Oil and natural gas face risk of disruption in the Red Sea

Oil prices and gas in Europe rose on Monday after several companies, including BP and Equinor, joined a growing list of companies that have suspended shipping in the Red Sea due to near-daily attacks by Iran-backed Houthi rebels. Events that have led London's marine insurance market to expand what it considers a high-risk area in the Red Sea, further restricting ship flows on the shortest route to Europe from the Middle East and Asia via the Suez Canal.

This is the latest disruption from the war between Israel and Hamas, in which Houthi attacks are being carried out in support of Hamas, and while it may increase short-term supply risks as ships will have to circumnavigate Africa, adding thousands of nautical miles to their voyage routes , thereby delaying cargo deliveries, the risk of lasting impact appears to be limited at this stage. Also considering that US Secretary of Defense Austin announced plans to create a new maritime task force aimed at protecting commercial ships from attacks. This announcement helped to contain the increase at the beginning of the week, and some weakening is already visible, especially in the case of gas.

Longer voyages will require more ships, and with freight rates potentially rising, shipowners stand to gain the most from this disruption. Since Friday's news, the global shipping index, which tracks the performance of water-based shipping stocks, has jumped 10%. An example is Denmark's Maersk, one of the world's largest container ship owners, which jumped by 18%, recently under pressure from the global economic slowdown and growing transport capacity. By Monday, about 46 container ships had diverted around the Cape of Good Hope instead of transiting the Red Sea, while another 78 container ships are delayed and awaiting further orders before transiting.

Suez update: 46 container ships now have diverted around the Cape of Good Hope rather than transiting the Red Sea. pic.twitter.com/4zaTXn3LO1

— Ryan Petersen (@typesfast) December 18, 2023

Gas: The biggest risk is the weather

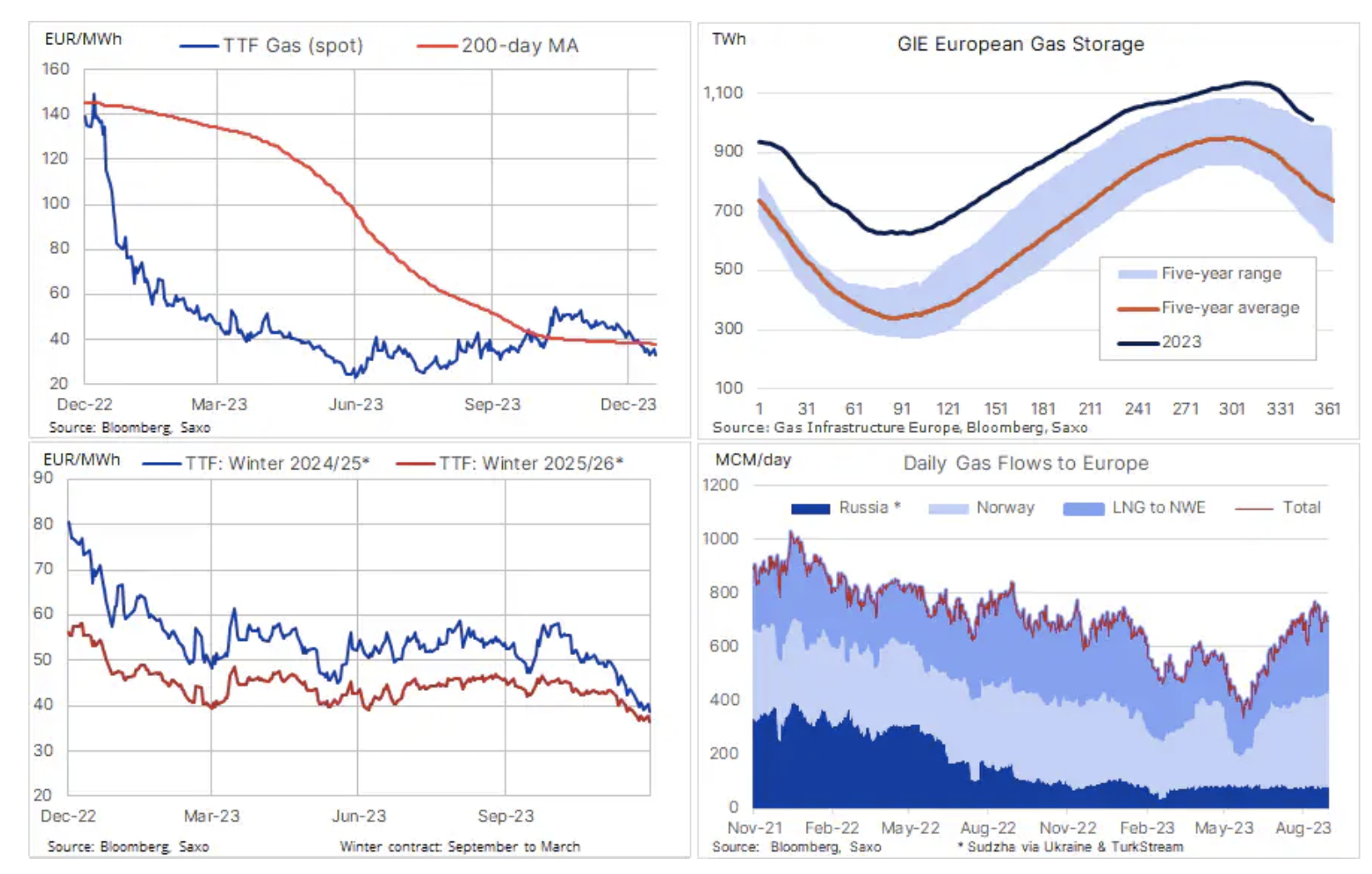

Returning to the energy sector, where the European benchmark TTF gas contract rose as much as 13% on Monday before falling the next day. The Suez Canal has become a major route for global LNG trade over the past two years as Europe looks to the Middle East for substitutes for pipeline gas from Russia. However, while the closure of the canal highlights Europe's increased dependence on gas chilled, demand forecasts this winter remain moderate due to high gas levels in storage, a mild start to winter and weak industrial demand, all of which are factors weighing on prices. With this in mind, spot prices are likely to remain above EUR 30 per MWh, and the main catalyst for changes in both directions will be weather developments.

Oil Benefits from Fund Mistakes

Brent and WTI crudes, which have been falling sharply since late September, received a boost from news that BP and Equinor, as well as other shippers oil and fuel products, will stop deliveries through the Red Sea. This thus supported the rebound that began last week's turnaround Fed towards lower interest rates supported a general recovery in risk appetite. As with gas, we expect disruptions to this major trade route to be short-lived and, as production will not be affected, the impact on prices is likely to be short-lived.

However, given the involvement of Iran-backed Houthi rebels, the risk of an escalation in tensions cannot be ruled out, and together with the very weak positioning of funds before 2024, these two events could signal the establishment of a new low. With Brent crude in the area around $72, which has provided support several times since March, raising speculation that this may be an invisible line in the sand that OPEC+ producers may try to defend.

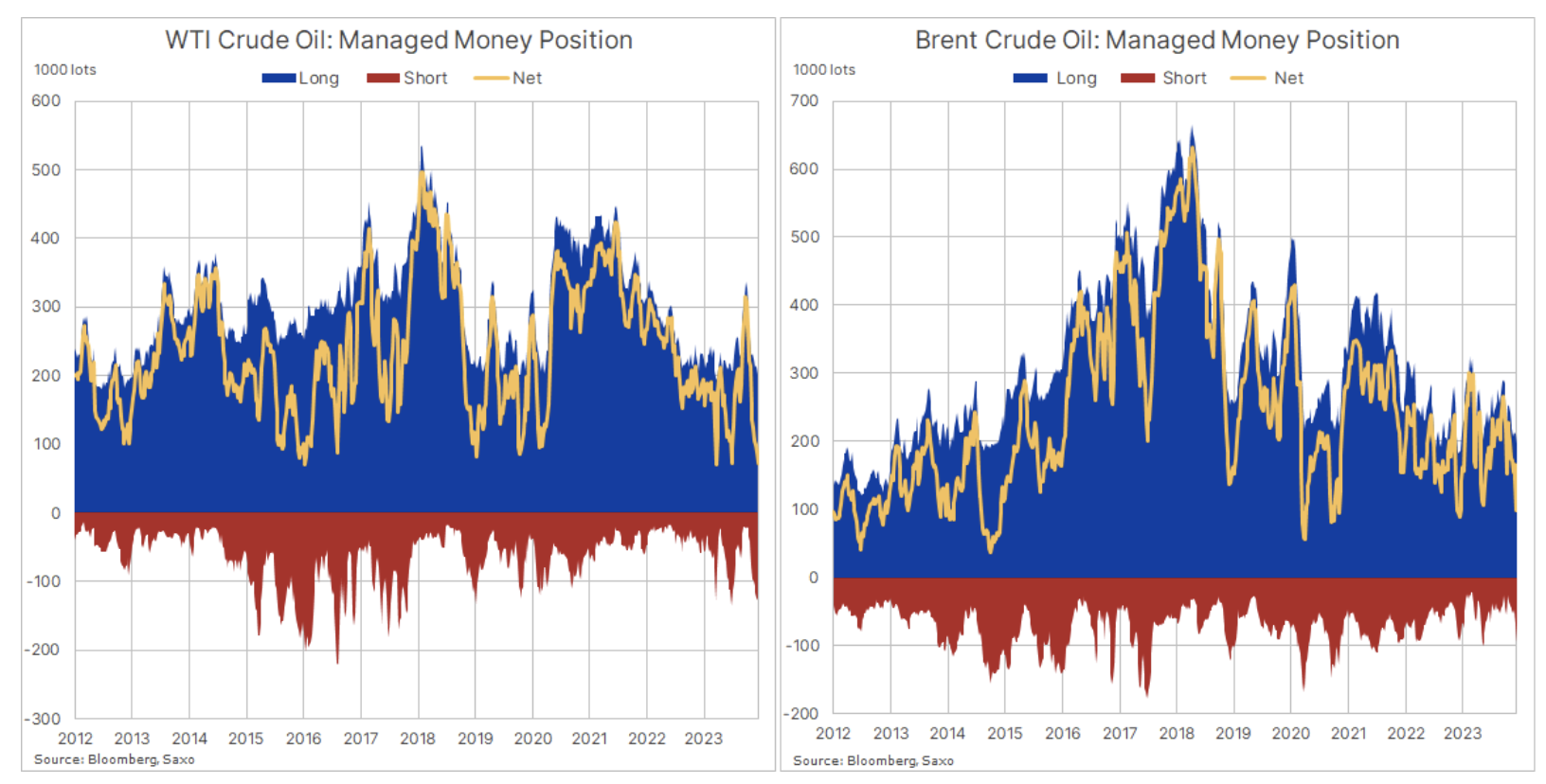

As we highlighted in one of the previous ones update, speculators such as hedge funds and CTAs (commodity trading advisors) reduced their net long positions in WTI and Brent to a 12-year low in the week leading up to last week's rebound supported by FOMC. The sale, which occurred in the week ending December 12, was conducted at volume-weighted average prices (VWAP) below current levels of both WTI and Brent and highlights the involvement of short covering, potentially telling us that the rebound was largely due to technical rather than fundamental Change. A drop to 171. contracts (171 million barrels) from the September peak of 560 thousand. contracts shows how the combination of weakening fundamentals and negative momentum can impact prices and positioning among speculators.

Keep in mind that this group of traders tends to anticipate, accelerate and amplify price movements that have been set in motion by fundamentals. Being momentum advocates, this strategy often shows this group of investors buying on strength and selling on weakness, which means they often find themselves holding the largest long position near the top of the cycle or the largest short position before a market breakout. Given the current weak positioning, it won't take much change to support the rebound, but with increasing trading activity ahead of Christmas and New Year, the prospect of further gains will depend on the economic outlook for the first months of 2024 and whether OPEC+ continue to actively manage supply.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![CRB index – one of the popular commodity market benchmarks [Guide] crb index](https://forexclub.pl/wp-content/uploads/2024/05/indeks-crb-184x120.jpg?v=1715055656)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![CRB index – one of the popular commodity market benchmarks [Guide] crb index](https://forexclub.pl/wp-content/uploads/2024/05/indeks-crb-300x200.jpg?v=1715055656)