Crude Oil Stock Reports - What You Need to Know About Them?

Reports on US crude oil inventories are vital data for traders on oil market. There are two main reports that are published each week. They are:

- API (American Petroleum Institute);

- EIA (US Energy Information Administration).

The EIA report is more respected by investors due to the fact that it is data from a government agency, so it is more reliable.

Weekly updates on crude oil inventories in the United States are one of the most important data on the situation on the market of this energy commodity. Oil analysts and traders track changes in inventories. The level of crude oil inventories is used by analysts to estimate market demand, which will translate into price changes in the near future.

If crude oil inventories have risen during the year, this could mean that oil demand is weaker than oil market participants expected. Weaker demand may reduce the demand for the raw material, which will lower the price. It is especially important when the level of inventories differs from analysts' expectations. If the level of inventories is much lower than analysts expected, it means that the demand for oil is much stronger, which may translate into higher prices.

American Petroleum Institute (API)

API is an association that represents American companies' commitment to the production, refining and distribution of crude oil and petroleum products. Currently, the API is included over 600 members from the oil and gas industry. The organization deals with industry representation and lobbying in Congress.

American Petroleum Institute was established in 1919. Currently, in addition to providing market data, it also introduces market standards regarding, inter alia, environmental protection. Over its history, it has developed around 700 industry standards. In 1920, API began publishing reports on weekly oil production. In 1924, the first oilfield equipment standard was introduced. From 1929, API draws up WSB (Weekly Statistical Bulletin), which contained information on crude oil stocks (regional and national) in the United States. There are also in the report information on production, import and stock of the four most important products: Motor gasoline, jet kerosene, distilled fuel oil and residual fuel oil. These products account for around 80% of the refinery's output. 1969 was an important year for the activities of the organization. API then moved the office from New York to Washington. This was to help bring about better lobbying in Congress.

American Petroleum Institute was established in 1919. Currently, in addition to providing market data, it also introduces market standards regarding, inter alia, environmental protection. Over its history, it has developed around 700 industry standards. In 1920, API began publishing reports on weekly oil production. In 1924, the first oilfield equipment standard was introduced. From 1929, API draws up WSB (Weekly Statistical Bulletin), which contained information on crude oil stocks (regional and national) in the United States. There are also in the report information on production, import and stock of the four most important products: Motor gasoline, jet kerosene, distilled fuel oil and residual fuel oil. These products account for around 80% of the refinery's output. 1969 was an important year for the activities of the organization. API then moved the office from New York to Washington. This was to help bring about better lobbying in Congress.

According to the American Petroleum Institute, the report covers approximately 90% of the oil extraction and processing industry. The remaining 10% is estimated by the agency. Most often, the API is taken as an introduction to the EIA report, as the WSB report is released Tuesday at 16:30 PM EST. If there is a public holiday on the Monday before the publication of the report, the report is published on Wednesday. Although analysts believe the EIA report is more accurate, the American Petroleum Institute reports it the monthly estimates of both reports are within 1% error 81% of the time.

Energy Information Administration (EIA)

Energy Information Administration (EIA) is a government agency that was established in 1977. The EIA is responsible for the objective collection of energy market data. The agency deals with, among others providing information on stocks, demand and prices of crude oil and petroleum products. Unlike API, the Energy Information Administration does not engage in any lobbying activity.

The EIA publishes a number of reports. Among them can be mentioned:

- This Week In Petroleum - is published every Wednesday. Provides information on crude oil supply stocks. In addition, it informs about the production of products such as gasoline, distillates and propane.

- The Monthly Energy Review - publishes data on energy consumption in the United States. The data goes back to 1949. At the same time, the EIA regularly publishes a draft on short- and long-term energy market. The report also includes information on energy production, consumption, as well as import and export.

- Petroleum Status Report - is also published every Wednesday. It contains detailed information on the crude oil reserves held in the United States and the production of crude oil and refined products.

Weekly Petroleum Status Report

EIA agency every Wednesday at 10:30 ET (Eastern Time) publishes Weekly Petroleum Status Report. This document provides information on crude oil supply as well as data on crude oil inventories and refinery products. The report also includes detailed data (regions, product prices). Additionally, the EIA publishes forecasts for petroleum products. "Weekly Petroleum Status Report" bases its data on surveys prepared by the largest oil producers and processors in the United States. As is the case in the API report, the value produced by the smallest entities is estimated.

EIA agency every Wednesday at 10:30 ET (Eastern Time) publishes Weekly Petroleum Status Report. This document provides information on crude oil supply as well as data on crude oil inventories and refinery products. The report also includes detailed data (regions, product prices). Additionally, the EIA publishes forecasts for petroleum products. "Weekly Petroleum Status Report" bases its data on surveys prepared by the largest oil producers and processors in the United States. As is the case in the API report, the value produced by the smallest entities is estimated.

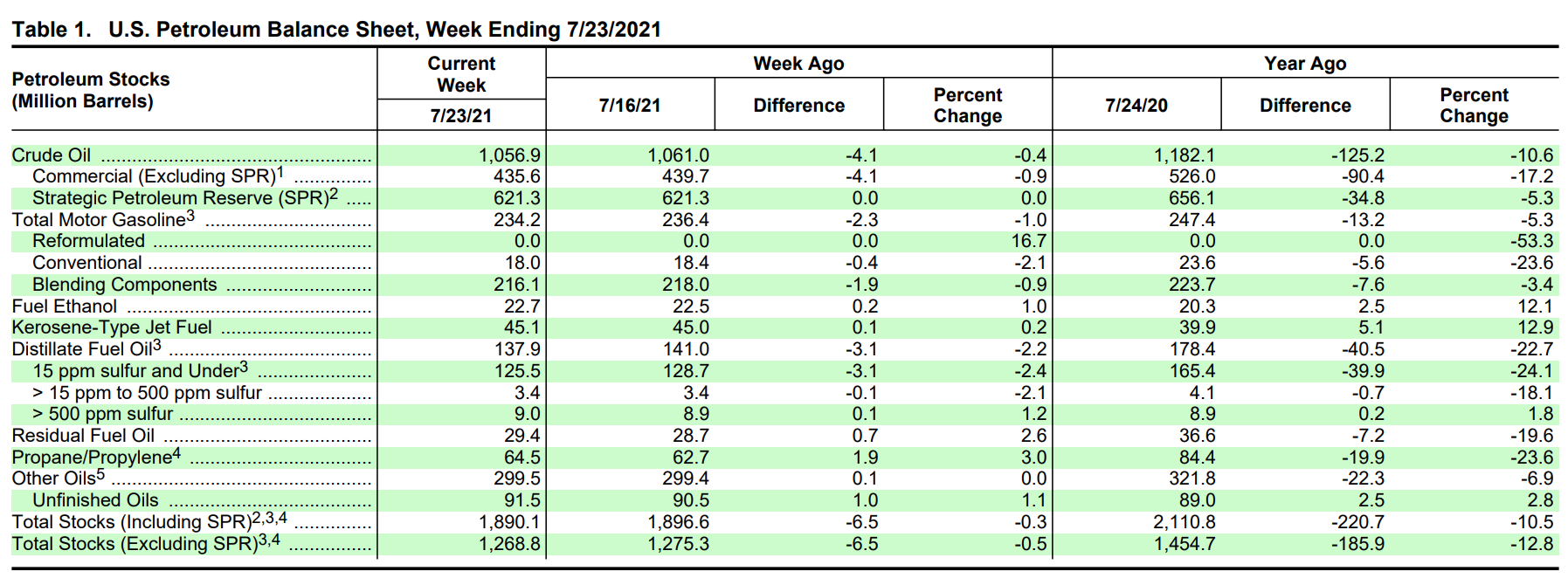

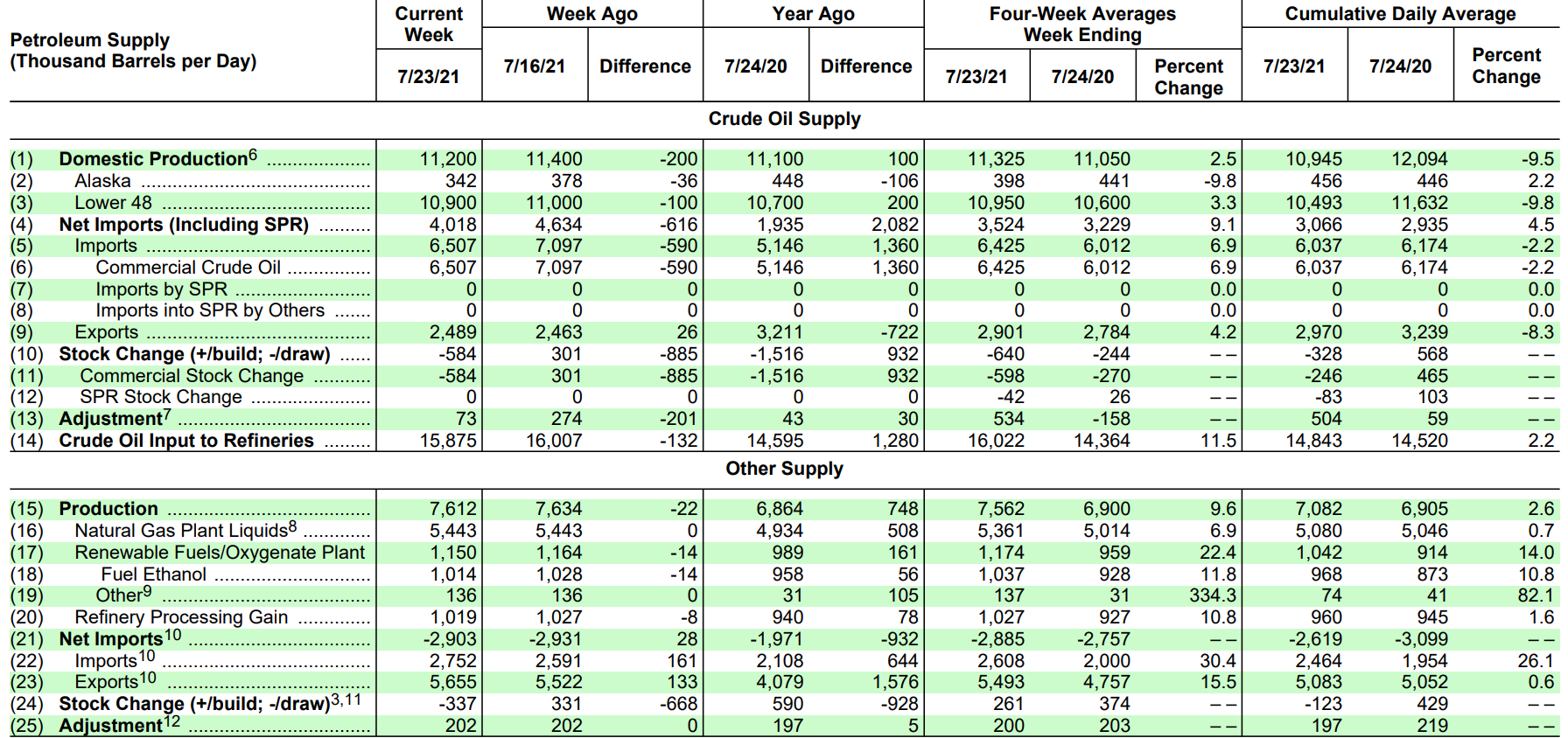

The first part of the report describes crude oil stocks and refined petroleum products. In addition to the current inventory, the report compares the inventories from a week ago and examines changes year on year. As at 23 July 2021, the reserves (together with the Strategic Petroleum Reserve) amounted to 1 million barrels, which meant a decrease of 890% y / y and 10,5% t / t.

The next part contains information on production, import, export and changes in crude oil stocks. During the year, the average daily “contribution” to refineries increased to 15,875 million barrels (per day). This meant an increase by 1,28 million barrels (+ 8,77% y / y). It is also worth mentioning that the report also includes information on the production of, for example, ethanol.

The next part of the report provides information on the production of processed crude oil. These include gasoline, aviation fuel and propane.

The first tables present aggregated data on oil production. The following parts of the Weekly Petroleum Status Report, however, provide detailed information on production by region. Additionally, information on the level of utilization is published. that is, the use of production capacity in refineries. On July 23, 2021, the capacity utilization was 85,1%, which was higher than a week ago (84,8%) and a year earlier (68,1%).

Crude Oil Stock Reports - How to Analyze Them?

Reports on crude oil inventories and refinery products are certainly useful information for investors in the crude oil market. However, it should be remembered that investors attach much greater importance to the EIA report. By closely monitoring your inventory levels, you can help you gauge future price movements for this commodity. If the stocks are rising, it means that the supply of the raw material was higher than the demand for it. As a result, this may mean that there is a slight price imbalance, which may contribute to a decline in the price of this commodity.

The reverse is true when stocks go down. This increases the likelihood of a rise in price as demand has outstripped supply this week. Of course, the inventory data should be compared to the historical data. It is best if the historical data covers a wide range of data to catch "cycles" in the oil market. It is also worth looking at the market reaction to the report.

Ignoring the bearish data from the EIA report may suggest a bullish sentiment by investors. In turn, declines after the "bullish" level of inventories may suggest that the market intends to go south. Despite the importance of this report, it should be remembered that the United States is the largest consumer of crude oil (around 20% of annual consumption). Another region is the European Union (15%) and China (14%). So a change in stocks in the United States can make a difference in oil prices as long as the rest of the world follows the same direction of oil consumption as the United States.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)