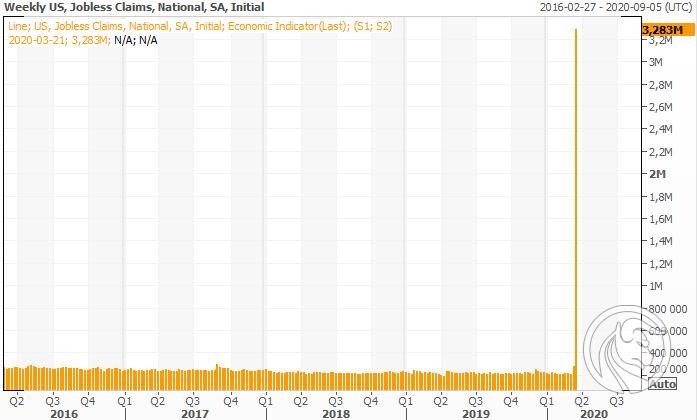

Over 3 million applications for benefits. The worst data ever ... investors liked

The coronavirus outbreak is taking tough toll in the US. Millions of Americans have found out. Exactly 3 million. In the last week, the number of new applications for unemployment benefits increased by 3 million and 1 thousand to the level of 3,283 million from 282 thousand. week earlier. This is the highest jump in the history of this data.

Market reaction

This dramatic jump in claims for benefits ... has appealed to investors. After their publication, futures contracts on American indices, and later the indices themselves moved up. Actually, it's not that they liked what investors felt relieved after their publication. First of all, some market participants expected even worse, reaching data levels of 4 million. Secondly, investors breathed a sigh that this fatal data is already behind them.

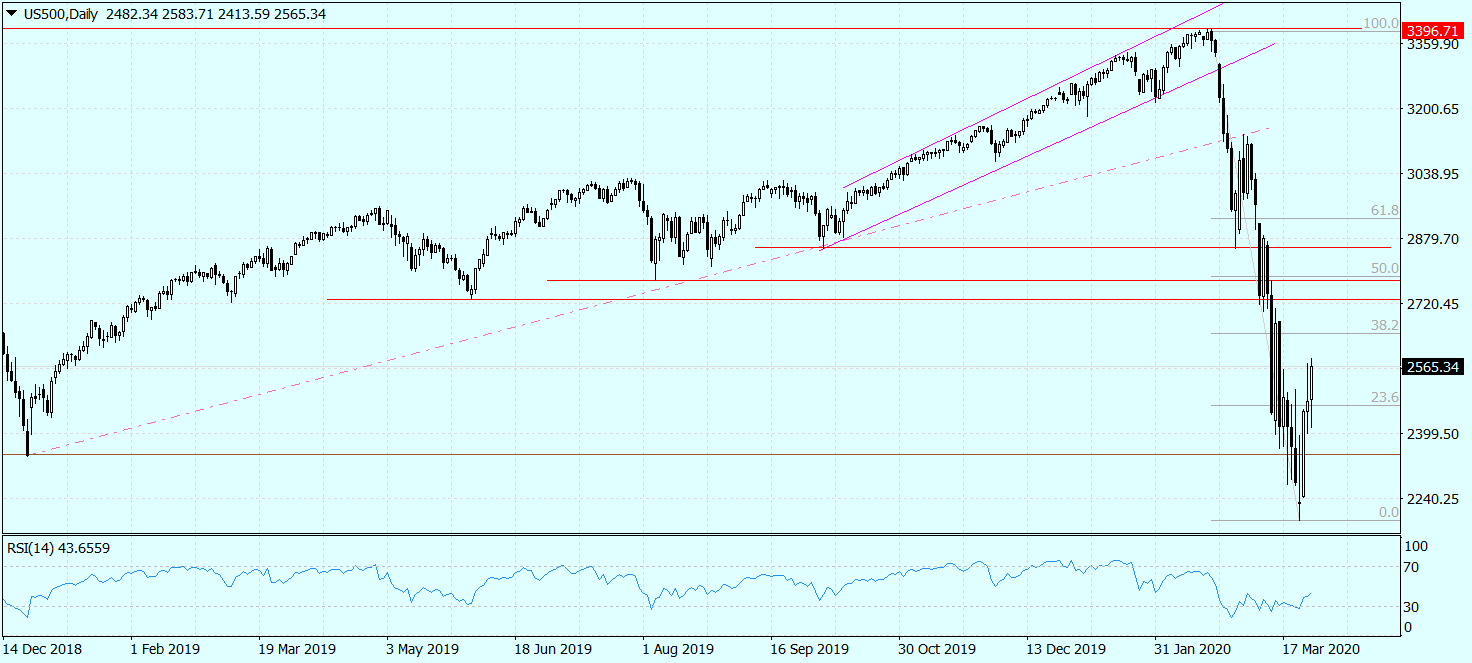

This feeling of relief is especially evident in Wall Street behavior. The US500 moved up, continuing the upward rebound that was initiated during Monday's discount, and confirmed the day after. As a result, yesterday's highs (2571,41) were violated, which opens the way for resistance created by 38,2% abolition of the last sell-off (2644,95). This is the maximum that the US500 can afford now. In a slightly more realistic scenario, the increases will end in a moment and the market will enter a lateral trend, with much smaller daily changes than recently. This could take up to mid-April, when Wall Street companies start publishing the results for the first quarter this year, which is likely to be an impulse for a new wave of sell-offs. Of course, unless earlier the stock exchanges derail the significant acceleration of the coronavirus epidemic in the US.

US500 chart (CFD per index S & P500), interval D1. Source: MT4 Tickmill.

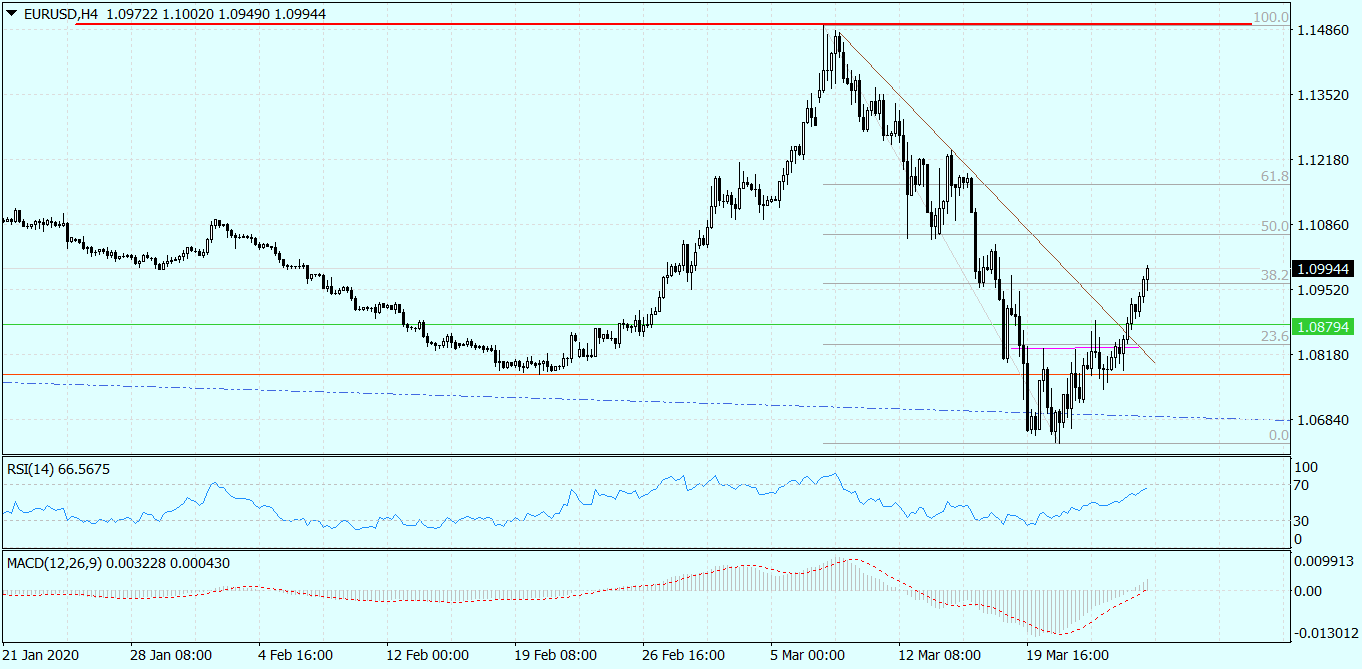

EUR / USD reacted much more calmly to data on benefits. However, the pair's exchange rate is also climbing to higher levels, benefiting from the improvement in global market sentiment. In this case, the demand side situation is much more favorable, which can be seen in the chart in H4 compression. Not only did he break above the downward trend line, but he also beat the 38,2% abolition of Fibo, which automatically opens his way even higher. It is not excluded that he will soon attack the resistance zone 1,1050-1,1065. However, this rally can end now.

Chart EUR / USD, D1 interval. Source: MT4 Tickmill.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)