Options: Iron Condor - earning on low volatility

Options, thanks to the asymmetric division of risk, allow you to build interesting investment strategies. Some of them offer a profit in the event of a sharp price change (e.g. long rack strategy). With such a strategy, the investor will earn when the underlying instrument either increases or decreases significantly. The investor will therefore be the beneficiary of high volatility. Another group of strategies are those built for the period of low volatility. An example of such a strategy is short butterfly or short rack strategy. With such a strategy, the investor will only make a profit if the price of the underlying instrument (at the time of the option expiration) remains approximately at the same level as when the position was opened.

In this article, we will introduce the Iron Condor strategy, which, despite the theoretically uninteresting profit-to-risk ratio, offers a high probability of closing the transaction with a profit.. However, it is necessary to "like" the statistics.

READ NECESSARY: WHAT ARE THE OPTIONS? INTRODUCTION

What is Iron Condor

This strategy is largely based on a risk analysis for which statistics are used. As a rule, it is assumed that price movements in the stock market obey the laws of the normal distribution. This means that the probability that the price of the underlying instrument will rise or fall is less than it will remain close to the current market price. However, the more time it is until the option expires, the greater the chances of a significant increase or decrease in the price of the underlying asset. From this it can be concluded that the more time it takes to exercise an option, the more its price increases. Conversely, as the time to settlement of options decreases, the potential range of price fluctuations (based on the normal distribution) decreases. The investor should manage the risk in such a way as to take the risk when the probability of winning is higher than ending the strategy at a loss.

Building the Iron Condor strategy

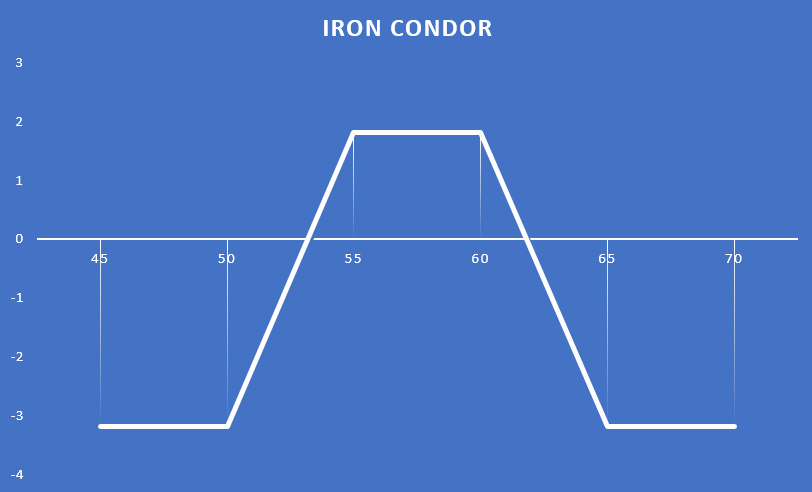

Iron Condor is not a simple strategy. It requires you to open four option positions that together create a solution that offers a predetermined maximum profit and maximum loss. So the strategy will be liked by investors who like to know in advance how much they can lose. So what are the details?

Iron Condor is created as a result of issuing two spreads (call and put). Options with a higher premium are posted, while "cheaper" options are bought. The purchased put and call options insure against the realization of an extremely negative but probable scenario of a sudden price change in any direction. It is therefore a cost that allows you to limit potential losses. Thanks to such a structure of the strategy, the investor receives bonuses, which are the maximum profit from the transaction. Until the expiry of the option, the investor tries to "defend" the received bonuses.

Sample transaction

On November 5, the investor decided to create an Iron Condor on Coca-Cola shares. The company's shares were then traded at around $ 57. The investor expected the company's share price to remain more or less at a similar level in the next few months. For this reason, options expiring on March 18, 2022 were exercised. The following transactions were made:

- A call option was issued with an exercise price of $ 60. The investor received $ 85 for this.

- A call option was purchased with an exercise price of $ 65. The investor had to pay $ 14.

- A put option was issued with an exercise price of $ 55. The investor received $ 177.

- Bought a put option with an exercise price of $ 50. The investor paid $ 66 for this.

Podsumowując:

The investor received $ 262 from the issued call and put options. To protect against large losses, the purchase of call and put options that are far beyond the money (OTM) was used. The investor had to pay $ 80 for the protection. As a result, the maximum profit per trade is $ 182 (bonus received). As a result, the investor has established the profitability of the transaction in the following range:

$ 55 -1,82; $ 60 + $ 1,82, which is $ 53,18 - $ 61,82

In turn, the maximum loss from the strategy is $ 318. This means that the profit / loss ratio seems unfavorable as the investor is risking 174% of the potential profit.

Source: own study

On December 30, 2021, the option prices are as follows:

- The issued call option with the strike price of $ 60 is currently worth $ 120

- A purchased call option with an exercise price of $ 65 is now worth $ 16

- A put option issued with an exercise price of $ 55 is now $ 67

- Bought a put option with an exercise price of $ 50 is now worth $ 25

If the investor then wanted to close the position, he would have to buy back the posted call option at $ 1,2 (per share). This would mean a loss of $ 35. He would also have to buy back the put option for $ 0,67 ($ 67). As a result, he would have made a profit of $ 110 as he put her down for $ 1,77 ($ 177). At the same time, he will close his long position in the call option at $ 16, which means a profit of $ 2. On the other hand, closing a put option with an exercise price of $ 50 generated a loss of $ 41 as the option price had dropped to $ 0,25 ($ 25). Bottom line: The closing of the iron condor at the current price resulted in a gain of $ 36.

Below is a summary table:

| 18.03.2022/XNUMX/XNUMX Coca-Cola | Opening price | Closing price | Transaction result |

| Short call $ 60 | 0,85$ | 1,20$ | -0,35 $ |

| Long call $ 65 | 0,14$ | 0,16$ | + 0,02 $ |

| Short put $ 55 | 1,77$ | 0,67$ | + 1,10 $ |

| Long put $ 50 | 0,66$ | 0,25$ | -0,41 $ |

Source: own study

Iron Condor management

The mentioned strategy does not always bring profits, it should be remembered that the potential loss is much greater than the possible profit. For this reason, a few lossy IC trades can offset many profitable trades. For this reason, you need to be very careful in managing your losing positions. What can be done if the position begins to lose money?

- Do not interfere with the transaction - if the price of the underlying instrument is approaching the profitability limit, the investor may use a passive approach. May assume that the current rise or fall is a typical market fluctuation and does not threaten the position. Due to the fact that the issued options are more sensitive to the passage of time (theta), if the price of the underlying instrument starts consolidation, the investor will benefit from the so-called time decay.

- Directional rolling - this is a strategy that involves closing a lossy spread (call or put) and opening a new one at a higher or lower price. The mentioned solution is not the most recommended as the new spread will be built at a lower premium. So it is securing a larger "profit area" at the cost of potentially lower profit.

- Rolling forward - it is a solution that involves the closure of the current Iron Condor and the opening of a new one, with the same execution prices, but with a longer execution period. This allows you to earn higher bonuses on your traded options and gain extra time. However, if the market continues to move in a strong trend, the investor will increase the loss.

- Directional and forward rolling - the strategy consists in closing the spread, opening a new one with different strike prices (higher or lower) in options with a longer period until their expiry.

Summation

The Iron Condor strategy can be a very interesting solution for investors looking for profit in a market characterized by low volatility. However, it should be remembered that this is a strategy that requires a great deal of attention to select the appropriate "components" of the strategy. The investor should compromise between the potential profit and exposure to the risk of a sharp change in price. This means that the investor must choose:

- How unfastened the Iron Condor should be,

- Select the option expiry period,

- How to defend a strategy,

- When to open an Iron Condor (market situation).

Do you know that…?

Saxo Bank is one of the few Forex brokers that offers vanilla options. The investor has a total of over 1200 options at his disposal (currencies, stocks, indices, interest rates, raw materials). CHECK

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![How to invest in Feeder Cattle? [Guide] how to invest in livestock - feeder cattle](https://forexclub.pl/wp-content/uploads/2023/09/jak-inwestowac-w-bydlo-hodowlane-feeder-cattle-300x200.jpg?v=1693821591)