile appear to be at the highest risk. The indicator compares each country's debt-to-GDP ratio with their five-year credit default swap spreads and money supply.

As we pointed out earlier, careful risk selection is important as some countries may be over-leveraged. Our EM stress index (below) shows that Russia, Indonesia, Mexico and the Czech Republic all offer stable market conditions. On the other hand, Turkey, Argentina, Egypt, Angola and Chile appear to be at the highest risk. The indicator compares each country's debt-to-GDP ratio with their five-year credit default swap spreads and money supply.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-300x200.jpg?v=1709556924)