Options: What is the naked put strategy?

Many investors focus only on buying call and put options. Strategies long put and long call are valued for a potentially favorable risk-reward ratio. At the same time, these strategies allow you to easily control the risk - the option buyer only loses the premium paid for them. Depending on whether the options are ITM (in money) or OTMs (apart from money), the investor exposes himself to a greater or lesser risk of losing time value. The reverse is the case when options are written. While writing a call option is very popular (famous covered call strategy), selling put options is not very popular. It's a pity because a properly applied strategy naked put can be an interesting tool in the hands of a long-term investor. Later in this article we will introduce the advantages and disadvantages of using posting put option.

READ NECESSARY: WHAT ARE THE OPTIONS? INTRODUCTION

What is issuing a put option?

Exhibiting put options consists in assuming the obligation to buy shares at the strike price on a specific date. In return for the consent to be ready to buy the shares at a certain price, the issuer receives an option premium. The more the put option is in price (ITM), the higher the premium is received. This is because the writer receives the intrinsic value of the option and a time premium. Below is a table that summarizes the different types of put options as of November 24, 2021:

| Underlying instrument | Option price | Execution price | Execution date |

| Microsoft | 0,77 | 300 | 17.12.2021 |

| Microsoft | 4,35 | 330 | 17.12.2021 |

| Microsoft | 23,65 | 360 | 17.12.2021 |

| Microsoft | 15,50 | 330 | 18.03.2021 |

Therefore, it can be said that the naked put policyholder is an "insurer" who receives a "premium", which is the option premium, for the willingness to unconditionally repurchase the underlying instrument at a predetermined price. It is worth mentioning that when issuing a put option, the investor has to pay a margin in order to guarantee his solvency. To fully understand the mechanics of issuing put options, we will use examples of ITM, ATM and OTM options. Another dependence that is visible in the aforementioned table is that as the time to exercise an option increases, its price increases. What it comes from? Among other reasons, because the longer the time to exercise an option, the more likely it is to expire in money (ITM).

Issue an ITM put option

The nakud put strategy using ITM options consists in selling a put option with an exercise price higher than the market price. By issuing a put option that is in money, the investor receives a small time premium, which will "evaporate" until the contract expires. For this reason, writing such an option is a speculative transaction which assumes that the price of the underlying will rise, which will lead to the loss of the intrinsic value of the option. The higher the increase, the lower the put option value. The disadvantage of such a solution is that in the case of a horizontal trend, the profit is small, while in the case of declines, there is no large "safety buffer", which is the time premium. Examples of such transactions are provided below.

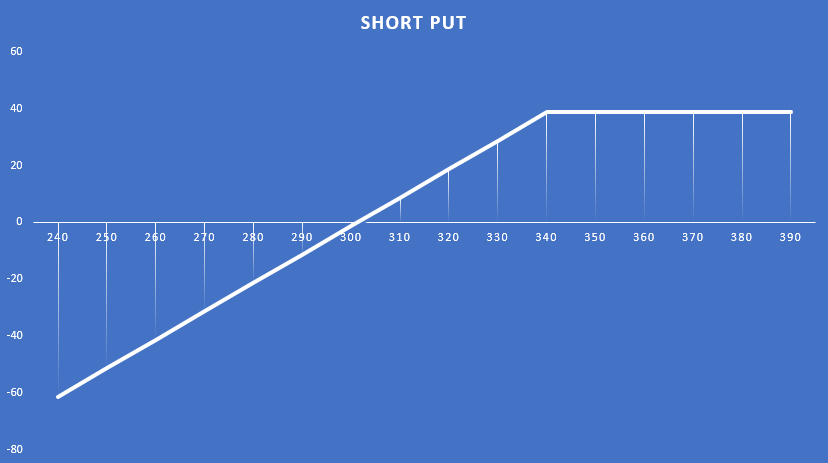

September 15 course Microsoft was in the $ 305 region. The investor decided to issue a put option with an exercise price of $ 340, which expired on December 17, 2021. The premium that the investor received was $ 38,75. This meant that the intrinsic value of the option was around $ 35. The rest ($ 3,75) was a time bonus. For this reason, if the price remains the same in the next 3 months, the trader will earn $ 3,75. However, if Microsoft share price increases, the intrinsic value of the option will decrease. This is what happened by November 24th. The Microsoft rate increased to around $ 338. As a result, the price of the put option fell to around $ 8,4. Below is the profitability chart of the transaction (when the option expires).

Issue of the PUT option being ATM

In this case, the investor issues the PUT option with the strike price around the market price. Thanks to such a strategy, the investor will have a large time premium, which will be about 100% of the value of the option (100% in the book). This is an interesting strategy if the investor intends to actually buy the financial instrument, but at a slightly lower price. If the price of the underlying instrument does not change, the investor will have to buy the underlying instrument at the strike price. However, it effectively retains money from the option premium. This allows the investor to slightly reduce the effective buy price (even if the price goes down) than if he would simply buy the stock in the market. Examples of such transactions are provided below.

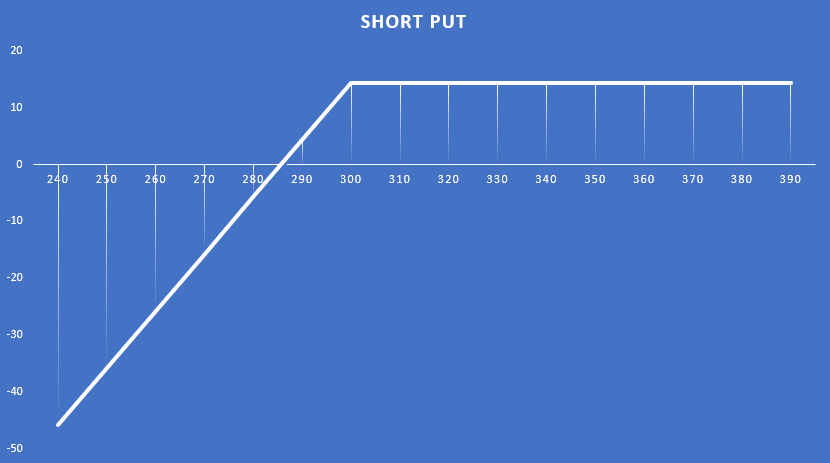

On September 22, the Microsoft rate was around $ 300. The investor decided to issue a put option with an exercise price of $ 300, which expires on December 17. The bonus the investor received was $ 14,30. This meant that the intrinsic value of the option was $ 0. As a result, the entire value of the option consisted of the time premium. For this reason, if the price remains the same in the next 3 months, the investor will receive $ 14,30. However, if the Microsoft share price rises, the time value of the option will decrease (the probability of exercising the ITM option will decrease). This is what happened by November 24th. The Microsoft rate increased to around $ 338. As a result, the price of the put option fell to around $ 0,76. Below is the profitability chart of the transaction (when the option expires). Below is the profitability chart of the transaction (when the option expires).

Issue of PUT option being an OTM

This is the safest type of transaction to write a PUT option. In such a situation, the investor sells the PUT option at a price below the current market price. As a result, it has more space for profitable transactions. However, the cost is lower profitability of the transaction. The strategy can be used by long-term investors who want to buy a fundamentally good company, but are waiting for lower prices. In order not to freeze the funds, they decide to regularly issue PUT options with an strike price below the market price. Examples of such transactions are provided below.

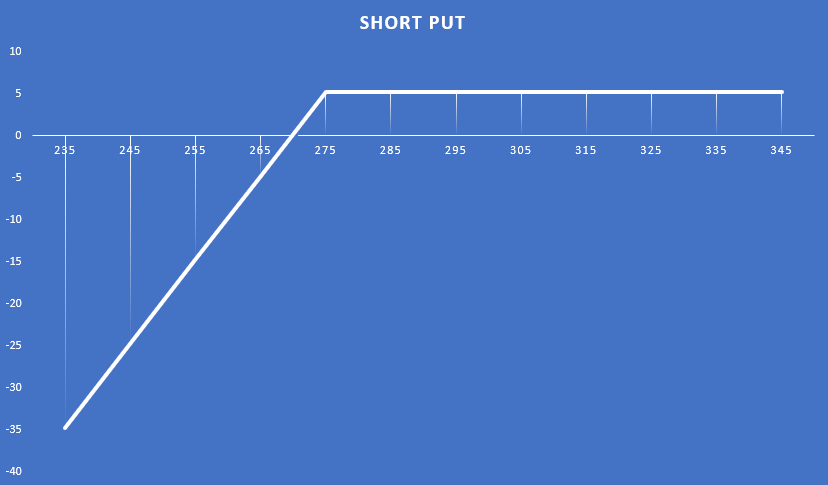

On September 15, Microsoft's rate was around $ 305. The investor decided to issue a put option with an exercise price of $ 275, which expires on December 17, 2021. The premium that the investor received was $ 5,25. This meant that the intrinsic value of the option was $ 0. As a result, the entire value of the option consisted of the time premium. For this reason, if the price remained the same in the next 3 months, the investor would earn $ 5,25. However, if the Microsoft share price rises, the time value of the option will decrease (the probability of exercising the ITM option will decrease). This is what happened by the time of November 24. The Microsoft rate increased to around $ 338. As a result, the price of the put option fell to around $ 0,33. Below is the profitability chart of the transaction (when the option expires). Below is the profitability chart of the transaction (when the option expires).

Position management - Strategia naked put

Limiting losses

If an investor does not want to buy shares with a naked put strategy, but rather to trade speculatively, he is exposing himself to an asymmetric risk. The maximum profit is the premium received, while the maximum loss is the difference between the current price and zero, minus the premium received. The investor can therefore theoretically lose a multiple of the potential profit. So how can an investor minimize losses?

Here are some solutions to this problem:

- close the position at a loss,

- roll the item down,

- buy a PUT option.

Close a losing position can be very difficult from a psychological point of view. It is an admission of a wrong assessment of the market situation. How can you get out of position? Most often by buying back options. As a result, the investor no longer has an obligation to absolutely buy the underlying asset at a certain price. So when to close a position? It depends on the trader's risk management. However, it is not worth waiting for the loss to exceed several times the potential profit. Better to cut the loss sooner than too late.

Roll the item down - it is a strategy that consists in closing a losing position and opening a new one with a lower option strike price. This allows "to postpone the problem in time". This is the solution used by traders who believe that the market will soon stop falling.

Purchase of the PUT option - this is a way out when the investor expects the current decline to be temporary and wants to hedge against a large decline. After the downward movement expires, the investor closes the purchased PUT option, which covers the losses from the issued PUT option. When the price of the underlying increases, the loss on the put option written decreases. Sometimes such a strategy allows you to generate more profit than the original trade.

Below is an example of a positive scenario working out:

September 7, 2021 Apple course was in the $ 155 area. The investor decided to issue a put option expiring on December 17, 2021. The option exercise price was $ 150. For writing the options, the investor received $ 5,55 per share ($ 555). However, on September 10, Apple fell 3,31% to $ 148. This pushed the put option up to $ 9,20. The investor decided to hedge against a further decline in Apple's share price. As a result, he bought a put option with an exercise price of $ 145, paying $ 6,90 for it. The investor closed the position on October 4 at $ 12 per share. At the same time, the put option price rose to $ 14,3. This meant that the loss on the put option was $ 8,75. However, the profit on the purchased put option was $ 5,1. As a result, the total loss was reduced to $ 3,65. The investor realized the profit on the purchased put option and left the put option issued.

From 4.10.2021/24.11.2021/139 to 162/150/1,00 the Apple price increased from $ 4,55 to $ 965. As a result, the option price with an exercise price of $ 9,65 fell to $ XNUMX. The investor then decided to close the position with a profit of $ XNUMX. Together, the investor generated $ XNUMX ($ XNUMX * multiplier) from the hedging transaction (buy put option) and the written option.

| Apple Lossless Audio CODEC (ALAC), | put $ 150 | put $ 145 |

| value of the option at the time of the transaction | 5,55$ | 6,90$ |

| transaction opening date | 7.09.2021 | 10.09.2021 |

| type of transaction | sale | purchase |

| price October 4 | 14,30$ | 12,0$ |

| closing the position | 24.11.2021 | 04.10.2021 |

| closing price | 1,00$ | 12,0$ |

| profit from the transaction | 4,55$ | 5,10$ |

Collecting profits

When the price of the underlying increases, the value of the put premium decreases. As a result, profit from the transaction appears on the account of the option writer. When writing PUT options, no let profit grow strategy is used as the maximum profit appears as the value of the option drops to 0 (around the expiry date). However, once the option has lost 90% of its value, it makes no sense to risk losing most of the profit for the next 10%. It is better to close the position with a profit, release your deposit and look for other opportunities.

Sometimes the investor can do the so-called rolling up. In such a situation, it closes the option with a profit and issues a new PUT option with a higher strike price. The deal may be successful if the company follows a smooth uptrend.

Naked Put Strategy: Calculating Profitability

When buying an option, profitability is calculated based on the capital invested in the investment (ie the premium paid). However, when a put option is issued, the investor does not spend any money. For this, he receives a bonus from the issued option. However, the cost of the investment is the net collateral provided by the investor. Depending on the broker, the hedging of options is usually 20% of the contract's nominal value.

To illustrate the potential profitability, we will use an example:

On September 22, the Microsoft rate was around $ 300. The investor decided to issue a put option with an exercise price of $ 300, which expired on December 17, 2021. The bonus the investor received was $ 14,30. The notional value of the contract was then $ 30 ($ 000 * multiplier). For this reason, the gross collateral was $ 300. Subtracting the bonus received ($ 6000), the net hedge was $ 1400.

On November 24, the investor decided to close the position. He bought back the option at $ 0,76 per share. This meant that the investor earned $ 1324 ($ 1400 - $ 76). This meant that the profitability of the investment was Present in several = 28,78%.

Do you know that…?

Saxo Bank is one of the few Forex brokers that offers vanilla options. The investor has a total of over 1200 options at his disposal (currencies, stocks, indices, interest rates, raw materials). CHECK

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![How to invest in Feeder Cattle? [Guide] how to invest in livestock - feeder cattle](https://forexclub.pl/wp-content/uploads/2023/09/jak-inwestowac-w-bydlo-hodowlane-feeder-cattle-300x200.jpg?v=1693821591)