The Polish capital market against the backdrop of the world - Invest wisely. Diversify!

Although the Polish capital market is not one of the largest and most liquid stock exchanges in the world, many Polish investors place their funds only on the Polish stock exchange. Such investors voluntarily cut themselves off from more developed financial markets.

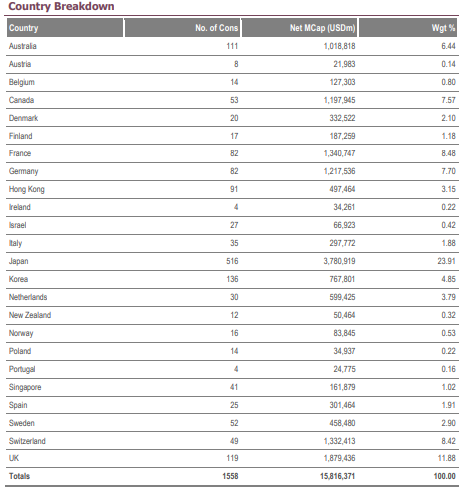

The scale of Poland's importance in the global global market is demonstrated by the share of the Polish stock exchange in the FTSE Developed ex US Index. It is an index that groups developed economies excluding the United States. At the end of October 2020, the index had 1558 companies from 24 countries. Poland's share in this index is modest: 14 companies and 0,22% of the index value. The following markets had a smaller and comparable share to Poland: Portuguese (0,16%), Irish (0,22%) and Austrian (0,14%).

Source: FTSE Russell

On the other hand, the share of the Polish market in the FTSE Developed Index (together with the American market) drops to 0,08%. Poland also has 14 representatives out of 2141 companies in this index.

If we take the index aggregating the behavior of the "global stock market", which represents 3979 companies from 49 countries, the share of the Polish market drops to 0,07%. Having a smaller share than the markets of: Indonesia (0,17%), Malaysia (0,24%) and the Philippines (0,12%).

Looking at the share of the Polish market in the global financial market, it can be said that it is a peripheral market.

Polish economy against the background of the world

According to World Bank data, in 2019 Poland was the 21st economy in the world with a GDP of $ 592 billion. In the previous year, the entire world generated GDP of $ 87,7 trillion. So Polish GDP accounted for less than 0,7% of the world's GDP. Taking into account the purchasing power (PPP), world GDP was $ 130 trillion, while Polish GDP was $ 1,256 trillion. Poland's share amounted to 0,96% of the world GDP, and Poland ranks 20th in the world in terms of GDP in purchasing power parity.

The last 30 years have been successful for Poland. The distance to the economies of Western Europe is being made up. Below is a World Bank breakdown of GDP per capita:

| GDP / person (PPP) in thous. | 1990 | 2003 | 2019 |

| Poland | 6,17 | 12,26 | 34,21 |

| Germany | 19,43 | 29,86 | 56,05 |

| Włochy | 18,6 | 29,17 | 44,20 |

| Portugal | 11,76 | 20,82 | 36,74 |

A question may therefore arise: Why is the share of Polish companies in the global stock market so small?

The answer to this is as follows:

Polish large and medium-sized companies do not reflect the Polish economy. Many companies bypass stock exchange financing and choose to issue bonds, finance with a loan or look for an industry investor or a VC or PE fund.

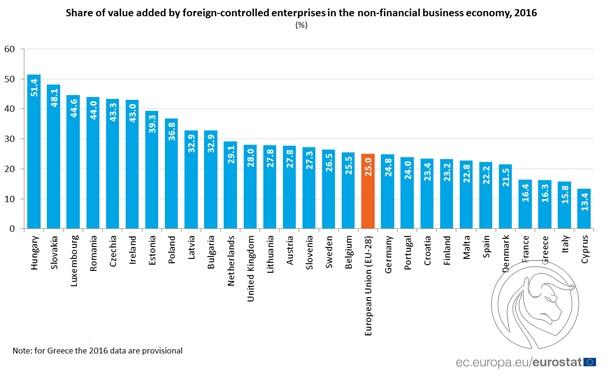

The share of foreign companies generating GDP in Poland also has a smaller impact. An example is the Volkswagen factory in Września, which generates GDP in Poland. At the same time, the factory is part of the assets of the VW automotive concern listed in Germany. The situation is similar with Polish branches of American corporations (CBRE, JLL, Google) or the Biedronka chain of stores (Jeronimo Martins listed in Portugal).

It is also worth taking a closer look at the composition of the Polish flagship index. WIG20 for most of its existence consisted of a large number of state-owned companies with "Old economy". Currently, out of 20 companies only two belong to the broadly understood "digital economy" (Allegro and CD Projekt). Companies from the financial sector (banks and insurers), energy companies (PGE, Tauron) and companies related to the oil and gas market (Orlen, Lotos, PGNiG) are still a significant part of the index. Over the last 20 years, investing in an index representing the largest Polish companies has not turned out to be a good investment.

WIG20 chart, W1 interval. Source: xNUMX XTB.

World 2050

According to the UN projection from 2019, the population is expected to increase to 2050 billion people in 9,74. This is an increase of approximately 1,95 billion people in 30 years.

| Region | 2020 | 2050 | CARG% |

| Afryka | 1 million | 2 million | + 2,08 % |

| Azja | 4 million | 5 million | + 0,44 % |

| Europe | 747,6 mln | 710,5 mln | -0,17% |

| Latin America and the Caribbean | 653,9 mln | 762,4 mln | + 0,51 % |

| Ameryka Północna | 368,9 mln | 425,2 mln | + 0,47 % |

| oceania | 42,7 mln | 57,4 mln | + 0,99 % |

Source: United Nations; World Population Prospects 2019, Medium Variant

According to the same forecasts, the Polish population is to shrink from 37,8 million people in 2020 to 33,3 million in 2050. Additionally, the demographic structure in Poland will change. An increasing percentage of the population will be in post-working age, which will significantly worsen the demographic dependency ratio.

In 2050, the distribution of forces in the global economy will also change. The top four of the largest economies in the world will include three Asian (China, India and Indonesia). According to PwC forecasts from 2017, Poland is to fall to the 30th place. The top twenty will include, among others Vietnam and the Philippines. In 2050, Bangladesh will have a greater GDP than Poland.

Demographic and economic forecasts suggest that Poland's share of global GDP will decrease rather than increase. For this reason, it can be expected that the share of Polish equities in the world market will be marginal. This does not mean that good companies will not be established in Poland in the next 30 years. Most likely, they will arise, but in order to grow they will have to invest outside Poland.

Prepare your fortune for the changing global trends. Geographic diversification is a wise choice for any investor.

home bias

As a rule, people don't like to leave their comfort zone. For this reason, there is a phenomenon known as "Home bias". This is a situation where an investor is excessively attached to investing funds in the domestic financial market. It is the error that is most often noticed "after the fact". If a person lives and earns in one country, wealth should be geographically diversified. Unfortunately, most people don't. Even if the household saves money, it invests it, for example, in the local real estate market. In the event of economic problems in the country, such a family may lose its source of income (work, company) and the value of its net assets will decrease (decrease in the value of real estate and shares). There may also be high inflation (as in the case of Venezuela, Turkey), which will reduce the purchasing power of the cash accumulated.

An example is the "average" Greek investor who only earned income in Greece. The property was placed in the ATHEX Composite Index 20 years ago and in 2007 it purchased real estate for investment purposes.

The debt crisis has led to an increase in the unemployment rate, a contraction in the economy and a decline in Greek real incomes. In the case of Greece from 2010-2020, one can speak of a "lost decade".

Below is a compilation from the World Bank:

| Greece | 1991 | 2008 | 2015 | 2019 |

| Unemployment rate | 7,66% | 7,76% | 24,9% | 15,47% |

| GDP / person (PPP) in thous. $ | 13,99 | 30,86 | 26,90 | 31,40 |

The plunging of the economy into problems also affected the values of Greek companies. Over the past twenty years, the ATHEX Composite index has lost over 80% of its value. At the same time, the prices of Greek real estate (the Greek House Price Index) have fallen by 2007% since 33. For comparison, the S&P 500 index increased by over 160% at the same time.

What discourages diversification?

What prevents investors from minimizing geographic risk? Some basic problems can be mentioned:

- Tax issues - require familiarization with the principles of capital gains taxation. An example is the necessity to fill in the W-8BEN form to avoid double taxation between Poland and the USA

- No knowledge of foreign markets - this is an often repeated argument in the case of foreign investment. However, it is easy to overturn. Everyone knows the names of companies such as Microsoft, Amazon, Nestle or Adidas. If an investor does not want to spend time investing in individual companies, he can benefit from investing in ETFsthat will invest in companies from specific countries or industries.

- Currency risk - to deal with currency fluctuations you can hedge yourself by trading on forex market or futures contracts. The second way is to create a 'currency basket' of investing in assets in different currencies (USD, EUR, GBP, AUD, CHF, etc.) to minimize currency concentration.

The benefits of geographic diversification

Thanks to geographic diversification, the investor becomes independent from errors in the economic policy of one country. In the long term, it also minimizes the impact of crises affecting specific economic areas.

Another positive aspect is the possibility to invest in companies of a similar nature, which, however, operate on a larger market. As an example, Allegro is an e-commerce platform that generates revenues mainly in Poland. However, companies operating in this market can be found all over the world. These can include:

- Mercadolibre (works in South America),

Mercadoliber stock chart, interval W1. Source: xNUMX XTB.

- Sea Ltd. (as Shopee operates, among others, in Thailand, Malaysia, Indonesia, Vietnam),

Sea Ltd. stock chart, interval W1. Source: xNUMX XTB.

- Alibaba (king of e-commerce in China, also works in Europe as Aliexpress).

Alibaba stock chart, interval W1. Source: xNUMX XTB.

Another aspect is liquidity which appears on foreign stock exchanges. It beats the Polish stock exchange. It is enough to compare the turnover on the WIG20 futures exchange with S & P 500. In the case of the S&P 500 index, the list applies to both e-mini and micro e-mini contracts.

Only the most liquid contract (December) was traded:

| Indeks | course | multiplier | The nominal value of the index | Volume (13/11/2020) |

| e-mini S&P 500 | 3582 | 50$ | 179 100 $ | 1 289 213 |

| micro e-mini S&P 500 | 3582 | 5$ | 17 910 $ | 827 963 |

| WIG 20 | 1750 | PLN 20 | 35 000 zł | 20 663 |

How can you invest abroad?

Thanks to technological advances, the investor can purchase foreign stocks and ETFs from his home. Access to global Internet resources allows to overcome the information asymmetry.

To diversify your assets, just open a brokerage account with access to foreign markets. Another solution is to use foreign brokers. However, this requires knowledge of foreign languages (mainly English) and self-settlement of your taxes. Another option is to take advantage of the offer forex brokers. However, keep in mind that investing in CFD on indices or stocks is a more expensive way than buying futures or stocks on a regulated market (mainly due to spreads and swap points). The benefits are lower capital requirements and a wide range of instruments.

The investor can invest in the foreign market through:

- Shares of companies listed on the stock exchange

- REITs listed on the stock exchange

- Futures and index options

- ETF

- CFDs (Stocks, Indices, ETFs)

| Broker |  |

|

|

| End | Poland | Denmark | Cyprus * |

| Shares on offer | approx. 2300 - shares approx. 1800 - CFDs on stocks 16 exchanges |

19 - shares 8 - CFDs on stocks 37 exchanges |

approx. 3 - CFDs on stocks 23 exchanges |

| Min. Deposit | PLN 0 (recommended minimum PLN 2000) |

2 000 USD | PLN 500 |

| Platform | xStation | SaxoTrader Pro Saxo Trader Go |

Plus500 platform |

* PLUS500 CY offer

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. From 72% to 89% of retail investor accounts record monetary losses as a result of trading CFDs. Think about whether you understand how CFDs work and whether you can afford the high risk of losing your money.

Summation

A Polish investor should diversify his portfolio by investing in various areas of the world. This will minimize the risk "Bet on the wrong horse"as long-term investors on the Greek market found out. Thanks to ETFs, an individual investor does not need to know about foreign companies. It is enough to diversify your portfolio and focus on investing in the most promising markets in the world.

On the pages of Forex Club in the coming months we will publish a cycle describing global economies. The articles will describe the economies and financial markets of both countries "West" and distant "Asian tigers". You are welcome!

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-300x200.jpg?v=1676364263)