Optimism on the oil market awaiting confirmation from OPEC +

Since the publication of the last analysis the price of oil It went up even more: Brent hit a 13-month high, exceeding $ 65 / b, while the price of WTI crude broke $ 60 / b and was well above levels that might have triggered a reaction from US shale oil producers. However, any prospects for increasing production were sidelined after last week's unprecedented polar vortex, which cut production by nearly 4 million barrels a day for a few days.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

This phenomenon has further contributed to the reduction of excess crude oil inventories, and in a recent memo, Morgan Stanley predicts that oil will face a quarter with perhaps the lowest supply since 2000. Meanwhile, Goldman Sachs, one of the first banks to mention the possibility of a new commodity supercycle, raised the six-month forecast for Brent crude oil by USD 10 to USD 75 / b. This was based on the assumption that there would be a strong recovery in global fuel consumption after the pandemic, coupled with the problems of non-OPEC producers in increasing the number of barrels as OPEC + maintained the production regime to support prices.

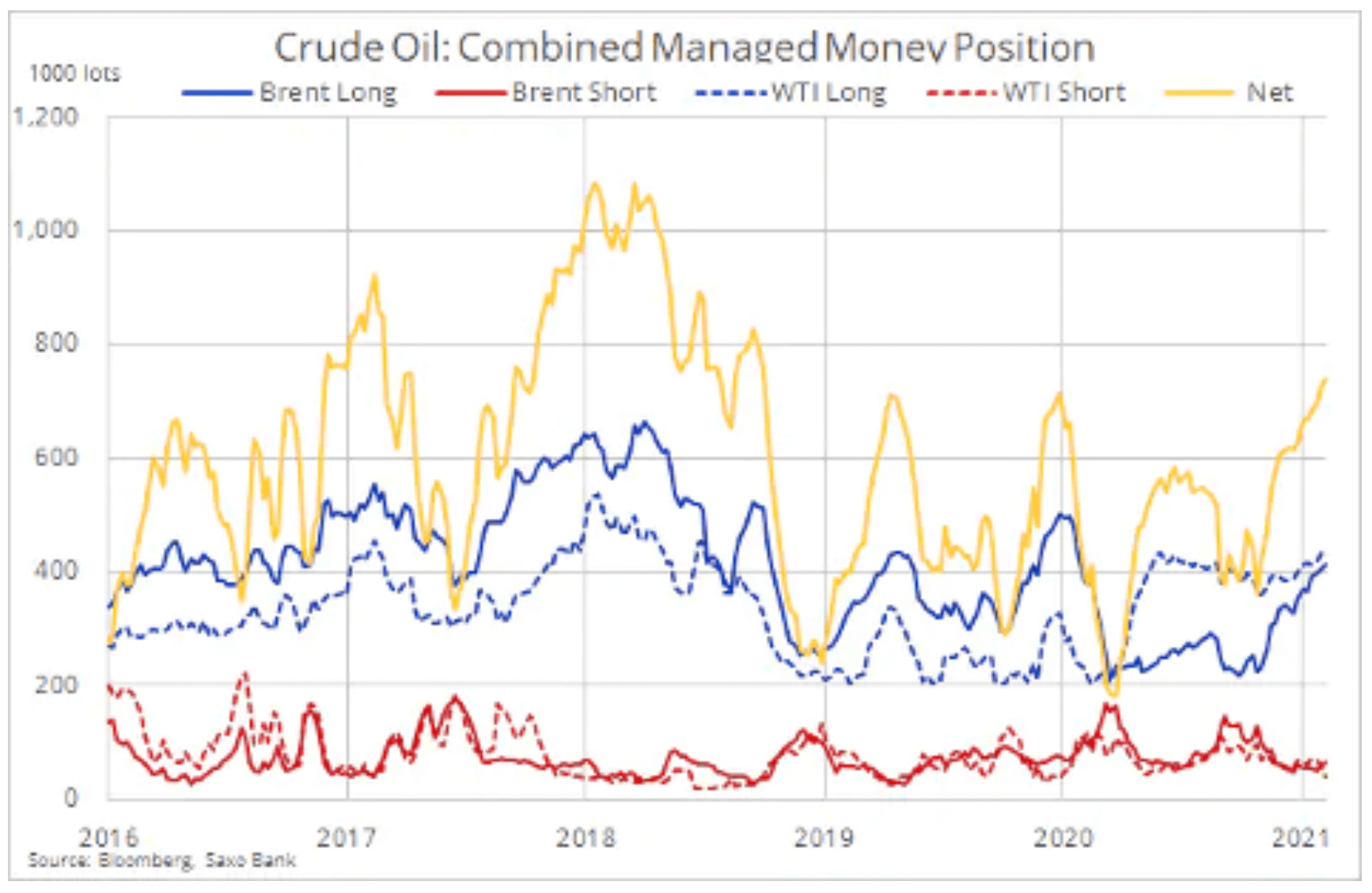

As a result of a colder than usual winter in the northern hemisphere, Saudi Arabia's unilateral 1m barrels / day cut in February and March, and US production cuts last week, the market rebalancing has accelerated. Speculative investors, who have been consistently increasing upward positions in crude oil, have benefited from this. In the week ending February 16, WTI and Brent crude oil's combined net long position was 737 lots or 000 million barrels, the largest price increase position since October 737, but still around 2018 lots below the March 350 record

Another indicator - the ratio of total long and short positions in Brent and WTI crude oil - recently showed seven long to one short. In 2018, this indicator hit its highest value (15 to 1) before a significant price correction brought it down to 6 to 1. Overall, it signals that market buying is not yet complete, unless there is a technical change and / or a fundamental short-term forecast.

Against this backdrop, the market will be closely following the March 4 OPEC + meeting where the group is expected to discuss the possibility of increasing oil supplies from April. Back in December, the group decided to restore the level of 500 barrels per day as part of the gradual introduction of the remaining 000 million barrels per day to the market, which was halted in January.

The current optimism in the market is a clear signal for the group that an increase in output is unlikely to have a negative impact on investors' moods. Although this may lead to a long-needed consolidation or even a slight correction, optimism remains strong. This is evidenced by, among others the belief, reinforced by production cuts last week, that US producers are still focusing on returning money to shareholders rather than another costly mining venture.

The market will be watching closely to see if the group can reconcile the opposing views, given Russia's pressure on market share and Saudi Arabia's desire to push prices even further to balance its budget. After the Saudis gave the market and the whole group a gift in the form of a price jump of almost 30% since the beginning of January, it can be assumed that they will be handing out cards and setting the future direction for the group, which is unlikely to have a significant negative impact on the market .

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)