Options: Delta - Greek key factor

So far, in the options cycle, we have focused on the practical application of options. However, most often in texts, transactions on options were closed upon their expiry. Most traders don't hold options that long, few investors use options for position trading. Most often, they use the option for periodic hedging strategies or for speculative transactions. In order to use options effectively in speculative transactions, you need to know how the price behaves when external factors act.

These factors include:

- time until option expires

- variability

- change in the price of the underlying instrument

- interest rate change

Each of the above-mentioned factors influences the option pricing in a different way. Due to the fact that these factors work simultaneously for many, the change in the price of an option is "strange". However, there is both math and "crowd psychology" behind these price changes. A proper understanding of how these factors affect the price can help you not overpay for an option or sell it too cheaply. Due to the complexity of the topic, individual factors will be described in the following articles. We invite you to read!

READ NECESSARY: WHAT ARE THE OPTIONS? INTRODUCTION

Greek coefficients

Currently, the letters of the Greek alphabet are associated with other variants of the coronavirus. However, "Greek" is also used in the "language" of the options. Terms such as delta, gamma, theta and rho are reflected in the study of changes in option prices caused by specific factors. In today's article, we will present what delta is and how it influences the price of an option, and what else it can be used for.

Delta is the most important and most widely used Greek coefficient by option traders. The aforementioned letter of the alphabet informs how much the option price will change when the price of the underlying instrument increases.

Delta is also called the first derivative because it tells you when the option price has changed. There are also second derivatives which tell how a given Greek coefficient will change due to another factor (it is also important).

The value of the delta is different for each type of option. There is a division into:

- type of option

- option settlement price

- the period until the option expires

Type of option

The basic distinction of this derivative is the division into call options and put options. The call option gives the buyer the right (not the obligation!) To buy the underlying instrument at a predetermined price. In turn, the put option gives the buyer the right to sell the underlying instrument at a predetermined price. Depending on the type of option, the right may apply on the expiry date of the option (European style), at any time (American style), on certain days (exotic option). What is the delta of call and put options?

- In the case of a purchased call option, the delta value is from 0 to 1

- For a purchased option, put delta is between -1 and 0

Why is the delta of the purchased call option between 0 and 1? The answer is simple. According to the formula, the delta is equal to the change in the price of the option divided by the change in the price of the underlying. The value of the call option increases with the increase in the price of the underlying instrument (ceteris paribus). If the delta is 0,5, then a change of the underlying instrument (share, index, etc.) by 1 results in a change of the option by 0,5. If the delta were higher than 1, there would be an opportunity for arbitration. If the option price increased by, for example, 1,5 and the price of the underlying instrument increased by 1 during that time, it would be profitable to sell the call option and buy shares with a delta value * nominal value of the option. If the call option has a delta of 0, it means that the change of the underlying instrument has no influence on the option price.

The delta of a bought put option has a range of -1 to 0. Why? This is because the change in the price of the put option is negatively correlated with the change in the price of the underlying. Since the put option allows you to "earn on declines", its value increases with the decline in the value of the stock or other asset on which the option is based. If the put delta is -0,6, it means the put value goes up by 0,6 when the underlying instrument goes down by 1.

Option settlement price

This parameter affects the size of the delta. As a rule, options can be divided into three types:

- ITM options,

- ATM type options,

- OTM options.

ITM options are "most expensive" in nominal terms. ITM stands for the type of options that have an intrinsic value. For a better explanation of what the intrinsic value of an option is, we will use the following example. The investor has a call option on the shares of XYZ. The exercise price of the option is 45 and the market price of the share is 50. What is the minimum value at which the option is sold? The answer is simple: 5. This is the intrinsic value of the option. If the price of the option were 4, it would be worth selling 100 shares of the company for 50 and buying 1 call option with a strike price of 45 for $ 400 ($ 4 * multiplier of 100). The investor sold the shares for $ 5000, pledged to buy them back for $ 4500, and paid $ 400 for it. The minimum profit per transaction would be $ 100. Coming back to the topic, an ITM option is one that has an intrinsic value. That is, the exercise price of the call option is lower than the market price of the underlying instrument or the exercise price of the put option is higher than the market price of the underlying instrument.

- ATM options is an option type where the strike price is equal to the current market price of the underlying. It has no intrinsic value. The total price of the option consists of the so-called time value.

- OTM option are the "cheapest" in nominal terms. These are options whose strike price is either higher than the market price of the underlying instrument (for call options) or lower (for put options).

The more the ITM option is, the larger the delta the call option has. This is due, inter alia, to an increase in the probability that options with an intrinsic value will expire. In turn, the more OTM option is, the lower its delta is. The chance of a trade ending profitable on the expiry date just drops. The delta of the call option being ATM has a value close to 0,5.

The put option is a bit different. The more the put option is ITM, the delta tends towards -1. On the other hand, the more the put option is OTM, the delta tends to 0. The delta of the put option, which is ATM, has a value close to - 0,5.

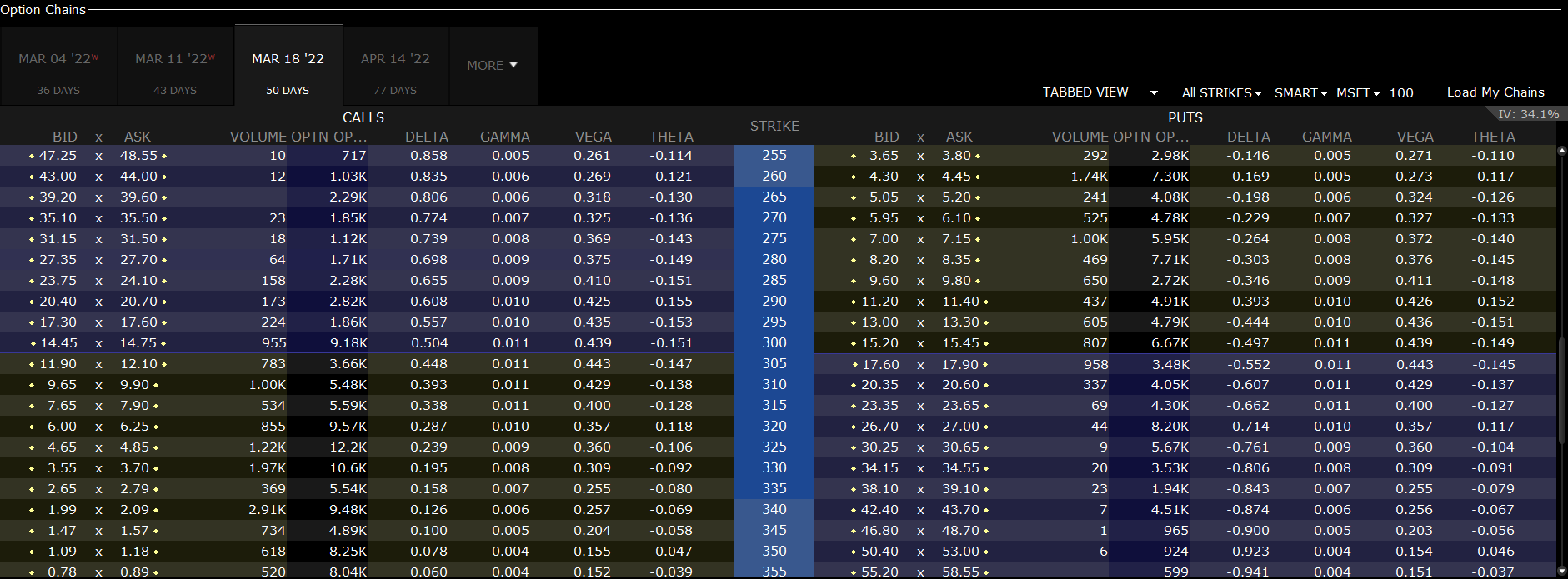

It is worth following an example from life. Below is an overview of the call and put options Microsoft shares ($ MSFT)which expire on March 18, 2022. The data is taken from January 27, 2022. At this point, Microsoft's stock was trading in the region of $ 300 per share.

Click to zoom. Source: platform TWS.

The picture clearly shows that in the case of the call delta option, the higher the ITM option is. For example, a call option with an exercise price of 300 has a delta of 0,504. For a call option with an strike of 260, the delta is 0,835.

The delta for a put option with an strike of 300 was -0,497. In the case of a put option with an exercise price of 340, the delta is -0,874. For the OTM option with strike price of 270, the delta was -0,229.

Period until option expiry

As options get closer to expiry, the delta for ITM options increases. This is due to the increased probability of expiry of the "in money" option. For the OTM option, the delta drops due to a decrease in the probability that an option with an intrinsic value will expire.

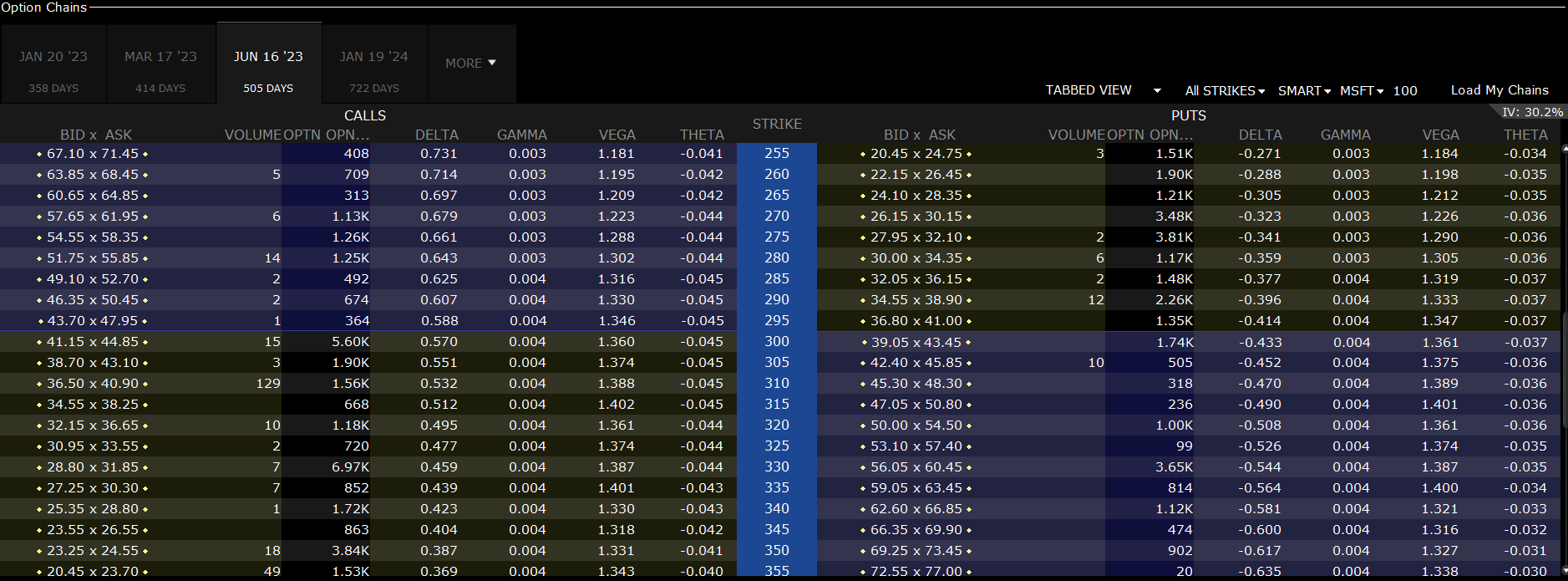

Below are examples of option deltas for Microsoft stock call options. Data from January 27, 2022:

|

Call options on Microsoft |

March 4, 2022 |

March 18, 2022 |

April 14 2022 |

|

Strike price: $ 260 |

0,867 |

0,843 |

0,810 |

|

Strike price: $ 280 |

0,733 |

0,712 |

0,690 |

|

Strike price: $ 300 |

0,516 |

0,522 |

0,528 |

|

Strike price: $ 320 |

0,267 |

0,304 |

0,347 |

|

Strike price: $ 340 |

0,096 |

0,134 |

0,190 |

As can be seen from the market data, this is correct. It can be concluded that for the OTM option, the delta increases with the time period until the option is exercised. It's worth seeing that for the "long execution time" option, the delta grows even more. For a call option with an exercise price of $ 340 and expires on June 16, 2023, the delta is 0,423. On the other hand, for a call option with an strike of $ 260, the delta is 0,714.

The delta coefficient as a measure of probability

Another use of options is to use delta as a probability index. In this case, the absolute value is used. If the option has a delta of 0,50, it means that the market is evaluating the probability of exercising the option "in money" at 50%. If the delta of the put option is -0,45, then the probability that the option price will expire is 45%. The more the option is OTM, the lower the delta it has, which means a low probability of an increase in the price of the underlying instrument around the option's exercise price. Of course, such a probability calculation is only an estimate and not an exact value.

Delta as a hedging position

Delta can also be used to create portfolio hedging strategies. This strategy is to build a portfolio with a delta of zero (delta neutral). In such a situation, the loss on the equity portfolio is compensated with the gain on options. It should be noted, however, that the wallet is only in the delta neutral position for a short time. The reason is the constant change of the option delta, which requires the portfolio adjustment (so-called rebalancing). The periodic change of the portfolio means that a so-called dynamic delta hedging is used.

What does an example delta neutral transaction look like? For example, an investor has a purchased call option for Microsoft shares expiring on March 18, 2022. The option exercise price is $ 270. Currently, the delta is 0,774. This means that a $ 1 increase in the stock price will increase the option price by 0,774. However, if the stock fell by $ 1, the loss would be 0,774. How can I protect my wallet? The easiest way is to sell Microsoft stock for a short time. Since the options have a face value of 100, this means that 77 shares have to be sold. Why? Because the delta for a briefly sold share is -1. The delta of the portfolio thus secured is therefore 0,004. If the stock price drops by $ 1, the option value will decrease by $ 77,4 (0,774 * a multiplier of 100). The loss on options is largely covered by a gain on short selling of 77 Microsoft shares.

Gamma and delta

Gamma is the so-called second derivative. The aforementioned Greek factor determines how the delta value changes when the underlying instrument changes. Let's take an example of Microsoft stock options expiring on March 18, 2022.

For a call option with a strike of $ 300, the delta is 0,504 and the gamma is 0,011. This gamma level means that an increase in the underlying by $ 1 causes a delta increase of 0,011. An increase of $ 5 means a delta increase of 0,055. If you look at the delta value for a call option with an strike of $ 295, the delta is 0,557.

Summation

Delta is a very important Greek coefficient that allows you to estimate how the value of the option will change in the event of a change in the price of the underlying instrument. This allows the trader to calculate the potential profit from buying or selling a call or put option. Another application of the delta is to estimate the probability of exercising the option "in money". In addition, the delta can help create a security for your wallet. This is known as the delta neutral strategy. It is worth mentioning that the delta is influenced by many factors. One of them is the change of the underlying instrument itself, which is calculated by the gamma indicator.

Do you know that…?

Saxo Bank is one of the few Forex brokers that offers vanilla options. The investor has a total of over 1200 options at his disposal (currencies, stocks, indices, interest rates, raw materials). CHECK

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![How to invest in Feeder Cattle? [Guide] how to invest in livestock - feeder cattle](https://forexclub.pl/wp-content/uploads/2023/09/jak-inwestowac-w-bydlo-hodowlane-feeder-cattle-300x200.jpg?v=1693821591)