Agreement at the OPEC + Summit? Almost mission impossible

A sudden shift of the summit, awakened hopes for agreement and prices hanging on the thread of speculation about its success. The oil market has recently become a real roller coaster among unprecedentedly volatile markets, and analysts predict that this is not the end of the experience.

OPEC + in focus

On April 9 at 16:00, a joint videoconference will begin for representatives of the OPEC cartel and a number of other oil-producing countries. They will discuss again the reduction in oil production. The result of this meeting will set the direction of the raw material, whose barrel in January cost over USD 65, and less than three months later it was valued at less than USD 20.

Donald Trump awakened hopes last week for a new agreement between oil-producing countries and a strong reduction in production. As a result, the oil exchange rate ended around 28,50. And just a few days earlier, a barrel on the New York Stock Exchange was paying less than 20 USD, the lowest since 2002. Currently, one barrel is valued at USD 26,5. The US president revealed that Saudi Arabia and Russia will bury the ax of the price war that has been going on for a month and are close to agreeing to reduce production by a minimum of 10 million barrels per day.

Chart oil (OILWTI), WN interval. Source: TMS

- Such a significant reduction will only be achieved if the agreement is extended to more than 20 countries (this is how many participated in the last OPEC + agreement, half of which were Cartel countries), including the United States. In recent years, the USA has significantly increased shale production and has become not only the largest consumer but also a producer of raw materials - explains raw material market expert and head of the Analysis Department at TMS Brokers Bartosz Sawicki.

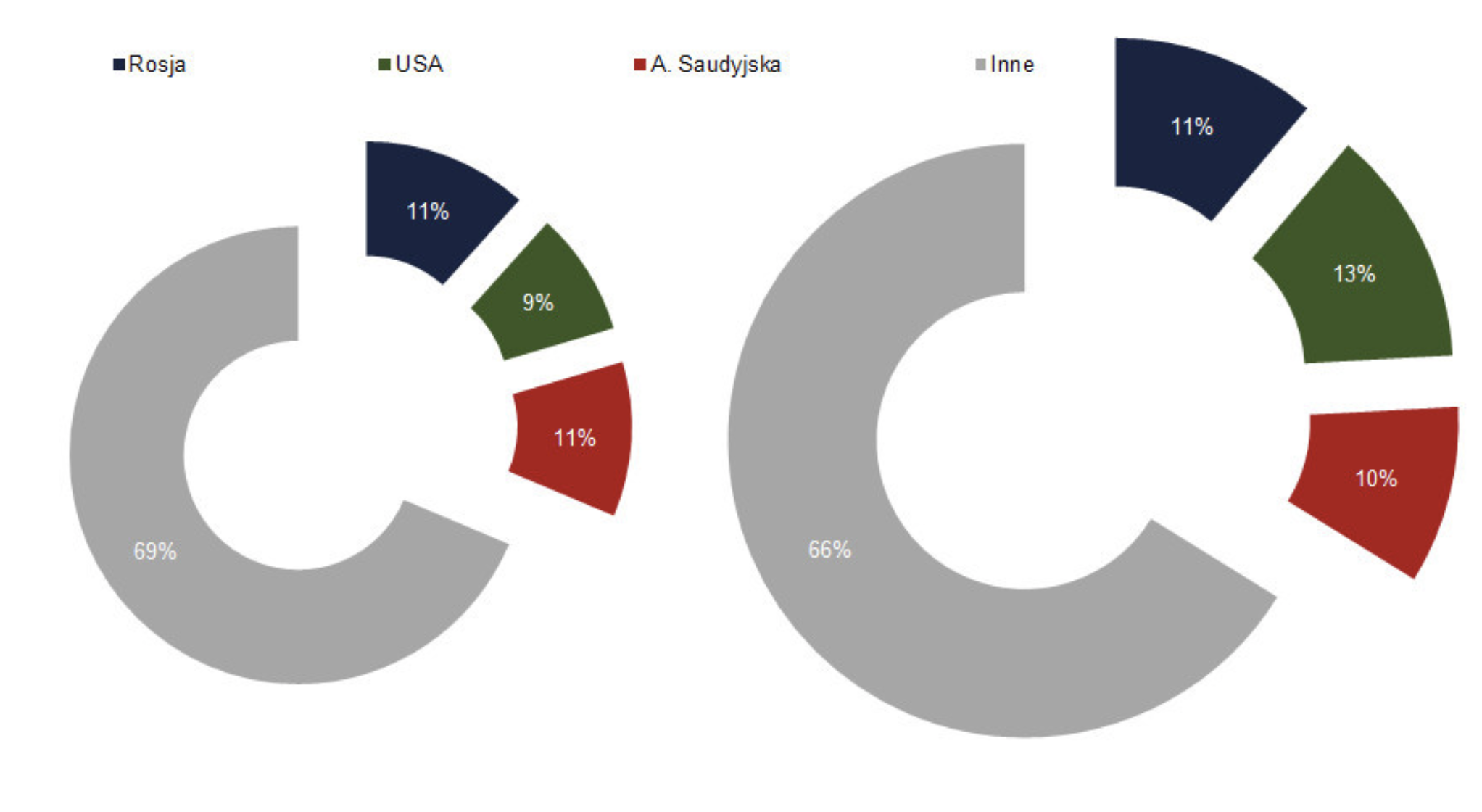

Estimated shares in the oil market in 2016 and 2020. Source: EIA. IEA, OPEC

At the beginning of the second quarter, the demand for oil is over 20 million b / d lower than before the outbreak of the COVID-19 pandemic.

- To effectively prevent gigantic oversupply and stock increases, the new agreement must not only reduce raw material supplies, but also credible control and coordination mechanisms - expert believes.

In the past, many manufacturers, with Russia at the forefront, chronically failed to fulfill their obligations.

- Even a sharp cut in production may not be enough to balance the market in the face of prolonged weakness in demand. It should also not be forgotten that since the beginning of the price war, world production has increased by an estimated 3 million barrels / day. In other words: cutting it by this value would only restore the state of affairs at the end of February - Sawicki explains.

The likelihood of the talks breaking off due to the divergent interests of the conflicting tycoons - the US, Russia and Saudi Arabia - is high, and it may be difficult for the contested powers to reach a compromise credible from the investor's point of view. The key element in assessing its effectiveness will be not only the scale, but also the duration of the reduction. No one will be convinced by a temporary reduction in production. In order to trigger a new wave of raw material price increases, a gigantic, long-term and credible reduction in production with the necessary US participation would be needed, and in the long run it may not be enough to balance the market. As a consequence, we see a significant risk of disappointment with the outcome of the negotiations.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Where to look for investment opportunities? Forecasts for the XNUMXth quarter [Download Ebook] forecasts for the fourth quarter](https://forexclub.pl/wp-content/uploads/2023/10/prognozy-na-iv-kwartal-300x200.jpg?v=1697785512)