Optimistic outlook for emerging market equities in 2021

We started this week with a clear divergence between stock exchanges: impetus stocks (ie technology companies) have gone down, while buy orders prevail in the broadly understood market, suggesting a renewed increase in the popularity of valuable assets.

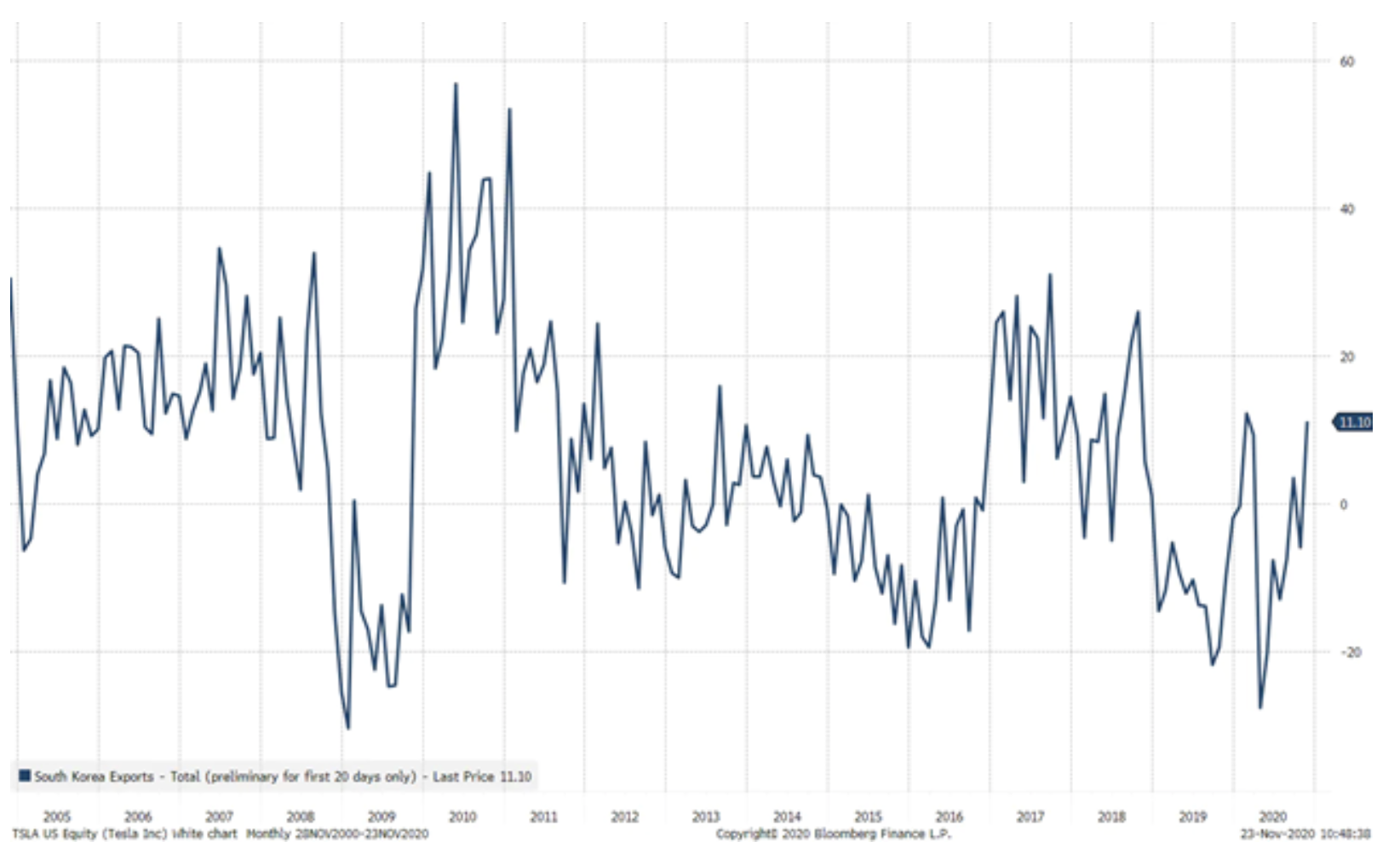

As we wrote last Friday, to confirm your return towards stocks of value it is imperative that the US ten-year bond yield exceeds 1-1,1%. In addition, we see emerging market equities performing the best yesterday morning on stronger-than-predicted year-on-year exports from South Korea (first 20 days of November) of 11,1% compared to the estimated - 5,8%, a signal that the cyclical component of the economy is actually warming up.

About the Author

Peter potter - director of equity markets strategy in Saxo Bank. Develops investment strategies and analyzes of the stock market as well as individual companies, using statistical methods and models. Garnry creates Alpha Picks for Saxo Bank, a monthly magazine in which the most attractive companies in the US, Europe and Asia are selected. It also contributes to Saxo Bank's quarterly and annual forecasts "Shocking forecasts". He regularly gives comments on television, including CNBC and Bloomberg TV.

The stock market in 2021

With China's industrial growth returning to pre-pandemic levels, there are many indications of strong growth in Asia, which will positively translate into stock prices in emerging market companies, primarily South Korea, China, Taiwan and India.

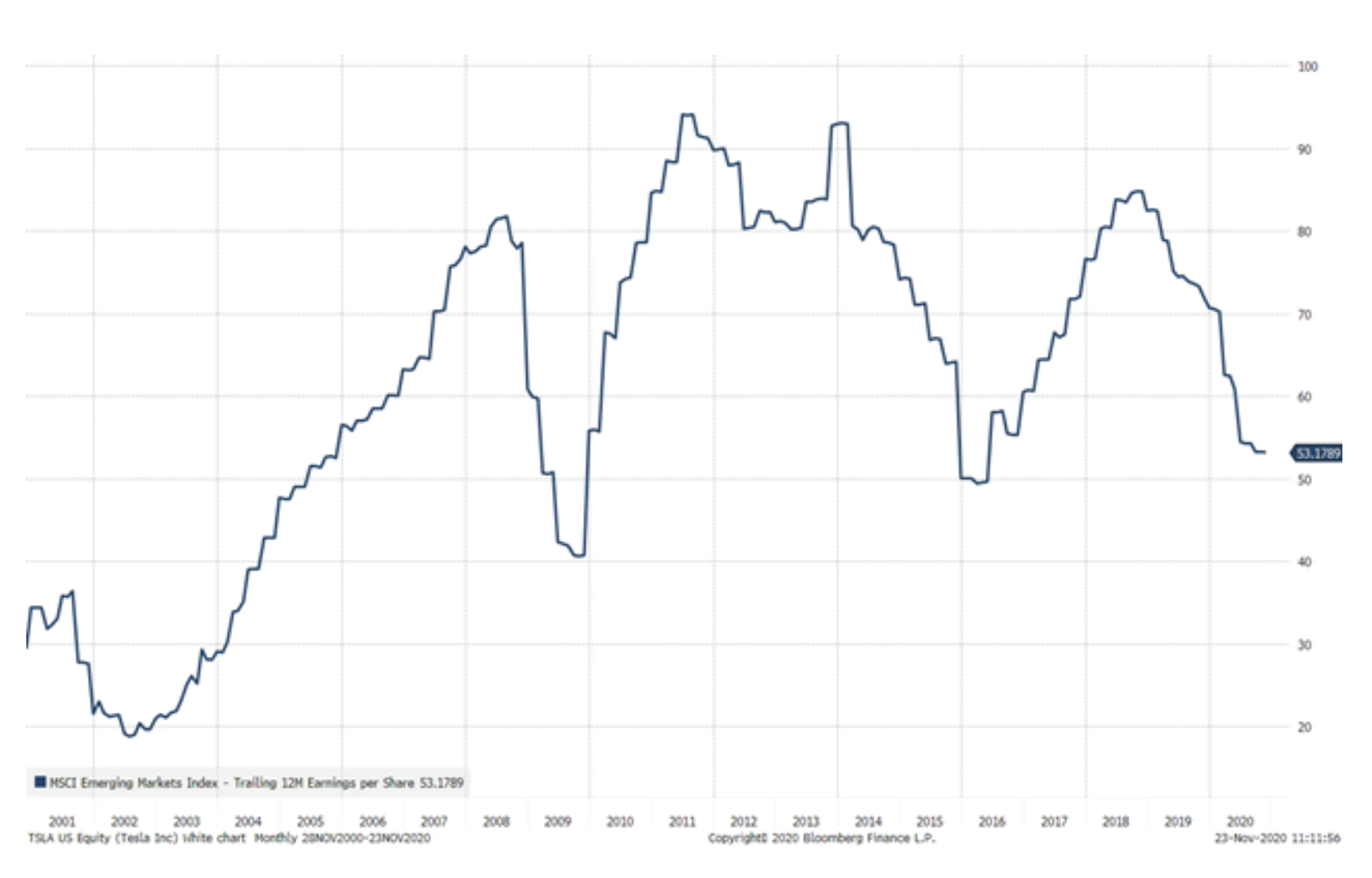

Emerging market equities have outperformed developed markets equities by 10,5% since the end of June. Sentiment is shifting as indicators from the major emerging economies (China, Taiwan, South Korea and India) will exceed projections as this part of the world is far better at dealing with the pandemic than developed countries. The relative performance of emerging and developed markets also suggests that we are facing a return to the average as emerging markets have been underperforming for years as investors are focused on US tech and healthcare equities.

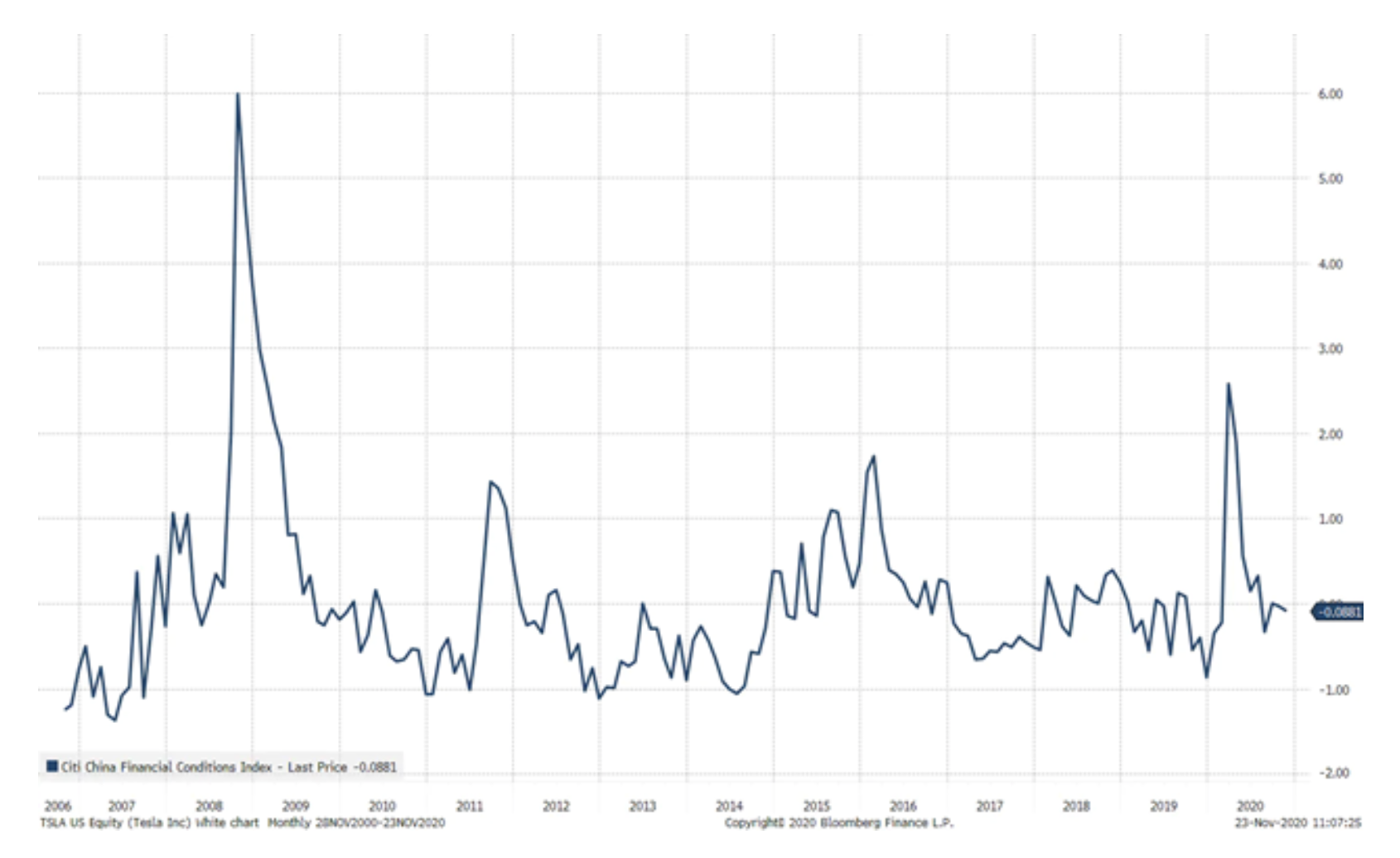

We base our optimistic view largely on the assumption that China will ease financial conditions through monetary policy. In many respects, financial conditions in China are too tight, which has consistently strengthened the Chinese currency against the dollar, but the long duration of these conditions is becoming problematic in the context of export growth and real estate related economic sectors. We anticipate that China will ease its monetary policy in 2021, which could push up equity prices due to higher valuation multipliers.

Another argument in favor of long positions in emerging market equities is that the incentives implemented by China and the improved positioning of the Asian economy will significantly increase returns compared to their current lows. Analysts predict that profits will increase by 12% in the next 43 months, which will most likely generate significant positive effects: higher-than-expected and rapidly growing y / y earnings usually translate into an improvement in market sentiment. For the years beyond 2021, analysts predict an 11-15% increase in earnings, which should also translate into higher stock prices as investors continue to be growth-oriented.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-300x200.jpg?v=1676364263)