China's reopening will fuel another strong year for commodities

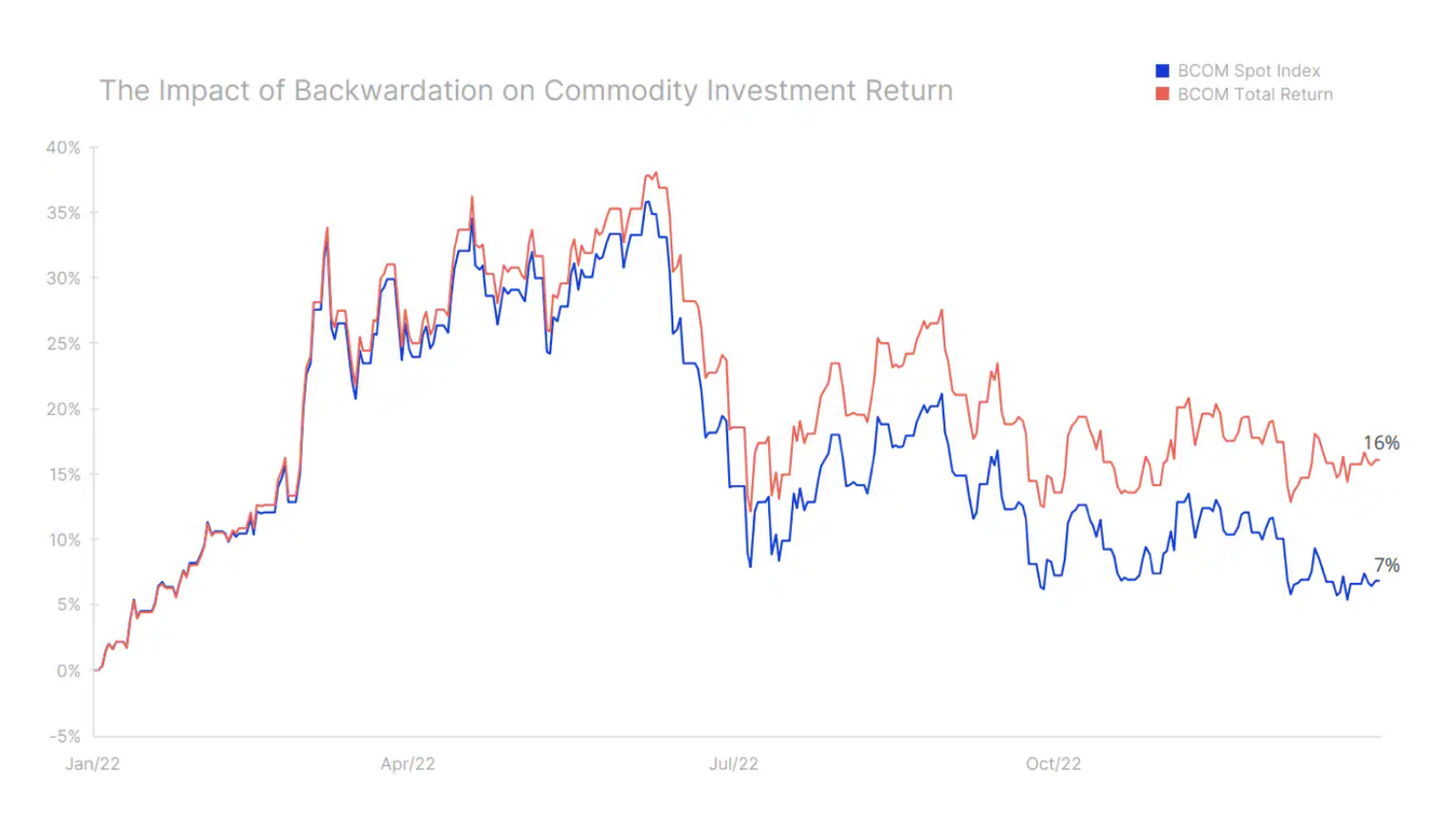

Cautious and defensive (with few exceptions): this is how best to describe the price action in early 2023 across the commodity sector; in a year that will hopefully mean less drama and volatility than last year, when Bloomberg's Bloomberg Commodity Total Return index surged sharply, gaining 38% in the first quarter, then it drifted down for the rest of the year and closed with a 16% gain. This was a very good result, taking into account the stronger dollar and the fact that in the second half of the year market participants were increasingly afraid of a recession.

This approach has contributed to financial deleveraging across the commodity sector and physical inventory shedding to such an extent that some markets have proven unprepared for a strong Chinese recovery, and could be even worse if the most anticipated recession in history turned out to be shallow.

Limited market conditions for most commodities in 2022 caused the futures curves to become deported - a structure that rewards long positions through a positive result (carry) from rolling (selling) an expiring contract at a higher price than the one at which they were purchased is next. Deportation enabled the aforementioned 9% return on a passive long investment in the Bloomberg Commodities Index of Overall Return, almost XNUMX% higher than the return signaled by spot price movements.

In our opinion, the most important macroeconomic event that will have the greatest impact on developments in 2023 has already occurred. The Chinese government's abrupt shift in approach away from a failed zero-Covid policy towards reopening and boosting the economy will have a major impact on commodity demand at a time when the supply of a range of key commodities, from energy to metals and agricultural products, remains Limited. In addition, risk appetite is likely to be supported by a steady and consistent decline in the value of the dollar as inflation continues to fall in the US, thus contributing to another downward revision in the path of Fed rate hikes.

Moreover, the increased likelihood that the coming recession will not materialize or turn out to be weaker than expected may also trigger a reaction from financial and physical investors, who are currently rebuilding positions and inventories in anticipation of an increase in demand. Under such a scenario, the thesis of structural underinvestment, mainly in the energy and mining industries, is likely to attract new investors and support prices.

The dynamic growth seen earlier this year – in particular for gold and copper – points us in the right direction for 2023. However, while the direction is correct as such, we believe that the timing of the actual change may be slightly delayed, which increases the risk of a correction before final reinforcement. With activity in China and parts of Asia unlikely to pick up in earnest before the Chinese New Year festivities are over, the prospect of a lull could be the impetus to pause the current rally until it gains new momentum and strength in QXNUMX.

All of this allows us to assume that the commodities sector remains on a path towards higher prices, and while the pace of this growth will be slow, we anticipate that the supply of key commodities may not meet demand for several years. With this in mind, we believe this will be another positive year for commodities, with the Bloomberg Commodities Overall Return Index up +10%.

Copper

Within our overall positive outlook for commodity markets, industrial metals stand out particularly constructively, led by copper, aluminum and lithium, due to the green transition and the huge political capital invested in its implementation. In addition, the new geopolitical environment will mean a huge boost for the European defense industry, which should record double-digit growth of around 20% per year in the next business cycle as the Old Continent doubles its defense spending as a percentage of GDP.

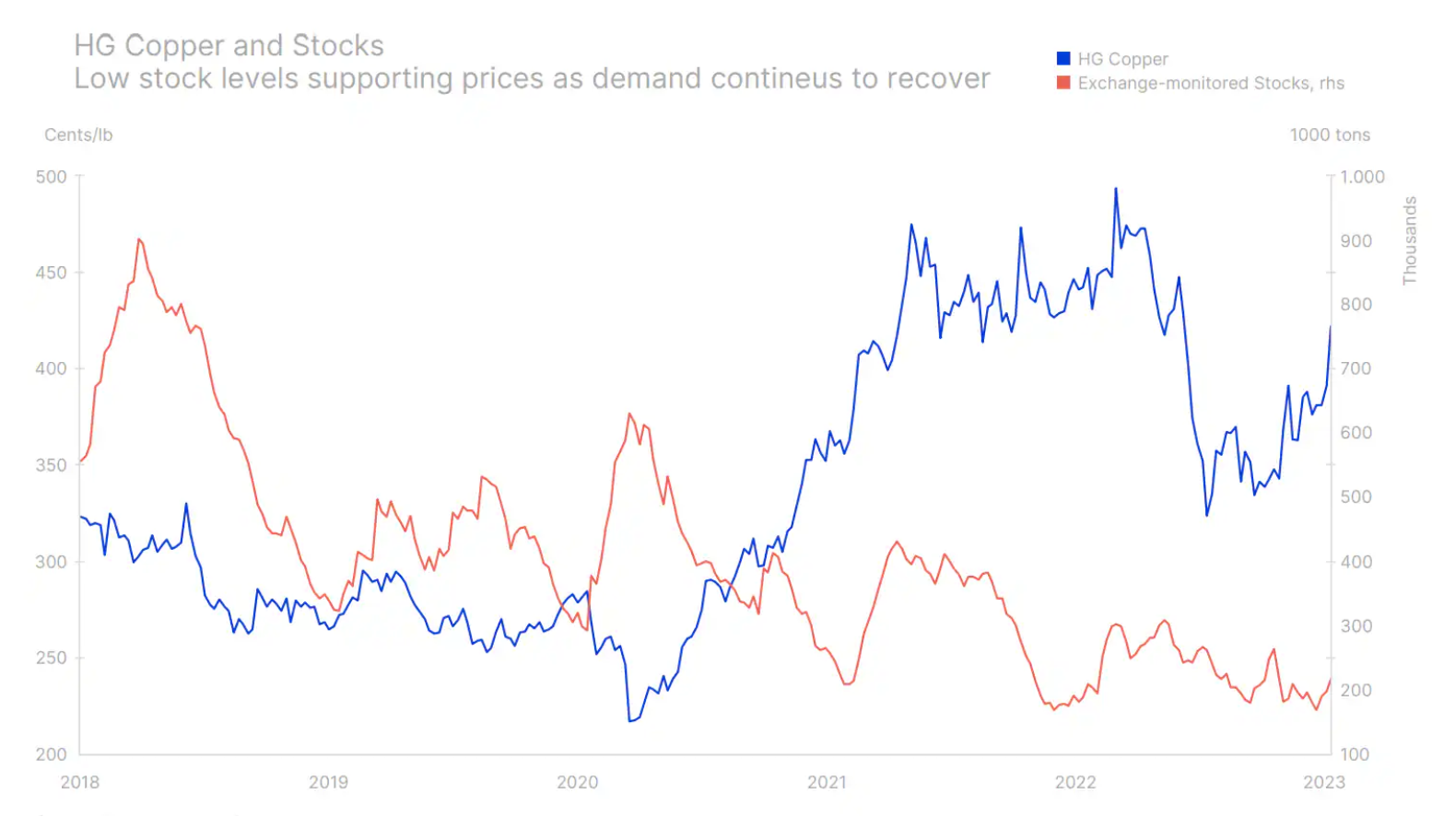

Copper - together with aluminum material – took the lead in industrial metals and started 2023 with a strong accent due to speculation that China, the world's largest consumer of this metal, will increase its economic support, similarly to what it did in 2003 (after joining the World Trade Organisation), 2009 (after the global financial crisis) and 2016 (currency devaluation). The purpose of this support is to strengthen the economic recovery in order to offset the economic consequences of President Xi's "zero Covid" policy, which failed and from which China has now firmly moved away. This optimism was also fueled by a weakening dollar amid speculation that the Federal Reserve is slowing the pace of future rate hikes as inflation forecasts remain moderate.

However, the initial strong rise in copper prices was mainly driven by technical and speculative investors expecting an increase in demand from China in the coming months. After the initial rally, the hard work will begin to sustain these gains, with an increase in physical demand needed to sustain the rally, especially given the prospect of increased supply in 2023 as a number of investment projects begin. Overall, we expect copper to trade between $3,75 and $4,75 in the coming months before eventually breaking higher to a new high in the second half of the year.

Gold and silver

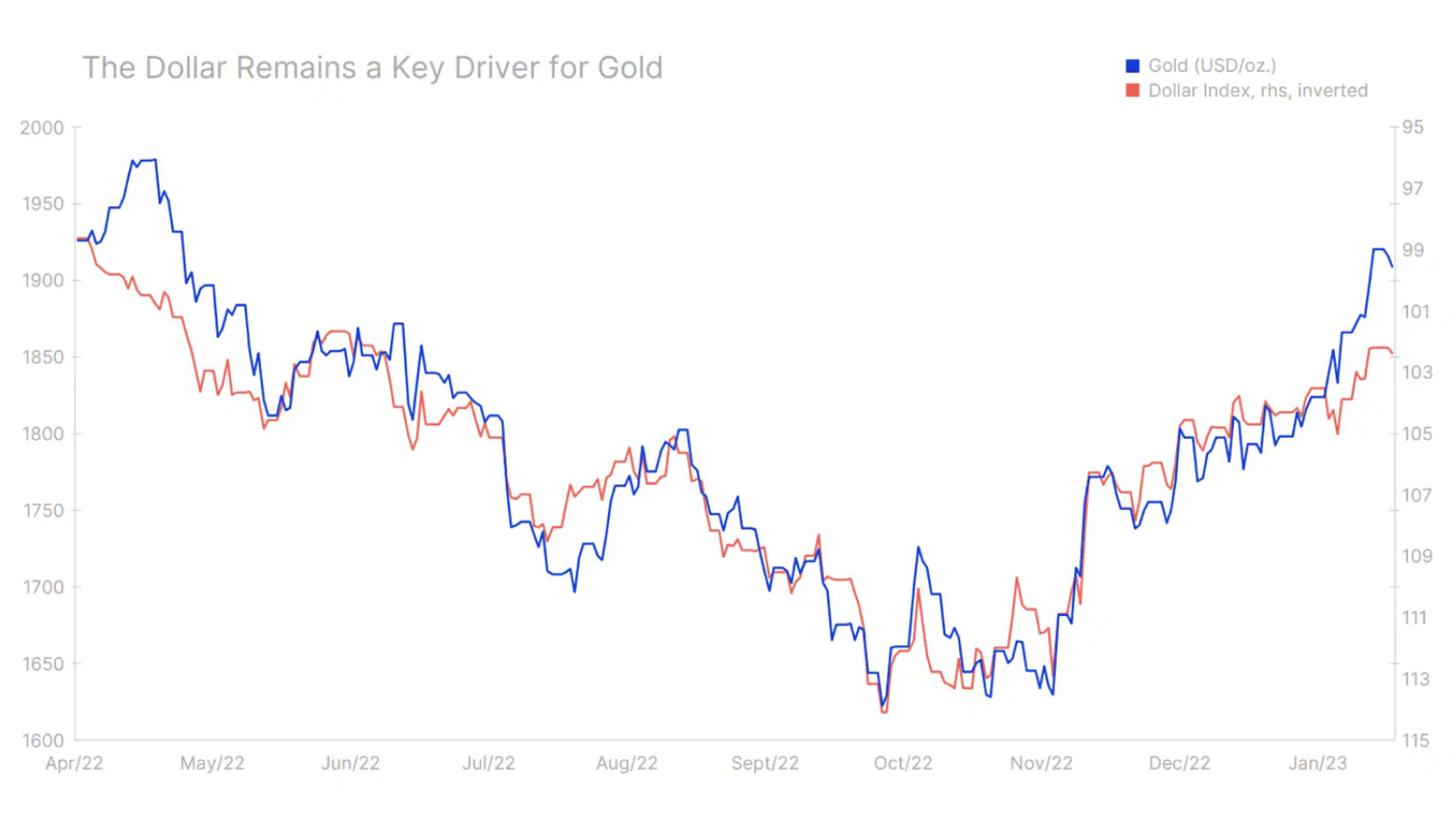

Gold broke out of the range to start 2023 with strong gains as a result of the positive momentum carried over from December as the dollar weakened. Silver struggled to keep up initially, but given our constructive stance on copper, we see the possibility of gold surpassing silver within a year, signaling a reversal in 2022, with previous impediments such as a stronger dollar and rising yields will turn into support.

In addition, we anticipate continued strong demand from central banks to provide a soft floor to market prices. While a repeat of last year's record purchase of 673 tons in the first three quarters (source: World Gold Council) is unlikely, this activity could nevertheless set a soft floor in the market, similar to the limit set in the oil market by OPEC+ through active supply management. In part, this demand is driven by several central banks seeking to reduce exposure to the dollar. Such "de-dollarization" and general appetite for gold should make it another solid year for gold buying by the institutional sector.

In addition, we expect a more gold-friendly investment environment to offset last year's reduction of 120 tonnes of exchange-traded funds holdings, contributing to new growth. However, so far, despite strong gains since November, demand for exchange-traded funds, usually popular with long-term investors, has not yet recovered, and the total position is still hovering around a two-year low. Demand for funds declines as investors become confident that central banks will deliver on their promises, and in a context of falling inflation, this confidence is now strong.

However, we believe that inflation, after a sharp fall in the next six months, will start to return to higher levels, mainly due to increasing wage pressure and stimulus measures implemented in China, which will increase demand and increase prices of key commodities, including energy and metals. Until then, gold is likely to spend most of Q1 consolidating in the $800-$1 range before finally starting to strengthen to a new high above $950. Should such a scenario materialise, silver could return to $2 an ounce, a level it briefly approached in early 100.

Petroleum

According to the International Energy Agency, demand for oil in 2023, it will increase by 1,9 million barrels per day to an all-time high. The main argument for this strengthening is the strong recovery in China, which is moving away from lockdowns to focus on economic growth, driven not only by increased ground mobility, but also by the post-pandemic increase in jet fuel consumption as it can finally meet the accumulated demand for travel.

How this will affect prices largely depends on the ability and willingness of producers to increase supply to meet this increase in demand. We anticipate that there will be a number of challenges in this regard, which will contribute to an increase in oil prices later in the year due to higher demand in China, the effects of sanctions on Russian oil and fuel products, and limited willingness of OPEC to increase production.

The leitmotiv of our quarterly forecast, i.e. a broken model, was very noticeable and visible in the entire energy sector last year. Russia's attempt to suppress a sovereign nation and the Western world's response to Putin's aggression remains a depressing and still unresolved situation that continues to disrupt the usual flows and prices of key raw materials, from industrial metals and key crops to gas, fuel products and, above all, crude oil. The sanctions on Russian oil imposed by the EU and the G7 last December have created a series of new oil price levels where differences in quality and distance from the end user are no longer the only factors influencing price differences between different grades of oil. Oil supplies from Russia by sea remain unchanged, but in the coming months they will be increasingly threatened in connection with the imposition of an EU embargo on fuel products in February.

This forced Russia to accept a large discount when selling oil to customers not participating in the sanctions, in particular China and India. A secondary reaction to these events was the increase in refinery margins in China, a country with a potential exceeding the demand of the domestic market. Depending on the strength of China's economic recovery, exports of Chinese fuel products to the rest of the world may increase. Combined with the United States and the Middle East, flows from the emerging refining powerhouse are likely to make up for the shortfall in Europe caused by the exclusion of supplies from Russia.

The trajectory of oil prices in the first quarter depends primarily on the pace of recovery in demand in China. In our opinion, this revival will be more noticeable in the later part of the year than in Q80, which usually shows a weakening of demand in seasonal terms. As such, we expect Brent crude to remain near the lower end of its range this quarter, primarily in the $XNUMX region, and later in the year, as recessionary risks begin to fade, China will gain momentum and the impact of sanctions on Russia will begin to materialize. felt even more strongly, prices will go up.

At the same time, OPEC is increasingly managing to regain control of prices, especially given the market share it controls with members of the OPEC+ group. Thanks to their actions, they managed to establish a soft floor on the market and the question remains how the group will react to a renewed increase in demand. In particular, frustration over the actions of Western energy companies and moves perceived as political interference in global oil flows, as well as last year's decision by the White House to release oil from strategic reserves, should be taken into account.

Overall, we anticipate that this will be another year where numerous events will continue to affect both supply and demand, thus increasing the risk of another year with high volatility in the market, which can sometimes lead to a reduction in liquidity and what consequently, to unreasonable peaks and troughs in the market. After a relatively weak first quarter where the price of Brent crude oil should mostly trade around USD 80, the subsequent increase in demand coupled with supply uncertainty should bring the price back to USD 90, with the possibility of a temporary strengthening above USD 100.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response